THREAD: aptiv stock skyrockets after bold

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

APTIV STOCK Skyrockets After Bold Business Move

— Aptiv plans to spin off its electrical distribution systems (EDS) into a new company. This bold move lets Aptiv focus on advanced driver-aid technology. After the announcement, Aptiv’s shares soared by 5%.

Analysts point out that EDS has lower profit margins. The adjusted EBITDA margin for EDS is expected to be 9.5% in 2024, while Aptiv’s other operations boast an 18.8% margin.

Garrett Nelson from CFRA Research supports the spin-off, saying it aligns with Aptiv’s push toward high-margin growth areas. This strategic shift could enhance Aptiv’s future profitability and market position.

TRUMP’S $500 BILLION AI Move: A Bold Step for America’s Future

— President Donald TRUMP has announced a massive $500 billion investment in artificial intelligence infrastructure. This joint venture involves OpenAI, Oracle, and SoftBank. The initiative aims to build data centers, marking a significant technological advancement.

The project began during the Biden administration but has gained momentum under Trump’s leadership. This investment underscores the importance of AI for future economic growth and national security.

Trump’s announcement highlights his commitment to keeping America ahead in technology. The collaboration between these major companies is expected to drive innovation and create jobs across the country.

AMERICAN EXPRESS Hit Hard: $230 Million Settlement Shocks Industry

— American Express has agreed to a $230 million settlement, surprising customers and industry insiders. This hefty financial blow highlights the growing scrutiny on major financial institutions. Analysts see this as a turning point, pushing companies to rethink their compliance strategies.

The settlement raises concerns about deeper issues within the financial industry. Customers are shocked and worried about how this might tarnish American Express’s reputation. Experts say this incident could lead to stricter oversight of financial firms in the future.

This development is crucial as it signals a potential shift in accountability for big financial players. The pressure is building for these giants to adapt to tighter regulations and increased consumer awareness. Financial companies may need to reevaluate their practices in response to this wake-up call.

TRUMP’S Inauguration Ignites Bitcoin Surge: Investors Rush to Crypto

— Following Donald Trump’s inauguration, Bitcoin’s value has surged. Investors are flocking to cryptocurrencies, driven by shifts in economic policies under the new administration. This trend highlights the volatile nature of cryptocurrency markets during major political changes.

AMERICAN EXPRESS FACES $230 MILLION BLOW: A Stark WARNING for Banks

American Express will pay a $230 million settlement for deceptive practices, impacting its financial standing. This serves as a warning to other financial institutions about the risks of misleading actions. The settlement underscores the regulatory challenges facing financial giants today.

VANGUARD’S SEC SETTLEMENT SHAKES TRUST: Investors on EDGE

Vanguard’s $106 million settlement with the SEC has sparked investor worries about compliance and risk management in investment firms. Transparency and ethical practices are crucial for maintaining trust in the financial sector. This case reminds investors of the importance of vigilance regarding regulatory issues within major firms.

BITCOIN SKYROCKETS: Trump’s Presidency Sparks Financial Frenzy

— Bitcoin has surged past $100,000 as enthusiasts anticipate swift action from Donald Trump when he assumes the presidency next week. Created in 2009 as a decentralized form of electronic cash, Bitcoin has moved from obscurity to mainstream fame. Republican Senator Cynthia Lummis of Wyoming suggests the U.S. government should stockpile Bitcoin to diversify holdings and reduce financial risks.

In other financial news, American Express will pay $230 million to settle U.S. charges over deceptive sales practices involving credit card and wire transfer products for small businesses. The Justice Department accused Amex of misrepresenting rewards and fees between 2014 and 2017, along with submitting false information about prospective customers without consent. This settlement addresses both criminal and civil probes into these allegations.

Meanwhile, Capital One is dealing with a service outage that has extended into its second day, affecting customer access to deposits and transactions. The bank blames technical issues impacting various services offered to clients for this disruption. This comes after a lawsuit by the Consumer Financial Protection Bureau against Capital One for allegedly misleading customers about savings-account offerings earlier this month.

Gold and silver are also gaining attention with forecasts predicting strong upside potential following Trump’s inauguration next week as president. Analysts are closely watching these precious metals amid shifting economic expectations under new leadership.;

VERTICAL THEME’S BIG Move: Alliance Bank Stake Sale to DBS?

— Investment firm Vertical Theme Sdn. plans to seek approval to start talks about selling its stake in Alliance Bank Malaysia Bhd. Sources close to the situation revealed this potential sale, which could lead to big changes in the bank’s ownership. This move hints at a strategy shift for Vertical Theme as it explores opportunities with DBS, a major player in banking.

RUPIAH and WON SHOCKED by Central Bank SURPRISES

The Indonesian rupiah is near six-month lows, and the South Korean won ended a three-day winning streak after unexpected central bank decisions. Investors were surprised as both countries’ central banks made unanticipated interest rate calls, causing market fluctuations. These moves highlight today’s volatile and unpredictable global financial markets.

HEXTAR INDUSTRIES BREWS UP Luckin Coffee LAUNCH THIS MONTH!

Hextar Industries Bhd is gearing up for a soft opening of five Luckin Coffee outlets by month’s end through its subsidiary Global Aroma Sdn Bhd (GASB). This expansion marks Hextar’s entry into the competitive coffee market, aiming to capture consumer interest with Luckin Coffee’s brand appeal. The openings show Hextar’s strategic growth ambitions within Malaysia’s food and beverage industry.

AMAZON’S BOLD Move: New South Africa Center Shakes UP Market

— Amazon has opened a new center in Cape Town, South Africa, to support its independent sellers. This is part of Amazon’s plan to grow its market share and compete with local leader Takealot, owned by Naspers. The center aims to help sellers attract more customers and expand Amazon’s product range, potentially boosting revenue.

APPLE’s CHINA TROUBLES: iPhone Shipments PLUMMET

Apple shares fell 3.2% after research firm Canalys reported a 17% drop in iPhone shipments in China for 2024. This decline pushed Apple down to third place in China’s market share rankings. Despite the stock’s volatility, this news is significant but doesn’t drastically change the company’s business outlook.

STOCK MARKET SLUMP: Earnings Reports RATTLE Investors

The stock market took a hit following Wednesday’s rally due to retail sales data and major bank earnings reports taking the spotlight. Analysts remain hopeful about gains for the S&P 500 by year-end despite current swings. Focus is also on upcoming hearings on tariff plans before President-elect Donald Trump that could affect future economic strategies moving forward.

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/25083616/Press_Image_FINAL_16x9_4.jpg)

MICROSOFT’S Bold AI Move: Copilot Chat Unleashed

— Microsoft has launched Copilot Chat, a new service designed to increase AI use among businesses. This pay-as-you-go chat tool uses OpenAI’s GPT-4 to create AI agents for tasks like market research and strategy document creation. It supports multiple languages, including English and Mandarin, making it accessible to many users.

BUSINESSES WORRY OVER TRUMP POLICIES AS HE RETURNS TO POWER

A Federal Reserve survey shows U.S. businesses are worried about possible price hikes under President-elect Donald Trump’s policies. Even with moderate economic growth and more jobs at the end of 2024, concerns remain about Trump’s return to the White House next week. The survey includes feedback from business contacts across the Fed’s 12 regional banks as of January 6th.

BUFFETT CAUTIONS AGAINST COPYING HIS INVESTMENT MOVES BLINDLY

Warren Buffett warns against blindly following his investment strategies without understanding them fully. He points out that Berkshire Hathaway often buys entire businesses, not just stocks, requiring deep analysis and long-term planning. Buffett notes that unique advantages like Berkshire’s insurance “free float” significantly influence their investment choices.

GOLD PRICES Soar: What You Need to Know About Plunging US Yields

— Gold prices climbed for the second day, fueled by falling U.S. yields and hints of easing core inflation. Investors are keeping a close eye on upcoming U.S. retail sales data, unemployment claims, and Federal Reserve announcements for more market insight.

The stock market saw a big lift after a surprisingly good consumer inflation report. The Dow surged 700 points while the Nasdaq jumped 2.5%. This shows optimism even though there are worries about high rates affecting stock performance.

Financial powerhouses Goldman Sachs and JPMorgan started the earnings season strong with impressive trading revenues, boosting the S&P 500’s financial sector to its best day in two months. Citigroup announced a $20 billion share buyback program as it tackles rising regulatory costs and compliance issues.

The U.S. dollar was volatile as traders analyzed inflation data showing core inflation dipped slightly from 3.3% to 3.2%. Market players await more direction from the Federal Reserve on interest rate policies amid these economic changes.

CHINA’S SHOCKING TikTok Move: Will Musk Take Over?

— Chinese officials are thinking about selling TikTok’s US operations to Elon Musk. This idea comes as the app faces a possible ban in the United States. The talks highlight ongoing worries about national security risks linked to TikTok, owned by ByteDance.

The potential sale of TikTok’s US operations shows the tension between the United States and China over data privacy issues. Regulatory scrutiny is growing, with technology and foreign investments at the heart of these global challenges.

Elon Musk’s involvement could change how TikTok operates in America if a sale happens. This development marks an important moment in US-China relations regarding technology and data privacy concerns.

STOCK MARKET Chaos: Inflation Fears Shake Investor Confidence

— The U.S. STOCK market took a big hit today, with major indexes dropping over 3% due to rising inflation fears. Investors worry about possible Federal Reserve policy changes after high inflation numbers came out earlier this week. This is one of the steepest drops in months, shaking confidence that had been boosted by strong job reports.

Bond yields are up, with the 10-year Treasury bond yield hitting about 4.1%, its highest since late 2023, signaling increased inflation expectations. Big tech stocks like Apple and Microsoft saw sell-offs over 5%, adding to the market slump. Analysts warn that ongoing inflation might push the Federal Reserve to rethink interest rate policies, possibly leading to more hikes instead of cuts.

The decline comes after a strong holiday shopping season that initially suggested steady economic growth but is now overshadowed by ongoing inflation problems. Retail and consumer sectors face rising costs and reduced spending, making investors cautious in these areas. Companies like Walmart and Target report higher holiday sales but shrinking profit margins due to inflation pressures, prompting them to rethink annual forecasts.

Banks like JPMorgan are bracing for possible loan defaults as consumers struggle with higher living costs by setting aside more reserves. Market analysts expect continued volatility as investors digest new inflation data and Fed policy implications.;

DELTA Airlines’ BOLD Move: Uber Partnership to Boost Rewards

— Delta Airlines has announced a new partnership with UBER, ending its previous collaboration with Lyft. This strategic move aims to give Delta customers more flexible travel options and enhance rewards. By linking Delta SkyMiles accounts to Uber, passengers can now earn miles on both flights and rides.

This decision reflects the airline industry’s competitive landscape, where companies seek innovative ways to attract loyal customers. Analysts suggest this change could boost Delta’s appeal among millennials who favor ride-sharing for convenience. The partnership is expected to enhance customer engagement and offer insights into travel habits for future marketing strategies.

This shift marks a broader trend in strategic partnerships within the travel sector, aligning better with consumer preferences. As the partnership develops, further changes in airline loyalty programs are anticipated to meet evolving consumer behaviors in the post-pandemic era.

WALL STREET Surges: Oil Price Drop Sparks Investor Optimism

— Wall Street is climbing today, driven by a 6% DROP in oil prices. Investors are gearing up for a crucial week of earnings reports from major tech firms.

Tech and energy stocks are leading the way, with analysts hopeful about tech giants’ futures. However, there is still caution about the overall economic outlook.

The fall in oil prices comes from oversupply worries and easing geopolitical tensions, affecting inflation rates and consumer spending that Wall Street closely monitors.

While U.S. markets rise, Asian markets face recession fears linked to U.S. economic performance, showing global interconnectedness and financial volatility.

PUB’S Wild Beer Names Ignite Fury And Laughter

— A pub in England is under fire for its bold beer names, but the owner calls it harmless fun. The Coach and Horses in Billinghay offers beers like “Osama Bin Lager” and “Kim Jong Ale.” These names have sparked a buzz on social media, with some laughing while others voice concern.

Catherine Mitchell owns the pub with her husband Luke Mitchell, who runs Mitchell Brewing Co., a microbrewery. Earlier this year, “Osama Bin Lager” went viral and sold out fast. Despite the uproar, many patrons reportedly enjoy these playful beverage names.

Mitchell Brewing Co.’s top-selling line is called “The Dictator,” featuring several edgy titles. Luke Mitchell claims most customers appreciate the humor when visiting The Coach and Horses. While some find them offensive, others see it as clever marketing fun.

— Alphabet Reports Strong Earnings, Driven by Cloud Growth The tech giant exceeded expectations in both revenue and profit, thanks to a significant increase in cloud services

— Tesla Stock Soars 22% on Musk’s Bold 2025 Growth Forecast The electric vehicle giant experienced its best trading day in over a decade following CEO Elon Musk’s optimistic projections for future growth

— S&P 500 and Nasdaq Soar to Close Out Best Week of 2024 The major US stock indices experienced significant gains on Friday, marking a record-breaking week for investors

— S&P 500 and Nasdaq Soar to Conclude Best Week of 2024 The stock indices experienced a significant rally on Friday, marking their strongest performance of the year thus far

— S&P 500 and Nasdaq End Eight-Day Winning Streak Amid Pause in Rebound Rally Major US stock indices, S&P 500 and Nasdaq, halt their consecutive gains after an eight-day winning streak

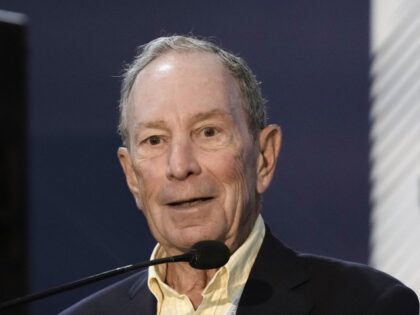

BLOOMBERG’S $1 Billion Gift Transforms Johns Hopkins Medical School

— Starting this fall, Bloomberg Philanthropies will cover tuition for Johns Hopkins medical students from families earning under $300,000 annually. This initiative aims to reduce student debt and increase opportunities.

Students from families making less than $175,000 a year will also have their living expenses and fees covered. Mike Bloomberg stated that more generous financial aid has made Johns Hopkins more economically diverse and selective.

The $1 billion gift will not only make medical school tuition-free for those with limited means but also boost financial aid for other graduate programs at Johns Hopkins. This move is expected to attract top students who might otherwise be deterred by financial constraints.

TIKTOK On The BRINK: Biden’s Bold Move to Ban or Force Sale of Chinese App

— TikTok and Universal Music Group have just renewed their partnership. This deal brings UMG’s music back to TikTok after a short break. The agreement includes better promotion strategies and new AI protections. Universal CEO Lucian Grainge said the deal will help artists and creators on the platform.

President Joe Biden has signed a new law that gives TikTok’s parent company, ByteDance, nine months to sell the app or face a ban in the U.S. This decision is due to worries from both political sides about national security and protecting American youth from foreign influence.

TikTok’s CEO, Shou Zi Chew, announced plans to fight this law in U.S courts, claiming it supports their constitutional rights. Yet, ByteDance would rather close TikTok in the U.S than sell it if they lose their legal battle.

This conflict shows the ongoing struggle between TikTok’s business goals and America’s national security needs. It points out big worries about data privacy and foreign influence in American digital spaces by China’s tech sector.

Dua Lipa’s NEW Album "Radical Optimism" EMBRACES Fearless Growth

— Dua Lipa’s latest work, “Radical Optimism,” released by Warner Music, features an intriguing cover of the artist in the ocean with a shark. This bold image captures the essence of finding calm in chaos, a central theme of the album. Dua Lipa takes a new direction with this release, enriching her music with deeper sounds and more profound themes.

Stepping away from her signature “dance-crying” style, “Radical Optimism” introduces elements of psychedelic electro-pop and live instrumentation. The influence of her worldwide tours is evident as she skillfully mixes trip hop with Britpop, showcasing a refined artistic vision.

In creating her third album, Lipa embraced experimentation over following a set formula. Despite venturing into new musical landscapes, she maintains her distinctive pop flair. This experimental approach marks a significant evolution from her 2020 hit “Future Nostalgia.”

With “Radical Optimism,” Dua Lipa promises an innovative auditory journey that pushes past traditional pop limits. Her latest release signals a bold move towards greater artistic freedom and complexity in her evolving music career.

ELF BAR Exposed: The Shocking Truth Behind the World’s Top E-Cigarette and Its Billion-Dollar TAX Scam

— In just two years, Elf Bar, a flashy vaping gadget, has skyrocketed to global prominence as the leading disposable e-cigarette. Not only has it raked in billions in sales, but it has also become a favorite among underage American teens who vape. Last week saw the first public confiscation of Elf Bar products by U.S. authorities during an operation that seized 1.4 million illegal flavored e-cigarettes from China.

The confiscated goods were worth $18 million and included brands beyond Elf Bar. However, public records and court documents disclose that Chinese e-cigarette manufacturers have smuggled in products valued at hundreds of millions while adeptly circumventing customs duties and import fees. These firms frequently mislabel their shipments as “battery chargers’ or ”flashlights', thereby hampering efforts to control teen vaping in America.

Eric Lindblom, a former FDA official, lambasted regulatory approaches towards disposables as “very weak”, allowing this issue to spiral out of control. Meanwhile, fruit-and-candy-flavored disposables have flooded into America following China’s ban on vaping flavors last year under the pretense of safeguard

OIL TYCOONS Rule COP28: A Shocking Paradox or a Bold Leap for Climate Goals?

— The forthcoming COP28 climate summit, to be held in the United Arab Emirates (UAE), is stirring up a storm of controversy. Critics are questioning the seemingly ironic choice of Sultan Ahmed Al Jaber, CEO of UAE’s state oil company, as the event’s overseer.

UK Guardian columnist Marina Hyde has expressed concerns about this decision. She compares it to China’s temporary factory closures during the 2008 Olympics for cleaner air. She questions whether UAE will also pause its gas flaring operations during the conference.

Climate advocates fear that powerful politicians and industrialists could twist climate policies for personal gain. These fears are amplified by reports that Al Jaber and UAE may exploit COP28 to broker oil and gas deals with other nations.

Despite these apprehensions, some believe that involving major oil producers is key to meeting climate objectives. But with President Joe Biden absent and protests pushed to distant locations, doubts over COP28’s effectiveness continue to mount.

FRONTIER AI: A Ticking Time Bomb? World Leaders and Tech Titans Convene to Discuss Risks

— The latest buzzword in the realm of artificial intelligence, Frontier AI, has been causing a stir due to its potential threats to human existence. Advanced chatbots like ChatGPT have dazzled with their capabilities, but fears about the risks associated with such technology are escalating. Top researchers, leading AI companies, and governments are advocating for protective measures against these looming dangers.

British Prime Minister Rishi Sunak is orchestrating a two-day summit on frontier AI at Bletchley Park. The event is set to draw around 100 officials from 28 nations including U.S. Vice President Kamala Harris and European Commission President Ursula von der Leyen. Executives from prominent U.S. artificial intelligence firms such as OpenAI, Google’s Deepmind and Anthropic will also be in attendance.

Sunak asserts that only governments can shield people from the hazards posed by this technology. However, he stressed that the U.K.'s strategy is not to hastily impose regulation despite identifying potential threats like using AI for crafting chemical or biological weapons.

Jeff Clune, an associate computer science professor at the University of British Columbia who specializes in AI and machine learning was among those urging for more government intervention in mitigating risks from AI last week — echoing warnings issued by tech tycoons like Elon Musk and Open

Video

ISRAEL STRIKES Hezbollah: Lebanon Rocked By Explosions

— Israel’s defense minister, Yoav Gallant, has announced a “new phase” of the war against Hezbollah militants in Lebanon. Gallant praised the army and security agencies for their impressive results and emphasized the need for courage as military resources shift northward.

Lebanon is reeling from mysterious explosions targeting electronic devices like walkie-talkies and solar equipment. These incidents follow previous pager explosions that killed nine people and injured 300, heightening fear among the Lebanese population.

Explosions disrupted a funeral in Beirut for Hezbollah members killed by earlier pager blasts, causing further damage in Sidon. The strategy appears aimed at destabilizing Hezbollah’s communication infrastructure and creating chaos within its ranks.

The situation remains tense with potential for broader regional conflict growing. As both sides prepare for intensified warfare, the humanitarian impact on civilians looms large, highlighting the urgent need for diplomatic intervention to prevent further bloodshed.

More Videos

Invalid Query

The keyword entered was invalid, or we couldn't gather enough relevant information to construct a thread. Try checking the spelling or entering a broader search term. Often simple one-word terms are enough for our algorithms to build a detailed thread on the topic. Longer multi-word terms will refine the search but create a narrower information thread.

Social Chatter

What the World is SayingInvesting in Indices #S&P500 #nasdaq #indicies #Investing. Investing in Indices #S&P500 #nasdaq #indicies #Investing "Discover why investing in indices is one of the smartest ways to grow your wealth! Learn how indices like the S&P 500, ...

. . .best ai stock trading bot. best ai stock trading bot Best AI Stock Trading Bots: Revolutionizing Investment Strategies in 2024 In the rapidly evolving world of financial technology, AI stock trading bots have emerged as game-changing tools for investors seeking to maximize their market potential. These sophisticated algorith...

. . .Momentum Stock Definition. Momentum Stock Definition Join over 5,000 traders with top stock alerts, live trading streams, nightly watchlists, and comprehensive education: https://whop.com/joinmomentum/?a=userfe5d2979848 Understanding Momentum Stock Definition and Its Role in Investment Strategies ----------------------------...

. . .my friend texted me she really likes my new layout for my apt and: “It’s brave and bold and more creative to not have everything up against a wall” lol brave?!

. . .my friend texted me she really likes my new layout for my apt and: “It’s brave and bold and more creative to not have everything up against a wall” lol brave?!

. . .