THREAD: stock market dips lifeline media

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

TRAGIC STABBING Spree at London Market Shocks Community

— A stabbing spree at East Street Market in south London left one dead and two injured on Sunday morning. Police arrested a man in his 60s at the scene. While they have not shared details about the suspect or his motives, they do not believe it is terror-related, hinting that mental health issues might be involved.

Witnesses described a chaotic scene as the attacker randomly targeted people. An unnamed fabric seller said, “I just saw a bloke running through the market stabbing people willy-nilly.” The attack happened around 10:30 am when the market was getting busy.

The witness immediately called police after seeing two men stabbed, noting one appeared severely injured. Emergency services quickly arrived but sadly, one victim died from injuries despite their efforts.

The investigation continues as authorities work to understand what led to this tragic event and ensure community safety moving forward.

MIGRANT CROSSINGS Surge: Lives at Risk in English Channel Crisis

— Migrants continue to risk their lives crossing the English Channel, highlighting a growing crisis for France and the U.K. This comes shortly after a tragic incident where a dozen migrants lost their lives. The mayor of Wimereux, Jean-Luc Dubaële, called for stronger action from both governments to address the issue.

Dubaële criticized the criminal networks smuggling people across the channel, labeling it “unacceptable” and “scandalous.” He emphasized that migrants are drawn to Britain rather than seeking asylum in France. He urged immediate discussions with Britain’s new government to find a lasting solution.

The issue of cross-Channel migration was pivotal in the recent U.K. general election, which saw Keir Starmer become prime minister after Labour’s victory. French maritime authorities confirmed an inflatable boat carrying 40 to 50 migrants was monitored by French patrols on Wednesday morning.

The overcrowded inflatable had people crammed side-by-side with some dangling their legs overboard. French patrol vessels were on standby to assist if needed, underscoring the ongoing risks and challenges of these perilous crossings.

LABOUR PARTY Surges Amid UK Election Betting Scandal

— The U.K. general election on July 4 is approaching, with the Labour Party expected to defeat Prime Minister Rishi Sunak’s Conservatives. Polls indicate Labour leader Keir Starmer will likely form the next government.

The Conservative campaign has struggled, facing allegations of election betting involving figures close to Sunak. This scandal has further dampened their already lackluster efforts.

In the U.K., the prime minister decides election dates, unlike fixed schedules in countries like the U.S. This unique system has led to a market for predicting election dates and outcomes.

Police officers and Conservative insiders are under investigation for their involvement in this betting scandal, adding another layer of controversy as over 50 countries prepare for elections in 2024.

CONSERVATIVE Officials in HOT Water Over Election Betting Scandal

— Nick Mason is the fourth Conservative official to be investigated by the U.K.’s Gambling Commission for allegedly betting on election timing before the date was announced. Dozens of bets with potential winnings worth thousands of pounds are under scrutiny.

Two other Conservative candidates, Laura Saunders and Craig Williams, are also being investigated. Tony Lee, Saunders’ husband and Conservative director of campaigning, has taken a leave of absence amid similar allegations.

The scandal comes just two weeks before the national election, dealing a blow to Prime Minister Rishi Sunak’s party. Sunak expressed anger over the allegations and stated that lawbreakers should be expelled from the party.

Saunders has pledged full cooperation with investigators. Williams served as Sunak’s parliamentary private secretary in addition to being a candidate.

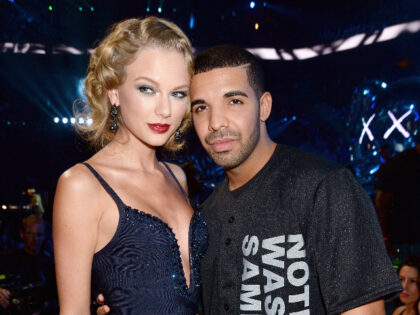

TIKTOK On The BRINK: Biden’s Bold Move to Ban or Force Sale of Chinese App

— TikTok and Universal Music Group have just renewed their partnership. This deal brings UMG’s music back to TikTok after a short break. The agreement includes better promotion strategies and new AI protections. Universal CEO Lucian Grainge said the deal will help artists and creators on the platform.

President Joe Biden has signed a new law that gives TikTok’s parent company, ByteDance, nine months to sell the app or face a ban in the U.S. This decision is due to worries from both political sides about national security and protecting American youth from foreign influence.

TikTok’s CEO, Shou Zi Chew, announced plans to fight this law in U.S courts, claiming it supports their constitutional rights. Yet, ByteDance would rather close TikTok in the U.S than sell it if they lose their legal battle.

This conflict shows the ongoing struggle between TikTok’s business goals and America’s national security needs. It points out big worries about data privacy and foreign influence in American digital spaces by China’s tech sector.

Dua Lipa’s NEW Album "Radical Optimism" EMBRACES Fearless Growth

— Dua Lipa’s latest work, “Radical Optimism,” released by Warner Music, features an intriguing cover of the artist in the ocean with a shark. This bold image captures the essence of finding calm in chaos, a central theme of the album. Dua Lipa takes a new direction with this release, enriching her music with deeper sounds and more profound themes.

Stepping away from her signature “dance-crying” style, “Radical Optimism” introduces elements of psychedelic electro-pop and live instrumentation. The influence of her worldwide tours is evident as she skillfully mixes trip hop with Britpop, showcasing a refined artistic vision.

In creating her third album, Lipa embraced experimentation over following a set formula. Despite venturing into new musical landscapes, she maintains her distinctive pop flair. This experimental approach marks a significant evolution from her 2020 hit “Future Nostalgia.”

With “Radical Optimism,” Dua Lipa promises an innovative auditory journey that pushes past traditional pop limits. Her latest release signals a bold move towards greater artistic freedom and complexity in her evolving music career.

BRITISH TRADER’S Appeal Crushed: Libor Conviction Stands Strong

— Tom Hayes, a former financial trader for Citigroup and UBS, has been unsuccessful in his attempt to overturn his conviction. This 44-year-old Brit was convicted in 2015 for manipulating the London Inter-Bank Offered Rate (LIBOR) from 2006 to 2010. His case marked the first-ever conviction of this kind.

Hayes served half of an 11-year sentence and was released in 2021. Despite asserting his innocence throughout, he faced another conviction by a U.S court in 2016.

Carlo Palombo, another trader implicated in similar manipulations with Euribor, also sought appeal through the U.K.'s Court of Appeal via the Criminal Cases Review Commission. However, after a three-day hearing earlier this month, both appeals were dismissed without success.

The Serious Fraud Office remained resolute against these appeals stating: “No one is above the law and the court has recognized that these convictions stand firm.” This decision comes on the heels of a contrasting verdict from a U.S court last year which reversed similar convictions of two former Deutsche Bank traders.

DEFENSE BILL Slashed: Allies Fear for US Reliability

— The House gave the green light to a $1.2 trillion defense bill on Friday, which includes crucial aid for Ukraine. However, the significantly trimmed budget and prolonged delays have left allies like Lithuania doubting the U.S.'s reliability.

The conflict in Ukraine, instigated by Russia, has been ongoing for over two years. While American backing for Kyiv has slightly lessened, European allies stand firm. Gabrielius Landsbergis, Lithuanian Foreign Minister, voiced concerns over Ukraine’s capacity to hold its front line based on the quantity of ammunition and equipment received.

Landsbergis also expressed apprehension about Russia’s potential future actions if Putin continues without restraint. He portrayed Russia as a “massive, aggressive empire with a bloodthirsty nature” that inspires other dictators globally.

This is an incredibly unsettling time," concluded Landsbergis underlining the worldwide repercussions of Russia’s unchecked aggression.

GREEN AGENDA Hits Hard: Ofgem Warns of Financial Burden on Low-Income Consumers

— The Office of Gas and Electricity Markets (Ofgem) sounded an alarm on Monday. It cautioned that the shift towards a “Net Zero” carbon emissions economy could unfairly impact low-income consumers. These individuals might lack the financial resources to acquire government-approved technology or modify their lifestyle habits.

In the past year alone, debts from energy consumers have skyrocketed by 50%, amassing a total of £3 billion. Ofgem voiced grave concerns about struggling households’ limited resilience to future price shocks. The regulator also highlighted that the burden of recovering bad debts could pose serious threats to the retail energy sector.

Economic difficulties have already pushed British consumers into rationing their energy consumption. This has led to “harms associated with living in a cold, damp home,” potentially triggering an increase in mental health issues rates.

Tim Jarvis, Ofgem’s director general, underscored the necessity for a long-term strategy to manage escalating debt levels and shield struggling consumers from future price shocks. He mentioned that measures such as altering standing charges for prepayment meter customers and tightening requirements on suppliers had been implemented.

-((($wid/$zoom)/2)-(($this.metadata.pointOfInterest.w/2)*100%))},{($this.metadata.pointOfInterest.y*100%)-((($hei/$zoom)/2)-(($this.metadata.pointOfInterest.h/2)*100%))},{$wid/$zoom},{$hei/$zoom}&w=$wid&h=$hei&sm=c&fmt=auto)

BODY SHOP Faces Uncertain Future: Insolvency Administrators Step In Amid Financial Crisis

— The Body Shop, a renowned British beauty and cosmetics retailer, has enlisted the help of insolvency administrators. This move follows years of financial struggles that have plagued the company. Established in 1976 as a single store, The Body Shop has grown into one of Britain’s most iconic high street retailers. Now, its future hangs in the balance.

FRP, the appointed administrators for The Body Shop, have revealed that past owners’ financial mismanagement has contributed to an extended period of hardship for the company. These issues are exacerbated by a challenging trading environment within the broader retail sector.

Just weeks before this announcement, European private equity firm Aurelius took over The Body Shop. Known for their expertise in revitalizing struggling companies, Aurelius now faces a significant challenge with this latest acquisition.

Anita Roddick and her husband established The Body Shop in 1976 with ethical consumerism at its core. Roddick earned herself the title “Queen of Green” by prioritizing corporate social responsibility and environmentalism long before they became fashionable business practices. Today however, her legacy is threatened by ongoing financial difficulties.

MASSIVE BLOW: Tata Steel Shutters Wales Plant, 2,800 Jobs Vanish Overnight

— Indian steel titan, Tata Steel, has revealed plans to close both blast furnaces at its Port Talbot plant in Wales. This drastic move will result in the loss of 2,800 jobs and is part of a broader strategy to streamline their unprofitable UK operation and make it more eco-friendly.

The company intends to transition from coal-fired blast furnaces to an electric arc furnace. This modern method emits less carbon and requires fewer workers. The British government backs this shift with a hefty £500 million ($634 million) investment. Tata Steel is confident that this transition will “turn around over a decade of losses” and foster a greener steel industry.

This decision strikes a severe blow to Port Talbot — a town heavily dependent on the steel industry since the early 20th century. Unions had suggested keeping one blast furnace operational while constructing the electric one as an attempt to mitigate job cuts — a proposal that Tata dismissed.

Both blast furnaces are slated for closure within this year. Meanwhile, plans for installing the new electric furnace are set for completion by 2027.

From BETTING FRENZY to Prison: Andy May’s £13M Gamble and His Fight Against Addiction

— Andy May, once a finance manager from Norfolk, squandered his family’s house deposit in a gambling frenzy. After seven years of abstinence from betting, the allure of a “free bet” during the 2014 World Cup lured him back into the destructive habit.

May’s addiction spiraled out of control as he misused his company credit card to gamble away £1.3 million. This reckless act led him straight to prison. Now released after two years, he has teamed up with GambleAware to share his cautionary tale and raise awareness about gambling addiction.

During his four-and-a-half-year betting spree, May wagered on everything conceivable. He even resorted to paying off personal credit card debts using company funds. His illicit activities eventually caught up with him in 2019 when he was found guilty of stealing over £1.3 million from his employer.

Despite losing his job and deceiving his family about it, May confesses that he might be tempted by gambling again but fights daily against this urge. He underscores that no amount of potential winnings could enhance his life while everything is

US STEEL Takeover: BLOCKING Japanese Buyout Could Save American Jobs

— Nippon Steel, Japan’s leading steel company, is facing a storm of criticism over its planned $14 billion acquisition of U.S. Steel Corporation. The deal, unveiled on Monday, values U.S. Steel at $55 per share and has sparked immediate opposition, especially in the Rust Belt where U.S. Steel has been a cornerstone since 1901.

Despite U.S. Steel’s assurances that the merger would unite “two storied companies with rich histories,” lawmakers are demanding action. Senators J.D. Vance (R-OH), Josh Hawley (R-MO), and Marco Rubio (R-FL) have written to Treasury Secretary Janet Yellen urging the Committee on Foreign Investment in the United States (CFIUS) to halt the deal.

The senators contend that domestic steel production is vital for national security and needs careful scrutiny before permitting foreign investment. CFIUS, led by Yellen, holds the authority to stop such investments after a review process.

While experts predict CFIUS is more likely to block deals involving countries perceived as adversaries like Russia or China rather than allies like Japan, this situation highlights bipartisan worries about foreign control over crucial industries.

UK INFLATION TUMBLES to 39%: Central Bank May Slash Rates Sooner Than Predicted

— The Office for National Statistics (ONS) recently announced a surprising drop in UK inflation to 3.9% in November, a decrease from the previous month’s 4.6%. This dip, larger than what financial markets had forecasted, marks the lowest inflation level since September 2021.

This decline is primarily attributed to falling fuel and food prices according to the ONS. However, despite this optimistic news, the Bank of England’s primary interest rate remains at a staggering high of 5.25%, not seen for over a decade and a half.

Governor Andrew Bailey hinted that this stringent interest rate policy might continue for some time. Yet Samuel Tombs, chief U.K economist at Pantheon Macroeconomics suggests an alternative view — that this sharp fall in inflation could trigger an earlier-than-expected cut in interest rates; perhaps as early as the first half of next year.

While elevated interest rates initially helped curb inflation sparked by supply chain disruptions and Russia’s invasion of Ukraine, they have also put pressure on consumer spending and slowed economic growth. As such there are growing worries that maintaining high rates could inflict unnecessary damage on the economy.

Bipartisan Committee CALLS for END of China’s Trade Status: A Potential Jolt to US Economy

— A bipartisan committee, led by Rep. Mike Gallagher (R-WI) and Rep. Raja Krishnamoorthi (D-IL), has been studying the economic effects of China on the US for a year. The investigation centered on job market changes, manufacturing shifts, and national security concerns since China joined the World Trade Organization (WTO) in 2001.

The committee released a report this Tuesday recommending President Joe Biden’s administration and Congress to implement nearly 150 policies to counteract China’s economic influence. One significant suggestion is to cancel China’s permanent normal trade relations status (PNTR) with the U.S., a status endorsed by former President George W. Bush in 2001.

The report argues that granting PNTR to China did not bring anticipated benefits for the US or trigger expected reforms in China. It asserts that this has led to a loss of vital U.S. economic leverage and inflicted damage on U.S industry, workers, and manufacturers due to unfair trade practices.

The committee proposes shifting China into a new tariff category that reinstates U.S economic leverage while reducing dependence on Chinese

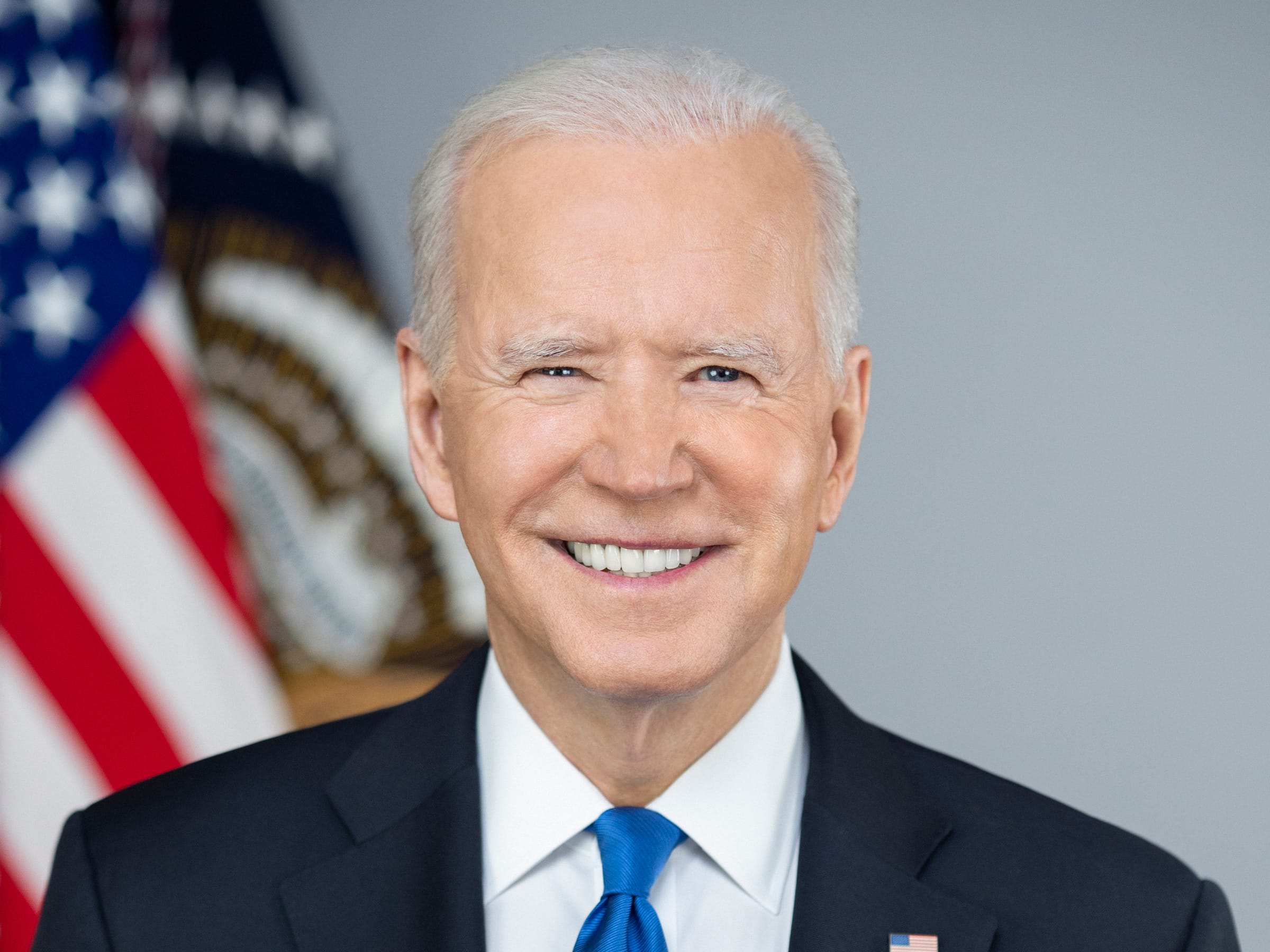

EXPOSED: BIDEN and Elites’ Unsettling Alliance with China

— President Joe Biden’s recent actions have stirred up a storm of controversy. His apparent dismissal of the idea of “decoupling” from China is causing concern among conservatives. These revelations come from a new book, Controligarchs: Exposing the Billionaire Class, Their Secret Deals, and the Globalist Plot to Dominate Your Life.

The book suggests that global elites and politicians like Biden and California Governor Gavin Newsom are actively pushing for a closer resemblance between the U.S. and its Communist adversary. It alleges that these individuals view Beijing’s elites not as threats or rivals but as business partners.

Among those named in these claims are influential figures such as BlackRock’s Larry Fink, Apple’s Tim Cook, and Blackstone’s Stephen Schwarzman. These business leaders were reportedly present at a dinner honoring Chinese Communist Party Leader Xi Jinping where they stood in applause for Chairman Xi.

This revelation comes at a time when concerns over China’s influence on global politics are growing. It highlights the urgent need for transparency in dealings between American leaders and foreign powers.

BIDEN-XI Summit: A Bold Leap or a Blunder in US-China Diplomacy?

— President Joe Biden and Chinese President Xi Jinping have committed to keeping direct lines of communication open. This decision follows their lengthy four-hour discussion at the 2023 APEC summit in San Francisco. The leaders unveiled an initial agreement aimed at halting the influx of fentanyl precursors into the U.S. They also plan to restore military communications, which were cut off after China’s disagreement with the Pentagon following Nancy Pelosi’s visit to Taiwan in 2022.

Despite rising tensions, Biden made efforts during Wednesday’s meeting to strengthen U.S.-China relations. He also vowed to persistently challenge Xi on human rights issues, arguing that frank discussions are “critical” for successful diplomacy.

Biden voiced positivity about his rapport with Xi, a relationship that began during their vice-presidential terms. However, uncertainty looms as a congressional investigation into COVID-19 origins threatens US-China relations.

It is unclear whether this renewed dialogue will result in substantial progress or further complications.

FRONTIER AI: A Ticking Time Bomb? World Leaders and Tech Titans Convene to Discuss Risks

— The latest buzzword in the realm of artificial intelligence, Frontier AI, has been causing a stir due to its potential threats to human existence. Advanced chatbots like ChatGPT have dazzled with their capabilities, but fears about the risks associated with such technology are escalating. Top researchers, leading AI companies, and governments are advocating for protective measures against these looming dangers.

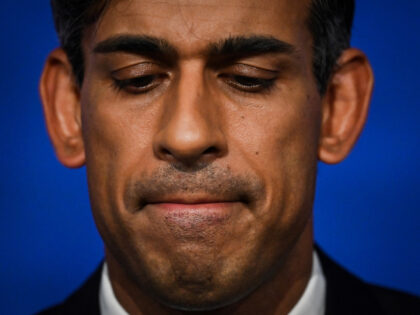

British Prime Minister Rishi Sunak is orchestrating a two-day summit on frontier AI at Bletchley Park. The event is set to draw around 100 officials from 28 nations including U.S. Vice President Kamala Harris and European Commission President Ursula von der Leyen. Executives from prominent U.S. artificial intelligence firms such as OpenAI, Google’s Deepmind and Anthropic will also be in attendance.

Sunak asserts that only governments can shield people from the hazards posed by this technology. However, he stressed that the U.K.'s strategy is not to hastily impose regulation despite identifying potential threats like using AI for crafting chemical or biological weapons.

Jeff Clune, an associate computer science professor at the University of British Columbia who specializes in AI and machine learning was among those urging for more government intervention in mitigating risks from AI last week — echoing warnings issued by tech tycoons like Elon Musk and Open

Rishi Sunak’s TURBULENT First Year: Is History About to REPEAT Itself for the Conservatives?

— Rishi Sunak, UK Prime Minister, has marked his first year in office amidst a storm of international conflicts and domestic challenges. His Conservative Party is haunted by the ghost of 1996, when they were dethroned by the Labour Party after ruling for more than a decade.

Recent opinion polls reveal that the Conservatives are lagging 15 to 20 points behind Labour. This gap has remained steady throughout Sunak’s term. An Ipsos poll showed that a whopping 65% of respondents felt the Conservatives did not deserve another term, while merely 19% believed they did.

The ongoing Israel-Hamas conflict and Russia’s war in Ukraine have added layers of complexity to Sunak’s situation. Despite acknowledging his challenging year and vowing to continue serving hardworking families nationwide, there are widespread fears these hurdles may trigger another Conservative downfall.

UK Inflation DEFIES Predictions, STAYS at 67%: What’s Next for the Economy?

— The UK’s inflation rate held steady at 6.7% in September, flying in the face of economists’ predictions for a slight decrease. The Office for National Statistics highlighted that while food and drink prices dipped, they were counterbalanced by an uptick in fuel costs.

This persistent inflation rate is more than triple the Bank of England’s target of 2%. Despite this, it is not expected that the bank will hike interest rates during its November policy meeting. Instead, it seems set to keep its main borrowing rate at a peak not seen in 15 years — a hefty 5.25%.

James Smith from the Resolution Foundation think tank offered his perspective on this economic puzzle: “For now, progress on reducing inflation has hit a roadblock.” He anticipates a significant drop to below 5% next month as energy prices are projected to fall for most consumers.

In response to price surges triggered by pandemic-induced supply chain disruptions and Russia’s invasion of Ukraine — both factors contributing heavily to increased food and energy costs — the Bank of England has been steadily cranking up interest rates from near zero levels.

Video

TRUMP’S Stunning 2024 Victory: A NEW ERA Begins

— Donald TRUMP has won the 2024 U.S. Presidential Election, marking a major political comeback. His victory is celebrated by supporters as proof of his lasting influence on American politics. Trump’s promises to tackle economic issues resonated with voters worried about inflation and job security after years under President Biden and Vice President Harris.

The election results reveal a nation divided, with Trump supporters prioritizing immigration and economic policies while Harris’s backers focused on democracy and social issues. This division highlights the challenges facing Trump’s administration in uniting the country and implementing its agenda. Bridging these divides will be crucial for effective governance in the coming years.

Trump’s foreign policy approach is already under scrutiny, especially regarding Ukraine. His interactions with Ukrainian President Zelenskyy suggest a potential shift towards a more transactional U.S. foreign policy. Speculation arises around Trump’s suggestion that Ukraine might cede territory to Russia for peace, drawing international attention and debate over this stance.

Globally, Trump’s victory signals a geopolitical shift as leaders like Netanyahu and Orban congratulate him, hinting at realigned international relations favoring hardline policies. These endorsements suggest strengthened alliances with nations supportive of Trump’s approach as he prepares to navigate complex global challenges during his presidency. The world watches closely to see how his administration will address these issues on the international stage.

More Videos

Invalid Query

The keyword entered was invalid, or we couldn't gather enough relevant information to construct a thread. Try checking the spelling or entering a broader search term. Often simple one-word terms are enough for our algorithms to build a detailed thread on the topic. Longer multi-word terms will refine the search but create a narrower information thread.

Chatter

What the world is saying!

NiftySmallCap100 Sharing the last 20 years cycles of the index.... Market cycles student should bookmark it ? 2004-2008 (Infra Boom Rally) 6x move from 1000 to 6400 Jan'08-Jan09(GFC) Gave...

. . .BREAKING: STOCK MARKET SOARS! DOW TOPS 44K, S&P HITS 6K ON OPTIMISM FOR TRUMP! https://x.com/i/broadcasts/1MYGNMjzZEpKw…

. . .When I was forced to escape Putin's crackdown in Russia and made my home in America, I never imagined I would be warning my new home about the threat of authoritarianism. But thanks to Trump,...

. . .STOCK MARKET Soars: Minor Uptick Predicted, Investors Urged to Seize Opportunity Amid Economic Stability ??????? Market briefing for ... https://lifeline.news/briefings/stock-market-...

. . ..@KamalaHarris will be a president for all Americans. She actually cares about making your lives better. Donald Trump only thinks about himself. I want you to remember this: if someone doesn’t...

. . .Join StoneX’s Chief Market Strategist, @KRooneyVera, in Miami as she unravels historical patterns to navigate modern chaos. At #CrossroadsSummit2024, we'll explore how past innovations shaped...

. . .Each month, I share my journey of navigating global markets in the Global Investment Letter. Along with my analysis of major stock, bond, currency, and global markets, I discuss my own investment...

. . .I am in the stock market. I am in on Alta, Triller, and the Italian Sea Group. I am only warming up in the stock market. I use to have zero trust in it for a reason. One of the guys I met,...

. . .? LIVE || ????????? ???????... | IMD DG Exclusive | Cyclone Dana | Kanak News. ? LIVE || ????????? ???????... | IMD DG Exclusive | Cyclone Dana | Kanak News Kanak News is Odisha's leading 24x7 news and current affairs TV channel from Eastern Media Limited. Odisha's largest media ...

. . .