THREAD: stock market set to rise adani

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

NBA’S SHOCKING Return to China: Millions at Stake After Controversial Ban Lifted

— The Brooklyn Nets and Phoenix Suns will play two preseason games in China. This follows the reinstatement of the NBA’s broadcast deal, worth millions. The league was banned in 2019 after a controversial tweet by Rockets executive Daryl Morey supporting Hong Kong protesters.

Chinese authorities demanded Morey be fired, but NBA Commissioner Adam Silver refused. Instead, Silver publicly criticized Morey, leading to his apology and retraction of support for the pro-democracy movement. Despite this, China suspended NBA broadcasts until now.

Morey’s tweet read: “Fight for freedom, stand with Hong Kong.” His apology aimed to mend relations with Chinese fans and sponsors offended by his stance. He stressed that his views were personal and not representative of the Rockets or the NBA as a whole.

The return of NBA games to Chinese screens marks a significant financial move for both parties involved. It highlights ongoing tensions between business interests and political stances within international sports diplomacy.

HARRIS ENTERS 2024 Race: National Security Fears Rise

— Kamala Harris has entered the race for the White House following President Biden’s announcement that he will not seek re-election. This sudden shift has raised alarms among national security experts who worry that adversaries like Russia, China, and Iran may exploit the “chaos” to their advantage.

These nations have shown little outward reaction to Biden’s withdrawal, but concerns remain high about potential changes in U.S. force posture abroad. Kremlin spokesperson Dmitry Peskov mentioned that Moscow was “not very surprised” by Biden’s decision and emphasized Russia’s focus on its military operations in Ukraine.

With four months until the elections, much can change, making it crucial for America to stay vigilant and monitor developments closely. The Democratic Party now faces the challenge of building a strong platform against Republican candidate Donald Trump amid these geopolitical tensions.

LABOUR PARTY Surges Amid UK Election Betting Scandal

— The U.K. general election on July 4 is approaching, with the Labour Party expected to defeat Prime Minister Rishi Sunak’s Conservatives. Polls indicate Labour leader Keir Starmer will likely form the next government.

The Conservative campaign has struggled, facing allegations of election betting involving figures close to Sunak. This scandal has further dampened their already lackluster efforts.

In the U.K., the prime minister decides election dates, unlike fixed schedules in countries like the U.S. This unique system has led to a market for predicting election dates and outcomes.

Police officers and Conservative insiders are under investigation for their involvement in this betting scandal, adding another layer of controversy as over 50 countries prepare for elections in 2024.

UN Chief BLASTS Fossil Fuel Industry for CLIMATE Chaos

— In a fiery speech in New York City, U.N. chief Antonio Guterres accused the fossil fuel industry of causing climate chaos while reaping record profits. He labeled climate change as a “stealth tax” on everyday people and vulnerable communities.

Guterres warned that the world is on a “highway to climate hell” and likened current actions to playing Russian roulette with our planet. He criticized the fossil fuel industry’s greenwashing efforts and their attempts to delay climate action through lobbying and legal threats.

The U.N. leader also targeted advertising and PR firms, comparing them to characters from Mad Men, for aiding fossil fuel companies in their destructive practices. He urged these firms to stop taking new fossil fuel clients immediately and plan to drop existing ones.

SUNAK SHOCKS Nation: Calls Surprise Election for July 4

— British Prime Minister Rishi Sunak has shocked many by calling a general election for July 4. Known for being thorough and evidence-led, this move contrasts sharply with his usual cautious approach.

Opinion polls suggest that Sunak’s Conservative Party is trailing behind the opposition Labour Party, which could spell trouble for his leadership. Sunak took office in October 2022, replacing Liz Truss after her economic policies caused market turmoil.

Sunak had warned against Truss’s unfunded tax cuts, predicting economic havoc that indeed followed. His rise to power was rapid, becoming Britain’s first leader of color and youngest prime minister in over two centuries at age 42.

Sunak previously served as Treasury chief during the coronavirus pandemic, where he introduced an unprecedented economic support package. Now at age 44, he faces a critical test with this upcoming election amid challenging political landscapes.

UK to RAMP UP Defense Spending: A Bold Call for NATO Unity

— During a military visit in Poland, British Prime Minister Rishi Sunak announced a significant increase in the UK’s defense budget. By 2030, spending is set to rise from just over 2% of GDP to 2.5%. Sunak described this boost as essential in what he termed “the most dangerous global climate since the Cold War,” calling it a "generational investment.

The next day, UK leaders pressed other NATO members to also raise their defense budgets. This push aligns with former U.S. President Donald Trump’s long-standing demand that NATO countries up their contributions for collective security. UK Defense Minister Grant Shapps voiced strong support for this initiative at an upcoming NATO summit in Washington DC.

Some critics question whether many nations will achieve these elevated spending targets without an actual attack on the alliance. Nonetheless, NATO has recognized that Trump’s firm stance on member contributions has significantly bolstered the alliance’s strength and capabilities.

At a Warsaw press conference with NATO Secretary General Jens Stoltenberg, Sunak discussed his commitment to supporting Ukraine and enhancing military cooperation within the alliance. This strategy represents a major policy shift aimed at strengthening Western defenses against escalating global threats.

ANC on SHAKY Ground: South Africa’s Opposition Parties Gaining Momentum

— Recent polling data indicates a potential shift in South Africa’s political scene, the likes of which haven’t been seen since 1994. The ruling party, the African National Congress (ANC), has experienced a decline in support from 44% to 39% since November 2022.

On the other hand, the opposition Democratic Alliance (DA) has seen its share rise from 23% to a notable 27%. A newcomer on the scene, the MK Party, has made an impressive debut with a surprising 13%, while support for the radical Economic Freedom Fighters (EFF) party has dwindled to just 10%.

This changing landscape could potentially pave the way for DA to form a majority coalition with other parties excluding ANC and EFF. This tactic proved successful in Cape Town’s municipal elections back in 2006. Despite ANC’s historical appeal due to its instrumental role in ending apartheid, ongoing issues such as electricity and water shortages, high crime rates, and rampant corruption have strained voters’ loyalty.

The shifting political climate suggests that voters are seeking change and are willing to look beyond traditional party lines. This could lead to significant changes in South Africa’s political landscape moving forward.

GREEN AGENDA Hits Hard: Ofgem Warns of Financial Burden on Low-Income Consumers

— The Office of Gas and Electricity Markets (Ofgem) sounded an alarm on Monday. It cautioned that the shift towards a “Net Zero” carbon emissions economy could unfairly impact low-income consumers. These individuals might lack the financial resources to acquire government-approved technology or modify their lifestyle habits.

In the past year alone, debts from energy consumers have skyrocketed by 50%, amassing a total of £3 billion. Ofgem voiced grave concerns about struggling households’ limited resilience to future price shocks. The regulator also highlighted that the burden of recovering bad debts could pose serious threats to the retail energy sector.

Economic difficulties have already pushed British consumers into rationing their energy consumption. This has led to “harms associated with living in a cold, damp home,” potentially triggering an increase in mental health issues rates.

Tim Jarvis, Ofgem’s director general, underscored the necessity for a long-term strategy to manage escalating debt levels and shield struggling consumers from future price shocks. He mentioned that measures such as altering standing charges for prepayment meter customers and tightening requirements on suppliers had been implemented.

-((($wid/$zoom)/2)-(($this.metadata.pointOfInterest.w/2)*100%))},{($this.metadata.pointOfInterest.y*100%)-((($hei/$zoom)/2)-(($this.metadata.pointOfInterest.h/2)*100%))},{$wid/$zoom},{$hei/$zoom}&w=$wid&h=$hei&sm=c&fmt=auto)

BODY SHOP Faces Uncertain Future: Insolvency Administrators Step In Amid Financial Crisis

— The Body Shop, a renowned British beauty and cosmetics retailer, has enlisted the help of insolvency administrators. This move follows years of financial struggles that have plagued the company. Established in 1976 as a single store, The Body Shop has grown into one of Britain’s most iconic high street retailers. Now, its future hangs in the balance.

FRP, the appointed administrators for The Body Shop, have revealed that past owners’ financial mismanagement has contributed to an extended period of hardship for the company. These issues are exacerbated by a challenging trading environment within the broader retail sector.

Just weeks before this announcement, European private equity firm Aurelius took over The Body Shop. Known for their expertise in revitalizing struggling companies, Aurelius now faces a significant challenge with this latest acquisition.

Anita Roddick and her husband established The Body Shop in 1976 with ethical consumerism at its core. Roddick earned herself the title “Queen of Green” by prioritizing corporate social responsibility and environmentalism long before they became fashionable business practices. Today however, her legacy is threatened by ongoing financial difficulties.

MASSIVE BLOW: Tata Steel Shutters Wales Plant, 2,800 Jobs Vanish Overnight

— Indian steel titan, Tata Steel, has revealed plans to close both blast furnaces at its Port Talbot plant in Wales. This drastic move will result in the loss of 2,800 jobs and is part of a broader strategy to streamline their unprofitable UK operation and make it more eco-friendly.

The company intends to transition from coal-fired blast furnaces to an electric arc furnace. This modern method emits less carbon and requires fewer workers. The British government backs this shift with a hefty £500 million ($634 million) investment. Tata Steel is confident that this transition will “turn around over a decade of losses” and foster a greener steel industry.

This decision strikes a severe blow to Port Talbot — a town heavily dependent on the steel industry since the early 20th century. Unions had suggested keeping one blast furnace operational while constructing the electric one as an attempt to mitigate job cuts — a proposal that Tata dismissed.

Both blast furnaces are slated for closure within this year. Meanwhile, plans for installing the new electric furnace are set for completion by 2027.

OPERATION PROSPERITY Guardian: Biden’s Strategy Crumbles as Houthis Successfully Target Maersk Ship

— Despite the Biden administration’s strategy to deter Houthi attacks, it seems to be falling short. The Times of Israel has reported a missile strike on a Maersk container ship in the Red Sea. This marks the first successful attack since an international coalition started patrolling this crucial waterway just ten days ago.

The USS Gravely was quick to respond to a distress call from the Maersk Hangzhou, intercepting two additional ballistic missiles. US Central Command (CentCom) confirms there were no injuries and that the ship remains operational. The attack happened shortly after Denmark joined the coalition and Danish-owned Maersk decided to resume shipping through the Red Sea and Suez Canal.

US Secretary of Defense Lloyd Austin initiated “Operation Prosperity Guardian” on December 18 with support from ten nations against Houthi attacks on shipping routes. The Houthis aim is to cut off Israel’s Red Sea port of Eilat. However, this recent attack raises serious doubts about Biden’s strategy and its effectiveness in maintaining maritime security.

US STEEL Takeover: BLOCKING Japanese Buyout Could Save American Jobs

— Nippon Steel, Japan’s leading steel company, is facing a storm of criticism over its planned $14 billion acquisition of U.S. Steel Corporation. The deal, unveiled on Monday, values U.S. Steel at $55 per share and has sparked immediate opposition, especially in the Rust Belt where U.S. Steel has been a cornerstone since 1901.

Despite U.S. Steel’s assurances that the merger would unite “two storied companies with rich histories,” lawmakers are demanding action. Senators J.D. Vance (R-OH), Josh Hawley (R-MO), and Marco Rubio (R-FL) have written to Treasury Secretary Janet Yellen urging the Committee on Foreign Investment in the United States (CFIUS) to halt the deal.

The senators contend that domestic steel production is vital for national security and needs careful scrutiny before permitting foreign investment. CFIUS, led by Yellen, holds the authority to stop such investments after a review process.

While experts predict CFIUS is more likely to block deals involving countries perceived as adversaries like Russia or China rather than allies like Japan, this situation highlights bipartisan worries about foreign control over crucial industries.

UK INFLATION TUMBLES to 39%: Central Bank May Slash Rates Sooner Than Predicted

— The Office for National Statistics (ONS) recently announced a surprising drop in UK inflation to 3.9% in November, a decrease from the previous month’s 4.6%. This dip, larger than what financial markets had forecasted, marks the lowest inflation level since September 2021.

This decline is primarily attributed to falling fuel and food prices according to the ONS. However, despite this optimistic news, the Bank of England’s primary interest rate remains at a staggering high of 5.25%, not seen for over a decade and a half.

Governor Andrew Bailey hinted that this stringent interest rate policy might continue for some time. Yet Samuel Tombs, chief U.K economist at Pantheon Macroeconomics suggests an alternative view — that this sharp fall in inflation could trigger an earlier-than-expected cut in interest rates; perhaps as early as the first half of next year.

While elevated interest rates initially helped curb inflation sparked by supply chain disruptions and Russia’s invasion of Ukraine, they have also put pressure on consumer spending and slowed economic growth. As such there are growing worries that maintaining high rates could inflict unnecessary damage on the economy.

Bipartisan Committee CALLS for END of China’s Trade Status: A Potential Jolt to US Economy

— A bipartisan committee, led by Rep. Mike Gallagher (R-WI) and Rep. Raja Krishnamoorthi (D-IL), has been studying the economic effects of China on the US for a year. The investigation centered on job market changes, manufacturing shifts, and national security concerns since China joined the World Trade Organization (WTO) in 2001.

The committee released a report this Tuesday recommending President Joe Biden’s administration and Congress to implement nearly 150 policies to counteract China’s economic influence. One significant suggestion is to cancel China’s permanent normal trade relations status (PNTR) with the U.S., a status endorsed by former President George W. Bush in 2001.

The report argues that granting PNTR to China did not bring anticipated benefits for the US or trigger expected reforms in China. It asserts that this has led to a loss of vital U.S. economic leverage and inflicted damage on U.S industry, workers, and manufacturers due to unfair trade practices.

The committee proposes shifting China into a new tariff category that reinstates U.S economic leverage while reducing dependence on Chinese

US-CHINA Economic Reset PROPOSED: Will Higher Tariffs Be the New Norm?

— A bipartisan committee in the House has put forth a proposal for a complete overhaul of US economic ties with China. This includes the suggestion of implementing higher tariffs. The pivotal recommendations were released in an extensive report by the House Select Committee on Strategic Competition Between the United States and Chinese Communist Party, chaired by Mike Gallagher (R-WI) and Raja Krishnamoorthi (D-IL).

The report posits that since its induction into the World Trade Organization in 2001, Beijing has been engaged in an economic conflict against both the US and its allies. It outlines three key strategies: revamping America’s economic relationship with China, limiting U.S. capital and technological inflow into China, and strengthening U.S. economic resilience with allied support.

One notable recommendation is to shift China to a new tariff column to enforce more robust tariffs. The committee also suggests imposing tariffs on essential semiconductor chips used in everyday devices like phones and cars. This move aims to prevent Chinese domination in this sector from granting Beijing undue control over global economy.

OIL TYCOONS Rule COP28: A Shocking Paradox or a Bold Leap for Climate Goals?

— The forthcoming COP28 climate summit, to be held in the United Arab Emirates (UAE), is stirring up a storm of controversy. Critics are questioning the seemingly ironic choice of Sultan Ahmed Al Jaber, CEO of UAE’s state oil company, as the event’s overseer.

UK Guardian columnist Marina Hyde has expressed concerns about this decision. She compares it to China’s temporary factory closures during the 2008 Olympics for cleaner air. She questions whether UAE will also pause its gas flaring operations during the conference.

Climate advocates fear that powerful politicians and industrialists could twist climate policies for personal gain. These fears are amplified by reports that Al Jaber and UAE may exploit COP28 to broker oil and gas deals with other nations.

Despite these apprehensions, some believe that involving major oil producers is key to meeting climate objectives. But with President Joe Biden absent and protests pushed to distant locations, doubts over COP28’s effectiveness continue to mount.

EXPOSED: BIDEN and Elites’ Unsettling Alliance with China

— President Joe Biden’s recent actions have stirred up a storm of controversy. His apparent dismissal of the idea of “decoupling” from China is causing concern among conservatives. These revelations come from a new book, Controligarchs: Exposing the Billionaire Class, Their Secret Deals, and the Globalist Plot to Dominate Your Life.

The book suggests that global elites and politicians like Biden and California Governor Gavin Newsom are actively pushing for a closer resemblance between the U.S. and its Communist adversary. It alleges that these individuals view Beijing’s elites not as threats or rivals but as business partners.

Among those named in these claims are influential figures such as BlackRock’s Larry Fink, Apple’s Tim Cook, and Blackstone’s Stephen Schwarzman. These business leaders were reportedly present at a dinner honoring Chinese Communist Party Leader Xi Jinping where they stood in applause for Chairman Xi.

This revelation comes at a time when concerns over China’s influence on global politics are growing. It highlights the urgent need for transparency in dealings between American leaders and foreign powers.

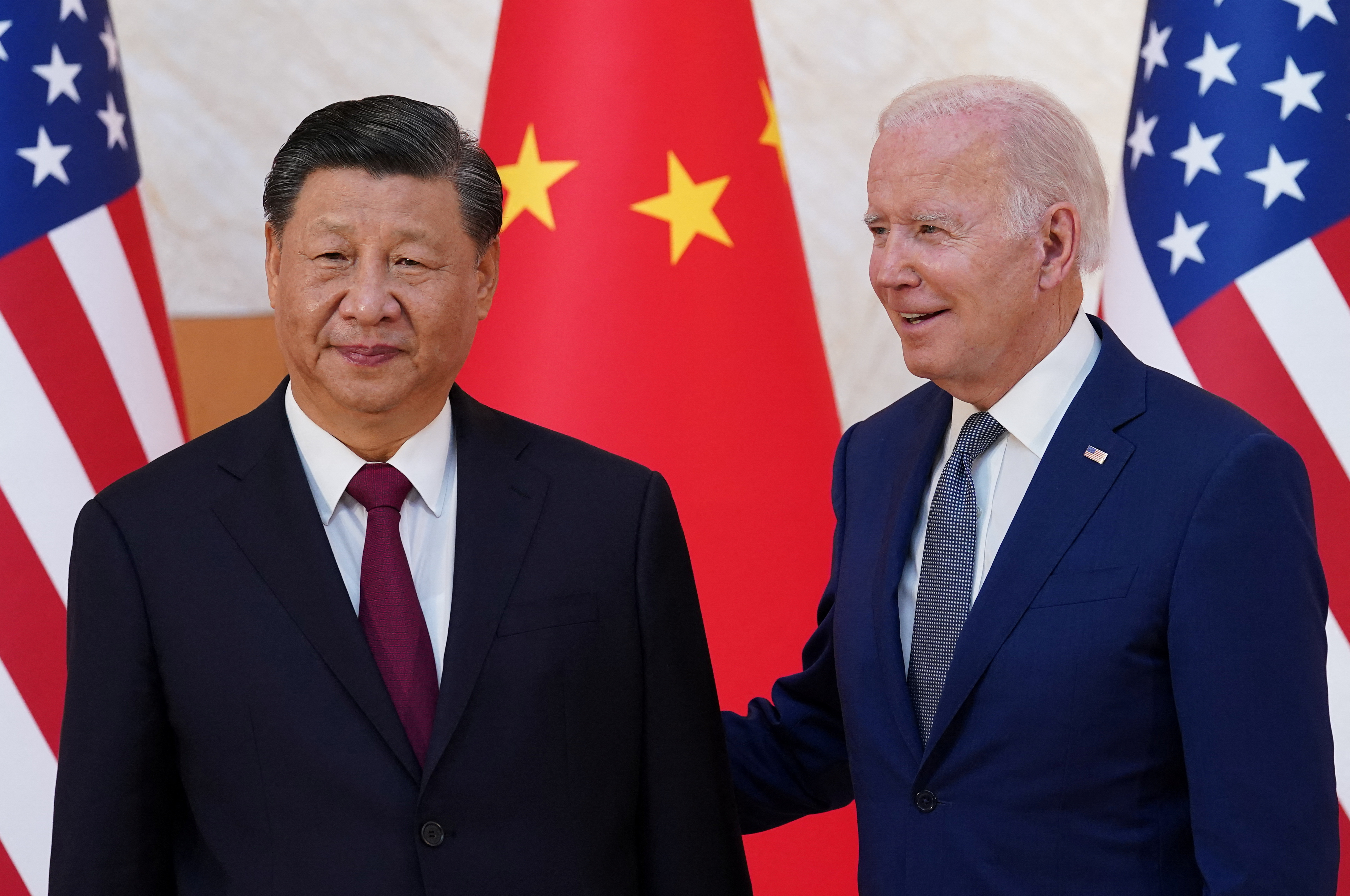

BIDEN and XI: Critical Trade Talks Amid Escalating Tensions

— President Joe Biden is scheduled to meet with Chinese President Xi Jinping in California this Wednesday. This marks their first rendezvous in a year, amidst the backdrop of strained U.S.-China relations. The world’s two largest economies will put trade and Taiwan at the forefront of their discussions.

The White House has been alluding to this meeting for some time now. It will occur on the fringes of the Asia-Pacific Economic Cooperation summit in San Francisco. Both leaders are aiming to “responsibly manage competition” and collaborate where mutual interests overlap.

Meanwhile, Treasury Secretary Janet Yellen has been engaging with Chinese Vice Premier He Lifeng for a second day of dialogue on Friday. Yellen underscored America’s aspiration for a robust economic relationship with China, while also urging Beijing to take action against firms suspected of circumventing sanctions to transact with Russia.

Yellen additionally expressed apprehensions about China’s export controls on graphite – an essential component in electric vehicle batteries – amidst escalating tensions between the nations that could see thousands protesting during the summit.

Rishi Sunak’s TURBULENT First Year: Is History About to REPEAT Itself for the Conservatives?

— Rishi Sunak, UK Prime Minister, has marked his first year in office amidst a storm of international conflicts and domestic challenges. His Conservative Party is haunted by the ghost of 1996, when they were dethroned by the Labour Party after ruling for more than a decade.

Recent opinion polls reveal that the Conservatives are lagging 15 to 20 points behind Labour. This gap has remained steady throughout Sunak’s term. An Ipsos poll showed that a whopping 65% of respondents felt the Conservatives did not deserve another term, while merely 19% believed they did.

The ongoing Israel-Hamas conflict and Russia’s war in Ukraine have added layers of complexity to Sunak’s situation. Despite acknowledging his challenging year and vowing to continue serving hardworking families nationwide, there are widespread fears these hurdles may trigger another Conservative downfall.

UK Inflation DEFIES Predictions, STAYS at 67%: What’s Next for the Economy?

— The UK’s inflation rate held steady at 6.7% in September, flying in the face of economists’ predictions for a slight decrease. The Office for National Statistics highlighted that while food and drink prices dipped, they were counterbalanced by an uptick in fuel costs.

This persistent inflation rate is more than triple the Bank of England’s target of 2%. Despite this, it is not expected that the bank will hike interest rates during its November policy meeting. Instead, it seems set to keep its main borrowing rate at a peak not seen in 15 years — a hefty 5.25%.

James Smith from the Resolution Foundation think tank offered his perspective on this economic puzzle: “For now, progress on reducing inflation has hit a roadblock.” He anticipates a significant drop to below 5% next month as energy prices are projected to fall for most consumers.

In response to price surges triggered by pandemic-induced supply chain disruptions and Russia’s invasion of Ukraine — both factors contributing heavily to increased food and energy costs — the Bank of England has been steadily cranking up interest rates from near zero levels.

Video

BRITISH PM’S Bold Housing Plan: 15 Million Homes to FIX Crisis

— British Prime Minister Keir Starmer has announced a plan to tackle the UK’s housing crisis by building 1.5 million homes over the next five years. This initiative aims to address the severe shortage of housing and create jobs in the construction sector.

The plan includes government-led projects and incentives for private developers, focusing on sustainable urban planning and energy-efficient homes. This aligns with broader goals to reduce carbon emissions and combat climate change.

Critics question whether the government can secure adequate funding and navigate bureaucratic challenges to achieve this ambitious goal. Despite these concerns, the government cites past successes in large-scale infrastructure as evidence of its capability.

More Videos

Invalid Query

The keyword entered was invalid, or we couldn't gather enough relevant information to construct a thread. Try checking the spelling or entering a broader search term. Often simple one-word terms are enough for our algorithms to build a detailed thread on the topic. Longer multi-word terms will refine the search but create a narrower information thread.

Social Chatter

Indian Stock Market Daily Discussion Thread. Indian Stock Market Daily Discussion Thread Ask and discuss your investing related queries here! Beware that these answers are just opinions of fellow Redditors and should only be used as a starting point for your research. This is NOT financial advice, in legal sense of the term.

. . .Markets Recovering. Markets Recovering Markets Recovering well, Brought few stocks of Chennai Petrochemical Will be glad to get your advice & opinions

. . .FII Inflow Alert! MSCI Rebalancing Boosts HDFC, Voltas & More! Adani Energy gets excluded 📈📊📉 #adani. FII Inflow Alert! MSCI Rebalancing Boosts HDFC, Voltas & More! Adani Energy gets excluded 📈📊📉 #adani MSCI index rebalancing brings in FII inflow of 10k! HDFC, Voltas, BSE, and Oberoi Realty benefit, while Adani Energy gets ...

. . .FII Inflow Alert! MSCI Rebalancing Boosts HDFC, Voltas & More! Adani Energy gets excluded 📈📊📉 #adani. FII Inflow Alert! MSCI Rebalancing Boosts HDFC, Voltas & More! Adani Energy gets excluded 📈📊📉 #adani MSCI index rebalancing brings in FII inflow of 10k! HDFC, Voltas, BSE, and Oberoi Realty benefit, while Adani Energy gets ...

. . .Adani 💥 Share MSCI Index Breaking news | adani news | adani news today | adani group | Vinay Equity. Adani 💥 Share MSCI Index Breaking news | adani news | adani news today | adani group | Vinay Equity Hello friends in this video I mention about Adani Share MSCI Index Breaking news | adani news | adani news today | adani ...

. . .