THREAD: bullish or bearish chinas market...

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

NET NEUTRALITY Revival Pushed by Biden’s New FCC Pick: The Real Impact on Telecom Companies

— Following the unsuccessful Senate endorsement of Gigi Sohn, President Biden has now confirmed Anna Gomez as the new commissioner for the Federal Communications Commission (FCC). This appointment breaks a 2-2 deadlock at the Commission. In response, Democrats and progressive nonprofits have begun to advocate for the return of Title II regulations on telecom companies.

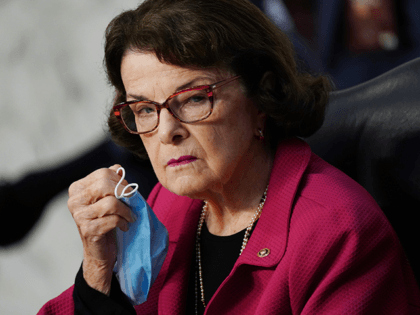

On Monday, a group of 27 Senate Democrats, which included Senators Dianne Feinstein (D-CA), Ron Wyden (D-OR), and Elizabeth Warren (D-MA), called on FCC Chairwoman Jessica Rosenworcel to reestablish Title II regulations on internet service providers. These were regulations that had been withdrawn during Trump’s tenure.

Last week, progressive nonprofit Free Press also stepped up its efforts by starting a petition urging the FCC to bring back net neutrality rules. These rules were first introduced during Obama’s presidency before social media censorship became widespread. Net neutrality was initially touted as a means to safeguard an open internet by classifying telecom companies as common carriers.

Free Press emphasized that net neutrality is essential for preserving an internet that is “free, open and accessible to all.” However, critics contend that such regulation could potentially stifle innovation and competition within the sector.

:max_bytes(150000):strip_icc()/GettyImages-2218070517-95fab5f5010549489d4b7a78b0dfabc9.jpg)

NO SHOCKING Market News Rocks Wall Street On June 5, 2025

— June 5, 2025 came and went without any surprise events shaking up the financial world. Markets stayed steady, and investors saw no unexpected drama.

Big stories like Amazon’s move into Australia, hedge fund closures, and Japan’s crypto rules are still leading the headlines. Global market trends remain unchanged for now.

Conservative investors and business owners faced no sudden risks or threats today. Everything important has already been reported in the news cycle.

We’ll keep a close eye out for any fresh updates or sector changes that could matter to you — count on us to bring you the facts first.

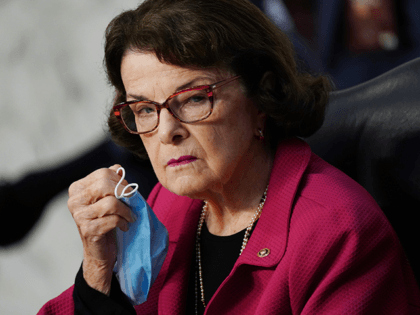

TECH GIANT’S Bold Gamble Shocks Global Market

— A top tech company just revealed big plans to break into new markets. Their goal? To shake up the industry by launching cutting-edge AI, cloud, and cybersecurity products. This bold move could threaten the old leaders of tech.

The CEO says the company is all-in on innovation and hinted at major spending and new global partners. Some experts think this news will send the company’s stock soaring as investors jump in.

Still, not everyone is convinced this risky expansion will work out. Some analysts warn that taking on so much at once could backfire if things don’t go as planned.

This story is moving fast. Expect more updates soon as rivals react and we learn more about how far this tech giant will go to win.

WALL STREET Panic: Trade WAR Fears Spark Shocking Market Plunge

— Wall Street took a hard hit today as trade tensions with China grew worse. The Dow Jones Industrial Average dropped over 300 points. Many investors are worried about new tariffs and talks that have stalled between the two countries.

Tech companies suffered the most, losing value as people feared more rules and crackdowns. At the same time, gold prices jumped to their highest level in four weeks because investors wanted safer places for their money.

The Federal Reserve is paying close attention to these changes. Some experts think interest rate cuts could happen if the economy keeps showing signs of trouble.

Big banks like JPMorgan Chase are already changing their plans to deal with all this uncertainty around the world. Today’s market drop shows just how shaky things can get when bad policies and global disputes take center stage.

TRUMP’S Bold Auto Tarifs Spark Fury And Hope In Global CAR Market

— President Trump has announced a 25% tariff on imported cars and parts, starting in April. He says this move will boost American car makers and bring jobs back to the U.S.

Some experts warn these tariffs could raise prices for buyers and shake up car production. The U.S. brought in about eight million foreign cars last year, making up half of all sales.

Financial analysts say the tariffs might lower stock values by 5%. They also worry about possible inflation, job losses, and even a recession if trade fights continue.

India is asking for an exemption to protect its $66 billion export business with America. The Trump team is using these tariffs as leverage while working on new trade deals that could change the global market and America’s future economy.

ALSEA SEIZES Control: Starbucks Colombia Franchise Deal Shocks Market

— Mexican company Alsea now fully owns all 72 Starbucks shops in Colombia. They bought out Grupo Nutresa’s 30% share, making Alsea the only owner. The price of the deal was not shared with the public.

This move gives Alsea more power in Latin America’s coffee market. With full control, they can make faster decisions and grow even more across the region.

In other news, Singapore Business Federation released a new e-book to help businesses handle tariffs and trade barriers. They’re also offering advice on financing and supply chains as global trade rules keep changing.

No other major business news happened on May 22, 2025, besides these updates.

GLOBAL MARKET Panic: US Sanctions on China Trigger Shockwaves

— Stock markets around the world took a nosedive after the US slapped new sanctions on China’s tech industry. The Biden administration claims China has been stealing American ideas and playing unfair in trade.

Some experts warn these tough measures could start a bigger trade war, hurting supply chains and slowing down the world economy. Asian markets, especially in Japan and South Korea, dropped fast as worries spread about what comes next.

Investors are being told to pay close attention as leaders rush to emergency meetings to figure out their next move. This story is still unfolding and could hit businesses everywhere hard.

INDIA STOCK Market Panic: Smallcaps HIT With Devastating Losses

— India’s smallcap and midcap stocks just faced their worst crash since the Covid lockdowns. In February 2025, more than 175 small companies saw double-digit losses. The BSE Smallcap index dropped by 14%, and the Nifty Midcap 100 fell almost 11%. Panic selling and weak earnings fueled the drop, with Natco Pharma alone crashing over 34%.

The sell-off has erased ?25 lakh crore in value from public sector companies since August. Over 240 smallcaps have lost more than half their value from recent highs, leaving many investors hurting. Even strong defense and railway stocks took a beating.

Experts say high prices, poor earnings, slower economic growth, rising U.S. bond yields, and foreign investors moving money to China all played a part in this mess. Minister Piyush Goyal called it a “wake-up call” for advisors who failed to warn regular investors about these risks.

Market analysts remind people that corrections like this do happen but urge caution going forward. Investment advisor Mihir Vora said if stocks have fallen by half, they are now much cheaper — hinting that careful buyers might find good deals or clean up their portfolios now.

FED SHOCKS Wall Street: Trump’S Trade Fight Sparks Market Jitters

— The Federal Reserve decided to keep interest rates the same on May 8, 2025. Officials said they are worried about the uncertainty caused by President Trump’s tough trade policies and tariffs. They want to see how inflation and the economy respond before making any changes.

Goldman Sachs warned that U.S. stocks could fall if tariffs stay in place or get worse. The recent rise in the S&P 500 might not last unless there is a clear move away from tariffs without hurting the economy.

In April, a short-term break from new tariffs gave markets a small boost, but investors are still uneasy about what comes next. The Fed says it will keep watching economic data closely as it deals with these challenges.

Right now, many on Wall Street want clearer answers from the White House about future trade moves. Until then, the Fed is focused on keeping prices steady and protecting American jobs as Trump sticks to his America First plan.

TRUMP’S Tariff CUT Sparks Stock Market Surge

— In a bold move, President Donald Trump announced a temporary cut in tariffs for many countries, while raising them for China. This decision caused U.S. stock indexes to soar, with the S&P 500 seeing its biggest gain since 2008, closing 9.5% higher. Trump’s tariff strategy aims to increase pressure on China amid ongoing trade tensions.

The announcement led to a sharp drop in the Cboe Volatility Index (VIX), which fell by 15 points to 37.2 after news of a 90-day tariff pause for most nations. However, China’s response was quick as they imposed an 84% retaliatory tariff on U.S. goods following the new U.S. levy on Chinese imports that took effect at midnight. This escalation adds uncertainty to global markets despite the initial boost in U.S stocks.

Meanwhile, on the home front, the U.S government has started monitoring immigrants’ social media accounts for signs of antisemitism as part of enhanced security measures. This initiative reflects growing concerns over hate speech and its potential impact on national security and social cohesion within immigrant communities across America.;

MARKET PANIC: Bitcoin and Stocks Plummet in US Tariff Chaos

— Bitcoin dropped below $80,000 on Sunday, falling over 3% in just two hours. This decline happened alongside major losses in U.S. stock markets. The S&P 500 and Nasdaq Composite both closed nearly 6% lower on April 4. Analyst Holger Zschaepitz noted the stock market lost $8.2 trillion, surpassing losses from the worst week of the 2008 financial crisis.

The market chaos comes from recent U.S. tariffs that have sparked widespread sell-offs across many sectors. Despite this turmoil, some investors see potential buying opportunities as stocks are now trading at historically low valuations of 15 times future earnings projections.

Jim Cramer has warned this could be just the start of a bigger downturn for the S&P 500, predicting a further meltdown of up to 20%. As of Sunday night, S&P futures were down about 4%. Global stocks have already lost $7.46 trillion since April 2nd and may exceed $10 trillion if recent sell-offs continue to unfold.;

TRUMP’S Trade Policy Shocks: US Stocks Plunge in Market Chaos

— The EURO has surged to a six-month high as investors react to the latest U.S. tariff announcements. Meanwhile, the Australian dollar has taken a hit, reflecting global market volatility. These currency shifts highlight ongoing economic uncertainties fueled by international trade tensions.

U.S. stock futures have plummeted after China’s retaliatory tariffs on American goods, marking another phase in the global trade conflict. The Dow Jones dropped 1,679 points, causing widespread concern among investors and financial strategists who urge calm and strategic planning during these turbulent times.

Bitcoin ETFs saw nearly $100 million in net outflows as markets reacted sharply to tariff news from the Trump administration. This exodus underscores investor anxiety and uncertainty about future economic conditions amid escalating trade disputes with China.

Goldman Sachs has revised its oil price forecasts downward due to fears of a potential recession and increased supply from OPEC+. Gold prices have steadied after an initial selloff triggered by aggressive U.S. tariff policies, indicating cautious optimism among investors seeking safe-haven assets in uncertain times.

— Canaccord Genuity sells US wholesale market making business The firm is divesting to sharpen its focus on US capital markets operations, according to CEO Jeff Barlow

— Canaccord Genuity sells US wholesale market making business The firm has signed a deal with Cantor to streamline its US operations and focus on core advisory and capital raising strengths

STOCK MARKET Chaos: US Faces Economic Fears as Tariffs Loom

— U.S. stocks took a nosedive today as President Donald Trump’s “Liberation Day” approaches, bringing potential tariffs on Canadian steel and aluminum imports. Analysts warn these tariffs could trigger a market downturn and increase recession risks. Wolfe Research has already revised U.S. growth estimates for 2025 down to 1.6%.

Retail giant Kohl’s experienced its worst trading day since 1992, with stocks tumbling by 26% after issuing disappointing guidance for the year. Investor anxiety is also heightened by an upcoming House vote on a stopgap funding bill, adding to market volatility.

The Dow Jones Industrial Average has fallen 8.3% from its peak, raising concerns about the tech sector’s performance compared to the S&P 500. Investors are bracing for further shifts as policy decisions unfold in the coming days amid fears of reduced earnings across sectors due to new tariffs and declining consumer confidence.

HONG KONG Surge Ignites Asian Market Boom

— Hong Kong is leading a major surge in Asian markets, sparking excitement and strong trading. Big gains are seen in Japan, India, and Malaysia. Indonesia trails slightly behind.

This market shift lines up with possible geopolitical changes, including hints from former President Trump about a potential visit from President Xi to Washington DC. Such moves could impact international relations and economic plans.

China’s tech giants like Alibaba and Tencent are seeing big gains thanks to positive domestic consumption outlooks. This growth shows the strength of China’s tech sector amid global uncertainties.

NIO’s partnership with CATL signals more growth in the tech industry, boosting investor confidence across Asia. The collaboration highlights the region’s focus on innovation and technological progress.

TRUMP’S Bold Move: How NEW Tariffs Rattle the Stock Market

— U.S. stocks fell sharply as President Donald Trump’s tariffs on Canada and Mexico took effect, sparking economic fears. Investors worry about the potential impact amid existing uncertainties. Analysts warn of a possible recession, urging caution in market activities.

The S&P 500 and Nasdaq composite saw major drops, hitting technology stocks hard. Companies across sectors are revising forecasts due to these new trade policies. Experts suggest these tariffs could worsen inflation and reduce consumer spending soon.

These tariffs are part of Trump’s broader trade agenda to boost U.S. manufacturing but risk retaliatory actions that may harm American businesses and consumers. The market remains bearish as analysts closely watch for policy fallout effects.

SENSEX SURGE: Investors Cheer as Market Confidence Grows

— The SENSEX index opened at 74,474.98 on March 9, 2025, marking a positive start to the trading day. This opening was slightly above its previous close of 74,332.58, signaling growing investor trust in the market’s stability.

As trading progressed, the index gained over 350 points, hitting a high of 74,713.17. This upward trend shows optimism among investors and suggests a strong economic outlook for India.

Growth in the SENSEX is often seen as an indicator of economic health and can positively influence global markets. Investors will be closely watching to see if this momentum continues in the coming days.

XRP PRICE Soars: Trump’s Bold Crypto Move Shakes Market

— XRP’s price jumped by 30%, hitting $2.75 after finding support at $2.00. This rise follows talk about its possible inclusion in a US Crypto Reserve.

President Trump suggested the US might add XRP, ADA, and SOL to a national crypto reserve along with Bitcoin and Ethereum. This could change the cryptocurrency world dramatically.

Analyst “Dark Defender” predicts XRP could reach $77.7 soon, showing growing investor hope. These forecasts highlight how government-backed crypto plans might affect market trends.

INNOVATIVE BUSINESS Ideas Face Economic Hurdles In Today’S Market

— The current market offers many opportunities for new business ideas. AI-powered financial coaching apps are gaining popularity, especially among women entrepreneurs. There’s also a growing demand for senior care services due to an aging population. Eco-friendly products, second-hand fashion, and zero-waste packaging are on the rise as consumers focus on sustainability.

Labour’s proposed tax hikes on businesses could threaten low-paid jobs in the UK. Employers face financial pressure from rising business rates and national insurance costs. These changes may cost businesses about £5 billion, potentially impacting low-income workers significantly.

In the U.S., stock markets saw a sharp decline with the Dow dropping nearly 750 points amid tariff concerns. Reports suggest U.S. business activity is nearing a stall with growth at a 17-month low. Businesses express widespread worries over federal policies affecting their operations and future optimism.

UNMISSABLE Business OPPORTUNITIES: How to Thrive in Today’s Market

— The current market offers many business opportunities that align with consumer needs and personal passions. AI-powered financial coaching apps are becoming popular, especially among women entrepreneurs seeking personalized advice. Senior care services are also in demand due to the aging population needing more in-home support.

Eco-friendly products like second-hand fashion and zero-waste packaging are trending as consumers focus on sustainability. Success in these areas depends on marketing strategies that emphasize transparency and ethical practices.

Meanwhile, Dorset is seeing fewer new business startups due to economic pressures and job security worries. Ian Girling of the Dorset Chamber of Commerce calls for government action to help new businesses survive better.

In contrast, Syntheia Corp., which specializes in AI-driven call handling solutions, reports a surge in subscriptions, doubling to 2,000 within a week. This growth highlights the increasing reliance on conversational AI technologies to transform customer service experiences.

TECH GIANTS Spark Stock Market Surge: What Investors Need to Know

— The STOCK MARKET is seeing a surge, with predictions of a 0.49% rise. This optimism comes from major tech companies, whose earnings reports are expected to beat estimates. Investors are eagerly awaiting these results, fueling excitement across the market.

However, concerns about rising interest rates could dampen this enthusiasm. While the outlook remains positive now, potential rate hikes might impact investor sentiment soon. Market participants stay cautious as they navigate these mixed signals.

Besides stock market news, debates continue over a new lunch plan proposed by a coalition that may affect small businesses’ futures. Stakeholders are split on the possible effects of these changes, highlighting ongoing challenges in balancing economic growth with regulations.

HORRIFIC CAR Attack at German Christmas Market: 11 Dead in Suspected Terrorist Act

— A car attack at a Christmas market in Magdeburg, Germany, left 11 people dead and over 80 injured on January 31, 2025. Authorities believe this was a terrorist act.

Emergency services arrived quickly to the chaotic scene. Many victims were critically hurt. Witnesses saw panic as people ran and some got trapped under the vehicle. Police caught the suspect, a 50-year-old man acting alone.

The German government shared condolences with victims’ families and vowed to investigate this tragic event thoroughly.

TRUMP’S Trade WAR Ignites Gold Rush And Market Turmoil

— Gold prices have hit a record high as investors flock to safe assets amid President Donald Trump’s new tariffs. These measures target imports from Canada, China, and Mexico, sparking worries about inflation and economic growth. JP Morgan is optimistic about gold, urging investors to buy during this dip.

Wall Street braces for losses due to fears of an escalating trade war from Trump’s tariff actions. The 25% tariffs on Canada and Mexico and 10% on China may cause “short-term” pain for Americans, according to Trump. Global markets watch cautiously as these policies unfold.

Oil prices are climbing in response to the tariffs, while metal and agricultural commodities face pressure downward. The financial landscape is shifting with markets adjusting to a potential prolonged trade conflict led by the U.S., causing the dollar to gain strength amid global trade uncertainty.

AMAZON’S BOLD Move: New South Africa Center Shakes UP Market

— Amazon has opened a new center in Cape Town, South Africa, to support its independent sellers. This is part of Amazon’s plan to grow its market share and compete with local leader Takealot, owned by Naspers. The center aims to help sellers attract more customers and expand Amazon’s product range, potentially boosting revenue.

APPLE’s CHINA TROUBLES: iPhone Shipments PLUMMET

Apple shares fell 3.2% after research firm Canalys reported a 17% drop in iPhone shipments in China for 2024. This decline pushed Apple down to third place in China’s market share rankings. Despite the stock’s volatility, this news is significant but doesn’t drastically change the company’s business outlook.

STOCK MARKET SLUMP: Earnings Reports RATTLE Investors

The stock market took a hit following Wednesday’s rally due to retail sales data and major bank earnings reports taking the spotlight. Analysts remain hopeful about gains for the S&P 500 by year-end despite current swings. Focus is also on upcoming hearings on tariff plans before President-elect Donald Trump that could affect future economic strategies moving forward.

STOCK MARKET Chaos: Inflation Fears Shake Investor Confidence

— The U.S. STOCK market took a big hit today, with major indexes dropping over 3% due to rising inflation fears. Investors worry about possible Federal Reserve policy changes after high inflation numbers came out earlier this week. This is one of the steepest drops in months, shaking confidence that had been boosted by strong job reports.

Bond yields are up, with the 10-year Treasury bond yield hitting about 4.1%, its highest since late 2023, signaling increased inflation expectations. Big tech stocks like Apple and Microsoft saw sell-offs over 5%, adding to the market slump. Analysts warn that ongoing inflation might push the Federal Reserve to rethink interest rate policies, possibly leading to more hikes instead of cuts.

The decline comes after a strong holiday shopping season that initially suggested steady economic growth but is now overshadowed by ongoing inflation problems. Retail and consumer sectors face rising costs and reduced spending, making investors cautious in these areas. Companies like Walmart and Target report higher holiday sales but shrinking profit margins due to inflation pressures, prompting them to rethink annual forecasts.

Banks like JPMorgan are bracing for possible loan defaults as consumers struggle with higher living costs by setting aside more reserves. Market analysts expect continued volatility as investors digest new inflation data and Fed policy implications.;

TRAGIC CHAOS: Car Attack at German Christmas Market Sparks Fear

— A Christmas market in Magdeburg, Germany, turned tragic when a car plowed into a crowd, killing five and injuring over 200. Authorities suspect terrorism as they investigate the incident. Several victims remain in critical condition.

U.S. State Department spokesperson Matthew Miller condemned the event as an “attack,” expressing condolences and support for Germany. Cardinal Dolan offered words of hope, stating that “light will prevail” after this tragedy.

Magdeburg Police identified the suspect as a 50-year-old Saudi doctor believed to have acted alone. The driver reportedly covered 400 meters before police subdued him at gunpoint.

TRAGIC STABBING Spree at London Market Shocks Community

— A stabbing spree at East Street Market in south London left one dead and two injured on Sunday morning. Police arrested a man in his 60s at the scene. While they have not shared details about the suspect or his motives, they do not believe it is terror-related, hinting that mental health issues might be involved.

Witnesses described a chaotic scene as the attacker randomly targeted people. An unnamed fabric seller said, “I just saw a bloke running through the market stabbing people willy-nilly.” The attack happened around 10:30 am when the market was getting busy.

The witness immediately called police after seeing two men stabbed, noting one appeared severely injured. Emergency services quickly arrived but sadly, one victim died from injuries despite their efforts.

The investigation continues as authorities work to understand what led to this tragic event and ensure community safety moving forward.

— UK Leads European Office Investment Resurgence The UK has emerged as a frontrunner in revitalizing office investments across Europe, signaling a strong recovery in the commercial property market

BULLISH on Bitcoin: Crypto Market ERUPTS in January as FEAR Turns to GREED

— Bitcoin (BTC) is on track to have the best January in the last decade as investors turn bullish on crypto after a disastrous 2022. Bitcoin leads the way as it approaches $24,000, up a massive 44% from the beginning of the month, where it hovered around $16,500 a coin.

The broader cryptocurrency market has also turned bullish, with other top coins such as Ethereum (ETH) and Binance Coin (BNB) seeing substantial monthly returns of 37% and 30%, respectively.

The upturn comes after last year saw the crypto market plunge, fueled by fears of regulation and the FTX scandal. The year shredded $600 billion (-66%) from Bitcoin’s market cap, ending the year worth only a third of its 2022 peak value.

Despite the ongoing concerns of regulation, the fear in the market looks to be shifting to greed as investors take advantage of bargain prices. The rise may continue, but savvy investors will be wary of another bear market rally where a sharp sell-off will send prices back to Earth.

Social Chatter

What the World is Saying