THREAD: financial trader

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

— BSE Shares Surge 17-18% After NSE Delays Expiry Day Change The delay by NSE to alter weekly expiry dates boosted BSE’s market share prospects amid a rally in Indian financial stocks

NO SHOCKING Financial News Rocks Markets: Investors Relieved on May 17, 2025

— Conservative investors hoping for big headlines today can breathe easy. There are no new financial shocks or surprises for May 17, 2025. The news cycle remains calm, with no sudden market drops or major policy changes making waves.

Instead, the main stories still center on ongoing issues like the Russia-Ukraine conflict and U.S. ties in the Middle East. Some reports mention local ceasefires, but nothing has rattled Wall Street or Main Street today. No big IPOs or earnings shakeups have hit the wires either.

Japan’s decision to treat crypto assets as financial products stands out as a recent highlight from late March — not today. Inflation is cooling a bit, but worries about tariffs and global trade fights continue to linger over the markets’ future direction.

In short, it’s a steady day for finance with no fresh disruptions or breakthroughs reported. Smart investors should keep watching world events that could change things in the days ahead — but for now, all is quiet on Wall Street.;

TRUMP’S Trade WAR: A Global Financial Nightmare?

— The Bank of England warns of a looming global financial crisis due to Donald Trump’s trade war. The Financial Policy Committee (FPC) pointed out risks from new global tariffs introduced on April 9. These tariffs have increased uncertainty in world markets, possibly leading to debt spirals for governments.

The UK, with its open economy and large financial sector, is especially vulnerable to shocks from international trade conflicts. Rachel Reeves, the Chancellor, confirmed ongoing talks with the Bank’s Governor to watch market developments amid these tensions.

Trump’s threats of more tariffs on China could escalate the conflict and harm international cooperation. Such actions may worsen financial conditions worldwide, according to the FPC’s warning note.

Despite these worries, analysts believe that the well-capitalized UK banking system might offer some protection against economic turmoil. However, watching trade war developments remains crucial as they could greatly impact both local and global markets.

— Global stock markets SWING sharply as Trump’s “Liberation Day” approaches Investors react to the impending event, causing volatility across financial markets

— DC delegate praises Trump’s budget support The non-voting House representative commends President Donald Trump for backing a financial fix that averts an immediate fiscal crisis for the District of Columbia

— MQM threatens to exit government over funding disputes The Muttahida Qaumi Movement is reevaluating its position in the coalition amid ongoing financial disagreements, raising concerns about the stability of the current administration

GOGOLD’S $75M WINDFALL: A Strategic Financial Move

— GoGold Resources Inc. just announced a major financial boost, securing C$75 million through a bought deal financing. The agreement involves a group of underwriters led by BMO Capital Markets. This move aims to strengthen GoGold’s financial position and support future projects.

The financing is exclusive to Canadian markets since the securities aren’t registered under U.S. law. GoGold stresses that these securities can’t be offered or sold in the U.S. without compliance, showing its commitment to regulatory standards while expanding its capital base.

The press release warns about “forward-looking information,” pointing out potential risks and uncertainties in their plans and expectations. Investors should consider these factors when thinking about joining this financing round. GoGold’s decision shows confidence in its growth strategy despite market challenges and opportunities.;

)

— Mount Logan Capital Inc reports strong financial results for Q4 and FY 2024 The company’s insurance segment saw a significant increase in SRE to $153 million, while Portman Ridge and Logan Ridge Finance Corporations announced a merger pending shareholder approval

LIV Golf’s SHOCKING Financial Woes: What’s Next for the Saudi-Backed League?

— LIV Golf is facing serious financial trouble, with losses skyrocketing. Reports show that the UK branch’s losses jumped from $244 million to $394 million in 2023. This has fueled rumors of possible merger talks with the PGA Tour.

The Saudi Public Investment Fund (PIF) is still providing crucial financial support to LIV Golf during these tough times. Without this backing, LIV Golf might struggle to survive as it deals with issues of profitability and sustainability.

These challenges raise questions about LIV Golf’s future in professional golf. Can it continue without major changes, or will a merger become necessary? The coming months could be pivotal for its survival and growth in the sport.

LIV Golf’s FINANCIAL Turmoil: Is the Dream Fading?

— LIV Golf is facing big financial problems, with losses “piling up at a staggering rate.” Analysts have looked into recent financial reports to reach this conclusion.

The UK branch of LIV Golf, which manages operations outside the U.S., saw its losses jump from $244 million to $394 million in 2023. This huge increase has sparked talk about possible merger discussions with the PGA Tour.

Regular cash boosts from the Saudi Public Investment Fund (PIF) are seen as vital for LIV Golf’s survival amid these growing losses. The situation raises questions about LIV Golf’s future and potential shifts in professional golf dynamics.

ITALY’S Financial Shock: Monte Paschi’s Bold Move

— Banca Monte dei Paschi di Siena SpA is making waves with its surprising plan to buy a larger competitor. Finance Minister Giancarlo Giorgetti shared his confidence in Paschi’s leadership, applauding their impressive results and strategic market vision. This acquisition could challenge bigger banks and keep Italy’s financial services under local control.

Monte Paschi’s rocky history began in 2007 when it bought Banca Antonveneta SpA for €9 billion, much more than its earlier value. The global financial crisis hit soon after, causing big losses for Paschi and years of restructuring efforts.

Despite past struggles, the Italian government remains the bank’s largest shareholder, backing its current plan to boost national financial independence.

UK BUSINESSES in TROUBLE: Financial Distress Hits Record Levels

— A recent report reveals a sharp rise in UK businesses facing severe financial distress. The hospitality, leisure, and retail sectors are hit hardest, with construction also struggling. From September to December last year, the number of distressed businesses jumped by 50%, reaching 46,583.

Ric Traynor of Begbies Traynor highlighted the challenges these businesses face as they navigate early 2025 hurdles. Many find it nearly impossible to overcome current economic obstacles. This situation stresses the urgent need for strategic solutions and support for these industries.

HONEYWELL’s BOLD MOVE: Strategic SPLIT on the Horizon

Honeywell CEO Vimal Kapur is leading a reinvention plan amid shifting market valuations for industrial giants. The company plans to spin off its advanced material business into a new public entity by late 2025 or early 2026. Honeywell might split into two independent entities focusing on automation and aerospace, though no formal announcement has been made yet.

Since late October, Honeywell’s shares have risen by 8%, showing investor optimism about these potential changes. This strategic shift aims to better position Honeywell in a competitive market while maximizing shareholder value through focused operations in distinct sectors.

AMERICAN EXPRESS Faces $230 Million Settlement: A Wake-Up Call for Financial Giants

— American Express has settled for $230 million over claims of misleading customers about fees and services. This hefty settlement reflects the increasing scrutiny on financial institutions and their business methods.

As part of the agreement, affected customers will receive refunds. American Express is also enhancing customer service training and tightening compliance measures to prevent future deceptive practices and regain customer trust.

This settlement highlights the stricter regulatory environment demanding more accountability from financial companies, showcasing the challenges in maintaining transparency under consumer protection laws.

This case serves as a reminder of how crucial ethical business practices are in a competitive market, stressing that consumer trust is key to long-term success in financial services.

BITCOIN SKYROCKETS: Trump’s Presidency Sparks Financial Frenzy

— Bitcoin has surged past $100,000 as enthusiasts anticipate swift action from Donald Trump when he assumes the presidency next week. Created in 2009 as a decentralized form of electronic cash, Bitcoin has moved from obscurity to mainstream fame. Republican Senator Cynthia Lummis of Wyoming suggests the U.S. government should stockpile Bitcoin to diversify holdings and reduce financial risks.

In other financial news, American Express will pay $230 million to settle U.S. charges over deceptive sales practices involving credit card and wire transfer products for small businesses. The Justice Department accused Amex of misrepresenting rewards and fees between 2014 and 2017, along with submitting false information about prospective customers without consent. This settlement addresses both criminal and civil probes into these allegations.

Meanwhile, Capital One is dealing with a service outage that has extended into its second day, affecting customer access to deposits and transactions. The bank blames technical issues impacting various services offered to clients for this disruption. This comes after a lawsuit by the Consumer Financial Protection Bureau against Capital One for allegedly misleading customers about savings-account offerings earlier this month.

Gold and silver are also gaining attention with forecasts predicting strong upside potential following Trump’s inauguration next week as president. Analysts are closely watching these precious metals amid shifting economic expectations under new leadership.;

ECONOMISTS SOUND Alarm: 2025 Financial Crisis Looms

— Economists are raising alarms about a potential financial crisis in 2025. David Kelly from JPMorgan warns that high stock market valuations pose a significant risk despite strong economic indicators like low layoffs and cooling inflation. Investors should be cautious as these inflated values could lead to a sudden market downturn.

Current economic signs show paychecks growing faster than prices, and stable gas prices offer optimism for Americans. However, the high asset valuations remain a critical concern for analysts. They suggest preparing for increased market volatility throughout 2025, with a crisis potentially emerging early in the year.

These warnings have led to cautious trading, especially in tech stocks that previously drove gains. Traders are balancing concern with optimism, causing fluctuating stock prices in early sessions.

This situation may prompt investors to reassess their portfolios and strategies as they navigate potential shifts due to changing market conditions. The economic concerns highlighted could significantly influence investor behavior and market dynamics moving forward.

ISRAEL STRIKES Back: Hezbollah’s Financial Stronghold Targeted

— Israel’s military is set to target Hezbollah’s financial operations in Lebanon. The focus will be on al-Qard al-Hassan, a unit that funds the Iran-backed group. Rear Adm. Daniel Hagari stated that evacuation warnings will be issued for certain areas in Beirut and beyond.

The Israeli military plans to hit many targets linked to Hezbollah’s financial activities. Al-Qard al-Hassan, sanctioned by the U.S. and Saudi Arabia, provides services used by both Hezbollah operatives and ordinary Lebanese citizens. The scope of these evacuation warnings remains unclear at this time.

This move follows rising tensions between Israel and Hezbollah over the war in Gaza, which escalated into full-scale conflict last month with Israeli ground troops entering Lebanon earlier this month.

The announcement comes amid calls from U.S. Defense Secretary Lloyd Austin for Israel to reduce civilian casualties, particularly around Beirut, labeling them "far too high.

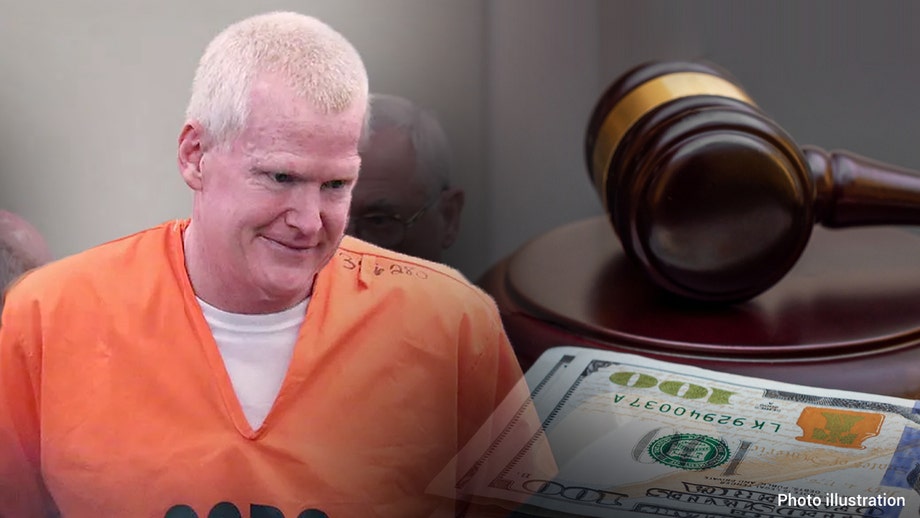

BRITISH TRADER’S Appeal Crushed: Libor Conviction Stands Strong

— Tom Hayes, a former financial trader for Citigroup and UBS, has been unsuccessful in his attempt to overturn his conviction. This 44-year-old Brit was convicted in 2015 for manipulating the London Inter-Bank Offered Rate (LIBOR) from 2006 to 2010. His case marked the first-ever conviction of this kind.

Hayes served half of an 11-year sentence and was released in 2021. Despite asserting his innocence throughout, he faced another conviction by a U.S court in 2016.

Carlo Palombo, another trader implicated in similar manipulations with Euribor, also sought appeal through the U.K.'s Court of Appeal via the Criminal Cases Review Commission. However, after a three-day hearing earlier this month, both appeals were dismissed without success.

The Serious Fraud Office remained resolute against these appeals stating: “No one is above the law and the court has recognized that these convictions stand firm.” This decision comes on the heels of a contrasting verdict from a U.S court last year which reversed similar convictions of two former Deutsche Bank traders.

GREEN AGENDA Hits Hard: Ofgem Warns of Financial Burden on Low-Income Consumers

— The Office of Gas and Electricity Markets (Ofgem) sounded an alarm on Monday. It cautioned that the shift towards a “Net Zero” carbon emissions economy could unfairly impact low-income consumers. These individuals might lack the financial resources to acquire government-approved technology or modify their lifestyle habits.

In the past year alone, debts from energy consumers have skyrocketed by 50%, amassing a total of £3 billion. Ofgem voiced grave concerns about struggling households’ limited resilience to future price shocks. The regulator also highlighted that the burden of recovering bad debts could pose serious threats to the retail energy sector.

Economic difficulties have already pushed British consumers into rationing their energy consumption. This has led to “harms associated with living in a cold, damp home,” potentially triggering an increase in mental health issues rates.

Tim Jarvis, Ofgem’s director general, underscored the necessity for a long-term strategy to manage escalating debt levels and shield struggling consumers from future price shocks. He mentioned that measures such as altering standing charges for prepayment meter customers and tightening requirements on suppliers had been implemented.

-((($wid/$zoom)/2)-(($this.metadata.pointOfInterest.w/2)*100%))},{($this.metadata.pointOfInterest.y*100%)-((($hei/$zoom)/2)-(($this.metadata.pointOfInterest.h/2)*100%))},{$wid/$zoom},{$hei/$zoom}&w=$wid&h=$hei&sm=c&fmt=auto)

BODY SHOP Faces Uncertain Future: Insolvency Administrators Step In Amid Financial Crisis

— The Body Shop, a renowned British beauty and cosmetics retailer, has enlisted the help of insolvency administrators. This move follows years of financial struggles that have plagued the company. Established in 1976 as a single store, The Body Shop has grown into one of Britain’s most iconic high street retailers. Now, its future hangs in the balance.

FRP, the appointed administrators for The Body Shop, have revealed that past owners’ financial mismanagement has contributed to an extended period of hardship for the company. These issues are exacerbated by a challenging trading environment within the broader retail sector.

Just weeks before this announcement, European private equity firm Aurelius took over The Body Shop. Known for their expertise in revitalizing struggling companies, Aurelius now faces a significant challenge with this latest acquisition.

Anita Roddick and her husband established The Body Shop in 1976 with ethical consumerism at its core. Roddick earned herself the title “Queen of Green” by prioritizing corporate social responsibility and environmentalism long before they became fashionable business practices. Today however, her legacy is threatened by ongoing financial difficulties.

Alex Murdaugh’s SHOCKING 27-Year Sentence: The TRUTH Behind His Financial Crimes Unveiled

— Alex Murdaugh, a convicted murderer and fallen lawyer, has been slapped with a 27-year sentence for his financial wrongdoings. This punishment is in addition to the two life terms he’s already serving for the brutal murders of his wife and son back in 2021. He confessed to an alarming total of 22 charges including breach of trust, money laundering, forgery, and dodging taxes.

South Carolina Circuit Court Judge Clifton Newman delivered the sentence this Tuesday. The accusations against Murdaugh rack up to a staggering $10 million from roughly around 100 counts. In a courtroom in Beaufort County, Murdaugh openly admitted to his horrendous actions.

Prosecutor Creighton Waters shed light on how Murdaugh’s perceived reliability played into his decade-long fraudulent scheme. Waters explained that numerous individuals were duped by him due to their trust in him and were victims of his cunning manipulations. His standing among community members, fellow lawyers and banking institutions aided these financial misdeeds.

After listening to several victims along with their legal representatives in court, Murdaugh directly

Wages SURGE at Historic Rate With Prospect of Further Interest Rate Hikes

— From April to June, wages soared by a record 7.8%, marking the highest annual growth since 2001. This unexpected spike has many predicting the Bank of England will hike interest rates to counter rising inflation, which currently sits at 7.9%.

US Could Enter RECESSION Next Year With Rising Inflation Rate

— Financial forecasters predict that the US could enter a recession in time for the 2024 election. With the inflation rate expected to increase next year, the state of the economy could cost Joe Biden votes.

Video

UK and CHINA Forge STRONGER Financial Bonds Amid Global Uncertainty

— The UK-China Financial Services Summit marked a key moment in economic collaboration between the United Kingdom and China. Rachel Reeves, a notable UK political figure, and He Lifeng, a senior Chinese official, addressed the event. Despite geopolitical tensions, both nations are committed to strengthening ties in financial services amid global economic challenges.

Rachel Reeves emphasized strategic partnerships in the financial sector to drive post-pandemic innovation and recovery. She outlined the UK’s vision for a resilient financial ecosystem through collaboration with international partners like China. This partnership is crucial for managing global risks and seizing growth opportunities.

He Lifeng highlighted China’s commitment to opening its financial markets and invited UK investors to explore new opportunities within China’s vast market. He pointed out recent reforms aimed at reducing market barriers and fostering competitiveness essential for foreign investments. International cooperation on issues like climate change was also stressed as vital for future progress.

The summit concluded with an agreement to advance dialogues on sustainable finance, digital banking, and regulatory innovations. Both countries see this collaboration as key to setting new standards in global finance while ensuring balanced growth. This event underscores their shared commitment to overcoming future economic challenges together through strategic cooperation and innovation.