THREAD: global stock market brace for...

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

BUSINESS PANIC: Bank Collapse, Tech Fraud Trial, And Massive Layoffs Rock America

— A billionaire tech boss is on trial in Manhattan, accused of cheating investors out of $500 million. Richard Caldwell’s case has grabbed headlines because he’s a big name in Silicon Valley. Prosecutors say he tricked people by hiding profits and playing games with stocks.

Last night, First National Bank failed after customers rushed to pull out their money. Federal agents took over this morning and handed the bank to the FDIC. This collapse is making folks worry about whether other local banks are safe.

OpenAI just scored $40 billion from investors led by SoftBank Group. The company now sits at a whopping $300 billion value. Even with all the talk about a shaky economy, big players are still betting on artificial intelligence.

Business Insider cut 21% of its workers as part of CEO Barbara Peng’s new plan. The company is dropping its Commerce team to save money. At the same time, President Biden slammed Bangladesh for banning an opposition party but faces heat here at home for rising prices and school budget cuts.

ISRAEL STRIKES Spark Fear in Tehran as Trump Urges Mass Evacuation

— Israel’s air campaign against Iran has hit a dangerous new point. Israeli forces told hundreds of thousands to leave central Tehran. Explosions shook the city, even near Iran’s state-run TV building. Panic spread quickly, and one TV anchor ran off live on air.

Former President Donald Trump spoke out online, saying, “IRAN CAN NOT HAVE A NUCLEAR WEAPON,” and called for people in Tehran to evacuate right away. His warning highlights growing fears about Iran’s nuclear plans and the safety of innocent families trapped in the fighting.

White House press secretary Karoline Leavitt said Trump is ending his G7 summit trip early because of rising tensions between Israel and Iran.

World leaders are watching closely as this crisis continues to unfold.

IRAN’S Shocking Nuclear Scheme Exposed: Hidden Weapons Plan Raises Global Alarm

— A new report says Iran is secretly building nuclear weapons under a project called the Kavir Plan. The National Council of Resistance of Iran (NCRI) claims this program is hidden behind missile research and takes place in secret sites west of Tehran.

The Kavir Plan started in 2009, after an earlier nuclear effort was discovered and stopped. NCRI’s Deputy Director, Alireza Jafarzadeh, warns that the goal is to make warheads for missiles that can strike U.S. bases and major cities in Europe.

To cover its tracks, Iran has erased roads from maps, used drones with facial recognition, and set up spy bases to keep outsiders away. Foreign researchers are watched closely — some have even been arrested or questioned.

NCRI says these harsh steps show not only a need to hide their nuclear work but also deep fear inside the regime about losing control over their own people.

AIR INDIA Plane Horror: Heartbreaking Crash Leaves 242 Dead, No Survivors

— A deadly Air India crash in Ahmedabad, India, has left the world in shock. A Boeing 787-8 Dreamliner went down just five minutes after takeoff on Thursday. All 242 people on board died when the plane crashed into a busy neighborhood called Meghani Nagar.

Thick smoke filled the sky as emergency crews rushed to help. The police commissioner confirmed there were no survivors and said 204 bodies have already been found. He also warned that people living and working nearby may have lost their lives too.

The flight was headed to London’s Gatwick Airport when it sent out a “mayday” call before losing contact with air traffic control. The cause of the crash is still unknown.

Air India’s chairman called this a “devastating event” and offered condolences to families of those lost. Many are now demanding answers about what went wrong with this tragic flight.

— UK invests $19 billion in first major nuclear plant since the 1990s. The funding aims to boost energy security and support climate goals amid rising tensions.

AMAZON’S Bold Australia Move: Business Owners Cheer Massive $77B Shakeup

— Amazon has rolled out its Amazon Business marketplace in Australia, aiming straight at the country’s booming $77 billion B2B sector. The new platform offers business-only prices, bulk discounts, and a simple way for companies to buy office supplies and electronics.

Australian business owners now get access to exclusive perks like Business Prime. This includes fast shipping and features such as shared accounts and custom buying rules designed for companies. Amazon claims these tools will help businesses save money and run smoother during tough economic times.

Recent studies show that 92 percent of Australian small and medium businesses have faced rising costs in the last three years. Amazon hopes to fill this gap by offering savings and convenience that are hard to find elsewhere — just in time for the new financial year.

This launch is set to boost Amazon’s influence in both retail and B2B markets across Australia. Many business owners welcome the move as they struggle with low confidence, tight budgets, and pressure on profits.

NO NEW Breaking World News: Calm Before the Next Global Storm

— Right now, there are no shocking or new breaking world news stories. The top headlines remain steady, with most attention on ongoing protests and diplomatic talks.

Tensions between countries are still high, but nothing fresh has come up that counts as truly breaking or unreported.

If you want updates about a certain country or topic, just ask and we’ll dig deeper for you.

Stay tuned — sometimes quiet moments like this come before big changes on the world stage.

TRUMP’S Bold Steel Tarifs Shock Markets, Spark Global Showdown

— President Trump just doubled tariffs on steel and aluminum to 50%, starting June 4, 2025. He says this move will protect American jobs and factories. The sharp increase has rattled global markets and put pressure on countries like China and India.

The federal trade court is now hearing lawsuits over these new tariffs. At the same time, the U.S. is in talks with India to lower taxes on farm goods and cars. Trump’s team hopes for a big trade deal by fall, showing he means business when it comes to tough trade rules.

Harvard University has filed a lawsuit against the administration’s tariff policy. This case could set new limits for what the government can do in future trade fights. Both sides are getting ready for a major legal battle.

Meanwhile, world leaders are watching closely. Brazil’s President Lula is heading to the BRICS summit while backing peace talks between Russia and Ukraine. In Colombia, violence hit home as Senator Miguel Uribe Turbay survived gunfire at a rally — a grim sign of unrest abroad.

SWISS BANKING Shock: UBS HIT With Tough New Rules After Global Chaos

— Switzerland is cracking down on its biggest bank, UBS, after a wave of global bank failures. The government just announced strict new rules. UBS now has to keep more cash on hand and tighten up how it manages risk, especially in its overseas branches. Regulators say this will help prevent another financial disaster like the one in 2008.

UBS’s branches in the U.S. and Europe will face higher costs because of these changes. Swiss officials say these steps are needed to protect their own economy from shocks caused by risky banking abroad.

This move sends a clear message: Switzerland wants banks to be more careful with their money. Experts believe other European banks could soon face similar tough rules.

Stricter lending rules could make it harder for people and businesses to get loans, and may change how money moves around the world. Conservatives see this as a return to common-sense banking after years of risky bets by big institutions.

UK PM’S Office Rocked: Shocking Corruption Leak Ignites Public Fury

— Leaked documents reveal alleged corruption inside the UK Prime Minister’s Office. Reports of cash payments and secret lobbying have sparked outrage across the country. The June 7 leak has led to immediate calls for answers and accountability from government leaders.

Evidence shows hidden financial deals and backroom agreements that could have swayed important decisions. Many now question if the current administration can be trusted. “People feel betrayed,” said a political expert, warning this could hurt faith in leadership for years to come.

Demands for investigations are growing louder as citizens push for transparency and justice. Social media is full of calls for legal action and parliamentary inquiries against those involved in the scandal.

This crisis comes at a tough time for the UK, with ongoing debates about immigration enforcement and shifting demographics. The fallout may put Prime Minister Keir Starmer’s government at risk, possibly changing future policies in major ways.

CHINA’S Bold Threat: Massive Military Drills Near Taiwan Spark Global Alarm

— China is flexing its military power near Taiwan, launching huge drills with missiles and warships. Beijing says it’s responding to “outside interference” and what it calls “provocations” from Taiwan’s leaders.

Experts say this is a clear warning from China. They want to scare off anyone supporting Taiwanese independence. The United States has stepped up patrols nearby, showing support for Taiwan and pushing back against China’s aggression.

America’s allies in the West are paying close attention as the situation heats up in East Asia. Many worry that one wrong move could set off a much bigger fight.

Tensions remain high, with both sides watching each other closely. The world waits to see what happens next as freedom hangs in the balance for millions in the region.

— Social Security Payment Delays. The Social Security Administration warns of potential disruptions due to staffing cuts and new claim priorities, risking delays for millions of beneficiaries. Dollar Stores Draw Higher-Income Shoppers. Brands like Dollar General see increased traffic from diverse income groups amid cautious spending, signaling economic caution.

BUSINESS FEARS Erupt: Tech Billionaire Trial, Bank Collapse, and Amazon Layoffs Rattle US Economy

— Richard Caldwell, a well-known tech billionaire, is on trial in Manhattan. He’s accused of cheating investors out of $500 million by hiding profits and rigging stock prices. The case has become a warning sign for trouble brewing in Silicon Valley and the business world at large.

But the problems don’t stop there. Tech companies are laying off workers across the board. People are worried about losing their jobs, and investors are getting nervous too. Faith in the economy is slipping as these stories pile up.

On June 5, 2025, Amazon said it will cut more jobs in its Books division — less than 100 positions — but it’s still making waves. Units like Goodreads and Kindle will feel the pinch. Many now fear job security at big companies isn’t what it used to be.

All these events show just how shaky things have become for American businesses right now — legal scandals, layoffs, and lost trust all hitting at once — even before many news outlets have caught on.;

UK PM’S Office Rocked: Shocking Corruption Leak Ignites Public Fury

— The UK Prime Minister’s Office is under fire after leaked documents revealed alleged corruption at the highest levels. Evidence shows cash payments and secret lobbying may have steered big government decisions. This news has sparked outrage and demands for change in Westminster.

Top ministers are accused of taking bribes to sway laws on infrastructure and defense deals. A whistleblower inside the government shared proof of secret meetings and shady money transfers, putting more heat on officials.

Opposition leaders want Prime Minister Liam Sterling to step down, calling this a “national disgrace.” Sterling denies any wrongdoing but says he will work with police as a special inquiry gets underway.

This scandal could shake up UK politics just before elections. Protests have broken out in major cities, while the world watches to see how Britain handles its biggest political crisis in years.

UK NEWS BLACKOUT Shocks Millions: Digital Chaos Leaves Public in the Dark

— A sudden news blackout has swept the UK, stopping many people from getting live updates. This digital failure is not just a local problem — it shows a bigger issue with how news is delivered around the world. Angry users are now doubting if they can trust online news and want clear answers fast.

This crisis reveals major problems in today’s digital systems for sharing news. Experts warn that if these weaknesses aren’t fixed, people will lose even more faith in getting timely and accurate information online.

Officials are telling citizens to turn to other trusted sources while work goes on to fix the problem. The blackout proves how much we all rely on digital platforms for important updates and daily information.

Many are now demanding quick action and better technology to stop this from happening again — especially when emergencies or breaking stories hit and reliable updates matter most.

HOUSE REPUBLICANS Ignite Hope With Bold TAX Cuts for Small Business

— House Republicans are pushing a bill to make the Tax Cuts and Jobs Act (TCJA) permanent. The plan also raises the small business tax break from 20% to 23%. Job Creators Network (JCN) has backed this idea for years, saying it will help local businesses grow.

Mary Schiavoni, who owns a small business, says these tax cuts would let her hire more workers and expand. “If I got a tax cut, I could hire more people. I could pay their salaries. I could expand my business,” she said.

The bill would bring back full immediate expensing and stop new taxes on successful small businesses. JCN says these changes could create over one million jobs and add $750 billion in growth for Main Street companies.

Since the TCJA passed, federal tax revenue has gone up — by half a trillion dollars above expectations in 2024 alone. Most small businesses want these cuts to stay, with four out of five supporting them in JCN polls. Now Senate Republicans are being called on to pass this bill so American workers and entrepreneurs can get lasting relief.

TRUMP’S 50% Steel Tarif Shock: America’s Powerful Comeback Rattles Global Markets

— President Trump has slapped a 50% tariff on imported steel and aluminum. He made the announcement at U.S. Steel’s Irvin Works in Pennsylvania, sending a clear message: America First is back in action.

Markets around the world took a hit after the news broke. Experts say prices could jump for companies that depend on foreign steel, which may lead to higher costs for everyday Americans.

The White House is getting ready for court fights over these tariffs. Some judges have questioned if the president has this much power over trade, making things even more uncertain.

At the same time, Japan is tightening its rules on cryptocurrency. Closer to home, federal agents stopped a migrant smuggling ring at our southern border — reminding us of the tough economic and security battles America still faces.

GAL GADOT Faces Vicious Attacks: London Protesters Target Star for Supporting Israel

— Gal Gadot, the Israeli actress best known as Wonder Woman, is under fire in London. Pro-Palestinian protesters have harassed her after she spoke out in support of Israel following the brutal October 7 Hamas terror attack that killed over a thousand innocent people.

London Police arrested five protesters on charges including harassment and workplace-related offenses. Superintendent Neil Holyoak said police “will not tolerate the harassment of or unlawful interference with those trying to go about their legitimate professional work in London.”

Protesters have tracked Gadot’s film set across the city, shouting insults and calling her a “terrorist” because she once served in Israel’s Defense Forces. Even with this backlash, Gadot explained that while she prefers to avoid politics, she could not stay silent after seeing what Hamas did on October 7.

Gadot’s experience shows how far some activists will go to silence voices they disagree with — even when it means attacking someone for standing up against terrorism.

NO MAJOR World News Shocks: Calm Before the Next Global Storm

— Major news outlets report no shocking world events outside the UK and US as of May 22, 2025. The global timeline is steady, with only previously covered incidents making headlines.

Recent stories highlight big jail breaks, court rulings in Britain, and ongoing immigration challenges. In Southeast Asia, millions are still struggling after deadly floods and landslides forced them from their homes.

The biggest diplomatic twist came when former President Donald Trump announced a surprise ceasefire between India and Pakistan — brokered with help from Russian President Vladimir Putin. This move caught many off guard and may shape future talks in the region.

For now, there are no new global crises or major breakthroughs to report. Conservative readers can expect more focus on local issues in coming days as the world waits for what happens next.

SAUDI OIL Shock: Painful BAN Sparks Global Price Surge

— Saudi Arabia just announced it will stop all oil exports for at least three months starting June 1, 2025. The kingdom says it needs to refill reserves and protect its national security. Oil prices shot up over 12% in a single day after the news broke.

Big countries like the United States, China, and India are already feeling the pinch. Some experts warn that if this ban lasts through summer, we could see energy shortages and even higher prices at the pump. Inflation may rise as a result, making life harder for working families.

Tensions are heating up in the Middle East as other nations talk about how to respond. Some market watchers think this is just a short-term move by Saudi Arabia. Others worry it could mean bigger changes to how they handle oil exports in the future.

Americans should get ready for more pain at gas stations and possible supply problems here at home. So far, President Biden’s White House has stayed silent on what steps they’ll take next.

— Joe Biden Diagnosed with Aggressive Prostate Cancer The former US president’s health diagnosis sparks nationwide debate on cancer awareness, treatment, and the importance of regular screenings

— India and Pakistan Reach Ceasefire After US Mediation The two nuclear-armed neighbors agreed to an immediate ceasefire following days of hostilities, offering a glimmer of hope for regional stability amid ongoing tensions in Kashmir

BUSINESS SHOCKER: Chorus, Saks, And Starbucks Unleash Bold Moves On Global Markets

— Chorus is rolling out faster business fibre plans in New Zealand. The company now offers a 1Gbit/s plan with equal upload and download speeds. They also promise quicker service if things go wrong. Experts say if more businesses use the cloud, it could add billions to New Zealand’s economy.

Saks Fifth Avenue is trying something new by selling luxury goods on Amazon’s UK website. With brands like Dolce&Gabbana and Balmain, Saks hopes Amazon will help them reach more shoppers across Europe.

Starbucks may sell part of its China business. The coffee giant has started talking with private equity groups and tech firms as it looks for new ways to grow in China.

These bold moves show how big companies are changing fast to stay ahead in a tough global market. Conservatives know that innovation and competition keep economies strong — these updates are proof of that belief.

UN BLAMES AMERICA: Gloomy Global Growth Forecast Sparks Outrage

— The United Nations is blaming the U.S. for a slowdown in global growth, pointing to higher American tariffs and trade fights. The U.N. now expects worldwide growth to hit just 2.4% this year and 2.5% in 2025 — both lower than what they predicted before.

Shantanu Mukherjee from the U.N.’s Economic Analysis team says “uncertainty” is everywhere right now. He also blames shaky politics, rising costs, supply chain messes, and financial worries for making things worse.

The slowdown is especially tough on developing countries. Their expected growth rate dropped from 4.6% to 4.1% since January — a huge loss for places already battling poverty.

U.N. experts warn that if these trends continue, more than half of the world’s poorest people could face even harder times ahead.

TRUMP’S Historic Arms Deal Shocks World: $142 Billion Boost For America

— President Trump just signed a record $142 billion arms deal with Saudi Arabia. This is the biggest defense sale in US history. The agreement gives Saudi Arabia advanced military gear, weapons, and support from American companies.

Part of the deal includes gas turbines and $3.3 billion worth of air-to-air missiles for Saudi jets. US officials say this strengthens our foreign policy and keeps a key ally close in the Gulf region.

Saudi Arabia also plans to invest up to $600 billion in America over four years. President Trump wants that number to reach $1 trillion. This trip was his first official visit of his second term, showing strong ties between Washington and Riyadh.

This deal proves America’s promise to keep the Middle East stable while creating jobs and bringing money back home.

GALLEGOS IMMIGRATION Shock: Amnesty Windfall and JOB Risks for Americans

— Rep. Gallego has released an immigration plan that would give amnesty to millions of illegal immigrants and raise legal immigration to new highs. The plan would boost green card numbers, remove country limits — helping places like India and China — and bring in more refugees.

Gallego also calls for E-Verify at workplaces and says he wants to deport criminal illegal aliens. But his proposal creates new visa programs that could let more foreign workers take jobs from Americans.

The plan includes building more border wall and extra migrant processing centers. Yet, it funnels border crossers through official entry points — a move critics say copies President Biden’s failed strategy.

Conservatives warn this approach rewards lawbreakers while putting American jobs at risk. They argue it will only encourage more people to cross the border illegally, making the crisis even worse.

US-UKRAINE MINERALS Deal Ignites Hope for Trump’S Strong Support

— The United States and Ukraine have signed a new deal giving America access to Ukraine’s key minerals. Ukrainian leaders say this version is better for them than past drafts, which would have made Ukraine less of an equal partner. The agreement still needs approval from Ukraine’s parliament.

The deal also sets up a fund to help rebuild Ukraine. Kyiv hopes this will secure more U.S. military aid in the future. A similar agreement almost happened before but was stopped during tense talks with President Trump, Vice President JD Vance, and President Zelenskyy.

Secretary of State Marco Rubio called this week “very critical” for ending the war in Ukraine. Treasury Secretary Scott Bessent said the deal sends Russia a clear message: The Trump administration stands by a free and independent Ukraine.

Ukraine sees this as an important move to keep America as its top ally against Russia’s invasion. Now all eyes are on whether Kyiv’s lawmakers will approve the plan.

BRAZIL’S Bold Gamble: Global Power Play Ignites Trade WAR Fears

— Brazil is grabbing the world’s attention as it gets ready to host the BRICS summit in July 2025. President Lula da Silva is leading a busy schedule, with plans for a regional meeting in Honduras, an official visit to France, and support for peace talks between Russia and Ukraine during his trip to Portugal.

These moves come at a tense moment. President Trump has warned he may slap new tariffs on Russian oil if there’s no deal over Ukraine. Meanwhile, China is trying to pull Latin America closer through its CELAC forum, hoping to boost its influence in the region.

Brazil’s active diplomacy shows it wants a bigger role on the world stage. The country hopes to act as mediator between major powers like the US, Russia, and China while pushing for stronger ties in Latin America.

With trade wars looming and global tensions rising, Brazil’s bold approach could shape how these big issues play out — or backfire if things go wrong.

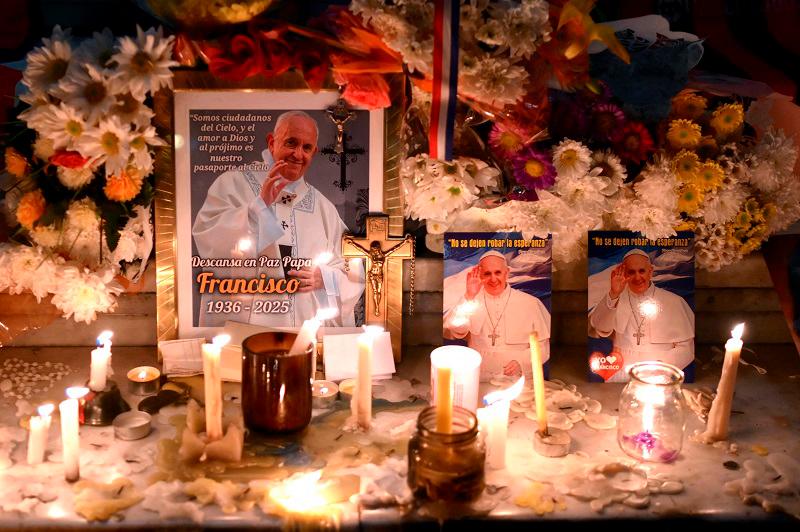

POPE FRANCIS Death Shock: World Stunned as Global News Stalls

— The world is standing still after the death of POPE FRANCIS. Business leaders worldwide have sent their condolences, but there are no major international events making headlines.

Most news outlets have shifted focus to U.S. stories, like the Arizona Department of Corrections investigation and Harvard’s lawsuit against the Trump administration. These are not global stories and offer little for those wanting international updates.

Outside of ongoing coverage about Pope Francis’s passing, there is almost no movement on the world stage. Anyone hoping for big news from abroad will have to wait until something new breaks.

PUTIN’S Shocking Praise for Elon Musk Sparks Global Buzz

— Russian President Vladimir Putin surprised many by comparing Elon Musk to Soviet space legend Sergei Korolev. Speaking with university students, Putin said Musk “raves about Mars” and called him a rare figure who makes the impossible happen. He linked Musk’s bold dreams to Korolev’s historic achievements in space.

Putin admitted that reaching Mars seems far off today but believes ideas like Musk’s can come true over time. He reminded listeners that Korolev, once doubted, led the Soviets to major victories in space exploration after years of struggle under Stalin.

Sergei Korolev was kept secret during his life but became a hero after his death for launching the first satellite and human into orbit. Putin used this story to show how visionaries can shape history, even if people doubt them at first.

Kirill Dmitriev, head of Russia’s wealth fund, added that missions to Mars are “getting more real.” Dmitriev recently visited Washington D.C., meeting with Trump officials after U.S. sanctions were lifted for his trip — a sign of possible new talks between Russia and America.;

RUSSIA’S Shocking Attack on Ukraine: EU Calls for Tough Sanctions

— European leaders are outraged by Russia’s missile attack on Sumy, Ukraine, which killed 34 and injured 117. The strike happened during Palm Sunday celebrations, marking the second major civilian tragedy in just over a week.

Polish Foreign Minister Radek Sikorski slammed Russia’s actions as mocking U.S.-led ceasefire efforts. He urged President Trump to see Russia’s blatant disregard for peace initiatives.

Finnish Foreign Minister Elina Valtonen noted the attack followed talks between Trump’s envoy and Putin, showing Russia’s indifference to peace and human life. Lithuania called using cluster munitions a war crime.

French Foreign Minister Jean-Noël Barrot demanded strict EU sanctions against Russia to cripple its economy and stop its war efforts, stressing Putin’s refusal to end hostilities willingly.

SOUTH CHINA SEA Showdown: Rising Fears and Global Stakes

— Armed forces from several nations are boosting their presence in the South China Sea, raising tensions over territorial claims. Chinese naval vessels have confronted American warships in disputed waters, leading to close encounters. The United States reaffirms its commitment to freedom of navigation, while China insists the area is under its sovereignty.

Regional allies like Japan and Australia are worried about the rising tension and call for diplomatic solutions. Chinese vessels have intercepted U.S. Navy ships during routine operations, prompting condemnation from the U.S. State Department. In response, China defends its actions as protecting sovereignty and warns against foreign provocations.

Both sides prepare for possible military drills in the region, raising fears of accidental conflict. Analysts warn that ongoing military posturing could trigger a major geopolitical crisis affecting trade routes and international relations across Asia-Pacific.

The situation demands careful handling to avoid unintended escalation and maintain regional stability as tensions continue to simmer in these contested waters.

Video

UK’S STARING DOWN Trump’S Tariffs: A Bold Stand for British Business

— UK Prime Minister Keir Starmer addressed the recent tariffs imposed by former U.S. President Donald Trump, outlining a cautious yet strategic response. These tariffs have hit key UK sectors like fishing and mining, sparking debate over their long-term economic effects.

The Centre for Inclusive Trade Policy estimates a potential 3% GDP decrease for the UK over five years due to these tariffs, threatening a £22 billion reduction in exports to the U.S. Starmer emphasized rekindling trade relations with America while safeguarding UK economic interests.

Beyond economics, diplomatic efforts are underway as Starmer engages in discussions with Trump, describing them as productive and expressing optimism about an eventual deal. However, concerns remain that these tariffs could increase consumer prices and disrupt supply chains across the Atlantic.

Facing criticism from political opponents and within his party, Starmer is under pressure to protect British businesses effectively. The government remains committed to exploring all options to mitigate tariff impacts and ensure national economic stability and growth.

Social Chatter

What the World is Saying