THREAD: markets soar as investor confidence...

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

SENSEX SURGE: Investors Cheer as Market Confidence Grows

— The SENSEX index opened at 74,474.98 on March 9, 2025, marking a positive start to the trading day. This opening was slightly above its previous close of 74,332.58, signaling growing investor trust in the market’s stability.

As trading progressed, the index gained over 350 points, hitting a high of 74,713.17. This upward trend shows optimism among investors and suggests a strong economic outlook for India.

Growth in the SENSEX is often seen as an indicator of economic health and can positively influence global markets. Investors will be closely watching to see if this momentum continues in the coming days.

METAL STOCKS Soar: Investors Cheer Global Demand Boom

— METAL stocks like Tata Steel, Hindalco, and Vedanta are seeing a rise of up to 4% in share prices. This jump is due to favorable global market conditions and increased demand for metals. Investors feel hopeful about the sector’s future.

Tata Steel shares have climbed about 4%, thanks to positive quarterly results and higher production forecasts. Hindalco gains from rising aluminum prices and a brighter outlook as global demand increases.

Vedanta’s shares are also climbing because of strong performance and smart strategies to boost production efficiency. These companies’ gains show broader economic conditions that favor raw material demand.

Market experts point to international trade dynamics, better supply chains, and more infrastructure spending worldwide for this bullish trend. These factors boost investor confidence in METAL stocks amid growing global need for raw materials.

TRUMP’S Trade WAR: Global Markets in Chaos

— President Donald TRUMP’s recent tariffs have sparked swift retaliation from Mexico, Canada, and China. These actions have thrown financial markets into chaos, raising fears of inflation and uncertainty for businesses.

Imports from Canada and Mexico now face a 25% tariff, with Canadian energy products specifically taxed at 10%. This move has heightened global trade tensions significantly.

China responded quickly to the U.S. tariffs, escalating an already heated international dispute. A Chinese spokesperson warned that these measures could harm the U.S. economy by disrupting beneficial trade relations.

Analysts worry about potential backlash against U.S. exports as these trade disputes unfold. The situation is seen as a risky maneuver that might reshape global trade dynamics and impact both consumers and businesses in the long run.

FEDERAL Election MONITORING Cuts: Security Risks Soar

— The dismantling of federal election monitoring efforts has sparked concern among lawmakers and national security experts. Critics argue this move opens the door for foreign interference in upcoming elections. The lack of strong oversight could lead to vulnerabilities being exploited, prompting bipartisan talks on restoring effective monitoring mechanisms.

Democratic officials call the decision irresponsible, claiming it threatens democracy by reducing transparency in election processes. They urge a recommitment to safeguarding electoral integrity. Republican leaders are divided, with some supporting reduced federal involvement to limit overreach.

This development has raised alarms and prompted congressional hearings to assess the impact on election security. Various stakeholders call for immediate action to restore monitoring capabilities against potential foreign manipulation. As critical electoral events approach, the need for reinstating protective measures becomes clear.

:max_bytes(150000):strip_icc()/GettyImages-2192142603-a439d21d07ef4ace9708e5f08f188b0b.jpg)

CHINA’S Tech Boom: How Deepseek AI is Shaking Global Markets

— China’s tech industry is booming, thanks to the rise of the DeepSeek AI model. Major companies like Alibaba, Baidu, and Xiaomi are seeing big benefits. This surge has pushed Hong Kong’s Hang Seng Tech Index up this year.

Alibaba, co-founded by Jack Ma, stands out in this market rally. The company’s growth shows the broader impact of tech advancements on China’s economy. Investors are watching these changes for possible global effects.

The rise in China’s tech stocks might affect U.S. investments and international trade ties. As U.S. markets close with small changes in the S&P 500, global investors keep an eye on shifts in Chinese tech trends.

This ongoing rally highlights China’s growing influence on worldwide economic dynamics, making it a key player to watch in global markets.

TRUMP’S Bold Trade Plan Sends Global Markets Into Turmoil

— President Donald TRUMP is set to announce new reciprocal tariffs on Thursday. These tariffs aim to match the tax rates other countries impose on U.S. imports. This move is part of Trump’s strategy to reshape international trade and counteract barriers that hurt American businesses.

Trump’s plan has sparked discussions among global trading partners, potentially impacting economic relations and market stability. The announcement follows a memo he signed, directing his team to calculate duties that align with those charged by other nations.

In addition to trade policy changes, the Trump administration has started workforce reductions across federal agencies, affecting recent hires in departments like Education and Energy. These actions reflect a broader agenda focused on reducing government size and boosting efficiency.

Meanwhile, Southern California faces severe weather threats as heavy rains prompt evacuations due to potential debris flows in wildfire-scarred areas. Residents are urged to stay alert as CalTrans crews work tirelessly to reduce flooding risks in affected regions.

TRUMP’S Bold Trade Plan: A Shockwave For Global Markets

— Former President Donald Trump is set to announce a new RECIPROCAL tariff policy on Thursday. This plan aims to match the higher duty rates imposed by other countries on U.S. goods. Trump’s strategy seeks to counteract foreign trade barriers, including regulations and subsidies, that hinder American exports.

The proposed tariffs are part of Trump’s broader effort to reshape trade in favor of American interests. By imposing equivalent charges on countries taxing U.S. products, the plan could escalate global trade tensions. This approach marks a significant shift in U.S. trade policy towards a more competitive stance against international markets deemed unfair.

Investors and analysts are watching closely as this announcement could impact stock markets, especially sectors dependent on international trade. The potential for increased tariffs may affect industries vulnerable to such changes, leading to market volatility.

This development is breaking news and has not yet appeared in existing news timelines, highlighting its significance for economic observers and policymakers alike. The implications for U.S.-foreign trade relationships remain a critical point of focus moving forward.

GOLD PRICES Soar: Trump’s Trade Policies Spark Investor Panic

— Gold prices are reaching near record highs after President Donald Trump announced new tariffs on major trading partners like Canada, China, and Mexico. Analysts predict gold could soon hit an all-time high of $2,850 an ounce as these tariffs stir up market volatility.

Peter Cardillo from Spartan Capital Securities noted that central banks are quickly buying gold due to worries about inflation and economic stability. This rush to gold shows investor fear amid the uncertainty caused by the tariff announcement.

Trump’s trade policy aims to boost U.S. industries but has raised concerns about possible retaliatory actions from affected countries, complicating global trade dynamics. The financial community is closely watching the impact of these tariffs as international tensions rise.

Market analysts expect commodity prices, especially precious metals, to stay volatile in response to ongoing geopolitical and economic changes. Investors should stay informed as the situation unfolds rapidly.

GOLD PRICES Skyrocket: Trump’s Bold Tariffs Spark Investor Panic

— Gold prices have soared to nearly $2,950 per ounce after President Trump announced new tariffs on steel and aluminum imports. Investors are rushing to gold, seeing it as a safe haven amid fears of a global trade war. This surge shows rising concerns about market instability and potential economic fallout.

The tariffs have caused big swings in both commodities and stock markets, with gold seeing the most dramatic rise. Analysts caution that these actions might lead to retaliation from other countries, making international trade relations even more complex.

Investors are keeping a close eye on U.S.-China trade talks since any changes could affect gold’s future path in the market. The situation is still developing, leaving many worried about the wider effects on global economic stability.

Bank of England’s RATE CUT Sends Shockwaves Through Markets

— The Bank of England has cut interest rates by 25 basis points, causing the Pound Sterling to drop sharply against the US Dollar. This move shows worries about economic growth and inflation. Experts expect more rate cuts in 2025, signaling a careful approach to monetary policy.

Market analysts warn this could affect savings rates and borrowing costs, urging people and businesses to rethink financial plans. The immediate effect saw GBP/USD fall by 0.93%, hitting a session low of 1.2359.

This has increased market volatility, raising concerns about future economic stability in the UK. As uncertainty grows, many wonder how these changes will impact their finances and investments moving forward.

LONDON KNIFE Attack: Fear Grips City as Safety Concerns Soar

— A recent knife attack in London has ignited serious safety concerns among residents. Initial reports indicate multiple injuries, creating a chaotic scene that witnesses found alarming. Calls for increased police presence in violence-prone areas have intensified.

Authorities are investigating the incident while local council officials express alarm over rising knife crime trends in the city. This attack fuels ongoing discussions about public safety and effective anti-violence measures in urban settings.

Community leaders and advocacy groups urge more preventive actions and timely law enforcement responses to stop future incidents. The situation highlights the need for decisive action to ensure citizen safety.

For further updates, visit LONDON KNIFE Attack(https://lifeline.news/fast-news?news=london-knife-attack-2025-01-31).

MARKETS UNDER Pressure: How Budget and Trade Uncertainty Impact You

— The BSE Sensex and Nifty have often closed lower on budget days over the past decade. Recent sessions continue this trend. However, a JM Financial report shows that Nifty usually rebounds within a week after the budget, posting positive results 75% of the time. The Nifty Mid-Cap Index also shows strength, closing higher 67% of the time with an average return of 1.5%.

In commodities, silver prices have fallen below $31.50 per ounce despite a bullish market outlook. Gold remains strong above $2,800 as fears over tariffs and inflation drive demand for safe-haven assets. Analysts predict growth toward $3,000 if current conditions persist.

The US Dollar Index is gaining strength due to expected tariffs on Mexico and Canada this weekend. These tariffs could affect grocery prices in America as President Trump plans a 25% levy on goods from these countries. Meanwhile, crude oil prices are dropping as analysts wait for confirmation before making further predictions about market trends.

In banking news, several branches of Lloyds Bank, Halifax, and Bank of Scotland will close in February 2025 due to broader economic adjustments. The Financial Conduct Authority is now empowered to address the impacts of these closures on communities and customers alike.

GOLD PRICES Soar: Trump’s Trade Moves Spark Investor Panic

— Gold prices soared to a record $2,800 on Friday as investors sought safety amid tariff threats from President Trump. His remarks have sparked concerns about potential economic impacts.

The uncertainty surrounding tariffs has driven demand for gold, a traditional safe-haven asset. Investors fear that any major trade moves could weaken the U.S. dollar, making gold more attractive.

Analysts also note that increased buying by jewelers and retailers ahead of the marriage season contributed to the price surge. These factors combined have led to unprecedented highs in gold prices.

GOLD PRICES Soar: What You Need to Know About Plunging US Yields

— Gold prices climbed for the second day, fueled by falling U.S. yields and hints of easing core inflation. Investors are keeping a close eye on upcoming U.S. retail sales data, unemployment claims, and Federal Reserve announcements for more market insight.

The stock market saw a big lift after a surprisingly good consumer inflation report. The Dow surged 700 points while the Nasdaq jumped 2.5%. This shows optimism even though there are worries about high rates affecting stock performance.

Financial powerhouses Goldman Sachs and JPMorgan started the earnings season strong with impressive trading revenues, boosting the S&P 500’s financial sector to its best day in two months. Citigroup announced a $20 billion share buyback program as it tackles rising regulatory costs and compliance issues.

The U.S. dollar was volatile as traders analyzed inflation data showing core inflation dipped slightly from 3.3% to 3.2%. Market players await more direction from the Federal Reserve on interest rate policies amid these economic changes.

STOCK MARKET Chaos: Inflation Fears Shake Investor Confidence

— The U.S. STOCK market took a big hit today, with major indexes dropping over 3% due to rising inflation fears. Investors worry about possible Federal Reserve policy changes after high inflation numbers came out earlier this week. This is one of the steepest drops in months, shaking confidence that had been boosted by strong job reports.

Bond yields are up, with the 10-year Treasury bond yield hitting about 4.1%, its highest since late 2023, signaling increased inflation expectations. Big tech stocks like Apple and Microsoft saw sell-offs over 5%, adding to the market slump. Analysts warn that ongoing inflation might push the Federal Reserve to rethink interest rate policies, possibly leading to more hikes instead of cuts.

The decline comes after a strong holiday shopping season that initially suggested steady economic growth but is now overshadowed by ongoing inflation problems. Retail and consumer sectors face rising costs and reduced spending, making investors cautious in these areas. Companies like Walmart and Target report higher holiday sales but shrinking profit margins due to inflation pressures, prompting them to rethink annual forecasts.

Banks like JPMorgan are bracing for possible loan defaults as consumers struggle with higher living costs by setting aside more reserves. Market analysts expect continued volatility as investors digest new inflation data and Fed policy implications.;

WALL STREET Surges: Oil Price Drop Sparks Investor Optimism

— Wall Street is climbing today, driven by a 6% DROP in oil prices. Investors are gearing up for a crucial week of earnings reports from major tech firms.

Tech and energy stocks are leading the way, with analysts hopeful about tech giants’ futures. However, there is still caution about the overall economic outlook.

The fall in oil prices comes from oversupply worries and easing geopolitical tensions, affecting inflation rates and consumer spending that Wall Street closely monitors.

While U.S. markets rise, Asian markets face recession fears linked to U.S. economic performance, showing global interconnectedness and financial volatility.

TRAGIC RISE: Migrant Deaths Soar in Deadly Channel Crossings

— Three migrants lost their lives attempting to cross the Channel near Calais, France, highlighting the ongoing crisis. The French coastguard reported that 45 others received treatment on the beach, with four hospitalized. This brings the total number of migrant fatalities in the Channel this year to 77, marking it as the deadliest year since 2018.

Pierre-Henri Dumont, MP for Pas-de-Calais, warned about crossing in frigid waters. He emphasized that even a few minutes in such conditions can be fatal despite quick rescue responses. His comments come amid a record number of crossings during Christmas week, with over 1,485 migrants making it across from December 25th to 28th alone.

The surge over Christmas has pushed total crossings past 150,000 since tracking began in 2018. This year alone has seen over 36,000 illegal crossings compared to last year’s figure of just under 30,000. The left-wing Labour government under Prime Minister Sir Keir Starmer pledged to curb these numbers by dismantling smuggling networks but has so far failed to deliver results as promised.

Since taking office in July, Starmer’s government has overseen more than 22,000 crossings — surpassing totals from previous years combined (2018-2020). Critics argue this reflects poorly

MIGRANT DEATHS in Channel Soar: A Tragic Record for 2024

— Three migrants tragically died while trying to cross the Channel near Calais, France, highlighting the ongoing crisis. The French coastguard reported that 45 others were treated for hypothermia, with four hospitalized. This incident raises the total number of migrant deaths in the Channel this year to 77, making 2024 the deadliest year since the crisis began in 2018.

Pas-de-Calais MP Pierre-Henri Dumont warned about the extreme dangers of crossing during winter months. He stressed that even brief exposure to cold waters can be fatal despite quick rescue efforts. The recent surge saw a record-breaking 1,485 illegal crossings from December 25th to 28th alone.

The total number of illegal crossings has now surpassed 150,000 since tracking began in 2018. Over 36,000 migrants have crossed this year alone, up from last year’s figures of over 29,000.

Prime Minister Sir Keir Starmer’s Labour Party government promised to curb illegal crossings by dismantling smuggler networks but faces criticism for failing to deliver results since taking office in July. With over 22,000 crossings under their watch already exceeding previous years’ totals combined before their tenure began, public pressure mounts for effective action against this ongoing issue.

RUSSIA’S Military Losses Soar Amid Ukraine Conflict

— Britain’s Ministry of Defence reports a sharp rise in Russian military casualties, averaging 1,271 per day in September. This marks the highest daily losses since the conflict began. The increase is linked to Ukraine’s counter-invasion efforts and Russia’s aggressive tactics.

The analysis shows Russia’s casualty rate has more than doubled compared to last year’s peaks. Despite harsh winter conditions, there’s no sign of reduced conflict intensity. Over 648,000 Russian casualties are estimated since the war started, based on Ukrainian figures.

Ukraine claims it inflicted over 38,000 casualties on Russian forces in September alone and destroyed thousands of vehicles like tanks and armored units. However, Western sources often highlight Russian losses without comprehensive data on Ukrainian casualties due to limited transparency from Kyiv.

While Ukraine’s reported figures for Russian losses exceed those from Britain’s Ministry of Defence, accurate assessments are tough due to wartime secrecy. President Zelensky dismissed Kremlin claims about Ukrainian casualties as exaggerated lies earlier this year but didn’t disclose specific numbers for his own forces’ losses.

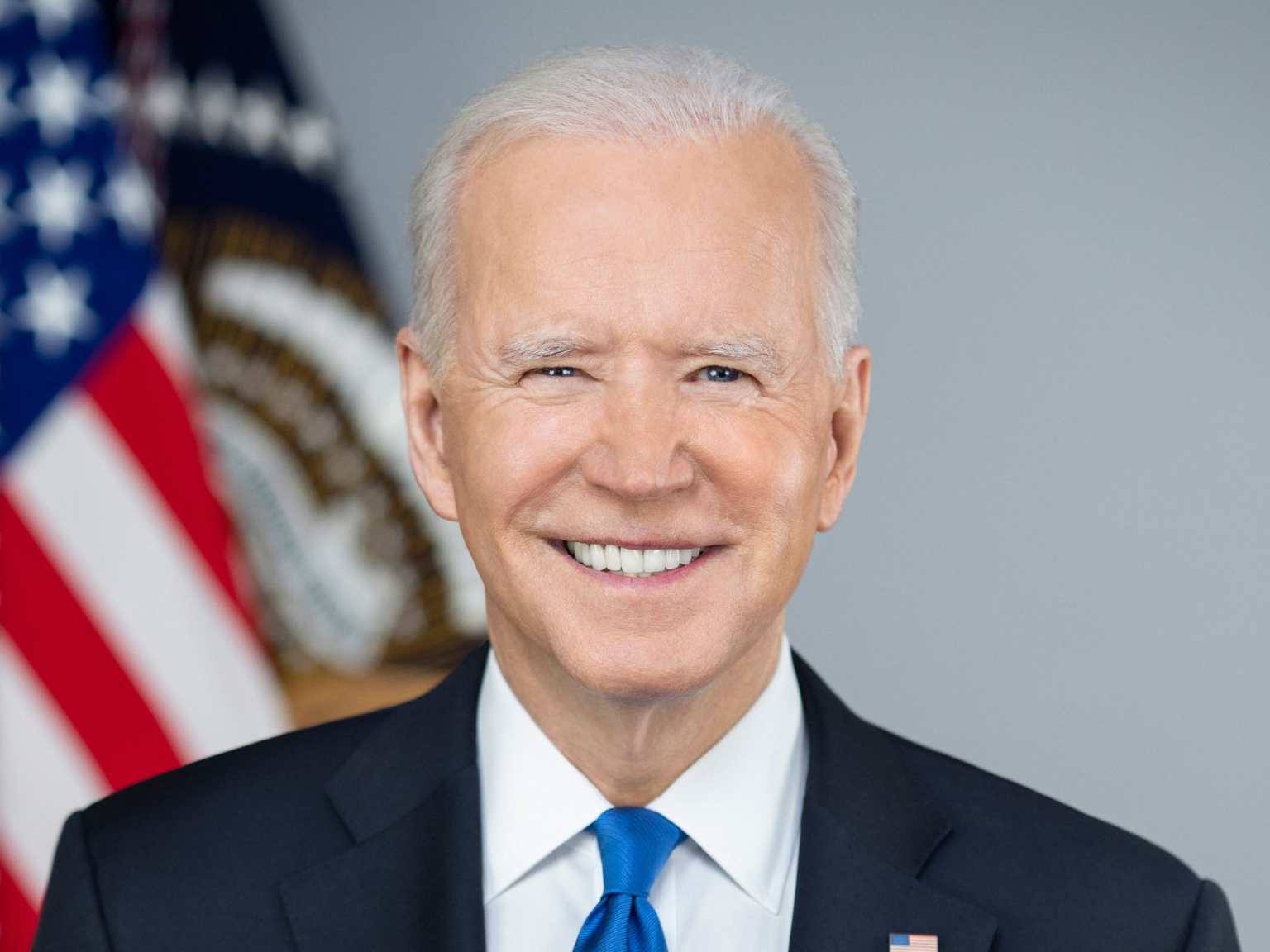

Biden’s BORDER Policy SHOCKS Americans: Crime Rates Soar

— President Biden’s border policy has led to a surge in illegal crossings. Many Americans are worried about the rising crime rates linked to this influx. Local communities are feeling the impact, and some residents say they no longer feel safe in their own neighborhoods.

Critics argue that Biden’s approach is too lenient and lacks proper enforcement. They believe this has encouraged more people to cross illegally, putting a strain on resources and law enforcement.

Supporters of stricter border control point out that crime rates have increased in areas with high numbers of illegal immigrants. They call for immediate action to secure the border and protect American citizens from further harm.

The debate over immigration policy continues, but one thing is clear: many Americans are deeply concerned about their safety and the future of their communities under current policies.

NETANYAHU ADMITS "Tragic Mistake" In Israeli Strike: Outrage Grows

— Prime Minister Benjamin Netanyahu admitted a “tragic mistake” in an Israeli strike on Rafah, Gaza, that killed at least 45 displaced Palestinians. This incident has intensified international criticism of Israel’s war with Hamas. Even Israel’s closest allies have expressed outrage over the civilian deaths.

Israel claims adherence to international law but faces scrutiny from global courts, one of which demanded a halt to the Rafah offensive last week. The military initially reported targeting a Hamas compound and killing two senior militants but later opened an investigation into civilian deaths as more details emerged.

Sunday night’s attack is among the deadliest in the conflict, pushing the Palestinian death toll above 36,000 according to Gaza Health Ministry figures. Netanyahu assured that Israel is investigating and will conclude how this error occurred as part of its policy to avoid harming civilians.

Mohammed Abuassa described rescuers pulling out people in horrific conditions from the camp fire aftermath in Tel al-Sultan neighborhood. “We pulled out children who were in pieces,” he said, highlighting the devastating impact on both young and elderly victims alike.

SCOTLAND on the BRINK: First Minister Faces Critical No Confidence Vote

— Scotland’s political scene is heating up as First Minister Humza Yousaf faces a potential ousting. His decision to end a coalition with the Scottish Green Party over climate policy disagreements has sparked calls for an early election. Leading the Scottish National Party (SNP), Yousaf now finds his party without a parliamentary majority, intensifying the crisis.

The termination of the 2021 Bute House Agreement has stirred considerable controversy, leading to severe repercussions for Yousaf. The Scottish Conservatives have declared their intention to hold a no-confidence vote against him next week. With all opposition forces, including former allies like the Greens, potentially unified against him, Yousaf’s political career hangs in balance.

The Greens have openly criticized SNP’s handling of environmental issues under Yousaf’s leadership. Green co-leader Lorna Slater remarked, “We no longer trust that there can be a progressive government in Scotland committed to climate and nature.” This comment sheds light on profound disagreements within pro-independence groups regarding their policy focus.

The ongoing political discord poses a significant threat to Scotland’s stability, possibly forcing an unplanned election well before 2026. This situation highlights the complex challenges faced by minority governments in maintaining cohesive alliances and achieving policy goals amidst conflicting interests.

ISRAEL’S WAR: Allies Demand Cease-Fire as Civilian Deaths Soar

— Israel is under increasing pressure from European allies to halt its ongoing 10-week conflict in Gaza. The calls for a cease-fire come in the wake of several shootings, including the unintended killing of three Israeli hostages. These incidents have ignited global unease about Israel’s conduct during the war and sparked protests within its borders. Citizens are urging their government to return to negotiations with Hamas.

U.S. Defense Secretary Lloyd Austin is slated for a visit on Monday, adding more weight to the call for Israel to reduce major combat operations. While the U.S. continues to provide vital military and diplomatic support, it has voiced growing concern over civilian casualties resulting from this conflict. The war has led to thousands of civilian deaths and displaced an estimated 90% of Gaza’s population from their homes.

In response, Israel has permitted U.N aid trucks access into Gaza via a second entry point starting Sunday. However, Palestinians desperate for aid swarmed these trucks at the Rafah crossing with Egypt causing some trucks to halt prematurely as supplies were hastily taken away by locals.

The U.N agency responsible for Palestinian refugees estimates that over 60% of Gaza’s infrastructure has been decimated due to this war,“ reports state, ”Telecom services are slowly coming back online after a four-day blackout which further hindered rescue efforts and aid delivery.

ETHICS In QUESTION: Biden Under Scrutiny as Hunter’s Investigations Intensify

— The ongoing investigations into Hunter Biden have begun to cast a significant shadow over President Joe Biden. The Justice Department, along with Republican members of Congress, are closely examining the president’s son for his alleged involvement in a criminal scheme with then-Vice President Biden. This comes alongside separate gun charges following the collapse of a plea deal on tax charges.

A recent poll indicates that 35% of U.S. adults believe the president has acted illegally, while 33% suspect unethical conduct. The investigation is spearheaded by House Oversight Committee Chairman James Comer (R-KY) and House Judiciary Committee Chairman Jim Jordan (R-OH). Their goal is to establish a connection between Hunter’s business dealings with a Ukrainian oil and gas firm and his father during his vice presidency.

Hunter Biden has been indicted by special counsel David Weiss in relation to a gun purchase in October 2018. He stands accused of violating orders prohibiting drug users from owning guns and has pleaded not guilty to all three counts against him. There are clear differences in perception across party lines: only 8% of Democrats believe the president is guilty of crimes related to his son’s activities, compared with 65% of Republicans.

As these investigations and indictments continue, they fuel growing controversy around the Bidens. This raises serious concerns about ethics at the

ASIAN MARKETS in Chaos: Evergrande Crisis and Wall Street Woes Trigger Shockwaves

— Asian stock markets experienced a significant downturn on Monday, with Tokyo standing as the sole major regional market to register gains. This follows on the heels of Wall Street’s most dismal week in half a year, which subsequently boosted U.S. futures and oil prices.

Investor confidence was shaken due to multiple factors including worries over China’s real estate sector, a potential shutdown of the U.S. government, and an ongoing strike by American auto industry workers. European markets weren’t spared either with Germany’s DAX, Paris’ CAC 40, and Britain’s FTSE 100 all experiencing a 0.6% drop.

China Evergrande Group saw its shares plummet nearly 22% after it disclosed its inability to secure additional debt due to an ongoing investigation into one of its subsidiaries. This revelation threatens the restructuring of its staggering debt that exceeds $300 billion. In response, Hong Kong’s Hang Seng dropped 1.8%, Shanghai Composite index fell by 0.5%, while Japan’s Nikkei 225 managed to climb by 0.9%.

Elsewhere in Asia, Seoul’s Kospi dipped by 0.5%. On a brighter note though, Australia’s S&P/ASX 200 managed to claw back some ground ending with a modest

LIBYA’S FLOOD Nightmare: Over 1,500 Lives Lost, Death Toll May Soar Beyond 5,000

— Emergency teams in Derna, an eastern city in Libya, have discovered more than 1,500 bodies following the catastrophic floods triggered by Mediterranean storm Daniel. The death toll is expected to climb over 5,000 as the city was devastated when floodwaters broke through dams and wiped out entire neighborhoods. This disaster underscores both the storm’s power and a nation’s susceptibility fractured by over ten years of turmoil.

Libya is divided between rival governments in the east and west leading to widespread neglect of infrastructure. Aid only started arriving in Derna on Tuesday, a full day and a half after the disaster hit. The floods damaged or destroyed numerous access routes to this coastal city home to roughly 89,000 people.

Video footage showed dozens of bodies draped with blankets in one hospital yard and mass graves brimming with victims. By Tuesday evening, more than half of the recovered bodies had been buried according to eastern Libya’s health minister. Mohammed Abu-Lamousha from east Libya’s interior ministry cited a death toll surpassing 5,300 for Derna alone while Tamer Ramadan from International Federation of Red Cross and Red Crescent Societies estimated that at least 10,000 people were still unaccounted for.

AMERICAN CAVER Trapped: Unfolding Drama in Turkish Cave as Rescue Operation Faces Challenges

— Mark Dickey, a seasoned American caver and researcher, is trapped deep within Turkey’s Morca cave. Located in the formidable Taurus Mountains, the cave has become Dickey’s unexpected prison nearly 1,000 meters below its entrance. During an expedition with fellow Americans, Dickey fell ill with severe stomach bleeding.

Despite receiving on-site medical attention from rescuers including a Hungarian doctor, his extraction from the constricted cave could take weeks. The complexity of the situation is due to both his condition and the challenging environment of the cold cave.

In a video message shared by Turkey’s communications directorate, Dickey expressed heartfelt gratitude towards both the caving community and Turkish government for their rapid response. He believes their efforts have been life-saving. While he appears alert in the video footage, he stressed that his internal recovery is still ongoing.

According to his affiliated New Jersey-based rescue group, Dickey has stopped vomiting and has been able to eat for the first time in days. However, what caused this sudden illness remains a mystery. The rescue operation continues under demanding conditions requiring multiple teams and constant medical care.

UKRAINE’S Defense Shake-Up: Zelenskyy UNVEILS Umerov as New Leader Amid WAR Scandal

— In a significant turn of events, Ukraine’s president, Volodymyr Zelenskyy, declared a leadership overhaul in the Defense Ministry on Sunday. The incumbent, Oleksii Reznikov, will step aside, making way for Rustem Umerov, a notable Crimean Tatar politician. This change comes after “more than 550 days of full-scale war”.

President Zelenskyy highlighted the necessity for “new approaches” and “different formats of interaction” with the military and society as the driving factors behind the leadership change. Umerov, who currently presides over Ukraine’s State Property Fund, is a familiar figure to the Verkhovna Rada, Ukraine’s parliament. He has played a pivotal role in evacuating citizens from territories under Russian control.

The leadership transition comes amidst a cloud of scrutiny over the Defense Ministry’s procurement practices. Investigative journalists exposed that military jackets were being bought at an exorbitant $86 per unit, a stark contrast from the customary $29 price tag.

Video

RUSSIAN TREASON Cases Soar Since Ukraine Invasion

— Maksim Kolker received a shocking call at 6 a.m. informing him of his father’s arrest. Initially, he thought it was a scam. His father, Dmitry Kolker, a prominent Russian physicist battling advanced pancreatic cancer, confirmed the grim news himself.

Dmitry Kolker had been charged with treason, a crime that has become increasingly common in Russia since the 2022 invasion of Ukraine. These cases are investigated by the Federal Security Service (FSB) and often involve secretive proceedings and harsh sentences.

The surge in treason and espionage prosecutions has drawn comparisons to Stalin-era show trials. Victims include Kremlin critics, independent journalists, and veteran scientists working with countries considered friendly by Moscow.

Accused individuals are typically held in strict isolation at Moscow’s Lefortovo Prison and tried behind closed doors. Convictions almost always result in long prison terms, highlighting an unprecedented crackdown on dissent under President Vladimir Putin’s regime.

More Videos

Invalid Query

The keyword entered was invalid, or we couldn't gather enough relevant information to construct a thread. Try checking the spelling or entering a broader search term. Often simple one-word terms are enough for our algorithms to build a detailed thread on the topic. Longer multi-word terms will refine the search but create a narrower information thread.