THREAD: stock market sees bright uptick...

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

SENSEX SURGE: Investors Cheer as Market Confidence Grows

— The SENSEX index opened at 74,474.98 on March 9, 2025, marking a positive start to the trading day. This opening was slightly above its previous close of 74,332.58, signaling growing investor trust in the market’s stability.

As trading progressed, the index gained over 350 points, hitting a high of 74,713.17. This upward trend shows optimism among investors and suggests a strong economic outlook for India.

Growth in the SENSEX is often seen as an indicator of economic health and can positively influence global markets. Investors will be closely watching to see if this momentum continues in the coming days.

XRP PRICE Soars: Trump’s Bold Crypto Move Shakes Market

— XRP’s price jumped by 30%, hitting $2.75 after finding support at $2.00. This rise follows talk about its possible inclusion in a US Crypto Reserve.

President Trump suggested the US might add XRP, ADA, and SOL to a national crypto reserve along with Bitcoin and Ethereum. This could change the cryptocurrency world dramatically.

Analyst “Dark Defender” predicts XRP could reach $77.7 soon, showing growing investor hope. These forecasts highlight how government-backed crypto plans might affect market trends.

INNOVATIVE BUSINESS Ideas Face Economic Hurdles In Today’S Market

— The current market offers many opportunities for new business ideas. AI-powered financial coaching apps are gaining popularity, especially among women entrepreneurs. There’s also a growing demand for senior care services due to an aging population. Eco-friendly products, second-hand fashion, and zero-waste packaging are on the rise as consumers focus on sustainability.

Labour’s proposed tax hikes on businesses could threaten low-paid jobs in the UK. Employers face financial pressure from rising business rates and national insurance costs. These changes may cost businesses about £5 billion, potentially impacting low-income workers significantly.

In the U.S., stock markets saw a sharp decline with the Dow dropping nearly 750 points amid tariff concerns. Reports suggest U.S. business activity is nearing a stall with growth at a 17-month low. Businesses express widespread worries over federal policies affecting their operations and future optimism.

UNMISSABLE Business OPPORTUNITIES: How to Thrive in Today’s Market

— The current market offers many business opportunities that align with consumer needs and personal passions. AI-powered financial coaching apps are becoming popular, especially among women entrepreneurs seeking personalized advice. Senior care services are also in demand due to the aging population needing more in-home support.

Eco-friendly products like second-hand fashion and zero-waste packaging are trending as consumers focus on sustainability. Success in these areas depends on marketing strategies that emphasize transparency and ethical practices.

Meanwhile, Dorset is seeing fewer new business startups due to economic pressures and job security worries. Ian Girling of the Dorset Chamber of Commerce calls for government action to help new businesses survive better.

In contrast, Syntheia Corp., which specializes in AI-driven call handling solutions, reports a surge in subscriptions, doubling to 2,000 within a week. This growth highlights the increasing reliance on conversational AI technologies to transform customer service experiences.

/Super%20Micro%20Computer%20Inc%20HQ%20photo-by%20Tada%20Images%20via%20Shutterstock.jpg)

SUPER MICRO Stock Skyrockets: Investors Cheer Bold 2026 Goals

— Super Micro’s stock jumped after the company set bold goals for 2026, calming investor worries about its future. Despite controversies and a Department of Justice probe into its accounting, Super Micro is working to stabilize. The company hired a new accountant and announced an independent review found no wrongdoing.

Nasdaq gave Super Micro more time to submit filings by February 25, which the company plans to meet. This extension follows a tough year with challenges noted in the Hindenburg report. Investors reacted positively to these updates, causing stock prices to soar after the business update on February 11.

TECH GIANTS Spark Stock Market Surge: What Investors Need to Know

— The STOCK MARKET is seeing a surge, with predictions of a 0.49% rise. This optimism comes from major tech companies, whose earnings reports are expected to beat estimates. Investors are eagerly awaiting these results, fueling excitement across the market.

However, concerns about rising interest rates could dampen this enthusiasm. While the outlook remains positive now, potential rate hikes might impact investor sentiment soon. Market participants stay cautious as they navigate these mixed signals.

Besides stock market news, debates continue over a new lunch plan proposed by a coalition that may affect small businesses’ futures. Stakeholders are split on the possible effects of these changes, highlighting ongoing challenges in balancing economic growth with regulations.

TRUMP’S Trade WAR Ignites Gold Rush And Market Turmoil

— Gold prices have hit a record high as investors flock to safe assets amid President Donald Trump’s new tariffs. These measures target imports from Canada, China, and Mexico, sparking worries about inflation and economic growth. JP Morgan is optimistic about gold, urging investors to buy during this dip.

Wall Street braces for losses due to fears of an escalating trade war from Trump’s tariff actions. The 25% tariffs on Canada and Mexico and 10% on China may cause “short-term” pain for Americans, according to Trump. Global markets watch cautiously as these policies unfold.

Oil prices are climbing in response to the tariffs, while metal and agricultural commodities face pressure downward. The financial landscape is shifting with markets adjusting to a potential prolonged trade conflict led by the U.S., causing the dollar to gain strength amid global trade uncertainty.

HORRIFIC CAR Attack at German Christmas Market: 11 Dead in Suspected Terrorist Act

— A car attack at a Christmas market in Magdeburg, Germany, left 11 people dead and over 80 injured on January 31, 2025. Authorities believe this was a terrorist act.

Emergency services arrived quickly to the chaotic scene. Many victims were critically hurt. Witnesses saw panic as people ran and some got trapped under the vehicle. Police caught the suspect, a 50-year-old man acting alone.

The German government shared condolences with victims’ families and vowed to investigate this tragic event thoroughly.

APTIV STOCK Skyrockets After Bold Business Move

— Aptiv plans to spin off its electrical distribution systems (EDS) into a new company. This bold move lets Aptiv focus on advanced driver-aid technology. After the announcement, Aptiv’s shares soared by 5%.

Analysts point out that EDS has lower profit margins. The adjusted EBITDA margin for EDS is expected to be 9.5% in 2024, while Aptiv’s other operations boast an 18.8% margin.

Garrett Nelson from CFRA Research supports the spin-off, saying it aligns with Aptiv’s push toward high-margin growth areas. This strategic shift could enhance Aptiv’s future profitability and market position.

SCOTUS DECISION Rocks TikTok: What It Means for America

— The U.S. Supreme Court has upheld the TikTok divest-or-ban law, dismissing claims of First Amendment violations. This decision requires ByteDance to sell its U.S. stake in TikTok by January 19 or face a nationwide ban. The ruling could change the social media landscape and has ignited debates on national security and data privacy concerns.

Legal experts are now exploring how this decision will affect freedom of expression for users. The ruling raises questions about balancing national security with constitutional rights, a topic that remains contentious among stakeholders.

Concerns are growing over how this could impact American users and businesses that rely on TikTok for communication and marketing purposes. As discussions continue, many eagerly await ByteDance’s next move in response to this landmark Supreme Court decision.

AMAZON’S BOLD Move: New South Africa Center Shakes UP Market

— Amazon has opened a new center in Cape Town, South Africa, to support its independent sellers. This is part of Amazon’s plan to grow its market share and compete with local leader Takealot, owned by Naspers. The center aims to help sellers attract more customers and expand Amazon’s product range, potentially boosting revenue.

APPLE’s CHINA TROUBLES: iPhone Shipments PLUMMET

Apple shares fell 3.2% after research firm Canalys reported a 17% drop in iPhone shipments in China for 2024. This decline pushed Apple down to third place in China’s market share rankings. Despite the stock’s volatility, this news is significant but doesn’t drastically change the company’s business outlook.

STOCK MARKET SLUMP: Earnings Reports RATTLE Investors

The stock market took a hit following Wednesday’s rally due to retail sales data and major bank earnings reports taking the spotlight. Analysts remain hopeful about gains for the S&P 500 by year-end despite current swings. Focus is also on upcoming hearings on tariff plans before President-elect Donald Trump that could affect future economic strategies moving forward.

CHINA’S SHOCKING TikTok Move: Will Musk Take Over?

— Chinese officials are thinking about selling TikTok’s US operations to Elon Musk. This idea comes as the app faces a possible ban in the United States. The talks highlight ongoing worries about national security risks linked to TikTok, owned by ByteDance.

The potential sale of TikTok’s US operations shows the tension between the United States and China over data privacy issues. Regulatory scrutiny is growing, with technology and foreign investments at the heart of these global challenges.

Elon Musk’s involvement could change how TikTok operates in America if a sale happens. This development marks an important moment in US-China relations regarding technology and data privacy concerns.

STOCK MARKET Chaos: Inflation Fears Shake Investor Confidence

— The U.S. STOCK market took a big hit today, with major indexes dropping over 3% due to rising inflation fears. Investors worry about possible Federal Reserve policy changes after high inflation numbers came out earlier this week. This is one of the steepest drops in months, shaking confidence that had been boosted by strong job reports.

Bond yields are up, with the 10-year Treasury bond yield hitting about 4.1%, its highest since late 2023, signaling increased inflation expectations. Big tech stocks like Apple and Microsoft saw sell-offs over 5%, adding to the market slump. Analysts warn that ongoing inflation might push the Federal Reserve to rethink interest rate policies, possibly leading to more hikes instead of cuts.

The decline comes after a strong holiday shopping season that initially suggested steady economic growth but is now overshadowed by ongoing inflation problems. Retail and consumer sectors face rising costs and reduced spending, making investors cautious in these areas. Companies like Walmart and Target report higher holiday sales but shrinking profit margins due to inflation pressures, prompting them to rethink annual forecasts.

Banks like JPMorgan are bracing for possible loan defaults as consumers struggle with higher living costs by setting aside more reserves. Market analysts expect continued volatility as investors digest new inflation data and Fed policy implications.;

TRAGIC CHAOS: Car Attack at German Christmas Market Sparks Fear

— A Christmas market in Magdeburg, Germany, turned tragic when a car plowed into a crowd, killing five and injuring over 200. Authorities suspect terrorism as they investigate the incident. Several victims remain in critical condition.

U.S. State Department spokesperson Matthew Miller condemned the event as an “attack,” expressing condolences and support for Germany. Cardinal Dolan offered words of hope, stating that “light will prevail” after this tragedy.

Magdeburg Police identified the suspect as a 50-year-old Saudi doctor believed to have acted alone. The driver reportedly covered 400 meters before police subdued him at gunpoint.

TRAGIC STABBING Spree at London Market Shocks Community

— A stabbing spree at East Street Market in south London left one dead and two injured on Sunday morning. Police arrested a man in his 60s at the scene. While they have not shared details about the suspect or his motives, they do not believe it is terror-related, hinting that mental health issues might be involved.

Witnesses described a chaotic scene as the attacker randomly targeted people. An unnamed fabric seller said, “I just saw a bloke running through the market stabbing people willy-nilly.” The attack happened around 10:30 am when the market was getting busy.

The witness immediately called police after seeing two men stabbed, noting one appeared severely injured. Emergency services quickly arrived but sadly, one victim died from injuries despite their efforts.

The investigation continues as authorities work to understand what led to this tragic event and ensure community safety moving forward.

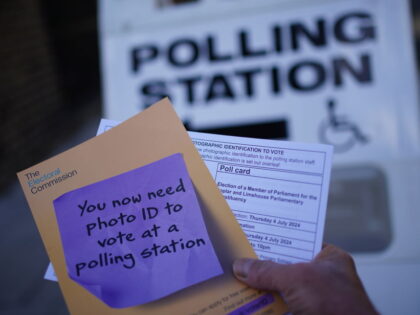

BRITISH Election Sees NEW Voter ID LAW in Action

— Polling stations across the UK opened this morning at 7 AM and will close at 10 PM. Ipsos pollsters are gathering exit poll data to provide an early picture of the election results. Detailed seat-specific results will only be available in the early hours of Friday.

British and Irish citizens, along with some Commonwealth immigrants, are eligible to vote if they are over 18. This election marks the first time voters must show legal identification to cast their ballots in person, a measure aimed at reducing voter fraud. The Electoral Commission has approved 22 forms of ID, including passports and driving licenses.

Prime Minister Rishi Sunak and his wife Akshata Murty were seen voting at Kirby Sigston Village Hall today. Reporting on the election is restricted while polling places are open, with broadcasters banned from discussing outcomes or publishing polls until voting ends. Violating these rules can result in imprisonment for news editors.

TIKTOK On The BRINK: Biden’s Bold Move to Ban or Force Sale of Chinese App

— TikTok and Universal Music Group have just renewed their partnership. This deal brings UMG’s music back to TikTok after a short break. The agreement includes better promotion strategies and new AI protections. Universal CEO Lucian Grainge said the deal will help artists and creators on the platform.

President Joe Biden has signed a new law that gives TikTok’s parent company, ByteDance, nine months to sell the app or face a ban in the U.S. This decision is due to worries from both political sides about national security and protecting American youth from foreign influence.

TikTok’s CEO, Shou Zi Chew, announced plans to fight this law in U.S courts, claiming it supports their constitutional rights. Yet, ByteDance would rather close TikTok in the U.S than sell it if they lose their legal battle.

This conflict shows the ongoing struggle between TikTok’s business goals and America’s national security needs. It points out big worries about data privacy and foreign influence in American digital spaces by China’s tech sector.

TIKTOK’S SHADOW BAN: Suppressing Content Critical of Chinese Communist Party?

— A recent investigation by Rutgers University’s Network Contagion Research Institute has unveiled unsettling details about TikTok’s content guidelines. The popular social media platform, notorious for its data collection and sharing with its parent company in China, now stands accused of stifling content that criticizes the Chinese Communist Party (CCP).

The research team found a stark contrast in the number of posts featuring contentious hashtags such as China’s conflict with India over Kashmir, the Tiananmen Square massacre, and the Uyghur genocide on TikTok compared to other platforms like Instagram. For instance, there were 206 Instagram posts tagged #HongKongProtests for every single one on TikTok. Similar ratios were observed for #StandWithKashmir, #FreeUyghurs, and #DalaiLama.

The report suggests that there is a high likelihood that TikTok either boosts or suppresses content depending on how it aligns with the Chinese government’s interests. This is worrisome since many Generation Z users rely on TikTok as their primary news source — interestingly enough, this is also the only generation reported not to take pride in being American.

TikTok cannot deny these findings as they mirror the methodology used by them last month to prove their platform was not biased against Israel. This revelation raises serious questions about

NO-FLY Zone Was Introduced for Nicola Bulley’s Funeral

— The Secretary of State for Transport implemented a no-fly zone over the church in Saint Michael’s on Wyre, Lancashire, where the funeral of Nicola Bulley took place on Wednesday. The move was made to prevent TikTok detectives from filming the funeral with drones following the arrest of one TikToker for allegedly filming Nicola’s body being pulled out of the River Wyre.

Nicola Bulley: TikToker ARRESTED for Filming Within Police Cordon

— The Kidderminster man (aka Curtis Media) who filmed and published footage of police recovering Nicola Bulley’s body from the River Wyre was arrested on malicious communications offenses. It comes after police are reportedly charging several content creators for disrupting the investigation.

TikToker Who FILMED Nicola Bulley Being Pulled from River Shamed by Media

— The man who filmed police removing Nicola Bulley’s body from the river has been identified as a Kidderminster hairdresser.

FTSE 100 Hits RECORD High of Over 8,000 Points

— The UK’s blue chip stock index surpassed 8,000 points for the first time in history as the pound plummets in value.

BULLISH on Bitcoin: Crypto Market ERUPTS in January as FEAR Turns to GREED

— Bitcoin (BTC) is on track to have the best January in the last decade as investors turn bullish on crypto after a disastrous 2022. Bitcoin leads the way as it approaches $24,000, up a massive 44% from the beginning of the month, where it hovered around $16,500 a coin.

The broader cryptocurrency market has also turned bullish, with other top coins such as Ethereum (ETH) and Binance Coin (BNB) seeing substantial monthly returns of 37% and 30%, respectively.

The upturn comes after last year saw the crypto market plunge, fueled by fears of regulation and the FTX scandal. The year shredded $600 billion (-66%) from Bitcoin’s market cap, ending the year worth only a third of its 2022 peak value.

Despite the ongoing concerns of regulation, the fear in the market looks to be shifting to greed as investors take advantage of bargain prices. The rise may continue, but savvy investors will be wary of another bear market rally where a sharp sell-off will send prices back to Earth.

Video

GERMAN CHRISTMAS Market Attack: Tragedy Sparks Fear and Unity

— A CAR crashed into a busy Christmas market in Germany, killing at least two people and injuring over 60. Authorities quickly secured the area and provided medical aid. Witnesses described the chaos as people scrambled for safety amidst festive stalls.

German police are investigating the incident as a potential terror attack. The driver, caught at the scene, may have had intentions beyond an accident. This raises concerns about extremist activities in Germany during festive times.

The nation has shown solidarity with victims through messages of support and trending hashtag #BerlinStrong on social media. Political leaders call for unity and reevaluation of security measures at public events.

As investigations continue, questions arise about the driver’s motives and possible extremist ties. The tragedy has sparked debate on public safety measures to prevent future incidents, but German resolve remains strong in recovery efforts.

More Videos

Invalid Query

The keyword entered was invalid, or we couldn't gather enough relevant information to construct a thread. Try checking the spelling or entering a broader search term. Often simple one-word terms are enough for our algorithms to build a detailed thread on the topic. Longer multi-word terms will refine the search but create a narrower information thread.