THREAD: stock market soars as cor...

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

UK TECH GIANTS Slammed: Heartbroken Parents Demand Action as Crime Soars

— Grieving parents across the UK are pleading with tech companies to do more to keep kids safe online. Their voices grow louder as social media and digital platforms face criticism for not protecting children. Conservatives have long warned about the dangers of letting Big Tech go unchecked. Reform UK is in hot water after some candidates posted offensive material online. The backlash puts extra pressure on the party as it tries to win over voters before the next election. Crime is also rising fast in Britain. New data shows personal theft in England and Wales jumped by 22%. Many families now worry if police are doing enough to keep their neighborhoods safe. Other news includes warnings about methanol poisoning, new rules expected on sex-based rights, a ban on sending video game controllers to Russia, and a mini heatwave set to bring the hottest weather of the year.

NEW JERSEY Wildfire Chaos: Thousands Flee Homes as Inferno Rages

— A raging wildfire in Ocean County, New Jersey, has scorched more than 13,000 acres since Tuesday. About 5,000 people had to leave their homes as thick smoke spread across the area. Part of the Garden State Parkway was shut down for safety. Firefighters are battling the flames and helping families who had to evacuate. Air quality warnings have gone up for nearby towns. This is one of the worst wildfires New Jersey has seen in years. The cause is still unknown, and officials are urging everyone to obey evacuation orders. For live updates and video coverage, visit: https://lifeline.news/video-for-news?video=wildfirenew-jersey-devastating-2025-04-24

:max_bytes(150000):strip_icc()/US10Y_2025-04-03_11-20-02-ed576f9bbbed4ee3924f06b3d31b0b93.png)

TRUMP’S Bold Trade Shift Ignites Stock Surge, Gold Soars, Bitcoin ETF Shatters Records

— U.S. stocks jumped for the third day after President Trump signaled a gentler approach on tariffs, especially with China and car makers. The White House is weighing exemptions for auto parts from China, lifting hopes among investors. Big names like Alphabet and Procter?&?Gamble will report earnings soon. Gold prices shot up over 1% after a rocky week. Uncertainty around the globe and changing interest rates helped push gold above $3,300 an ounce. Experts say it’s smart to hold gold right now as Trump eases up on both the Fed and China. The U.S. dollar lost steam when Trump backed away from firing Fed Chair Jerome Powell and hinted at softer trade moves. The Japanese Yen got stronger as talk of a fast US-China deal faded. In crypto news, BlackRock’s Bitcoin ETF smashed records — pulling in $643 million in one day and winning “Best New ETF.” Trump Media also announced new financial products focused on American-made digital assets and held an invite-only event for top holders of its meme coin.

LE PEN Shocked by Conviction as Trump Unleashes Bold Trade Blitz

— Marine Le Pen, the leader of France’s National Rally party, has been convicted of misusing European Parliament funds. She was given a four-year sentence, with two years suspended and the rest served at home under electronic monitoring. This ruling blocks her from running in France’s 2027 presidential race, ending her hopes for another campaign.

French officials claim there is no political motive behind Le Pen’s conviction. Still, many in France are calling it a political earthquake that could shake up the country’s future.

At the same time, President Donald Trump announced tough new tariffs on foreign cars and auto parts coming into America. The 25% tariffs start April 3 and are part of Trump’s plan to bring back U.S. auto jobs and manufacturing strength.

Trump called April 2 “Liberation Day” for American industry and hinted he might negotiate with other countries after the tariffs begin. The markets have reacted with caution as people debate how these bold moves will affect global trade in the long run.

PUTIN’S Fake Ceasefire Sparks Outrage As Attacks Rock Ukraine

— Russian President Vladimir Putin announced a 30-hour Easter ceasefire, but deadly attacks still hit the Kherson region. Ukrainian officials say three people were killed and three more hurt during what was supposed to be a truce. The head of Kherson’s administration, Oleksandr Prokudin, shared these numbers with the public.

Ukrainian President Volodymyr Zelenskyy accused Russia of breaking the ceasefire over 2,900 times. He said Russian forces kept up shelling and drone strikes along the front lines. Zelenskyy told his people that “actions always speak louder than words” and promised Ukraine would only stay silent if Russia did too.

Russia’s Defense Ministry pushed back, blaming Ukraine for 4,900 violations instead. They claimed Moscow’s troops “strictly observed the ceasefire.” But as soon as midnight hit and the truce ended, fighting picked right back up across both sides.

Putin says he’ll only agree to a real ceasefire if Western countries stop sending weapons to Kyiv and if Ukraine stops calling up new soldiers — terms Ukraine flatly rejects. With both sides pointing fingers and refusing to budge, this war looks far from over.

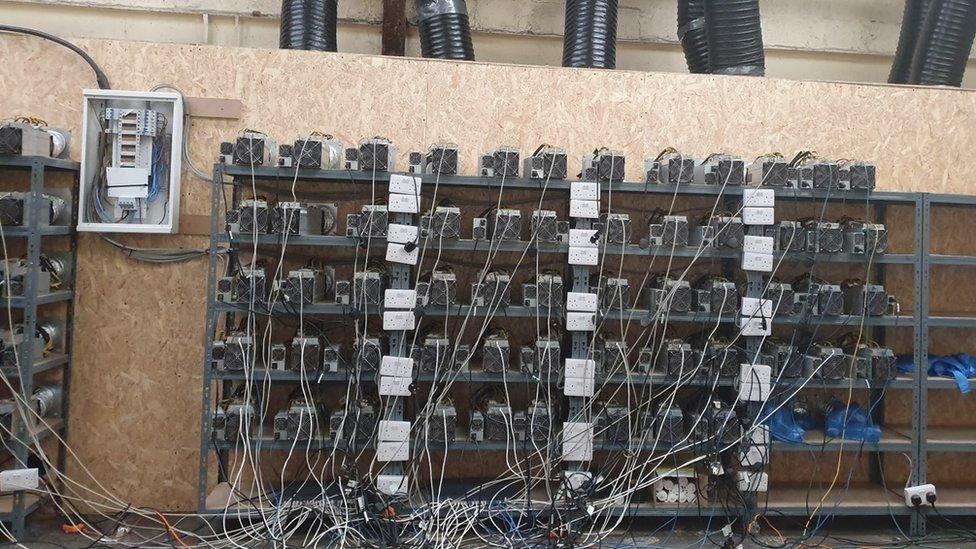

UK ENERGY THEFT Surge: Families Desperate as Bills Spike and Dangers Grow

— Energy theft is exploding across the UK as families battle record-high bills in 2025. Reports from Crimestoppers show more people are tampering with meters or making illegal hookups. The latest government price cap hike and the cost-of-living crisis are pushing many to take risky steps just to keep the lights on. Experts say this is not just about money — it’s a real danger. Messing with gas lines or meters can cause deadly fires and explosions, putting whole neighborhoods at risk. There have already been tragic deaths linked to these desperate acts. The financial toll is massive too. Stolen energy now costs an estimated £1.5 billion each year, while total energy debt in Britain has soared to a record £3.9 billion — more than double what it was before the crisis. Lawmakers say urgent action is needed, like better home insulation and lower rates for struggling families. Critics argue current government help isn’t enough, warning that without stronger action, both public safety and the UK’s entire energy system could be in trouble.

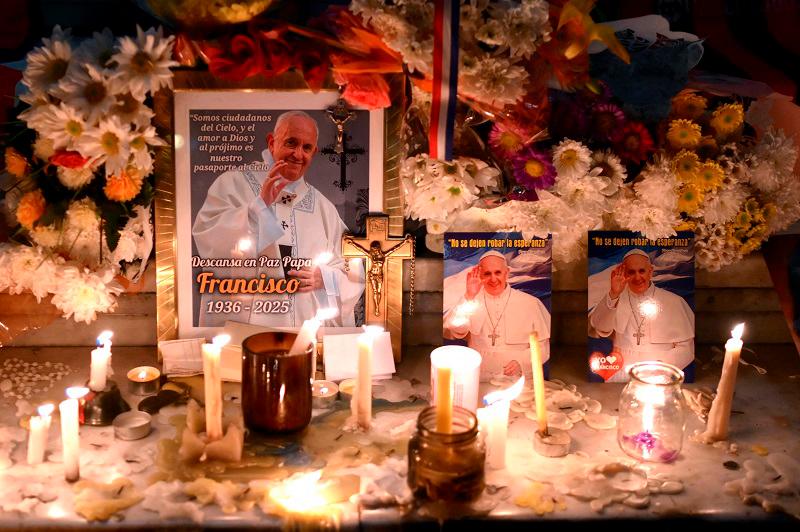

POPE FRANCIS Death Shock: World Stunned as Global News Stalls

— The world is standing still after the death of POPE FRANCIS. Business leaders worldwide have sent their condolences, but there are no major international events making headlines.

Most news outlets have shifted focus to U.S. stories, like the Arizona Department of Corrections investigation and Harvard’s lawsuit against the Trump administration. These are not global stories and offer little for those wanting international updates.

Outside of ongoing coverage about Pope Francis’s passing, there is almost no movement on the world stage. Anyone hoping for big news from abroad will have to wait until something new breaks.

— Technical glitch disrupts service Users experience delays as the system encounters an error, prompting a retry

— Technical glitch halts service Users experience delays as the system encounters an error, prompting a retry later

RETAIL CHAOS: Forever 21 and Joann Shut Doors as Ollie’S Surges Forward

— Forever 21 is heading for its second bankruptcy and plans to shutter about 200 U.S. stores. Once a mall favorite, the chain has struggled to keep up with online shopping and new trends. Closures have already begun in states like Michigan, New York, and California. Joann Fabrics is closing all its locations after filing for Chapter 11 bankruptcy. Even their website has shut down because of high demand during clearance sales. Many shoppers are upset about store policies as hundreds of sites get ready to close. While others shrink, Ollie’s Bargain Outlet is on the rise. The discount chain will grab up to 100 Big Lots store leases as Big Lots faces its own financial troubles. Ollie’s expects to open around 75 new outlets in 2025 — much faster than usual. Retailers are feeling the heat from online competition and a shaky economy. Walgreens and Kohl’s are also closing hundreds of stores as more Americans turn away from old-school shopping habits.

— Technical glitch causes website downtime Users report frustration as the service becomes temporarily inaccessible

TRUMP’S “Liberation DAY” Shocks Markets: Wall Street Reels as Tariffs Spark Global Showdown

— President Trump’s “Liberation Day” tariffs have rocked the markets. The Dow dropped more than 2,000 points on some days. The S&P 500 and Nasdaq both fell into bear market territory. These tariffs, reaching up to 125% for some countries, are the highest seen in a hundred years. China, the EU, and Japan are feeling the pain most. China hit back with its own tariffs on American goods. Japan’s finance minister warned of global trouble ahead. Still, US officials say they’re hopeful about future trade talks. Big companies are taking hits too. CarMax shares sank after weak earnings reports. Nvidia tumbled more than 20% from its high point this year. UnitedHealth lowered its profit forecast because Medicare costs keep rising. Experts think this wild ride will last until trade fights settle down. Some industries are holding up better than others under pressure. The Federal Reserve might cut rates three times this year if things get worse — some warn a financial crisis could happen if tariff chaos continues much longer.

FSU SHOOTING Horror: Campus Fears Surge as Crime Crisis Grows

— A gunman opened fire at Florida State University on April 17, killing two and injuring six. The suspect, Phoenix Ikner, is the stepson of a local sheriff’s deputy. He used a gun registered to his stepmother. Police have not shared a motive yet, but Ikner is in custody as the investigation continues. Students hid in classrooms for five minutes while shots rang out. Now, the campus is grieving and demanding answers about how this could happen. Violent crime isn’t just a campus problem — it’s rising across America. In South Carolina, an inmate was executed by firing squad for two murders from 2004 — a rare punishment these days. In Texas, police charged a teen with fatally stabbing another student. International news adds to growing concerns about safety and law enforcement. An American pastor kidnapped in South Africa was rescued after police used deadly force against his captors. Meanwhile, U.S. immigration policies face new questions after deportation mistakes led a senator to visit El Salvador — sparking debate over how best to protect Americans at home and abroad.

— UK Supreme Court rules trans women cannot use single-sex female toilets or changing rooms The landmark decision affirms the legal definition of a woman as based on biological sex

— UK Supreme Court rules trans women cannot use single-sex female toilets or changing rooms The landmark decision affirms the legal definition of a woman as based on biological sex

TRUMP’S Bold Harvard Threat Ignites Fury as Political Violence Surges

— Former President Donald Trump is taking a hard stand against Harvard University. He wants to strip its tax-exempt status and freeze $2.2 billion in federal funds unless the school ends DEI programs and works with immigration officials. Barack Obama called Trump’s plan “unlawful,” but many conservatives see it as a needed pushback against elite institutions. In Pennsylvania, Governor Josh Shapiro’s home was set on fire in an arson attack while his family was inside. This comes after last year’s attempt on Trump’s life, raising alarms about growing political violence across the country. The suspect in the arson case was let out on bail despite a violent past, leading many to question law enforcement choices. Meanwhile, France is facing its own political storm. Marine Le Pen, leader of the far-right movement, has been convicted of embezzlement and banned from running for president until 2030. Le Pen says she is being targeted by her opponents to keep her out of power. Americans are worried about rising crime and chaos in their cities. National Guard troops have been sent into areas hit by youth crime and violence. The nation remains divided over issues like immigration policy, abortion laws, transgender rights, and how federal money should be spent — all while political tensions keep rising.

RUSSIAN MISSILE Strike: Ukraine Mourns as 34 Lives Lost

— A RUSSIAN missile strike in Ukraine’s Sumy region has taken the lives of at least 34 people. President Volodymyr Zelenskiy condemned the attack, calling it terrorism and urging a strong international response. He asked the United States and European nations to take decisive action against Moscow.

This tragic event raises tensions amid ongoing ceasefire talks between Ukraine and Russia. Both countries have accused each other of breaking agreements meant to protect energy infrastructure, making diplomatic efforts more difficult.

Zelenskiy stressed the need for stronger diplomatic pressure on Russia during a CBS News interview, highlighting the urgency for global intervention in this escalating crisis.

TRUMP’S Tariff CUT Sparks Stock Market Surge

— In a bold move, President Donald Trump announced a temporary cut in tariffs for many countries, while raising them for China. This decision caused U.S. stock indexes to soar, with the S&P 500 seeing its biggest gain since 2008, closing 9.5% higher. Trump’s tariff strategy aims to increase pressure on China amid ongoing trade tensions.

The announcement led to a sharp drop in the Cboe Volatility Index (VIX), which fell by 15 points to 37.2 after news of a 90-day tariff pause for most nations. However, China’s response was quick as they imposed an 84% retaliatory tariff on U.S. goods following the new U.S. levy on Chinese imports that took effect at midnight. This escalation adds uncertainty to global markets despite the initial boost in U.S stocks.

Meanwhile, on the home front, the U.S government has started monitoring immigrants’ social media accounts for signs of antisemitism as part of enhanced security measures. This initiative reflects growing concerns over hate speech and its potential impact on national security and social cohesion within immigrant communities across America.;

MARKET PANIC: Bitcoin and Stocks Plummet in US Tariff Chaos

— Bitcoin dropped below $80,000 on Sunday, falling over 3% in just two hours. This decline happened alongside major losses in U.S. stock markets. The S&P 500 and Nasdaq Composite both closed nearly 6% lower on April 4. Analyst Holger Zschaepitz noted the stock market lost $8.2 trillion, surpassing losses from the worst week of the 2008 financial crisis.

The market chaos comes from recent U.S. tariffs that have sparked widespread sell-offs across many sectors. Despite this turmoil, some investors see potential buying opportunities as stocks are now trading at historically low valuations of 15 times future earnings projections.

Jim Cramer has warned this could be just the start of a bigger downturn for the S&P 500, predicting a further meltdown of up to 20%. As of Sunday night, S&P futures were down about 4%. Global stocks have already lost $7.46 trillion since April 2nd and may exceed $10 trillion if recent sell-offs continue to unfold.;

TRUMP’S Trade Policy Shocks: US Stocks Plunge in Market Chaos

— The EURO has surged to a six-month high as investors react to the latest U.S. tariff announcements. Meanwhile, the Australian dollar has taken a hit, reflecting global market volatility. These currency shifts highlight ongoing economic uncertainties fueled by international trade tensions.

U.S. stock futures have plummeted after China’s retaliatory tariffs on American goods, marking another phase in the global trade conflict. The Dow Jones dropped 1,679 points, causing widespread concern among investors and financial strategists who urge calm and strategic planning during these turbulent times.

Bitcoin ETFs saw nearly $100 million in net outflows as markets reacted sharply to tariff news from the Trump administration. This exodus underscores investor anxiety and uncertainty about future economic conditions amid escalating trade disputes with China.

Goldman Sachs has revised its oil price forecasts downward due to fears of a potential recession and increased supply from OPEC+. Gold prices have steadied after an initial selloff triggered by aggressive U.S. tariff policies, indicating cautious optimism among investors seeking safe-haven assets in uncertain times.

TRUMP’S 10% Tarifts Spark Stock Market Chaos

— U.S. stocks plunged after President Trump announced a 10% tariff on all trading partners. The Dow dropped about 1,300 points, with the S&P 500 and Nasdaq also taking hits. Investors quickly reacted, showing concern over potential economic fallout.

President Trump plans to impose reciprocal tariffs starting at 10%, targeting countries worldwide and adding extra duties for “worst offenders.” This move has unsettled markets and might lead to higher consumer costs and a possible recession. Economists are worried about the long-term effects on both domestic and global economies.

Globally, the response has been mostly negative, with many countries considering countermeasures to protect their economies from these new tariffs. This rise in trade tensions marks a significant shift in international economic relations under Trump’s leadership. Key sectors relying on international trade may face challenges as relationships with major trading partners change.

FOREIGN STUDENTS as Pawns: How Hamas Manipulates US Campuses

— Al-Ketbi warns that foreign students are being manipulated by terrorist groups like Hamas, backed by Iran. His comments follow the arrest of Mahmoud Khalil, a Palestinian-born Columbia University graduate facing deportation for pro-Hamas activities. Khalil’s case highlights how extremist groups exploit U.S. immigration laws to infiltrate society.

Khalil is accused of being a Hamas sympathizer with anti-American views, linked to violent campus activities at Columbia University. Videos show him urging protesters to “destroy” and “explode the heads of Zionists.” Al-Ketbi warns this is part of a pattern where foreign students act as proxies for hostile regimes like Iran on American campuses.

Student groups such as Columbia University’s Apartheid Divest and Students for Justice in Palestine are cited as platforms spreading antisemitic or pro-terrorism discourse under humanitarian pretenses. Al-Ketbi emphasizes that these organizations often mask their true intentions behind human rights activism while promoting dangerous ideologies.

He argues that U.S. academic institutions are vulnerable due to inadequate vetting and misuse of free speech protections. Universities must prevent political or terrorist exploitation to safeguard against these threats, according to Al-Ketbi’s analysis in the Saudi outlet Elaph translated by MEMRI.

STOCK MARKET Chaos: US Faces Economic Fears as Tariffs Loom

— U.S. stocks took a nosedive today as President Donald Trump’s “Liberation Day” approaches, bringing potential tariffs on Canadian steel and aluminum imports. Analysts warn these tariffs could trigger a market downturn and increase recession risks. Wolfe Research has already revised U.S. growth estimates for 2025 down to 1.6%.

Retail giant Kohl’s experienced its worst trading day since 1992, with stocks tumbling by 26% after issuing disappointing guidance for the year. Investor anxiety is also heightened by an upcoming House vote on a stopgap funding bill, adding to market volatility.

The Dow Jones Industrial Average has fallen 8.3% from its peak, raising concerns about the tech sector’s performance compared to the S&P 500. Investors are bracing for further shifts as policy decisions unfold in the coming days amid fears of reduced earnings across sectors due to new tariffs and declining consumer confidence.

TRUMP’S Targeted Tarif Plan Ignites Stock Surge

— Global stocks soared on Monday, fueled by gains in U.S. markets. Reports suggest President TRUMP’s tariff strategy is more targeted than expected, boosting investor confidence and risk appetite.

U.S. Treasury yields rose with the optimistic outlook on tariffs. Investors hope a targeted approach will ease potential economic disruptions. The market’s reaction shows strong support for Trump’s strategic trade policy shift.

Meanwhile, the IRS expects a significant drop in tax revenue — over 10% by April 15th — according to the Washington Post. This decline raises concerns about fiscal health and future government funding.

In currency markets, the dollar strengthened against both the euro and yen as U.S. business activity improved in March. Bitcoin analysts predict a potential surge to $110K before any major correction, reflecting ongoing interest in cryptocurrency markets.

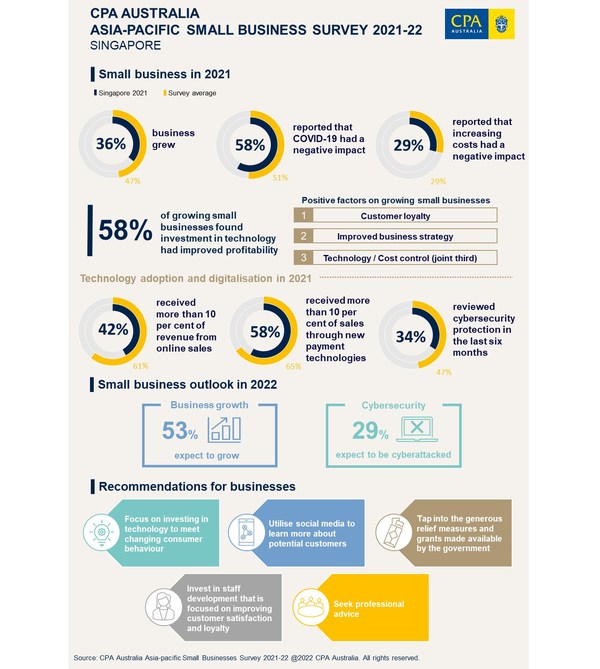

SINGAPORE’S Business Boom: Small Firms’ Confidence Soars to New Heights

— Confidence among small businesses in Singapore has hit its highest point since 2019, says a survey by CPA Australia. The Asia-Pacific Small Business Survey shows that 62% of these businesses expect growth this year, marking the most optimism since 2018. This positive trend is expected to continue into 2025.

Greg Unsworth from CPA Australia notes that this confidence reflects not just business prospects but also a brighter economic environment. The survey highlights a big jump in technology use, with more firms embracing online and digital payments.

In 2024, an impressive 63% of small businesses reported earning over 10% of their revenue from online sales, up from just 36% in 2019. This shift shows a strong move towards digital transformation among Singapore’s small enterprises.

:max_bytes(150000):strip_icc()/GettyImages-2204542885-111eebb0d66b4ccdb80baeba920b68a8.jpg)

SENSEX SOARS: 3,000-Point Rally Ignites Investor Hope

— The SENSEX has soared over 3,000 points in just five sessions, marking its best week in four years. This impressive rally is fueled by cooling bond yields and a stronger rupee. Increased foreign investor interest also plays a key role in this upward trend.

Analysts urge investors to stay engaged and see market dips as chances for long-term growth. They warn of short-term volatility that might affect immediate gains. Vinod Nair from Geojit Financial Services highlights that improving domestic indicators are encouraging investors to seize bargains despite global uncertainties.

This surge shows significant market activity and investor sentiment in the Indian stock market. The unusual upward trend suggests optimism among investors amid strong earnings expectations. Staying informed and cautious remains crucial for navigating these financial waters effectively.

AMERICANS CHEER Bigger TAX Refunds As Dollar Soars

— Many Americans are seeing larger tax refunds this year, with the average refund hitting $3,324. This increase comes from changes in tax policies and economic conditions. The bigger refunds provide a welcome relief for taxpayers facing ongoing economic uncertainties.

The US DOLLAR has gained strength against major currencies after the Federal Reserve decided to stick with its current interest rate path. Traders expect the Fed to continue with planned rate cuts in 2025, boosting confidence in the dollar’s stability. However, concerns about trade wars remain as markets await an April tariff deadline.

The stock market took a hit despite an initial rise following the Federal Reserve meeting. Investors are cautious due to potential tariff impacts and signs of an economic slowdown highlighted by experts like Jeffrey Roach from LPL Financial. The Dow Jones Industrial Average showed some resilience, but worries about trade tensions persist among market participants.

In other financial news, gold prices reached record highs after the FOMC meeting as investors turned to safe-haven assets amid market volatility. Additionally, Social Security announced changes aimed at speeding up direct deposits while enhancing ID security measures for beneficiaries’ protection. These developments reflect broader trends affecting both personal finances and global markets today.

HONG KONG Surge Ignites Asian Market Boom

— Hong Kong is leading a major surge in Asian markets, sparking excitement and strong trading. Big gains are seen in Japan, India, and Malaysia. Indonesia trails slightly behind.

This market shift lines up with possible geopolitical changes, including hints from former President Trump about a potential visit from President Xi to Washington DC. Such moves could impact international relations and economic plans.

China’s tech giants like Alibaba and Tencent are seeing big gains thanks to positive domestic consumption outlooks. This growth shows the strength of China’s tech sector amid global uncertainties.

NIO’s partnership with CATL signals more growth in the tech industry, boosting investor confidence across Asia. The collaboration highlights the region’s focus on innovation and technological progress.

TRUMP’S Bold Move: How NEW Tariffs Rattle the Stock Market

— U.S. stocks fell sharply as President Donald Trump’s tariffs on Canada and Mexico took effect, sparking economic fears. Investors worry about the potential impact amid existing uncertainties. Analysts warn of a possible recession, urging caution in market activities.

The S&P 500 and Nasdaq composite saw major drops, hitting technology stocks hard. Companies across sectors are revising forecasts due to these new trade policies. Experts suggest these tariffs could worsen inflation and reduce consumer spending soon.

These tariffs are part of Trump’s broader trade agenda to boost U.S. manufacturing but risk retaliatory actions that may harm American businesses and consumers. The market remains bearish as analysts closely watch for policy fallout effects.

SENSEX SURGE: Investors Cheer as Market Confidence Grows

— The SENSEX index opened at 74,474.98 on March 9, 2025, marking a positive start to the trading day. This opening was slightly above its previous close of 74,332.58, signaling growing investor trust in the market’s stability.

As trading progressed, the index gained over 350 points, hitting a high of 74,713.17. This upward trend shows optimism among investors and suggests a strong economic outlook for India.

Growth in the SENSEX is often seen as an indicator of economic health and can positively influence global markets. Investors will be closely watching to see if this momentum continues in the coming days.

XRP PRICE Soars: Trump’s Bold Crypto Move Shakes Market

— XRP’s price jumped by 30%, hitting $2.75 after finding support at $2.00. This rise follows talk about its possible inclusion in a US Crypto Reserve.

President Trump suggested the US might add XRP, ADA, and SOL to a national crypto reserve along with Bitcoin and Ethereum. This could change the cryptocurrency world dramatically.

Analyst “Dark Defender” predicts XRP could reach $77.7 soon, showing growing investor hope. These forecasts highlight how government-backed crypto plans might affect market trends.

INNOVATIVE BUSINESS Ideas Face Economic Hurdles In Today’S Market

— The current market offers many opportunities for new business ideas. AI-powered financial coaching apps are gaining popularity, especially among women entrepreneurs. There’s also a growing demand for senior care services due to an aging population. Eco-friendly products, second-hand fashion, and zero-waste packaging are on the rise as consumers focus on sustainability.

Labour’s proposed tax hikes on businesses could threaten low-paid jobs in the UK. Employers face financial pressure from rising business rates and national insurance costs. These changes may cost businesses about £5 billion, potentially impacting low-income workers significantly.

In the U.S., stock markets saw a sharp decline with the Dow dropping nearly 750 points amid tariff concerns. Reports suggest U.S. business activity is nearing a stall with growth at a 17-month low. Businesses express widespread worries over federal policies affecting their operations and future optimism.

UNMISSABLE Business OPPORTUNITIES: How to Thrive in Today’s Market

— The current market offers many business opportunities that align with consumer needs and personal passions. AI-powered financial coaching apps are becoming popular, especially among women entrepreneurs seeking personalized advice. Senior care services are also in demand due to the aging population needing more in-home support.

Eco-friendly products like second-hand fashion and zero-waste packaging are trending as consumers focus on sustainability. Success in these areas depends on marketing strategies that emphasize transparency and ethical practices.

Meanwhile, Dorset is seeing fewer new business startups due to economic pressures and job security worries. Ian Girling of the Dorset Chamber of Commerce calls for government action to help new businesses survive better.

In contrast, Syntheia Corp., which specializes in AI-driven call handling solutions, reports a surge in subscriptions, doubling to 2,000 within a week. This growth highlights the increasing reliance on conversational AI technologies to transform customer service experiences.

/Super%20Micro%20Computer%20Inc%20HQ%20photo-by%20Tada%20Images%20via%20Shutterstock.jpg)

SUPER MICRO Stock Skyrockets: Investors Cheer Bold 2026 Goals

— Super Micro’s stock jumped after the company set bold goals for 2026, calming investor worries about its future. Despite controversies and a Department of Justice probe into its accounting, Super Micro is working to stabilize. The company hired a new accountant and announced an independent review found no wrongdoing.

Nasdaq gave Super Micro more time to submit filings by February 25, which the company plans to meet. This extension follows a tough year with challenges noted in the Hindenburg report. Investors reacted positively to these updates, causing stock prices to soar after the business update on February 11.

TECH GIANTS Spark Stock Market Surge: What Investors Need to Know

— The STOCK MARKET is seeing a surge, with predictions of a 0.49% rise. This optimism comes from major tech companies, whose earnings reports are expected to beat estimates. Investors are eagerly awaiting these results, fueling excitement across the market.

However, concerns about rising interest rates could dampen this enthusiasm. While the outlook remains positive now, potential rate hikes might impact investor sentiment soon. Market participants stay cautious as they navigate these mixed signals.

Besides stock market news, debates continue over a new lunch plan proposed by a coalition that may affect small businesses’ futures. Stakeholders are split on the possible effects of these changes, highlighting ongoing challenges in balancing economic growth with regulations.

TRUMP’S Trade WAR Ignites Gold Rush And Market Turmoil

— Gold prices have hit a record high as investors flock to safe assets amid President Donald Trump’s new tariffs. These measures target imports from Canada, China, and Mexico, sparking worries about inflation and economic growth. JP Morgan is optimistic about gold, urging investors to buy during this dip.

Wall Street braces for losses due to fears of an escalating trade war from Trump’s tariff actions. The 25% tariffs on Canada and Mexico and 10% on China may cause “short-term” pain for Americans, according to Trump. Global markets watch cautiously as these policies unfold.

Oil prices are climbing in response to the tariffs, while metal and agricultural commodities face pressure downward. The financial landscape is shifting with markets adjusting to a potential prolonged trade conflict led by the U.S., causing the dollar to gain strength amid global trade uncertainty.

HORRIFIC CAR Attack at German Christmas Market: 11 Dead in Suspected Terrorist Act

— A car attack at a Christmas market in Magdeburg, Germany, left 11 people dead and over 80 injured on January 31, 2025. Authorities believe this was a terrorist act.

Emergency services arrived quickly to the chaotic scene. Many victims were critically hurt. Witnesses saw panic as people ran and some got trapped under the vehicle. Police caught the suspect, a 50-year-old man acting alone.

The German government shared condolences with victims’ families and vowed to investigate this tragic event thoroughly.

APTIV STOCK Skyrockets After Bold Business Move

— Aptiv plans to spin off its electrical distribution systems (EDS) into a new company. This bold move lets Aptiv focus on advanced driver-aid technology. After the announcement, Aptiv’s shares soared by 5%.

Analysts point out that EDS has lower profit margins. The adjusted EBITDA margin for EDS is expected to be 9.5% in 2024, while Aptiv’s other operations boast an 18.8% margin.

Garrett Nelson from CFRA Research supports the spin-off, saying it aligns with Aptiv’s push toward high-margin growth areas. This strategic shift could enhance Aptiv’s future profitability and market position.

AMAZON’S BOLD Move: New South Africa Center Shakes UP Market

— Amazon has opened a new center in Cape Town, South Africa, to support its independent sellers. This is part of Amazon’s plan to grow its market share and compete with local leader Takealot, owned by Naspers. The center aims to help sellers attract more customers and expand Amazon’s product range, potentially boosting revenue.

APPLE’s CHINA TROUBLES: iPhone Shipments PLUMMET

Apple shares fell 3.2% after research firm Canalys reported a 17% drop in iPhone shipments in China for 2024. This decline pushed Apple down to third place in China’s market share rankings. Despite the stock’s volatility, this news is significant but doesn’t drastically change the company’s business outlook.

STOCK MARKET SLUMP: Earnings Reports RATTLE Investors

The stock market took a hit following Wednesday’s rally due to retail sales data and major bank earnings reports taking the spotlight. Analysts remain hopeful about gains for the S&P 500 by year-end despite current swings. Focus is also on upcoming hearings on tariff plans before President-elect Donald Trump that could affect future economic strategies moving forward.

STOCK MARKET Chaos: Inflation Fears Shake Investor Confidence

— The U.S. STOCK market took a big hit today, with major indexes dropping over 3% due to rising inflation fears. Investors worry about possible Federal Reserve policy changes after high inflation numbers came out earlier this week. This is one of the steepest drops in months, shaking confidence that had been boosted by strong job reports.

Bond yields are up, with the 10-year Treasury bond yield hitting about 4.1%, its highest since late 2023, signaling increased inflation expectations. Big tech stocks like Apple and Microsoft saw sell-offs over 5%, adding to the market slump. Analysts warn that ongoing inflation might push the Federal Reserve to rethink interest rate policies, possibly leading to more hikes instead of cuts.

The decline comes after a strong holiday shopping season that initially suggested steady economic growth but is now overshadowed by ongoing inflation problems. Retail and consumer sectors face rising costs and reduced spending, making investors cautious in these areas. Companies like Walmart and Target report higher holiday sales but shrinking profit margins due to inflation pressures, prompting them to rethink annual forecasts.

Banks like JPMorgan are bracing for possible loan defaults as consumers struggle with higher living costs by setting aside more reserves. Market analysts expect continued volatility as investors digest new inflation data and Fed policy implications.;

WILDFIRES WREAK Havoc In LOS Angeles: Death Count Soars To 24

— Los Angeles is facing a crisis as wildfires, driven by strong Santa Ana winds, have claimed 24 lives. Emergency crews are battling the flames under tough conditions, struggling to contain the spread.

Governor Gavin Newsom has declared a state of emergency and called for investigations into firefighting failures after hydrants ran dry at critical moments. His administration faces criticism over handling the crisis and questions about tax dollar allocation.

Firefighters are tackling several blazes, including one in Pacific Palisades. This raises fears of looting as residents evacuate. Reports suggest some individuals disguise themselves as first responders to commit burglaries.

Authorities warn that private drones are interfering with aerial firefighting efforts. Despite the chaos, community resilience shines through as residents form neighborhood fire brigades and support each other during evacuations amid forecasted harsh winds.

TRAGIC CHAOS: Car Attack at German Christmas Market Sparks Fear

— A Christmas market in Magdeburg, Germany, turned tragic when a car plowed into a crowd, killing five and injuring over 200. Authorities suspect terrorism as they investigate the incident. Several victims remain in critical condition.

U.S. State Department spokesperson Matthew Miller condemned the event as an “attack,” expressing condolences and support for Germany. Cardinal Dolan offered words of hope, stating that “light will prevail” after this tragedy.

Magdeburg Police identified the suspect as a 50-year-old Saudi doctor believed to have acted alone. The driver reportedly covered 400 meters before police subdued him at gunpoint.

TRAGIC STABBING Spree at London Market Shocks Community

— A stabbing spree at East Street Market in south London left one dead and two injured on Sunday morning. Police arrested a man in his 60s at the scene. While they have not shared details about the suspect or his motives, they do not believe it is terror-related, hinting that mental health issues might be involved.

Witnesses described a chaotic scene as the attacker randomly targeted people. An unnamed fabric seller said, “I just saw a bloke running through the market stabbing people willy-nilly.” The attack happened around 10:30 am when the market was getting busy.

The witness immediately called police after seeing two men stabbed, noting one appeared severely injured. Emergency services quickly arrived but sadly, one victim died from injuries despite their efforts.

The investigation continues as authorities work to understand what led to this tragic event and ensure community safety moving forward.

SENIOR CITIZEN Soars Skyward: Security Shutter in Wales Store Lifts Woman Off Ground

— In an unusual turn of events, Anne Hughes, a 71-year-old woman, found herself lifted off the ground when her coat became entangled with a security shutter outside a store in Wales.

Hughes, who works as a cleaner at the Best One shop near Cardiff, was caught off guard when her coat snagged and she was hoisted into the air. “I thought “flipping heck!”” said Hughes. A quick-thinking colleague came to her aid and helped her down after she spent 12 seconds suspended mid-air.

Despite the odd incident, Hughes managed to retain her sense of humor about it all. She expressed relief that she hadn’t landed face-first and even joked that such an event could only happen to her.

The store seized this unexpected opportunity by using the footage for online promotion with a humorous caption about their deals and staff members’ antics. The video clip was shared on social media platform X with this playful tagline: "Don’t hang about like Ann, come down to Best One for unbeatable deals! The only thing going up in our shop is our staff — not our prices!

ETHICS In QUESTION: Biden Under Scrutiny as Hunter’s Investigations Intensify

— The ongoing investigations into Hunter Biden have begun to cast a significant shadow over President Joe Biden. The Justice Department, along with Republican members of Congress, are closely examining the president’s son for his alleged involvement in a criminal scheme with then-Vice President Biden. This comes alongside separate gun charges following the collapse of a plea deal on tax charges.

A recent poll indicates that 35% of U.S. adults believe the president has acted illegally, while 33% suspect unethical conduct. The investigation is spearheaded by House Oversight Committee Chairman James Comer (R-KY) and House Judiciary Committee Chairman Jim Jordan (R-OH). Their goal is to establish a connection between Hunter’s business dealings with a Ukrainian oil and gas firm and his father during his vice presidency.

Hunter Biden has been indicted by special counsel David Weiss in relation to a gun purchase in October 2018. He stands accused of violating orders prohibiting drug users from owning guns and has pleaded not guilty to all three counts against him. There are clear differences in perception across party lines: only 8% of Democrats believe the president is guilty of crimes related to his son’s activities, compared with 65% of Republicans.

As these investigations and indictments continue, they fuel growing controversy around the Bidens. This raises serious concerns about ethics at the

UK Immigration Policy DISCONTENT Soars to RECORD High: Britons Demand Change

— A recent study conducted by Ipsos and British Future has unveiled a significant rise in public dissatisfaction with the UK government’s immigration policy. The survey reveals that a staggering 66% of Britons are dissatisfied with the current policy, marking the highest level of discontent since 2015. Conversely, a mere 12% expressed satisfaction with how things stand.

The discontent is widespread, cutting through party lines but for varying reasons. Among Conservative voters, only 22% were satisfied with their party’s performance on immigration issues. A majority of 56% expressed dissatisfaction, while an additional 26% were “extremely unhappy”. In contrast, about three-quarters (73%) of Labour supporters disapproved of the government’s handling of immigration.

Labour supporters primarily voiced concerns about creating a “negative or fearful environment for migrants” (46%) and “poor treatment towards asylum-seekers” (45%). On the other hand, an overwhelming majority (82%) of Conservatives criticized the government for its inability to curb illegal Channel crossings. Both parties identified this failure as a top reason for their dissatisfaction.

Despite assurances from Prime Minister Rishi Sunak’s administration that their policies have made an impact, migrant crossings have seen only slight reduction from last year’s record-setting pace. Over one weekend alone witnessed more than 800 individuals making this dangerous journey

AMERICAN CAVER Trapped: Unfolding Drama in Turkish Cave as Rescue Operation Faces Challenges

— Mark Dickey, a seasoned American caver and researcher, is trapped deep within Turkey’s Morca cave. Located in the formidable Taurus Mountains, the cave has become Dickey’s unexpected prison nearly 1,000 meters below its entrance. During an expedition with fellow Americans, Dickey fell ill with severe stomach bleeding.

Despite receiving on-site medical attention from rescuers including a Hungarian doctor, his extraction from the constricted cave could take weeks. The complexity of the situation is due to both his condition and the challenging environment of the cold cave.

In a video message shared by Turkey’s communications directorate, Dickey expressed heartfelt gratitude towards both the caving community and Turkish government for their rapid response. He believes their efforts have been life-saving. While he appears alert in the video footage, he stressed that his internal recovery is still ongoing.

According to his affiliated New Jersey-based rescue group, Dickey has stopped vomiting and has been able to eat for the first time in days. However, what caused this sudden illness remains a mystery. The rescue operation continues under demanding conditions requiring multiple teams and constant medical care.

UKRAINE’S Defense Shake-Up: Zelenskyy UNVEILS Umerov as New Leader Amid WAR Scandal

— In a significant turn of events, Ukraine’s president, Volodymyr Zelenskyy, declared a leadership overhaul in the Defense Ministry on Sunday. The incumbent, Oleksii Reznikov, will step aside, making way for Rustem Umerov, a notable Crimean Tatar politician. This change comes after “more than 550 days of full-scale war”.

President Zelenskyy highlighted the necessity for “new approaches” and “different formats of interaction” with the military and society as the driving factors behind the leadership change. Umerov, who currently presides over Ukraine’s State Property Fund, is a familiar figure to the Verkhovna Rada, Ukraine’s parliament. He has played a pivotal role in evacuating citizens from territories under Russian control.

The leadership transition comes amidst a cloud of scrutiny over the Defense Ministry’s procurement practices. Investigative journalists exposed that military jackets were being bought at an exorbitant $86 per unit, a stark contrast from the customary $29 price tag.

FTSE 100 Hits RECORD High of Over 8,000 Points

— The UK’s blue chip stock index surpassed 8,000 points for the first time in history as the pound plummets in value.

BULLISH on Bitcoin: Crypto Market ERUPTS in January as FEAR Turns to GREED

— Bitcoin (BTC) is on track to have the best January in the last decade as investors turn bullish on crypto after a disastrous 2022. Bitcoin leads the way as it approaches $24,000, up a massive 44% from the beginning of the month, where it hovered around $16,500 a coin.

The broader cryptocurrency market has also turned bullish, with other top coins such as Ethereum (ETH) and Binance Coin (BNB) seeing substantial monthly returns of 37% and 30%, respectively.

The upturn comes after last year saw the crypto market plunge, fueled by fears of regulation and the FTX scandal. The year shredded $600 billion (-66%) from Bitcoin’s market cap, ending the year worth only a third of its 2022 peak value.

Despite the ongoing concerns of regulation, the fear in the market looks to be shifting to greed as investors take advantage of bargain prices. The rise may continue, but savvy investors will be wary of another bear market rally where a sharp sell-off will send prices back to Earth.

Video

WEST BANK Chaos Ignored: Heartbreaking Surge in Violence as World Looks Away

— While the world watches GAZA, deadly violence is exploding in the West Bank. Israeli military raids in places like Jenin and Nur Shams have ramped up since early 2025. Dozens are dead, and thousands more have been forced out of their homes. In April alone, the Palestinian Red Crescent said 14 people died during a single raid. The crisis is getting worse fast. The United Nations says about 40,000 Palestinians have been pushed from their houses since fighting grew this year. With shelters packed full, Israeli curfews and roadblocks make it even harder for families to move or find safety. Attacks by settlers are also on the rise. Human Rights Watch says there have been over 700 attacks by settlers since October — often with little action from Israeli troops to stop them. Armed patrols and land grabs are making many fear that Israel wants to take even more land for good. In a twist that’s shocking some observers, parts of the Palestinian Authority are now working with Israeli forces during these raids. This shows just how divided things have become among Palestinians themselves. As global leaders keep their eyes on Gaza, people stuck in the West Bank wonder when — or if — anyone will step in to help them escape this nightmare.

More Videos

Invalid Query

The keyword entered was invalid, or we couldn't gather enough relevant information to construct a thread. Try checking the spelling or entering a broader search term. Often simple one-word terms are enough for our algorithms to build a detailed thread on the topic. Longer multi-word terms will refine the search but create a narrower information thread.

Politics

The latest uncensored news and conservative opinions in US, UK, and global politics.

get the latestLaw

In-depth legal analysis of the latest trials and crime stories from around the world.

get the latest