THREAD: stock market surge how weak...

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

— Crypto Market Shock: CryptoNet, one of the largest exchanges, has frozen all withdrawals amid fears of hacking or insolvency. The move has sparked global panic and raised concerns over liquidity and security.

— Innovatech Announces $10 Billion Stock Buyback Amid Market Turmoil. The tech giant aims to boost shareholder value and stabilize its stock amid strong earnings and economic uncertainties.

TRUMP’S Bold Auto Tarifs Spark Fury And Hope In Global CAR Market

— President Trump has announced a 25% tariff on imported cars and parts, starting in April. He says this move will boost American car makers and bring jobs back to the U.S.

Some experts warn these tariffs could raise prices for buyers and shake up car production. The U.S. brought in about eight million foreign cars last year, making up half of all sales.

Financial analysts say the tariffs might lower stock values by 5%. They also worry about possible inflation, job losses, and even a recession if trade fights continue.

India is asking for an exemption to protect its $66 billion export business with America. The Trump team is using these tariffs as leverage while working on new trade deals that could change the global market and America’s future economy.

— Chicago Memorial Day weekend sees 22 shot, 2 dead. The city faces a surge in gun violence amid increased holiday activity.

TESLA STOCK Panic: Musk’s Shocking Admission Triggers Investor Fear

— Tesla shares took a hard hit on May 22 after CEO Elon Musk openly admitted the company is struggling with short-term production goals. Musk’s rare honesty came as he told investors he worries Tesla may not meet targets in today’s tough market. The electric car industry is facing more rivals and shaky economic times.

This blunt statement from Musk caught many off guard. He usually paints a bright picture of Tesla’s future. Investors didn’t wait to react — the stock price tumbled, and trading became more frantic.

Experts now wonder if this hints at bigger problems for Tesla down the road. “Investors are starting to doubt if Tesla can stay ahead,” one analyst said.

The news has sparked heated talk among shareholders and industry watchers about where Tesla goes next. For now, faith in the company seems rattled, leaving many to question what comes next for the electric car giant.

CHINA’S $20 Billion Tech Boom: Alarming Surge Fueled by Government Handouts

— China’s digital sales have exploded to $20 billion in just four months. This massive jump is driven by heavy government handouts aimed at boosting online commerce and tech growth.

Beijing is pouring money into digital infrastructure, electronics, and internet services. Their goal? To make Chinese tech firms stronger and push their influence around the world.

This fast growth could shake up global supply chains. American companies now face stiffer competition as China props up its own businesses with taxpayer cash.

Conservatives warn that letting China expand unchecked puts U.S. jobs and security at risk. They urge leaders to put American innovation first instead of letting foreign subsidies win the day.

ALSEA SEIZES Control: Starbucks Colombia Franchise Deal Shocks Market

— Mexican company Alsea now fully owns all 72 Starbucks shops in Colombia. They bought out Grupo Nutresa’s 30% share, making Alsea the only owner. The price of the deal was not shared with the public.

This move gives Alsea more power in Latin America’s coffee market. With full control, they can make faster decisions and grow even more across the region.

In other news, Singapore Business Federation released a new e-book to help businesses handle tariffs and trade barriers. They’re also offering advice on financing and supply chains as global trade rules keep changing.

No other major business news happened on May 22, 2025, besides these updates.

FRENCH QUARTER Attack Ignites Fury Over Weak Public Safety

— A brutal attack in New Orleans’ French Quarter early Thursday has left a tourist in the hospital and sparked a wave of anger over public safety. Police say Mark Johnson, 45, beat David Miller, 32, with a metal pipe outside a crowded restaurant. Witnesses reported Johnson was drunk and yelling racial slurs before the assault.

Officers acted fast and caught Johnson nearby. He had blood on his clothes and was carrying the suspected weapon. Police charged him with assault with a deadly weapon, hate crime, and aggravated battery. Records show he has been convicted before for assault and disorderly conduct.

The attack has many residents and tourists demanding more police on the streets. Mayor LaToya Cantrell called the violence unacceptable. She promised more patrols in the French Quarter along with new security cameras.

Locals say this is just another example of rising crime during tourist season. Many believe stronger law enforcement is needed to keep repeat offenders like Johnson off the streets — and to protect both visitors and residents from harm.

TESLA STOCK Panic: Musk’s Shocking Admission Sparks Investor Fear

— Tesla stock took a hard hit after CEO Elon Musk openly admitted the company is facing serious problems. His rare honesty sent investors scrambling, causing shares to drop fast.

Musk did not spell out the exact issues, leaving everyone guessing. This uncertainty has rattled shareholders. Many are now waiting for more news and watching how these troubles could affect Tesla’s next earnings report.

A photo from the event shows Musk on stage, holding his phone and speaking directly to the crowd. The personal tone of his message made it even more dramatic.

The announcement came out on May 22, 2025. Now, debate is heating up about where Tesla goes from here — and if Musk can turn things around.

SAUDI OIL Shock: Painful BAN Sparks Global Price Surge

— Saudi Arabia just announced it will stop all oil exports for at least three months starting June 1, 2025. The kingdom says it needs to refill reserves and protect its national security. Oil prices shot up over 12% in a single day after the news broke.

Big countries like the United States, China, and India are already feeling the pinch. Some experts warn that if this ban lasts through summer, we could see energy shortages and even higher prices at the pump. Inflation may rise as a result, making life harder for working families.

Tensions are heating up in the Middle East as other nations talk about how to respond. Some market watchers think this is just a short-term move by Saudi Arabia. Others worry it could mean bigger changes to how they handle oil exports in the future.

Americans should get ready for more pain at gas stations and possible supply problems here at home. So far, President Biden’s White House has stayed silent on what steps they’ll take next.

TESLA STOCK Shock: Musk’s Candid Admission Sparks Investor Fears

— Elon Musk spoke at the Qatar Economic Forum and openly admitted Tesla sales are down in Europe. He claimed the company has “already turned around” worldwide, but his comments came as Tesla’s stock price kept bouncing up and down.

Musk told investors not to panic over short-term drops in TESLA shares. He said, “The market is the ultimate scoreboard,” trying to calm fears by focusing on long-term results instead of daily changes. Still, many investors are worried.

Conservatives have long warned against trusting big promises from corporate leaders or getting swept up in market hype. Musk’s latest admission could make some shareholders even more cautious.

This situation shows that Tesla still faces real challenges overseas and growing doubts here at home. Investors will be watching closely to see if Musk can deliver on his promises this time.

TESLA STOCK Shock: Musk’s Bold Promise Sparks Investor Fears

— Elon Musk faced tough questions at the Qatar Economic Forum. He admitted Tesla’s sales are weak in Europe but claimed the company has “already turned around” worldwide. Musk told investors not to worry about short-term drops in TESLA stock, calling the market “the ultimate scoreboard” for business health.

Musk pushed back against critics who say he’s stretched too thin across his many companies and government projects, especially with his Department of Government Efficiency (DOGE) plan. He also admitted Tesla’s software team Cariad is struggling and will have layoffs soon.

Still, Musk pointed to new partnerships with companies like Geely-backed Ecarx to boost smart car technology in Europe and America. He says these deals will help Tesla stay ahead as competition grows stronger around the globe.

Investors remain nervous about Tesla’s future and Musk’s leadership style. The company is betting on innovation and global teamwork to fix its weak spots and calm worried shareholders.

GLOBAL MARKET Panic: US Sanctions on China Trigger Shockwaves

— Stock markets around the world took a nosedive after the US slapped new sanctions on China’s tech industry. The Biden administration claims China has been stealing American ideas and playing unfair in trade.

Some experts warn these tough measures could start a bigger trade war, hurting supply chains and slowing down the world economy. Asian markets, especially in Japan and South Korea, dropped fast as worries spread about what comes next.

Investors are being told to pay close attention as leaders rush to emergency meetings to figure out their next move. This story is still unfolding and could hit businesses everywhere hard.

— US Loses ‘Perfect’ Credit Rating Amid Rising Debt Concerns The downgrade raises fears of higher borrowing costs and increased market volatility as investors seek safety in gold

— US Loses Perfect Credit Rating Amid Debt Concerns The downgrade raises fears of higher borrowing costs, market volatility, and slower economic growth amid ongoing political tensions and crises

BUSINESS SHOCKER: Chorus, Saks, And Starbucks Unleash Bold Moves On Global Markets

— Chorus is rolling out faster business fibre plans in New Zealand. The company now offers a 1Gbit/s plan with equal upload and download speeds. They also promise quicker service if things go wrong. Experts say if more businesses use the cloud, it could add billions to New Zealand’s economy.

Saks Fifth Avenue is trying something new by selling luxury goods on Amazon’s UK website. With brands like Dolce&Gabbana and Balmain, Saks hopes Amazon will help them reach more shoppers across Europe.

Starbucks may sell part of its China business. The coffee giant has started talking with private equity groups and tech firms as it looks for new ways to grow in China.

These bold moves show how big companies are changing fast to stay ahead in a tough global market. Conservatives know that innovation and competition keep economies strong — these updates are proof of that belief.

TRUMP’S Trade WAR Truce Sparks Surge in Asian Markets

— Asian stocks soared Tuesday after the U.S. and China agreed to a 90-day pause in their trade war. Both nations announced big tariff cuts. U.S. tariffs on Chinese goods dropped from as high as 145% to 30%. China lowered its tariffs on American products from 125% to just 10%.

This truce gives both sides more time for talks after meeting in Geneva. Experts say the deal was better than expected and calmed investors, but warn President Trump could still change course if needed.

Japan’s Nikkei index jumped nearly 2%. Automakers like Toyota and Suzuki led the gains, while Nissan shares rose too after news about major layoffs tied to restructuring.

South Korea’s Kospi index edged up by 0.2%. Investors are still careful about long-term risks, but for now, markets are responding with relief and optimism.

RECORD TRADE Deficit Ignites Alarm Over Weak US-China Deal

— America’s trade deficit has hit a record $1.2 trillion, sparking fresh fears about the country’s financial health. Treasury Secretary Scott Bessent claimed “substantial progress” in talks with China but failed to share any real details about the agreement made in Geneva.

The U.S. wants China to change its economic habits and shrink the $295 billion gap between the two nations. Many hoped this deal would lower tensions, but doubts are growing because no one knows what was actually agreed on.

Republicans are demanding answers and real results, warning that out-of-control deficits put American jobs and factories at risk. The Biden administration now faces heavy pressure to deliver actual solutions instead of empty promises.

Until Washington releases clear terms, Americans have every right to question if their leaders are truly fighting for U.S. interests in these critical talks with China.

INDIA STOCK Market Panic: Smallcaps HIT With Devastating Losses

— India’s smallcap and midcap stocks just faced their worst crash since the Covid lockdowns. In February 2025, more than 175 small companies saw double-digit losses. The BSE Smallcap index dropped by 14%, and the Nifty Midcap 100 fell almost 11%. Panic selling and weak earnings fueled the drop, with Natco Pharma alone crashing over 34%.

The sell-off has erased ?25 lakh crore in value from public sector companies since August. Over 240 smallcaps have lost more than half their value from recent highs, leaving many investors hurting. Even strong defense and railway stocks took a beating.

Experts say high prices, poor earnings, slower economic growth, rising U.S. bond yields, and foreign investors moving money to China all played a part in this mess. Minister Piyush Goyal called it a “wake-up call” for advisors who failed to warn regular investors about these risks.

Market analysts remind people that corrections like this do happen but urge caution going forward. Investment advisor Mihir Vora said if stocks have fallen by half, they are now much cheaper — hinting that careful buyers might find good deals or clean up their portfolios now.

DISNEY PROFITS Surge: Americans Flock to Parks Despite Hard Times

— Disney posted a strong quarter, beating Wall Street’s expectations with $23.62 billion in revenue — a 7% jump from last year. Earnings per share rose 20% to $1.45, well above the predicted $1.20.

The company credits its U.S. theme parks for most of this growth. Even as families face higher prices and tough economic times, they keep visiting and spending at Disney parks. The streaming services also helped, with profits expected to hit $875 million in fiscal 2025.

Internationally, park attendance is steady but visitors are spending less — especially in China. Disney just announced its first Middle East resort in Abu Dhabi through a deal with Miral, showing CEO Bob Iger’s push for global growth and new ideas.

These results show Disney can still succeed when many American families are struggling — mainly because people keep coming back for the experiences at home and online that only Disney offers.;

SCOTTISH ISLAND Owner’S Bold Gift: Free Food Business Changes Lives

— A Scottish island business owner is giving away his food company for free to a young couple. Richard Irvine, 65, wants someone willing to move long-term and help keep the small Colonsay community alive. There are only about 120 people living on this remote Hebridean island.

Irvine started Colonsay Smokery three years ago after falling in love with the area during his honeymoon in the 1980s. The business supplies smoked salmon to local shops and restaurants both on and off the island.

He believes bringing in younger folks is key as more residents get older every year. Irvine says he will mentor whoever takes over, hoping it will boost both the local economy and school enrollment.

FORD’S $15 Billion Trade WAR Shock: How Trump’s Tough Tariffs Rattled the Auto Giant

— Ford Motor Company just hit the brakes on its earnings forecast. The company says tariffs from President Trump’s trade war could cost Ford a whopping $15 billion. Profits have already dropped 64% in the first quarter, and Ford blames these tariffs for most of the pain. Other carmakers may face over $100 billion in extra costs too.

To dodge some of these fees, Ford started sending cars from Mexico to Canada using special bond carriers. This helps avoid certain tariffs but doesn’t solve everything. By suspending its guidance, Ford is telling investors things are shaky and uncertain.

The Federal Reserve chose not to raise interest rates this time. Leaders pointed to risks from trade fights and older tariff rules as reasons for their caution. Big banks like Goldman Sachs also warned about possible trouble ahead for Wall Street.

There is some good news for global trade, though. A fresh deal between the U.S. and UK will remove steel and aluminum tariffs while cutting car taxes down to 10%. This agreement — first set up under President Trump — could help cool off some tensions even as other problems remain unsolved.

FED SHOCKS Wall Street: Trump’S Trade Fight Sparks Market Jitters

— The Federal Reserve decided to keep interest rates the same on May 8, 2025. Officials said they are worried about the uncertainty caused by President Trump’s tough trade policies and tariffs. They want to see how inflation and the economy respond before making any changes.

Goldman Sachs warned that U.S. stocks could fall if tariffs stay in place or get worse. The recent rise in the S&P 500 might not last unless there is a clear move away from tariffs without hurting the economy.

In April, a short-term break from new tariffs gave markets a small boost, but investors are still uneasy about what comes next. The Fed says it will keep watching economic data closely as it deals with these challenges.

Right now, many on Wall Street want clearer answers from the White House about future trade moves. Until then, the Fed is focused on keeping prices steady and protecting American jobs as Trump sticks to his America First plan.

CRIME WAVE Surge: FBI and Nypd Race to Stop Border Chaos

— Federal agents are cracking down on violent gangs as crime surges across the country. The FBI now has over 250 open cases tied to the “764” criminal network. Police are also hunting suspects in attacks on officers and solving high-profile murders, like a pastor found dead in Arizona. Violent crime is a growing threat for many American families.

The NYPD is under fire after sharing a Palestinian woman’s sealed arrest record with ICE. This move has sparked debate about how local police should work with federal immigration officials. At the same time, ICE is stepping up efforts against migrant networks while critics slam the Biden administration over weak border security.

Conservatives scored a win as the Supreme Court upheld President Trump’s ban on transgender people in the military. The Trump team is also fighting lawsuits that would limit access to abortion drugs, while Minnesota’s attorney general pushes back against bans on transgender athletes.

Communities are shaken by deadly crashes near Yellowstone and shootings of law enforcement officers. As cities face more gang violence, drug crimes, and illegal immigration, Americans want stronger action to keep their neighborhoods safe.

REFORM UK’S STUNNING Surge: Farage Ignites Hope, Shatters Old Politics

— Nigel Farage stunned Britain Friday night as Reform UK scored big wins in over 1,600 local elections. The party grabbed control of ten councils, two mayor positions, a parliamentary seat, and 677 council spots. Farage called it a “truly historic landmark” and said the results ended the old two-party rule in England.

The BBC reported that if these numbers repeated in a national election, Reform UK could take power — pushing both Labour and Conservatives aside. Farage called this moment a “Reformquake” and told supporters his party is here to stay.

Standing before cheering crowds, Farage said: “This marks the end of two-party politics as we have known it for over a century.” He promised to make history at the next General Election and described Reform as “agents of change… agents of optimism.”

Farage also warned council workers focused on climate or diversity programs to look for new jobs. He signaled plans to cut government waste. Many voters said they were fed up with how officials handled illegal migration and taxpayer-funded migrant housing — key issues that helped Reform rise so fast.

SHOCKING SURGE: Violent Gangs Flood US-Canada Border After Trump Inauguration

— Dozens of suspected Venezuelan Tren De Aragua (TdA) gang members have been caught at the U.S.-Canada border since President Trump took office in January. Customs and Border Protection reported 40 arrests at Detroit’s Ambassador Bridge between January 20 and March 21, 2025.

The Ambassador Bridge, often confusing for drivers, has become a main spot for catching violent criminals trying to enter the country. Some Democrats, like Rep. Rashida Talib, and groups such as the ACLU claim most detainees ended up there by mistake because of GPS errors or unclear signs.

CBP says there is no proof that Trump’s border policies caused these arrests. Still, a former DEA agent believes tougher crackdowns on drug rings are pushing gangs like TdA to try new routes into America.

This recent spike shows how important strong border security remains as criminal groups look for any chance to slip through.

:max_bytes(150000):strip_icc()/US10Y_2025-04-03_11-20-02-ed576f9bbbed4ee3924f06b3d31b0b93.png)

TRUMP’S Bold Trade Shift Ignites Stock Surge, Gold Soars, Bitcoin ETF Shatters Records

— U.S. stocks jumped for the third day after President Trump signaled a gentler approach on tariffs, especially with China and car makers. The White House is weighing exemptions for auto parts from China, lifting hopes among investors. Big names like Alphabet and Procter?&?Gamble will report earnings soon.

Gold prices shot up over 1% after a rocky week. Uncertainty around the globe and changing interest rates helped push gold above $3,300 an ounce. Experts say it’s smart to hold gold right now as Trump eases up on both the Fed and China.

The U.S. dollar lost steam when Trump backed away from firing Fed Chair Jerome Powell and hinted at softer trade moves. The Japanese Yen got stronger as talk of a fast US-China deal faded.

In crypto news, BlackRock’s Bitcoin ETF smashed records — pulling in $643 million in one day and winning “Best New ETF.” Trump Media also announced new financial products focused on American-made digital assets and held an invite-only event for top holders of its meme coin.

UK ENERGY THEFT Surge: Families Desperate as Bills Spike and Dangers Grow

— Energy theft is exploding across the UK as families battle record-high bills in 2025. Reports from Crimestoppers show more people are tampering with meters or making illegal hookups. The latest government price cap hike and the cost-of-living crisis are pushing many to take risky steps just to keep the lights on.

Experts say this is not just about money — it’s a real danger. Messing with gas lines or meters can cause deadly fires and explosions, putting whole neighborhoods at risk. There have already been tragic deaths linked to these desperate acts.

The financial toll is massive too. Stolen energy now costs an estimated £1.5 billion each year, while total energy debt in Britain has soared to a record £3.9 billion — more than double what it was before the crisis.

Lawmakers say urgent action is needed, like better home insulation and lower rates for struggling families. Critics argue current government help isn’t enough, warning that without stronger action, both public safety and the UK’s entire energy system could be in trouble.

FSU SHOOTING Horror: Campus Fears Surge as Crime Crisis Grows

— A gunman opened fire at Florida State University on April 17, killing two and injuring six. The suspect, Phoenix Ikner, is the stepson of a local sheriff’s deputy. He used a gun registered to his stepmother. Police have not shared a motive yet, but Ikner is in custody as the investigation continues. Students hid in classrooms for five minutes while shots rang out. Now, the campus is grieving and demanding answers about how this could happen. Violent crime isn’t just a campus problem — it’s rising across America. In South Carolina, an inmate was executed by firing squad for two murders from 2004 — a rare punishment these days. In Texas, police charged a teen with fatally stabbing another student. International news adds to growing concerns about safety and law enforcement. An American pastor kidnapped in South Africa was rescued after police used deadly force against his captors. Meanwhile, U.S. immigration policies face new questions after deportation mistakes led a senator to visit El Salvador — sparking debate over how best to protect Americans at home and abroad.

Trump’s TRADE Policies SPARK Dollar Hedge Surge to 5-Year High

— Demand for hedging against a potential decline in the US dollar has surged to a five-year high. Traders are reacting to the Trump administration’s tariff policies, which they believe could weaken America’s economic strength. This uncertainty has prompted investors to seek protection against possible currency fluctuations.

Meanwhile, gold prices have retreated from record highs after initially climbing due to confusion over Trump’s trade agenda. The precious metal was seen as a safe haven amid market volatility but faced selling pressure as traders reassessed their positions. The US dollar’s resilience also contributed to gold’s pullback from its peak of $3,245.

In other financial news, spot Bitcoin ETFs have seen significant withdrawals amid ongoing trade tensions, indicating a move away from riskier assets. Over $713 million was pulled out in just one week, reflecting investor caution during uncertain times. Additionally, Nvidia shares dropped 25% from their 52-week high despite an initial surge following Trump’s announcement of a temporary pause on tariffs.

The Bank of Thailand plans new regulations holding financial institutions accountable for losses due to call center scams. These measures aim to enhance customer protection and ensure service providers share responsibility if they fail regulatory standards. This move underscores global efforts to tackle technology-related financial crimes and protect consumers’ interests in an increasingly digital world.

TRUMP’S Tariff CUT Sparks Stock Market Surge

— In a bold move, President Donald Trump announced a temporary cut in tariffs for many countries, while raising them for China. This decision caused U.S. stock indexes to soar, with the S&P 500 seeing its biggest gain since 2008, closing 9.5% higher. Trump’s tariff strategy aims to increase pressure on China amid ongoing trade tensions.

The announcement led to a sharp drop in the Cboe Volatility Index (VIX), which fell by 15 points to 37.2 after news of a 90-day tariff pause for most nations. However, China’s response was quick as they imposed an 84% retaliatory tariff on U.S. goods following the new U.S. levy on Chinese imports that took effect at midnight. This escalation adds uncertainty to global markets despite the initial boost in U.S stocks.

Meanwhile, on the home front, the U.S government has started monitoring immigrants’ social media accounts for signs of antisemitism as part of enhanced security measures. This initiative reflects growing concerns over hate speech and its potential impact on national security and social cohesion within immigrant communities across America.;

MARKET PANIC: Bitcoin and Stocks Plummet in US Tariff Chaos

— Bitcoin dropped below $80,000 on Sunday, falling over 3% in just two hours. This decline happened alongside major losses in U.S. stock markets. The S&P 500 and Nasdaq Composite both closed nearly 6% lower on April 4. Analyst Holger Zschaepitz noted the stock market lost $8.2 trillion, surpassing losses from the worst week of the 2008 financial crisis.

The market chaos comes from recent U.S. tariffs that have sparked widespread sell-offs across many sectors. Despite this turmoil, some investors see potential buying opportunities as stocks are now trading at historically low valuations of 15 times future earnings projections.

Jim Cramer has warned this could be just the start of a bigger downturn for the S&P 500, predicting a further meltdown of up to 20%. As of Sunday night, S&P futures were down about 4%. Global stocks have already lost $7.46 trillion since April 2nd and may exceed $10 trillion if recent sell-offs continue to unfold.;

CHINA’S 34% Tariff Shock: How It Could Hurt American Wallets

— China has slapped a 34% tariff on U.S. goods, ramping up trade tensions. This follows recent U.S. tariffs on Chinese imports, sparking fears of a trade war.

Experts warn these tariffs might harm American businesses and consumers by raising prices and slowing economic growth. Washington is concerned about undoing post-pandemic recovery efforts.

The Trump administration is considering countermeasures and may seek international support to tackle China’s trade practices. This situation has ignited debates over the future of U.S.-China relations and global trade dynamics.

Financial markets reacted quickly, with stocks dropping due to fears that escalating conflicts could further destabilize the global economy. These developments could significantly affect both U.S.-China relations and international markets.

TRUMP’S Trade Policy Shocks: US Stocks Plunge in Market Chaos

— The EURO has surged to a six-month high as investors react to the latest U.S. tariff announcements. Meanwhile, the Australian dollar has taken a hit, reflecting global market volatility. These currency shifts highlight ongoing economic uncertainties fueled by international trade tensions.

U.S. stock futures have plummeted after China’s retaliatory tariffs on American goods, marking another phase in the global trade conflict. The Dow Jones dropped 1,679 points, causing widespread concern among investors and financial strategists who urge calm and strategic planning during these turbulent times.

Bitcoin ETFs saw nearly $100 million in net outflows as markets reacted sharply to tariff news from the Trump administration. This exodus underscores investor anxiety and uncertainty about future economic conditions amid escalating trade disputes with China.

Goldman Sachs has revised its oil price forecasts downward due to fears of a potential recession and increased supply from OPEC+. Gold prices have steadied after an initial selloff triggered by aggressive U.S. tariff policies, indicating cautious optimism among investors seeking safe-haven assets in uncertain times.

TRUMP’S 10% Tarifts Spark Stock Market Chaos

— U.S. stocks plunged after President Trump announced a 10% tariff on all trading partners. The Dow dropped about 1,300 points, with the S&P 500 and Nasdaq also taking hits. Investors quickly reacted, showing concern over potential economic fallout.

President Trump plans to impose reciprocal tariffs starting at 10%, targeting countries worldwide and adding extra duties for “worst offenders.” This move has unsettled markets and might lead to higher consumer costs and a possible recession. Economists are worried about the long-term effects on both domestic and global economies.

Globally, the response has been mostly negative, with many countries considering countermeasures to protect their economies from these new tariffs. This rise in trade tensions marks a significant shift in international economic relations under Trump’s leadership. Key sectors relying on international trade may face challenges as relationships with major trading partners change.

GOLD PRICES Surge: Brace for Economic Shockwaves from New US Tariffs

— Gold prices have surged as investors brace for the U.S. “Liberation Day” tariff announcement. This has led to cautious trading, with businesses gearing up for possible economic shifts.

The jump in gold signals a move towards safety amid uncertainty over trade relations and policies under the current administration. Many companies are rethinking strategies due to potential tariff impacts.

Analysts worry about major economic fallout, especially for export-reliant industries. The business community is closely watching international reactions and possible retaliatory measures that could escalate global trade tensions.

FOREIGN STUDENTS as Pawns: How Hamas Manipulates US Campuses

— Al-Ketbi warns that foreign students are being manipulated by terrorist groups like Hamas, backed by Iran. His comments follow the arrest of Mahmoud Khalil, a Palestinian-born Columbia University graduate facing deportation for pro-Hamas activities. Khalil’s case highlights how extremist groups exploit U.S. immigration laws to infiltrate society.

Khalil is accused of being a Hamas sympathizer with anti-American views, linked to violent campus activities at Columbia University. Videos show him urging protesters to “destroy” and “explode the heads of Zionists.” Al-Ketbi warns this is part of a pattern where foreign students act as proxies for hostile regimes like Iran on American campuses.

Student groups such as Columbia University’s Apartheid Divest and Students for Justice in Palestine are cited as platforms spreading antisemitic or pro-terrorism discourse under humanitarian pretenses. Al-Ketbi emphasizes that these organizations often mask their true intentions behind human rights activism while promoting dangerous ideologies.

He argues that U.S. academic institutions are vulnerable due to inadequate vetting and misuse of free speech protections. Universities must prevent political or terrorist exploitation to safeguard against these threats, according to Al-Ketbi’s analysis in the Saudi outlet Elaph translated by MEMRI.

CANADIAN PRIDE Surge: US Businesses Face Tough Times

— The “Buy Canadian” movement is gaining steam, impacting U.S. companies looking to expand into Canada. Demeter Fragrances, a Pennsylvania perfume maker, stopped its expansion plans due to changing Canadian tastes. CEO Mark Crames noted a growing dislike for American products in Canada.

This trend isn’t just about perfumes but spans different sectors like drinks and citrus fruits from the U.S. Canadian businesses are thriving as local goods win over consumers. Jason McAllister of Irving Personal Care reported their Canadian-made diapers’ weekly shipments have quadrupled, showing this shift in buyer behavior.

The movement worries U.S.-based consumer companies that depended on the Canadian market for growth chances. Executives are now rethinking strategies as they face more difficulties entering the Canadian retail space amid rising protectionist feelings.

STOCK MARKET Chaos: US Faces Economic Fears as Tariffs Loom

— U.S. stocks took a nosedive today as President Donald Trump’s “Liberation Day” approaches, bringing potential tariffs on Canadian steel and aluminum imports. Analysts warn these tariffs could trigger a market downturn and increase recession risks. Wolfe Research has already revised U.S. growth estimates for 2025 down to 1.6%.

Retail giant Kohl’s experienced its worst trading day since 1992, with stocks tumbling by 26% after issuing disappointing guidance for the year. Investor anxiety is also heightened by an upcoming House vote on a stopgap funding bill, adding to market volatility.

The Dow Jones Industrial Average has fallen 8.3% from its peak, raising concerns about the tech sector’s performance compared to the S&P 500. Investors are bracing for further shifts as policy decisions unfold in the coming days amid fears of reduced earnings across sectors due to new tariffs and declining consumer confidence.

CHINESE MIGRANTS Surge: Florida’s Wealthy Enclave Under Pressure

— A wave of Chinese migrants arriving by boat in South Florida is sparking a human smuggling investigation. Coral Gables, known for its wealthy neighborhoods and Mediterranean Revival architecture, is seeing this unusual influx. The rise in migrant interceptions highlights a broader trend across Florida since 2020.

U.S. Customs and Border Protection data shows a big jump in Chinese nationals entering the state, from 406 in 2020 to 723 by 2024 — a shocking 78% increase. This trend raises concerns about China’s growing influence near affluent American areas like Coral Gables’ Gables Estates, the priciest housing market nationwide according to Zillow.

Eric Brown, a retired Green Beret and CEO of Imperio Consulting, notes that Coral Gables’ closeness to international waterways makes it an appealing entry point for migrants. “Coral Gables is right next to international waters,” Brown explained, stressing its strategic location just 90 miles from Cuba’s coastline. This geographical edge may be aiding the recent rise in migrant arrivals from China.

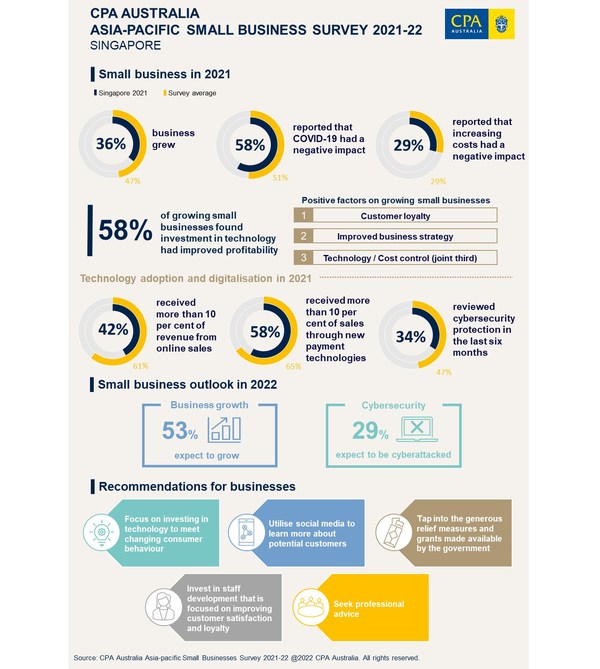

SINGAPORE’S Business Boom: Small Firms’ Confidence Soars to New Heights

— Confidence among small businesses in Singapore has hit its highest point since 2019, says a survey by CPA Australia. The Asia-Pacific Small Business Survey shows that 62% of these businesses expect growth this year, marking the most optimism since 2018. This positive trend is expected to continue into 2025.

Greg Unsworth from CPA Australia notes that this confidence reflects not just business prospects but also a brighter economic environment. The survey highlights a big jump in technology use, with more firms embracing online and digital payments.

In 2024, an impressive 63% of small businesses reported earning over 10% of their revenue from online sales, up from just 36% in 2019. This shift shows a strong move towards digital transformation among Singapore’s small enterprises.

TRUMP’S Targeted Tarif Plan Ignites Stock Surge

— Global stocks soared on Monday, fueled by gains in U.S. markets. Reports suggest President TRUMP’s tariff strategy is more targeted than expected, boosting investor confidence and risk appetite.

U.S. Treasury yields rose with the optimistic outlook on tariffs. Investors hope a targeted approach will ease potential economic disruptions. The market’s reaction shows strong support for Trump’s strategic trade policy shift.

Meanwhile, the IRS expects a significant drop in tax revenue — over 10% by April 15th — according to the Washington Post. This decline raises concerns about fiscal health and future government funding.

In currency markets, the dollar strengthened against both the euro and yen as U.S. business activity improved in March. Bitcoin analysts predict a potential surge to $110K before any major correction, reflecting ongoing interest in cryptocurrency markets.

HONG KONG Surge Ignites Asian Market Boom

— Hong Kong is leading a major surge in Asian markets, sparking excitement and strong trading. Big gains are seen in Japan, India, and Malaysia. Indonesia trails slightly behind.

This market shift lines up with possible geopolitical changes, including hints from former President Trump about a potential visit from President Xi to Washington DC. Such moves could impact international relations and economic plans.

China’s tech giants like Alibaba and Tencent are seeing big gains thanks to positive domestic consumption outlooks. This growth shows the strength of China’s tech sector amid global uncertainties.

NIO’s partnership with CATL signals more growth in the tech industry, boosting investor confidence across Asia. The collaboration highlights the region’s focus on innovation and technological progress.

TRUMP’S Bold Move: How NEW Tariffs Rattle the Stock Market

— U.S. stocks fell sharply as President Donald Trump’s tariffs on Canada and Mexico took effect, sparking economic fears. Investors worry about the potential impact amid existing uncertainties. Analysts warn of a possible recession, urging caution in market activities.

The S&P 500 and Nasdaq composite saw major drops, hitting technology stocks hard. Companies across sectors are revising forecasts due to these new trade policies. Experts suggest these tariffs could worsen inflation and reduce consumer spending soon.

These tariffs are part of Trump’s broader trade agenda to boost U.S. manufacturing but risk retaliatory actions that may harm American businesses and consumers. The market remains bearish as analysts closely watch for policy fallout effects.

GOLD PRICES Soar: How Trade Uncertainty is Shaking Markets

— Gold prices have hit a record high of $2,985 as trade tensions shake up markets. Mixed signals from the Trump administration are fueling fears of a trade-induced recession. Investors are flocking to gold and the Japanese Yen, pushing the metal closer to the $3,000 mark.

The S&P 500 index has seen its first 10% drop from its peak since 2023. Market volatility is increasing, with many stocks showing big daily declines. This correction shows growing uncertainty in financial markets amid ongoing economic challenges.

Despite risks, variable-rate mortgages are attracting borrowers looking for lower initial rates. The current economic climate is influencing mortgage trends and borrower behavior significantly. Homebuyers must weigh potential savings against future rate increases in their financial decisions.

The IRS warns that over one billion dollars in unclaimed tax refunds for 2021 will expire soon if not claimed by April 15, 2025. After this deadline, these funds will revert to the U.S Treasury permanently. Taxpayers should act quickly to claim their refunds before it’s too late.

MAGNACHIP’S BOLD Move: Shift to Power Business Promises Big Profits

— Magnachip Semiconductor Corporation is making a bold shift to focus solely on its Power business. This strategic move, decided by the Board and management, aims to boost revenue growth and increase shareholder value.

The company plans to phase out its Display segment, classifying it as discontinued in the next Q1 results. Options like selling or merging this segment are on the table. The goal is clear: ensure steady profits and keep shareholders happy.

Magnachip aims for quarterly break-even by Q4 2025 and expects positive operating income by 2026. By 2027, they foresee positive free cash flow. The Power business will target stable markets with long product cycles, unlike the unpredictable smartphone market of their Display segment.

SENSEX SURGE: Investors Cheer as Market Confidence Grows

— The SENSEX index opened at 74,474.98 on March 9, 2025, marking a positive start to the trading day. This opening was slightly above its previous close of 74,332.58, signaling growing investor trust in the market’s stability.

As trading progressed, the index gained over 350 points, hitting a high of 74,713.17. This upward trend shows optimism among investors and suggests a strong economic outlook for India.

Growth in the SENSEX is often seen as an indicator of economic health and can positively influence global markets. Investors will be closely watching to see if this momentum continues in the coming days.

DIGITAL NEWS Chaos: How Tech Issues Leave Readers Frustrated

— In today’s digital world, TECHNICAL difficulties can block access to important news. Recently, users struggled to get the latest updates.

These disruptions reveal weaknesses in our digital systems and raise questions about their reliability. Such problems affect how fast and accurately people get vital news.

For those wanting timely information, these barriers are annoying and inconvenient.

Building strong systems is key to keeping public trust in online news platforms.

XRP PRICE Soars: Trump’s Bold Crypto Move Shakes Market

— XRP’s price jumped by 30%, hitting $2.75 after finding support at $2.00. This rise follows talk about its possible inclusion in a US Crypto Reserve.

President Trump suggested the US might add XRP, ADA, and SOL to a national crypto reserve along with Bitcoin and Ethereum. This could change the cryptocurrency world dramatically.

Analyst “Dark Defender” predicts XRP could reach $77.7 soon, showing growing investor hope. These forecasts highlight how government-backed crypto plans might affect market trends.

MEASLES OUTBREAK in Texas: Shocking Surge Raises Alarm

— The MEASLES outbreak in rural West Texas has climbed to 124 confirmed cases across nine counties. The state health department announced this concerning rise on Tuesday. Currently, 18 people are hospitalized due to the outbreak.

Local health officials are stunned by the severity of the situation. One resident remarked, “I’ve never seen it this close, ever.” The outbreak’s impact has drawn national media attention as officials work hard to contain the crisis.

Concerns over vaccination rates and public health measures have been highlighted by this outbreak. Health authorities urge vaccinations and increased public awareness to prevent further spread of this highly contagious disease.

INNOVATIVE BUSINESS Ideas Face Economic Hurdles In Today’S Market

— The current market offers many opportunities for new business ideas. AI-powered financial coaching apps are gaining popularity, especially among women entrepreneurs. There’s also a growing demand for senior care services due to an aging population. Eco-friendly products, second-hand fashion, and zero-waste packaging are on the rise as consumers focus on sustainability.

Labour’s proposed tax hikes on businesses could threaten low-paid jobs in the UK. Employers face financial pressure from rising business rates and national insurance costs. These changes may cost businesses about £5 billion, potentially impacting low-income workers significantly.

In the U.S., stock markets saw a sharp decline with the Dow dropping nearly 750 points amid tariff concerns. Reports suggest U.S. business activity is nearing a stall with growth at a 17-month low. Businesses express widespread worries over federal policies affecting their operations and future optimism.

UNMISSABLE Business OPPORTUNITIES: How to Thrive in Today’s Market

— The current market offers many business opportunities that align with consumer needs and personal passions. AI-powered financial coaching apps are becoming popular, especially among women entrepreneurs seeking personalized advice. Senior care services are also in demand due to the aging population needing more in-home support.

Eco-friendly products like second-hand fashion and zero-waste packaging are trending as consumers focus on sustainability. Success in these areas depends on marketing strategies that emphasize transparency and ethical practices.

Meanwhile, Dorset is seeing fewer new business startups due to economic pressures and job security worries. Ian Girling of the Dorset Chamber of Commerce calls for government action to help new businesses survive better.

In contrast, Syntheia Corp., which specializes in AI-driven call handling solutions, reports a surge in subscriptions, doubling to 2,000 within a week. This growth highlights the increasing reliance on conversational AI technologies to transform customer service experiences.

“Trump’s COMMENTS Ignite SURGE of Canadian Pride”

— Canadians celebrated the 60th anniversary of their flag with a boost in patriotism, sparked by President Trump’s tariff threats and his suggestion that Canada could become the 51st U.S. state. Deborah Weismiller, a retired journalist from Edmonton, displayed her Canadian flag for the first time, feeling a new urge to show national pride. “Most Canadians are horrified at becoming a 51st state,” she said.

Many Canadians were shocked by Trump’s comments and his pressure on Ottawa about border security. In response, they displayed flags on vehicles and balconies as symbols of defiance and unity. Bill Hawke, an 83-year-old retired investment advisor, decided to fly his flag after several years to emphasize Canada’s importance and democratic values.

Bradley Miller, an associate professor at the University of British Columbia, noted that while Canadians typically display their flag during events like the Olympics, Trump’s actions have unexpectedly united them in patriotic expression. This surge in nationalism highlights Canada’s commitment to its sovereignty amid external pressures from its southern neighbor.

SANTANDER’S UK Business Safe: Rumors Debunked

— Banco Santander has confirmed its UK division is not for sale, despite recent rumors. A company spokesperson highlighted the importance of the UK business to Santander’s global strategy. This statement follows reports suggesting potential talks with NatWest and Barclays about selling the unit.

The Financial Times reported that discussions took place between Santander and NatWest, leading to speculation about a possible sale. However, these talks did not result in any formal proposals. Earlier interest from Barclays also didn’t turn into an offer as Santander reassessed its British operations.

Santander’s reassurance comes amid increased scrutiny of its UK activities and aims to calm stakeholders’ concerns. The bank emphasizes the strategic value of its British presence within its diverse financial portfolio.

This development underscores Santander’s commitment to maintaining a strong foothold in the competitive UK market, assuring investors and customers alike of their continued dedication to this key region.

:max_bytes(150000):strip_icc()/GettyImages-2192142603-a439d21d07ef4ace9708e5f08f188b0b.jpg)

CHINA’S Tech Boom: How Deepseek AI is Shaking Global Markets

— China’s tech industry is booming, thanks to the rise of the DeepSeek AI model. Major companies like Alibaba, Baidu, and Xiaomi are seeing big benefits. This surge has pushed Hong Kong’s Hang Seng Tech Index up this year.

Alibaba, co-founded by Jack Ma, stands out in this market rally. The company’s growth shows the broader impact of tech advancements on China’s economy. Investors are watching these changes for possible global effects.

The rise in China’s tech stocks might affect U.S. investments and international trade ties. As U.S. markets close with small changes in the S&P 500, global investors keep an eye on shifts in Chinese tech trends.

This ongoing rally highlights China’s growing influence on worldwide economic dynamics, making it a key player to watch in global markets.

Video

DISNEY PROFITS Surge: Families Flock to Parks Despite Tough Times

— Disney’s profits are up, beating what Wall Street expected. The company brought in $23.62 billion last quarter, a 7% jump from last year. Earnings per share rose 20%. Disney credits its strong U.S. theme parks and streaming services for the big gains.

Even with high prices and more choices out there, families keep coming to Disney’s American parks. Overseas parks, like those in China, are also busy — even as people spend less on other things.

Disney+ and other streaming platforms are pulling in more viewers and money. The company expects almost $875 million in streaming profits next year.

Disney isn’t slowing down. It plans to open a new theme park and resort in Abu Dhabi — the first one in the Middle East. CEO Bob Iger says this will mix Disney magic with local culture and help the company grow worldwide.