THREAD: tech stocks soar as cor...

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

LE PEN Shocked by Conviction as Trump Unleashes Bold Trade Blitz

— Marine Le Pen, the leader of France’s National Rally party, has been convicted of misusing European Parliament funds. She was given a four-year sentence, with two years suspended and the rest served at home under electronic monitoring. This ruling blocks her from running in France’s 2027 presidential race, ending her hopes for another campaign.

French officials claim there is no political motive behind Le Pen’s conviction. Still, many in France are calling it a political earthquake that could shake up the country’s future.

At the same time, President Donald Trump announced tough new tariffs on foreign cars and auto parts coming into America. The 25% tariffs start April 3 and are part of Trump’s plan to bring back U.S. auto jobs and manufacturing strength.

Trump called April 2 “Liberation Day” for American industry and hinted he might negotiate with other countries after the tariffs begin. The markets have reacted with caution as people debate how these bold moves will affect global trade in the long run.

NEW JERSEY Wildfire Chaos: Thousands Flee Homes as Inferno Rages

— A raging wildfire in Ocean County, New Jersey, has scorched more than 13,000 acres since Tuesday. About 5,000 people had to leave their homes as thick smoke spread across the area. Part of the Garden State Parkway was shut down for safety. Firefighters are battling the flames and helping families who had to evacuate. Air quality warnings have gone up for nearby towns. This is one of the worst wildfires New Jersey has seen in years. The cause is still unknown, and officials are urging everyone to obey evacuation orders. For live updates and video coverage, visit: https://lifeline.news/video-for-news?video=wildfirenew-jersey-devastating-2025-04-24

UK TECH GIANTS Slammed: Heartbroken Parents Demand Action as Crime Soars

— Grieving parents across the UK are pleading with tech companies to do more to keep kids safe online. Their voices grow louder as social media and digital platforms face criticism for not protecting children. Conservatives have long warned about the dangers of letting Big Tech go unchecked. Reform UK is in hot water after some candidates posted offensive material online. The backlash puts extra pressure on the party as it tries to win over voters before the next election. Crime is also rising fast in Britain. New data shows personal theft in England and Wales jumped by 22%. Many families now worry if police are doing enough to keep their neighborhoods safe. Other news includes warnings about methanol poisoning, new rules expected on sex-based rights, a ban on sending video game controllers to Russia, and a mini heatwave set to bring the hottest weather of the year.

PUTIN’S Fake Ceasefire Sparks Outrage As Attacks Rock Ukraine

— Russian President Vladimir Putin announced a 30-hour Easter ceasefire, but deadly attacks still hit the Kherson region. Ukrainian officials say three people were killed and three more hurt during what was supposed to be a truce. The head of Kherson’s administration, Oleksandr Prokudin, shared these numbers with the public.

Ukrainian President Volodymyr Zelenskyy accused Russia of breaking the ceasefire over 2,900 times. He said Russian forces kept up shelling and drone strikes along the front lines. Zelenskyy told his people that “actions always speak louder than words” and promised Ukraine would only stay silent if Russia did too.

Russia’s Defense Ministry pushed back, blaming Ukraine for 4,900 violations instead. They claimed Moscow’s troops “strictly observed the ceasefire.” But as soon as midnight hit and the truce ended, fighting picked right back up across both sides.

Putin says he’ll only agree to a real ceasefire if Western countries stop sending weapons to Kyiv and if Ukraine stops calling up new soldiers — terms Ukraine flatly rejects. With both sides pointing fingers and refusing to budge, this war looks far from over.

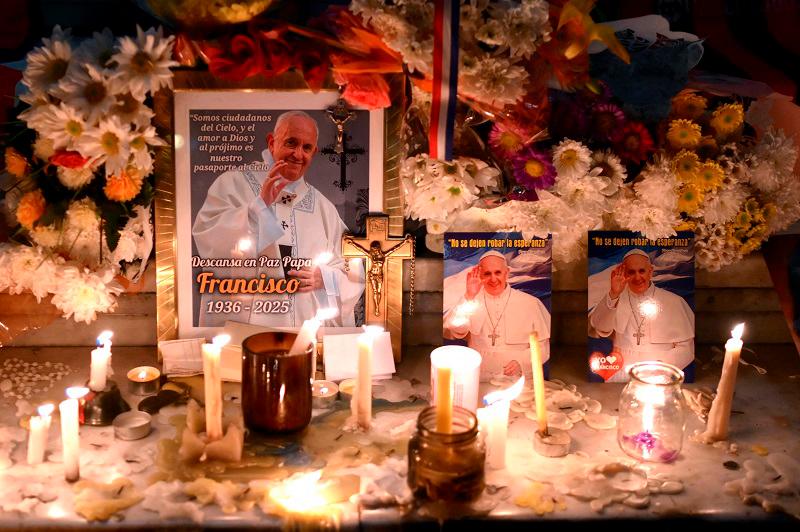

POPE FRANCIS Death Shock: World Stunned as Global News Stalls

— The world is standing still after the death of POPE FRANCIS. Business leaders worldwide have sent their condolences, but there are no major international events making headlines.

Most news outlets have shifted focus to U.S. stories, like the Arizona Department of Corrections investigation and Harvard’s lawsuit against the Trump administration. These are not global stories and offer little for those wanting international updates.

Outside of ongoing coverage about Pope Francis’s passing, there is almost no movement on the world stage. Anyone hoping for big news from abroad will have to wait until something new breaks.

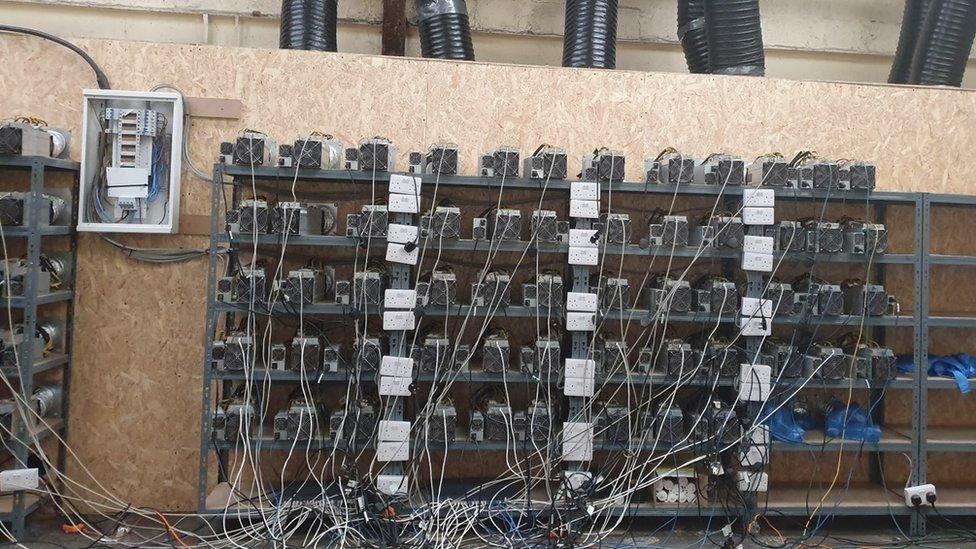

UK ENERGY THEFT Surge: Families Desperate as Bills Spike and Dangers Grow

— Energy theft is exploding across the UK as families battle record-high bills in 2025. Reports from Crimestoppers show more people are tampering with meters or making illegal hookups. The latest government price cap hike and the cost-of-living crisis are pushing many to take risky steps just to keep the lights on. Experts say this is not just about money — it’s a real danger. Messing with gas lines or meters can cause deadly fires and explosions, putting whole neighborhoods at risk. There have already been tragic deaths linked to these desperate acts. The financial toll is massive too. Stolen energy now costs an estimated £1.5 billion each year, while total energy debt in Britain has soared to a record £3.9 billion — more than double what it was before the crisis. Lawmakers say urgent action is needed, like better home insulation and lower rates for struggling families. Critics argue current government help isn’t enough, warning that without stronger action, both public safety and the UK’s entire energy system could be in trouble.

— Technical glitch disrupts service Users experience delays as the system encounters an error, prompting a retry

— Technical glitch halts service Users experience delays as the system encounters an error, prompting a retry later

RETAIL CHAOS: Forever 21 and Joann Shut Doors as Ollie’S Surges Forward

— Forever 21 is heading for its second bankruptcy and plans to shutter about 200 U.S. stores. Once a mall favorite, the chain has struggled to keep up with online shopping and new trends. Closures have already begun in states like Michigan, New York, and California. Joann Fabrics is closing all its locations after filing for Chapter 11 bankruptcy. Even their website has shut down because of high demand during clearance sales. Many shoppers are upset about store policies as hundreds of sites get ready to close. While others shrink, Ollie’s Bargain Outlet is on the rise. The discount chain will grab up to 100 Big Lots store leases as Big Lots faces its own financial troubles. Ollie’s expects to open around 75 new outlets in 2025 — much faster than usual. Retailers are feeling the heat from online competition and a shaky economy. Walgreens and Kohl’s are also closing hundreds of stores as more Americans turn away from old-school shopping habits.

— Technical glitch causes website downtime Users report frustration as the service becomes temporarily inaccessible

TRUMP’S “Liberation DAY” Shocks Markets: Wall Street Reels as Tariffs Spark Global Showdown

— President Trump’s “Liberation Day” tariffs have rocked the markets. The Dow dropped more than 2,000 points on some days. The S&P 500 and Nasdaq both fell into bear market territory. These tariffs, reaching up to 125% for some countries, are the highest seen in a hundred years. China, the EU, and Japan are feeling the pain most. China hit back with its own tariffs on American goods. Japan’s finance minister warned of global trouble ahead. Still, US officials say they’re hopeful about future trade talks. Big companies are taking hits too. CarMax shares sank after weak earnings reports. Nvidia tumbled more than 20% from its high point this year. UnitedHealth lowered its profit forecast because Medicare costs keep rising. Experts think this wild ride will last until trade fights settle down. Some industries are holding up better than others under pressure. The Federal Reserve might cut rates three times this year if things get worse — some warn a financial crisis could happen if tariff chaos continues much longer.

FSU SHOOTING Horror: Campus Fears Surge as Crime Crisis Grows

— A gunman opened fire at Florida State University on April 17, killing two and injuring six. The suspect, Phoenix Ikner, is the stepson of a local sheriff’s deputy. He used a gun registered to his stepmother. Police have not shared a motive yet, but Ikner is in custody as the investigation continues. Students hid in classrooms for five minutes while shots rang out. Now, the campus is grieving and demanding answers about how this could happen. Violent crime isn’t just a campus problem — it’s rising across America. In South Carolina, an inmate was executed by firing squad for two murders from 2004 — a rare punishment these days. In Texas, police charged a teen with fatally stabbing another student. International news adds to growing concerns about safety and law enforcement. An American pastor kidnapped in South Africa was rescued after police used deadly force against his captors. Meanwhile, U.S. immigration policies face new questions after deportation mistakes led a senator to visit El Salvador — sparking debate over how best to protect Americans at home and abroad.

— UK Supreme Court rules trans women cannot use single-sex female toilets or changing rooms The landmark decision affirms the legal definition of a woman as based on biological sex

— UK Supreme Court rules trans women cannot use single-sex female toilets or changing rooms The landmark decision affirms the legal definition of a woman as based on biological sex

TRUMP’S Bold Harvard Threat Ignites Fury as Political Violence Surges

— Former President Donald Trump is taking a hard stand against Harvard University. He wants to strip its tax-exempt status and freeze $2.2 billion in federal funds unless the school ends DEI programs and works with immigration officials. Barack Obama called Trump’s plan “unlawful,” but many conservatives see it as a needed pushback against elite institutions. In Pennsylvania, Governor Josh Shapiro’s home was set on fire in an arson attack while his family was inside. This comes after last year’s attempt on Trump’s life, raising alarms about growing political violence across the country. The suspect in the arson case was let out on bail despite a violent past, leading many to question law enforcement choices. Meanwhile, France is facing its own political storm. Marine Le Pen, leader of the far-right movement, has been convicted of embezzlement and banned from running for president until 2030. Le Pen says she is being targeted by her opponents to keep her out of power. Americans are worried about rising crime and chaos in their cities. National Guard troops have been sent into areas hit by youth crime and violence. The nation remains divided over issues like immigration policy, abortion laws, transgender rights, and how federal money should be spent — all while political tensions keep rising.

RUSSIAN MISSILE Strike: Ukraine Mourns as 34 Lives Lost

— A RUSSIAN missile strike in Ukraine’s Sumy region has taken the lives of at least 34 people. President Volodymyr Zelenskiy condemned the attack, calling it terrorism and urging a strong international response. He asked the United States and European nations to take decisive action against Moscow.

This tragic event raises tensions amid ongoing ceasefire talks between Ukraine and Russia. Both countries have accused each other of breaking agreements meant to protect energy infrastructure, making diplomatic efforts more difficult.

Zelenskiy stressed the need for stronger diplomatic pressure on Russia during a CBS News interview, highlighting the urgency for global intervention in this escalating crisis.

TRUMP’S Tariff CUT Sparks Stock Market Surge

— In a bold move, President Donald Trump announced a temporary cut in tariffs for many countries, while raising them for China. This decision caused U.S. stock indexes to soar, with the S&P 500 seeing its biggest gain since 2008, closing 9.5% higher. Trump’s tariff strategy aims to increase pressure on China amid ongoing trade tensions.

The announcement led to a sharp drop in the Cboe Volatility Index (VIX), which fell by 15 points to 37.2 after news of a 90-day tariff pause for most nations. However, China’s response was quick as they imposed an 84% retaliatory tariff on U.S. goods following the new U.S. levy on Chinese imports that took effect at midnight. This escalation adds uncertainty to global markets despite the initial boost in U.S stocks.

Meanwhile, on the home front, the U.S government has started monitoring immigrants’ social media accounts for signs of antisemitism as part of enhanced security measures. This initiative reflects growing concerns over hate speech and its potential impact on national security and social cohesion within immigrant communities across America.;

IRS TECH OVERHAUL Promises BIG Changes for Taxpayers

— The IRS is set to roll out its Technical Roadmapping Initiative, aiming to modernize and streamline its tech systems. This move seeks to improve taxpayer services, enhance data security, and boost efficiency. A team of skilled IRS engineers will work on creating efficient systems for American taxpayers.

A seminar called the IRS Roadmapping Kickoff will launch this week, featuring strategy sessions led by these engineers. They plan to update the agency’s outdated tech infrastructure that’s been around for decades. Central to this effort is a unified API system for secure communication and better management of taxpayer info.

This modernization aligns with President Donald Trump’s commitment to transparency and responsible use of taxpayer resources. A senior tech executive at the IRS highlighted new features like a “Where is my refund?” tool that could help Americans track their federal tax returns more easily.

MARKET PANIC: Bitcoin and Stocks Plummet in US Tariff Chaos

— Bitcoin dropped below $80,000 on Sunday, falling over 3% in just two hours. This decline happened alongside major losses in U.S. stock markets. The S&P 500 and Nasdaq Composite both closed nearly 6% lower on April 4. Analyst Holger Zschaepitz noted the stock market lost $8.2 trillion, surpassing losses from the worst week of the 2008 financial crisis.

The market chaos comes from recent U.S. tariffs that have sparked widespread sell-offs across many sectors. Despite this turmoil, some investors see potential buying opportunities as stocks are now trading at historically low valuations of 15 times future earnings projections.

Jim Cramer has warned this could be just the start of a bigger downturn for the S&P 500, predicting a further meltdown of up to 20%. As of Sunday night, S&P futures were down about 4%. Global stocks have already lost $7.46 trillion since April 2nd and may exceed $10 trillion if recent sell-offs continue to unfold.;

TRUMP’S Trade Policy Shocks: US Stocks Plunge in Market Chaos

— The EURO has surged to a six-month high as investors react to the latest U.S. tariff announcements. Meanwhile, the Australian dollar has taken a hit, reflecting global market volatility. These currency shifts highlight ongoing economic uncertainties fueled by international trade tensions.

U.S. stock futures have plummeted after China’s retaliatory tariffs on American goods, marking another phase in the global trade conflict. The Dow Jones dropped 1,679 points, causing widespread concern among investors and financial strategists who urge calm and strategic planning during these turbulent times.

Bitcoin ETFs saw nearly $100 million in net outflows as markets reacted sharply to tariff news from the Trump administration. This exodus underscores investor anxiety and uncertainty about future economic conditions amid escalating trade disputes with China.

Goldman Sachs has revised its oil price forecasts downward due to fears of a potential recession and increased supply from OPEC+. Gold prices have steadied after an initial selloff triggered by aggressive U.S. tariff policies, indicating cautious optimism among investors seeking safe-haven assets in uncertain times.

TRUMP’S 10% Tarifts Spark Stock Market Chaos

— U.S. stocks plunged after President Trump announced a 10% tariff on all trading partners. The Dow dropped about 1,300 points, with the S&P 500 and Nasdaq also taking hits. Investors quickly reacted, showing concern over potential economic fallout.

President Trump plans to impose reciprocal tariffs starting at 10%, targeting countries worldwide and adding extra duties for “worst offenders.” This move has unsettled markets and might lead to higher consumer costs and a possible recession. Economists are worried about the long-term effects on both domestic and global economies.

Globally, the response has been mostly negative, with many countries considering countermeasures to protect their economies from these new tariffs. This rise in trade tensions marks a significant shift in international economic relations under Trump’s leadership. Key sectors relying on international trade may face challenges as relationships with major trading partners change.

FOREIGN STUDENTS as Pawns: How Hamas Manipulates US Campuses

— Al-Ketbi warns that foreign students are being manipulated by terrorist groups like Hamas, backed by Iran. His comments follow the arrest of Mahmoud Khalil, a Palestinian-born Columbia University graduate facing deportation for pro-Hamas activities. Khalil’s case highlights how extremist groups exploit U.S. immigration laws to infiltrate society.

Khalil is accused of being a Hamas sympathizer with anti-American views, linked to violent campus activities at Columbia University. Videos show him urging protesters to “destroy” and “explode the heads of Zionists.” Al-Ketbi warns this is part of a pattern where foreign students act as proxies for hostile regimes like Iran on American campuses.

Student groups such as Columbia University’s Apartheid Divest and Students for Justice in Palestine are cited as platforms spreading antisemitic or pro-terrorism discourse under humanitarian pretenses. Al-Ketbi emphasizes that these organizations often mask their true intentions behind human rights activism while promoting dangerous ideologies.

He argues that U.S. academic institutions are vulnerable due to inadequate vetting and misuse of free speech protections. Universities must prevent political or terrorist exploitation to safeguard against these threats, according to Al-Ketbi’s analysis in the Saudi outlet Elaph translated by MEMRI.

STOCK MARKET Chaos: US Faces Economic Fears as Tariffs Loom

— U.S. stocks took a nosedive today as President Donald Trump’s “Liberation Day” approaches, bringing potential tariffs on Canadian steel and aluminum imports. Analysts warn these tariffs could trigger a market downturn and increase recession risks. Wolfe Research has already revised U.S. growth estimates for 2025 down to 1.6%.

Retail giant Kohl’s experienced its worst trading day since 1992, with stocks tumbling by 26% after issuing disappointing guidance for the year. Investor anxiety is also heightened by an upcoming House vote on a stopgap funding bill, adding to market volatility.

The Dow Jones Industrial Average has fallen 8.3% from its peak, raising concerns about the tech sector’s performance compared to the S&P 500. Investors are bracing for further shifts as policy decisions unfold in the coming days amid fears of reduced earnings across sectors due to new tariffs and declining consumer confidence.

HONG KONG Surge Ignites Asian Market Boom

— Hong Kong is leading a major surge in Asian markets, sparking excitement and strong trading. Big gains are seen in Japan, India, and Malaysia. Indonesia trails slightly behind.

This market shift lines up with possible geopolitical changes, including hints from former President Trump about a potential visit from President Xi to Washington DC. Such moves could impact international relations and economic plans.

China’s tech giants like Alibaba and Tencent are seeing big gains thanks to positive domestic consumption outlooks. This growth shows the strength of China’s tech sector amid global uncertainties.

NIO’s partnership with CATL signals more growth in the tech industry, boosting investor confidence across Asia. The collaboration highlights the region’s focus on innovation and technological progress.

“GOLD Prices SOAR: A Safe-Haven in Chaotic Times”

— Gold prices skyrocketed to a record $3,000 an ounce on Friday. Investors are anxious over President Trump’s tariffs and global tensions. Viktoria Kuszak from Sucden Financial highlighted Russia’s rejection of a US ceasefire proposal in Ukraine as a key factor adding to the instability.

Gold’s rise proves its lasting role as a safe-haven asset during uncertain times. It first topped $1,000 after the financial crisis and hit $2,000 during COVID-19. Now, it reaches new heights amid trade wars and global unrest.

The gold surge mirrors broader financial market shifts influenced by geopolitical factors. Meanwhile, the crypto market is on edge awaiting a crucial ruling in the Ripple-SEC case that could change digital asset regulations worldwide. This decision may set new standards for future finance tech developments.

TRUMP’S Bold Move: How NEW Tariffs Rattle the Stock Market

— U.S. stocks fell sharply as President Donald Trump’s tariffs on Canada and Mexico took effect, sparking economic fears. Investors worry about the potential impact amid existing uncertainties. Analysts warn of a possible recession, urging caution in market activities.

The S&P 500 and Nasdaq composite saw major drops, hitting technology stocks hard. Companies across sectors are revising forecasts due to these new trade policies. Experts suggest these tariffs could worsen inflation and reduce consumer spending soon.

These tariffs are part of Trump’s broader trade agenda to boost U.S. manufacturing but risk retaliatory actions that may harm American businesses and consumers. The market remains bearish as analysts closely watch for policy fallout effects.

GOLD PRICES Soar: How Trade Uncertainty is Shaking Markets

— Gold prices have hit a record high of $2,985 as trade tensions shake up markets. Mixed signals from the Trump administration are fueling fears of a trade-induced recession. Investors are flocking to gold and the Japanese Yen, pushing the metal closer to the $3,000 mark.

The S&P 500 index has seen its first 10% drop from its peak since 2023. Market volatility is increasing, with many stocks showing big daily declines. This correction shows growing uncertainty in financial markets amid ongoing economic challenges.

Despite risks, variable-rate mortgages are attracting borrowers looking for lower initial rates. The current economic climate is influencing mortgage trends and borrower behavior significantly. Homebuyers must weigh potential savings against future rate increases in their financial decisions.

The IRS warns that over one billion dollars in unclaimed tax refunds for 2021 will expire soon if not claimed by April 15, 2025. After this deadline, these funds will revert to the U.S Treasury permanently. Taxpayers should act quickly to claim their refunds before it’s too late.

SENSEX SURGE: Investors Cheer as Market Confidence Grows

— The SENSEX index opened at 74,474.98 on March 9, 2025, marking a positive start to the trading day. This opening was slightly above its previous close of 74,332.58, signaling growing investor trust in the market’s stability.

As trading progressed, the index gained over 350 points, hitting a high of 74,713.17. This upward trend shows optimism among investors and suggests a strong economic outlook for India.

Growth in the SENSEX is often seen as an indicator of economic health and can positively influence global markets. Investors will be closely watching to see if this momentum continues in the coming days.

DIGITAL NEWS Chaos: How Tech Issues Leave Readers Frustrated

— In today’s digital world, TECHNICAL difficulties can block access to important news. Recently, users struggled to get the latest updates.

These disruptions reveal weaknesses in our digital systems and raise questions about their reliability. Such problems affect how fast and accurately people get vital news.

For those wanting timely information, these barriers are annoying and inconvenient.

Building strong systems is key to keeping public trust in online news platforms.

METAL STOCKS Soar: Investors Cheer Global Demand Boom

— METAL stocks like Tata Steel, Hindalco, and Vedanta are seeing a rise of up to 4% in share prices. This jump is due to favorable global market conditions and increased demand for metals. Investors feel hopeful about the sector’s future.

Tata Steel shares have climbed about 4%, thanks to positive quarterly results and higher production forecasts. Hindalco gains from rising aluminum prices and a brighter outlook as global demand increases.

Vedanta’s shares are also climbing because of strong performance and smart strategies to boost production efficiency. These companies’ gains show broader economic conditions that favor raw material demand.

Market experts point to international trade dynamics, better supply chains, and more infrastructure spending worldwide for this bullish trend. These factors boost investor confidence in METAL stocks amid growing global need for raw materials.

XRP PRICE Soars: Trump’s Bold Crypto Move Shakes Market

— XRP’s price jumped by 30%, hitting $2.75 after finding support at $2.00. This rise follows talk about its possible inclusion in a US Crypto Reserve.

President Trump suggested the US might add XRP, ADA, and SOL to a national crypto reserve along with Bitcoin and Ethereum. This could change the cryptocurrency world dramatically.

Analyst “Dark Defender” predicts XRP could reach $77.7 soon, showing growing investor hope. These forecasts highlight how government-backed crypto plans might affect market trends.

INNOVATIVE BUSINESS Ideas Face Economic Hurdles In Today’S Market

— The current market offers many opportunities for new business ideas. AI-powered financial coaching apps are gaining popularity, especially among women entrepreneurs. There’s also a growing demand for senior care services due to an aging population. Eco-friendly products, second-hand fashion, and zero-waste packaging are on the rise as consumers focus on sustainability.

Labour’s proposed tax hikes on businesses could threaten low-paid jobs in the UK. Employers face financial pressure from rising business rates and national insurance costs. These changes may cost businesses about £5 billion, potentially impacting low-income workers significantly.

In the U.S., stock markets saw a sharp decline with the Dow dropping nearly 750 points amid tariff concerns. Reports suggest U.S. business activity is nearing a stall with growth at a 17-month low. Businesses express widespread worries over federal policies affecting their operations and future optimism.

UNMISSABLE Business OPPORTUNITIES: How to Thrive in Today’s Market

— The current market offers many business opportunities that align with consumer needs and personal passions. AI-powered financial coaching apps are becoming popular, especially among women entrepreneurs seeking personalized advice. Senior care services are also in demand due to the aging population needing more in-home support.

Eco-friendly products like second-hand fashion and zero-waste packaging are trending as consumers focus on sustainability. Success in these areas depends on marketing strategies that emphasize transparency and ethical practices.

Meanwhile, Dorset is seeing fewer new business startups due to economic pressures and job security worries. Ian Girling of the Dorset Chamber of Commerce calls for government action to help new businesses survive better.

In contrast, Syntheia Corp., which specializes in AI-driven call handling solutions, reports a surge in subscriptions, doubling to 2,000 within a week. This growth highlights the increasing reliance on conversational AI technologies to transform customer service experiences.

FEDERAL Election MONITORING Cuts: Security Risks Soar

— The dismantling of federal election monitoring efforts has sparked concern among lawmakers and national security experts. Critics argue this move opens the door for foreign interference in upcoming elections. The lack of strong oversight could lead to vulnerabilities being exploited, prompting bipartisan talks on restoring effective monitoring mechanisms.

Democratic officials call the decision irresponsible, claiming it threatens democracy by reducing transparency in election processes. They urge a recommitment to safeguarding electoral integrity. Republican leaders are divided, with some supporting reduced federal involvement to limit overreach.

This development has raised alarms and prompted congressional hearings to assess the impact on election security. Various stakeholders call for immediate action to restore monitoring capabilities against potential foreign manipulation. As critical electoral events approach, the need for reinstating protective measures becomes clear.

:max_bytes(150000):strip_icc()/GettyImages-2192142603-a439d21d07ef4ace9708e5f08f188b0b.jpg)

CHINA’S Tech Boom: How Deepseek AI is Shaking Global Markets

— China’s tech industry is booming, thanks to the rise of the DeepSeek AI model. Major companies like Alibaba, Baidu, and Xiaomi are seeing big benefits. This surge has pushed Hong Kong’s Hang Seng Tech Index up this year.

Alibaba, co-founded by Jack Ma, stands out in this market rally. The company’s growth shows the broader impact of tech advancements on China’s economy. Investors are watching these changes for possible global effects.

The rise in China’s tech stocks might affect U.S. investments and international trade ties. As U.S. markets close with small changes in the S&P 500, global investors keep an eye on shifts in Chinese tech trends.

This ongoing rally highlights China’s growing influence on worldwide economic dynamics, making it a key player to watch in global markets.

GOLD PRICES Soar: Trump’s Trade Policies Spark Investor Panic

— Gold prices are reaching near record highs after President Donald Trump announced new tariffs on major trading partners like Canada, China, and Mexico. Analysts predict gold could soon hit an all-time high of $2,850 an ounce as these tariffs stir up market volatility.

Peter Cardillo from Spartan Capital Securities noted that central banks are quickly buying gold due to worries about inflation and economic stability. This rush to gold shows investor fear amid the uncertainty caused by the tariff announcement.

Trump’s trade policy aims to boost U.S. industries but has raised concerns about possible retaliatory actions from affected countries, complicating global trade dynamics. The financial community is closely watching the impact of these tariffs as international tensions rise.

Market analysts expect commodity prices, especially precious metals, to stay volatile in response to ongoing geopolitical and economic changes. Investors should stay informed as the situation unfolds rapidly.

TECH GIANTS Spark Stock Market Surge: What Investors Need to Know

— The STOCK MARKET is seeing a surge, with predictions of a 0.49% rise. This optimism comes from major tech companies, whose earnings reports are expected to beat estimates. Investors are eagerly awaiting these results, fueling excitement across the market.

However, concerns about rising interest rates could dampen this enthusiasm. While the outlook remains positive now, potential rate hikes might impact investor sentiment soon. Market participants stay cautious as they navigate these mixed signals.

Besides stock market news, debates continue over a new lunch plan proposed by a coalition that may affect small businesses’ futures. Stakeholders are split on the possible effects of these changes, highlighting ongoing challenges in balancing economic growth with regulations.

HORRIFIC CAR Attack at German Christmas Market: 11 Dead in Suspected Terrorist Act

— A car attack at a Christmas market in Magdeburg, Germany, left 11 people dead and over 80 injured on January 31, 2025. Authorities believe this was a terrorist act.

Emergency services arrived quickly to the chaotic scene. Many victims were critically hurt. Witnesses saw panic as people ran and some got trapped under the vehicle. Police caught the suspect, a 50-year-old man acting alone.

The German government shared condolences with victims’ families and vowed to investigate this tragic event thoroughly.

TRUMP’S Trade WAR Ignites Gold Rush And Market Turmoil

— Gold prices have hit a record high as investors flock to safe assets amid President Donald Trump’s new tariffs. These measures target imports from Canada, China, and Mexico, sparking worries about inflation and economic growth. JP Morgan is optimistic about gold, urging investors to buy during this dip.

Wall Street braces for losses due to fears of an escalating trade war from Trump’s tariff actions. The 25% tariffs on Canada and Mexico and 10% on China may cause “short-term” pain for Americans, according to Trump. Global markets watch cautiously as these policies unfold.

Oil prices are climbing in response to the tariffs, while metal and agricultural commodities face pressure downward. The financial landscape is shifting with markets adjusting to a potential prolonged trade conflict led by the U.S., causing the dollar to gain strength amid global trade uncertainty.

LONDON KNIFE Attack: Fear Grips City as Safety Concerns Soar

— A recent knife attack in London has ignited serious safety concerns among residents. Initial reports indicate multiple injuries, creating a chaotic scene that witnesses found alarming. Calls for increased police presence in violence-prone areas have intensified.

Authorities are investigating the incident while local council officials express alarm over rising knife crime trends in the city. This attack fuels ongoing discussions about public safety and effective anti-violence measures in urban settings.

Community leaders and advocacy groups urge more preventive actions and timely law enforcement responses to stop future incidents. The situation highlights the need for decisive action to ensure citizen safety.

For further updates, visit LONDON KNIFE Attack(https://lifeline.news/fast-news?news=london-knife-attack-2025-01-31).

GOLD PRICES Soar: Trump’s Trade Moves Spark Investor Panic

— Gold prices soared to a record $2,800 on Friday as investors sought safety amid tariff threats from President Trump. His remarks have sparked concerns about potential economic impacts.

The uncertainty surrounding tariffs has driven demand for gold, a traditional safe-haven asset. Investors fear that any major trade moves could weaken the U.S. dollar, making gold more attractive.

Analysts also note that increased buying by jewelers and retailers ahead of the marriage season contributed to the price surge. These factors combined have led to unprecedented highs in gold prices.

UPS STOCKS Plummet: Amazon Partnership Slashed, Investors Shocked

— United Parcel Service Inc. (UPS) shares have dropped sharply after announcing a major cut in its business dealings with Amazon.com Inc. UPS plans to reduce its low-margin Amazon business by half, surprising analysts and impacting the company’s revenue projections. Daniel Imbro from Stephens Inc. noted the unexpected nature of this rapid shift in strategy.

The company has projected $89 billion in revenue for 2025, falling short of analysts’ expectations of $94.9 billion, following a reported $91.1 billion for 2024. UPS is focusing on higher-margin sectors like healthcare, aiming for $20 billion in revenue from this segment by 2026 as it raises prices and implements surcharges to offset losses from Amazon’s reduced contribution.

Amazon accounted for 11.8% of UPS’s revenue last year, making the decision to slash this partnership significant amid weak demand recovery for parcel services this year. This strategic pivot highlights UPS’s efforts to stabilize its financial outlook by prioritizing more profitable ventures over volume-driven partnerships with lower margins like Amazon’s delivery services.;

CHINESE AI Revolution: DeepSeek’s Shockwave Hits US Tech Giants

— A new force in artificial intelligence, DeepSeek from China, is shaking up major U.S. tech firms. Their latest AI model, DeepSeek-R1, rivals top U.S. products like OpenAI’s GPT-4 and Google’s Gemini but at a fraction of the cost. This move challenges American dominance and has triggered a massive selloff in tech stocks.

Launched on January 20, 2025, DeepSeek-R1 boasts impressive performance with lower training costs than competitors. Nvidia faced a record market cap drop of over $500 billion — the largest single-day loss in U.S. stock market history — due to this launch. Experts are both amazed and skeptical about DeepSeek’s cost claims, sparking debate on future AI investment strategies.

DeepSeek’s CEO Liang Wenfeng has held closed-door meetings with Chinese leaders to discuss global tech competition implications from their advancements. The rapid rise of DeepSeek has sparked talks about traditional tech investment sustainability and potential industry shifts needed moving forward. Consumers are also interested, as the DeepSeek app topped download charts in both U.S. and China App Stores shortly after release.;

CHINA’S AI Threat: Tech Stocks in Danger of $1 Trillion Wipeout

— Chinese AI startup DeepSeek has shaken global tech stocks, sparking fears about America’s technological advantage. Investors worry about a potential $1 trillion loss in tech value due to rising foreign competition.

The drop in tech shares shows growing concern over the competitive landscape. Major indices have fallen, urging investors to be cautious as the situation develops.

This happens amid wider talks on global trade and economic competitiveness, especially in tech-heavy areas. Experts recommend reassessing portfolios, favoring stable investments over risky tech stocks.

Market analysts emphasize watching these changes closely as they could affect market stability and growth prospects in the technology sector moving forward.

AMAZON’S BOLD Move: New South Africa Center Shakes UP Market

— Amazon has opened a new center in Cape Town, South Africa, to support its independent sellers. This is part of Amazon’s plan to grow its market share and compete with local leader Takealot, owned by Naspers. The center aims to help sellers attract more customers and expand Amazon’s product range, potentially boosting revenue.

APPLE’s CHINA TROUBLES: iPhone Shipments PLUMMET

Apple shares fell 3.2% after research firm Canalys reported a 17% drop in iPhone shipments in China for 2024. This decline pushed Apple down to third place in China’s market share rankings. Despite the stock’s volatility, this news is significant but doesn’t drastically change the company’s business outlook.

STOCK MARKET SLUMP: Earnings Reports RATTLE Investors

The stock market took a hit following Wednesday’s rally due to retail sales data and major bank earnings reports taking the spotlight. Analysts remain hopeful about gains for the S&P 500 by year-end despite current swings. Focus is also on upcoming hearings on tariff plans before President-elect Donald Trump that could affect future economic strategies moving forward.

GOLD PRICES Soar: What You Need to Know About Plunging US Yields

— Gold prices climbed for the second day, fueled by falling U.S. yields and hints of easing core inflation. Investors are keeping a close eye on upcoming U.S. retail sales data, unemployment claims, and Federal Reserve announcements for more market insight.

The stock market saw a big lift after a surprisingly good consumer inflation report. The Dow surged 700 points while the Nasdaq jumped 2.5%. This shows optimism even though there are worries about high rates affecting stock performance.

Financial powerhouses Goldman Sachs and JPMorgan started the earnings season strong with impressive trading revenues, boosting the S&P 500’s financial sector to its best day in two months. Citigroup announced a $20 billion share buyback program as it tackles rising regulatory costs and compliance issues.

The U.S. dollar was volatile as traders analyzed inflation data showing core inflation dipped slightly from 3.3% to 3.2%. Market players await more direction from the Federal Reserve on interest rate policies amid these economic changes.

NEW US CHIP Rules Shake Nvidia: What It Means for Tech’s Future

— Nvidia faces new challenges as the US limits GPU shipments to 100,000 units per country. Larger orders now need US government approval. This move aims to control the spread of advanced technology worldwide.

In response to past restrictions, Nvidia designed a less powerful chip for China, following Biden’s 2022 rules. Despite these hurdles, experts like Chris Miller believe high demand may help soften any sales impacts.

These regulations could reshape Nvidia’s market strategies and global operations as it strives to keep its lead in the semiconductor industry amid changing rules.

STOCK MARKET Chaos: Inflation Fears Shake Investor Confidence

— The U.S. STOCK market took a big hit today, with major indexes dropping over 3% due to rising inflation fears. Investors worry about possible Federal Reserve policy changes after high inflation numbers came out earlier this week. This is one of the steepest drops in months, shaking confidence that had been boosted by strong job reports.

Bond yields are up, with the 10-year Treasury bond yield hitting about 4.1%, its highest since late 2023, signaling increased inflation expectations. Big tech stocks like Apple and Microsoft saw sell-offs over 5%, adding to the market slump. Analysts warn that ongoing inflation might push the Federal Reserve to rethink interest rate policies, possibly leading to more hikes instead of cuts.

The decline comes after a strong holiday shopping season that initially suggested steady economic growth but is now overshadowed by ongoing inflation problems. Retail and consumer sectors face rising costs and reduced spending, making investors cautious in these areas. Companies like Walmart and Target report higher holiday sales but shrinking profit margins due to inflation pressures, prompting them to rethink annual forecasts.

Banks like JPMorgan are bracing for possible loan defaults as consumers struggle with higher living costs by setting aside more reserves. Market analysts expect continued volatility as investors digest new inflation data and Fed policy implications.;

TRAGIC RISE: Migrant Deaths Soar in Deadly Channel Crossings

— Three migrants lost their lives attempting to cross the Channel near Calais, France, highlighting the ongoing crisis. The French coastguard reported that 45 others received treatment on the beach, with four hospitalized. This brings the total number of migrant fatalities in the Channel this year to 77, marking it as the deadliest year since 2018.

Pierre-Henri Dumont, MP for Pas-de-Calais, warned about crossing in frigid waters. He emphasized that even a few minutes in such conditions can be fatal despite quick rescue responses. His comments come amid a record number of crossings during Christmas week, with over 1,485 migrants making it across from December 25th to 28th alone.

The surge over Christmas has pushed total crossings past 150,000 since tracking began in 2018. This year alone has seen over 36,000 illegal crossings compared to last year’s figure of just under 30,000. The left-wing Labour government under Prime Minister Sir Keir Starmer pledged to curb these numbers by dismantling smuggling networks but has so far failed to deliver results as promised.

Since taking office in July, Starmer’s government has overseen more than 22,000 crossings — surpassing totals from previous years combined (2018-2020). Critics argue this reflects poorly

MIGRANT DEATHS in Channel Soar: A Tragic Record for 2024

— Three migrants tragically died while trying to cross the Channel near Calais, France, highlighting the ongoing crisis. The French coastguard reported that 45 others were treated for hypothermia, with four hospitalized. This incident raises the total number of migrant deaths in the Channel this year to 77, making 2024 the deadliest year since the crisis began in 2018.

Pas-de-Calais MP Pierre-Henri Dumont warned about the extreme dangers of crossing during winter months. He stressed that even brief exposure to cold waters can be fatal despite quick rescue efforts. The recent surge saw a record-breaking 1,485 illegal crossings from December 25th to 28th alone.

The total number of illegal crossings has now surpassed 150,000 since tracking began in 2018. Over 36,000 migrants have crossed this year alone, up from last year’s figures of over 29,000.

Prime Minister Sir Keir Starmer’s Labour Party government promised to curb illegal crossings by dismantling smuggler networks but faces criticism for failing to deliver results since taking office in July. With over 22,000 crossings under their watch already exceeding previous years’ totals combined before their tenure began, public pressure mounts for effective action against this ongoing issue.

TRAGIC CHAOS: Car Attack at German Christmas Market Sparks Fear

— A Christmas market in Magdeburg, Germany, turned tragic when a car plowed into a crowd, killing five and injuring over 200. Authorities suspect terrorism as they investigate the incident. Several victims remain in critical condition.

U.S. State Department spokesperson Matthew Miller condemned the event as an “attack,” expressing condolences and support for Germany. Cardinal Dolan offered words of hope, stating that “light will prevail” after this tragedy.

Magdeburg Police identified the suspect as a 50-year-old Saudi doctor believed to have acted alone. The driver reportedly covered 400 meters before police subdued him at gunpoint.

TRAGIC STABBING Spree at London Market Shocks Community

— A stabbing spree at East Street Market in south London left one dead and two injured on Sunday morning. Police arrested a man in his 60s at the scene. While they have not shared details about the suspect or his motives, they do not believe it is terror-related, hinting that mental health issues might be involved.

Witnesses described a chaotic scene as the attacker randomly targeted people. An unnamed fabric seller said, “I just saw a bloke running through the market stabbing people willy-nilly.” The attack happened around 10:30 am when the market was getting busy.

The witness immediately called police after seeing two men stabbed, noting one appeared severely injured. Emergency services quickly arrived but sadly, one victim died from injuries despite their efforts.

The investigation continues as authorities work to understand what led to this tragic event and ensure community safety moving forward.

RUSSIA’S Military Losses Soar Amid Ukraine Conflict

— Britain’s Ministry of Defence reports a sharp rise in Russian military casualties, averaging 1,271 per day in September. This marks the highest daily losses since the conflict began. The increase is linked to Ukraine’s counter-invasion efforts and Russia’s aggressive tactics.

The analysis shows Russia’s casualty rate has more than doubled compared to last year’s peaks. Despite harsh winter conditions, there’s no sign of reduced conflict intensity. Over 648,000 Russian casualties are estimated since the war started, based on Ukrainian figures.

Ukraine claims it inflicted over 38,000 casualties on Russian forces in September alone and destroyed thousands of vehicles like tanks and armored units. However, Western sources often highlight Russian losses without comprehensive data on Ukrainian casualties due to limited transparency from Kyiv.

While Ukraine’s reported figures for Russian losses exceed those from Britain’s Ministry of Defence, accurate assessments are tough due to wartime secrecy. President Zelensky dismissed Kremlin claims about Ukrainian casualties as exaggerated lies earlier this year but didn’t disclose specific numbers for his own forces’ losses.

MYSTERIOUS DEATH of British Tech Entrepreneur’s Co-Defendant Before Yacht Sinks

— Stephen Chamberlain, a former Autonomy Corp. executive, was fatally struck by a car in Cambridgeshire on Saturday. His death happened just days before his co-defendant Mike Lynch and five others went missing after their yacht sank off the coast of Italy.

Authorities confirmed that divers recovered a body from the sunken yacht near Palermo, Italy. The identity of the body has not been announced yet. NBC and Reuters reported another body was found inside the vessel.

Chamberlain had recently been acquitted alongside Lynch in a multibillion-dollar fraud case involving Hewlett Packard’s $11 billion takeover of Autonomy Corp. His lawyer praised him as "a courageous man with unparalleled integrity.

BRITISH Tech Magnate MISSING After Superyacht Tragedy

— British tech magnate Mike Lynch and five others are missing after their luxury superyacht sank during a freak storm off Sicily. Lynch’s wife and 14 others survived the incident. Authorities confirmed that one body has been recovered, and police divers are attempting to reach the hull of the ship at a depth of 50 meters (163 feet).

The yacht, named Bayesian, was anchored near Porticello when a waterspout struck overnight. The sudden storm battered the area precisely where the 56-meter (184-foot) British-flagged vessel was moored. Salvo Cocina of Sicily’s civil protection agency stated, “They were in the wrong place at the wrong time.”

The Bayesian had a crew of 10 and 12 passengers on board. Another nearby superyacht assisted in rescuing some of the survivors, including Lynch’s wife Angela Bacares. The yacht was notable for its single 75-meter (246-feet) mast made of aluminum, which was lit up just hours before it sank.

Video

WEST BANK Chaos Ignored: Heartbreaking Surge in Violence as World Looks Away

— While the world watches GAZA, deadly violence is exploding in the West Bank. Israeli military raids in places like Jenin and Nur Shams have ramped up since early 2025. Dozens are dead, and thousands more have been forced out of their homes. In April alone, the Palestinian Red Crescent said 14 people died during a single raid. The crisis is getting worse fast. The United Nations says about 40,000 Palestinians have been pushed from their houses since fighting grew this year. With shelters packed full, Israeli curfews and roadblocks make it even harder for families to move or find safety. Attacks by settlers are also on the rise. Human Rights Watch says there have been over 700 attacks by settlers since October — often with little action from Israeli troops to stop them. Armed patrols and land grabs are making many fear that Israel wants to take even more land for good. In a twist that’s shocking some observers, parts of the Palestinian Authority are now working with Israeli forces during these raids. This shows just how divided things have become among Palestinians themselves. As global leaders keep their eyes on Gaza, people stuck in the West Bank wonder when — or if — anyone will step in to help them escape this nightmare.

More Videos

Invalid Query

The keyword entered was invalid, or we couldn't gather enough relevant information to construct a thread. Try checking the spelling or entering a broader search term. Often simple one-word terms are enough for our algorithms to build a detailed thread on the topic. Longer multi-word terms will refine the search but create a narrower information thread.

Politics

The latest uncensored news and conservative opinions in US, UK, and global politics.

get the latestLaw

In-depth legal analysis of the latest trials and crime stories from around the world.

get the latest