THREAD: tsmcs billion investment fedexs decline

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

US and ISRAEL REJECT $53 Billion Gaza Plan: A Bold Stand or Missed Opportunity?

— Egypt proposed a $53 billion plan to rebuild Gaza, gaining broad support but facing rejection from the U.S. and Israel. The White House criticized the plan, stating it ignores complex realities on the ground. Palestinians in Gaza strongly oppose any attempts to displace them, with some international voices warning forced relocation could be seen as ethnic cleansing.

U.S. HALTS Intelligence Sharing with UKRAINE: A New Era of European Uncertainty

The United States has stopped sharing intelligence with Ukraine amidst growing tensions in Europe. French President Macron cautioned Europe to prepare for a scenario where America might not be an ally anymore. Meanwhile, Sir Keir Starmer expressed readiness to deploy military resources for peace efforts in Ukraine at a recent defense summit.

APPLE’S $500 Billion Gamble: Can It Really Boost American Jobs?

— Apple has unveiled a groundbreaking $500 billion investment plan in the U.S. over the next four years. A new manufacturing facility in Houston, focused on AI servers, is part of this initiative. CEO Tim Cook highlighted this as a major push for American innovation and job creation.

The plan includes doubling Apple’s U.S. Advanced Manufacturing Fund to $10 billion, aiming to create 20,000 jobs. The Houston plant will cover 250,000 square feet and produce hardware for Apple Intelligence, their AI system. This comes amid trade tensions from tariffs on Chinese imports imposed by President Trump that affect tech sectors like chips.

Apple’s strategy appears aimed at countering trade challenges while competing with tech giants like Microsoft and Google in AI markets. Yet analysts question the feasibility of such an ambitious plan given Apple’s current capital of less than $160 billion and wonder if inflation-adjusted spending might actually decrease rather than increase real terms spending.

Questions persist about creating 20,000 jobs at an estimated cost of $25 million per job, casting doubt on Apple’s claims’ practicality. While Apple’s bold move seeks to navigate geopolitical pressures and market realities, its success remains uncertain amidst these challenges.

NEWSOM’S $39 BILLION Wildfire Plea: Is It Enough?

— California Governor Gavin Newsom is asking Congress for over $39 billion in federal aid. This request aims to help communities hit hard by recent wildfires around Los Angeles. Newsom warns these fires could become the most expensive natural disaster in U.S. history.

The aid package includes $9.61 billion for business recovery through loans and grants. These funds are meant for both immediate and long-term recovery, focusing on businesses severely affected by the firestorms.

Governor Newsom stressed the urgent need for public assistance, especially for schools impacted by the fires. At least 22 schools were damaged or destroyed, including 10 public or charter schools, highlighting a major blow to education infrastructure.

In his letter to Congress, Newsom thanked California lawmakers who quickly approved over $2.5 billion in state disaster relief for Los Angeles, showing how urgent it is to address wildfire recovery needs swiftly and effectively.

BATTERY GIANT’S $26 Billion Georgia Plant Cancelation Shocks Industry

— A massive battery manufacturing project in Georgia, worth $26 billion, has been unexpectedly canceled. This decision is causing concern across the industry as experts consider its impact on electric vehicle production and battery supply in the United States. The reasons for this abrupt cancelation are still under investigation, with regulatory challenges and market saturation being potential factors.

The plant was set to be a major player in the manufacturing sector, showcasing Georgia’s role in energy innovation. Its cancelation raises questions about future investments and projects within the state and beyond. Industry insiders are closely watching how this development will affect supply chains and production timelines for electric vehicles nationwide.

This news arrives amid ongoing discussions about energy sustainability initiatives across the U.S., marking a pivotal moment for stakeholders in both energy and automotive sectors. The project’s halt highlights the complexities of balancing regulatory demands with market needs, a challenge that continues to shape America’s industrial landscape.

BATTERY Giant’s SHOCKING Exit: $26 Billion Georgia Plant Scrapped

— A battery company has scrapped its plan for a $2.6 billion manufacturing plant in Georgia, sparking concerns about the future of electric vehicle (EV) production. This decision raises questions about the local economy and job market, which were expected to thrive from this project.

Details are limited, but the move follows struggles within the battery production sector. The plant was supposed to be a major supplier for EVs as part of a global shift toward sustainability and green technology.

Industry experts wonder if this decision will affect EV demand in Georgia and create challenges for other manufacturers expanding in the U.S., possibly impacting investments and economic growth in regions relying on such projects.

As events progress, stakeholders will keep a close watch on the viability of large investment projects linked to renewable energy and EV industries across America.

TRUMP’S $500 BILLION AI Move: A Bold Step for America’s Future

— President Donald TRUMP has announced a massive $500 billion investment in artificial intelligence infrastructure. This joint venture involves OpenAI, Oracle, and SoftBank. The initiative aims to build data centers, marking a significant technological advancement.

The project began during the Biden administration but has gained momentum under Trump’s leadership. This investment underscores the importance of AI for future economic growth and national security.

Trump’s announcement highlights his commitment to keeping America ahead in technology. The collaboration between these major companies is expected to drive innovation and create jobs across the country.

JANUARY 6 LAWSUIT: Defendants’ Bold $50 Billion Move Against Government

— Over 100 people charged in the January 6 Capitol riot are suing the government. They’re filing a $50 billion class-action lawsuit, claiming unfair targeting and mistreatment by the FBI. The lawsuit accuses political bias behind their harsh treatment and sentencing.

As Donald Trump gears up for his potential return, talks about pardons for January 6 defendants are heating up. Trump may consider clemency for some involved in the riots. The decision is tricky due to serious charges like seditious conspiracy, even though some defendants acted non-violently.

Attorney General Merrick Garland marked four years since the Capitol attack with a statement on legal actions against over 1,500 individuals involved. He stressed the Justice Department’s commitment to law and civil rights while holding those responsible accountable for that day’s violence.

These events highlight ongoing legal and political fallout from January 6, showcasing law enforcement’s response and court proceedings tied to this significant moment in recent history.

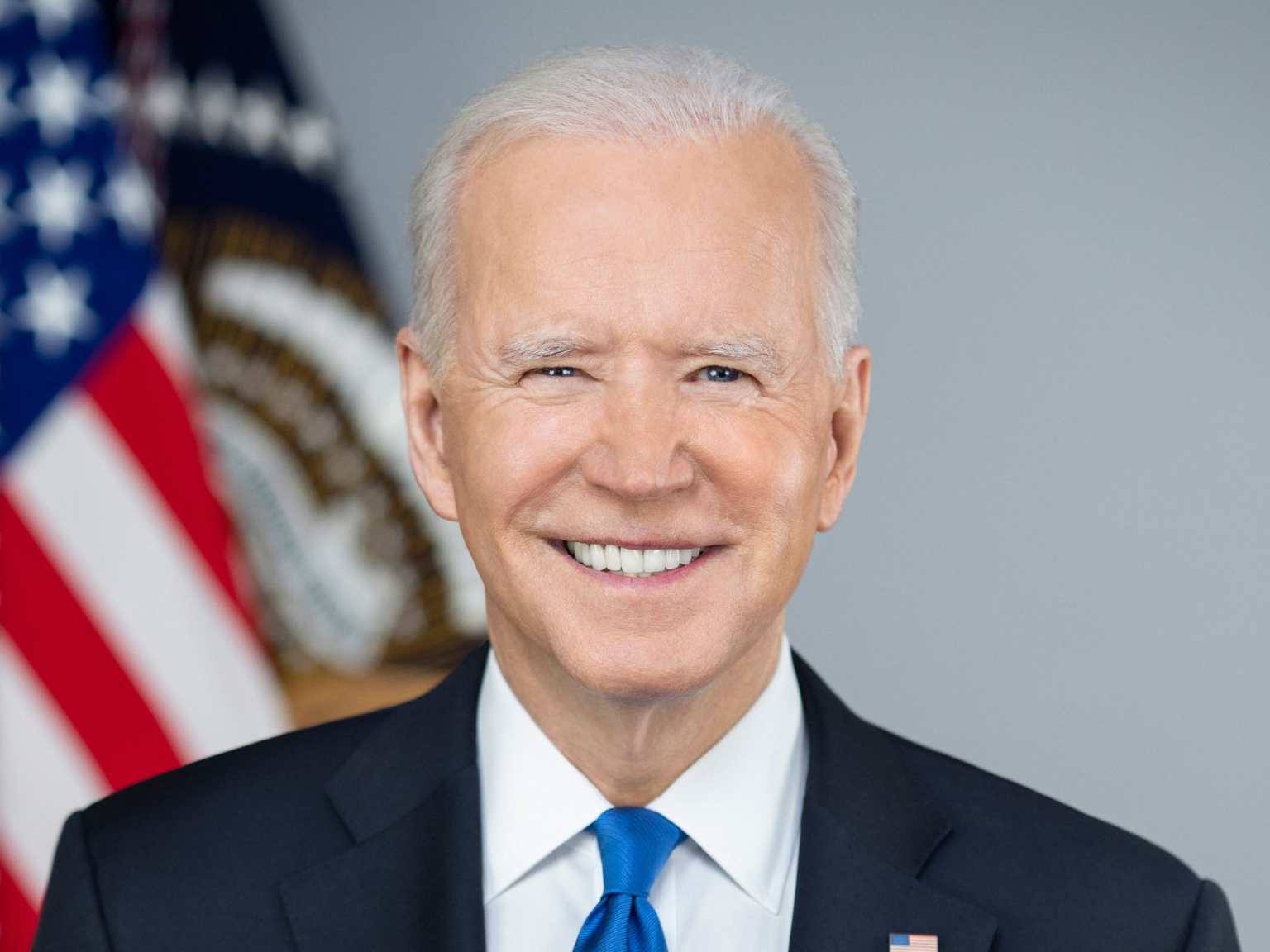

BIDEN’S $100 BILLION AID Plan: What It Means for America’s Future

— Congress has approved over $100 billion in emergency aid after a rush to finalize a government spending bill. This funding responds to hurricanes Helene and Milton, which caused major damage in the southeastern United States. President Joe Biden signed the bill, ensuring federal operations continue through March 14.

The disaster relief package covers more than just hurricane damage. It includes funds for rebuilding the Francis Scott Key Bridge in Baltimore, which collapsed after being hit by a container ship. The bill faced delays due to demands from President-elect Donald Trump, but Republicans passed a streamlined version without his key requests.

The Federal Emergency Management Agency (FEMA) will manage much of this funding through its disaster relief fund. This fund helps reimburse states and local governments for expenses like debris removal and overtime for emergency personnel during disasters. The aid aims to support recovery efforts across affected regions efficiently and promptly.

WORLD’S Largest Gold Discovery: China’s $83 Billion Treasure Unearthed

— Geologists in China have uncovered what is being called the largest gold deposit in the world. The find, located in Pingjiang County, Hunan Province, is valued at $83 billion. This discovery was made about 12 miles beneath the surface and includes 40 gold ore veins with a total of 300.2 tons of gold resources.

The Hunan Academy of Geology suggests there could be over 1,000 tons of gold reserves at depths beyond 3,000 meters. This major find highlights China’s position as the world’s top gold producer, contributing around 10% to global output in 2023.

This discovery comes amid rising bullion prices and growing interest in gold investments worldwide. As markets react to this news, it could heavily influence global economic strategies and investment trends.

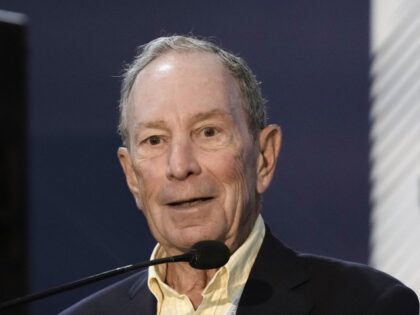

BLOOMBERG’S $1 Billion Gift Transforms Johns Hopkins Medical School

— Starting this fall, Bloomberg Philanthropies will cover tuition for Johns Hopkins medical students from families earning under $300,000 annually. This initiative aims to reduce student debt and increase opportunities.

Students from families making less than $175,000 a year will also have their living expenses and fees covered. Mike Bloomberg stated that more generous financial aid has made Johns Hopkins more economically diverse and selective.

The $1 billion gift will not only make medical school tuition-free for those with limited means but also boost financial aid for other graduate programs at Johns Hopkins. This move is expected to attract top students who might otherwise be deterred by financial constraints.

SENATE Triumphs: $953 Billion AID Package Passed Despite GOP Divisions

— The Senate, in a significant move early Tuesday, passed a $95.3 billion aid package. This substantial financial support is destined for Ukraine, Israel, and Taiwan. The decision comes despite challenging negotiations that have lasted months and growing political divisions within the Republican Party over America’s international role.

A select group of Republicans held the Senate floor throughout the night in opposition to the $60 billion earmarked for Ukraine. Their argument? The U.S. should first address its domestic issues before allocating more funds overseas.

However, 22 Republicans joined nearly all Democrats to pass the package with a 70-29 vote count. Supporters argued that ignoring Ukraine could potentially strengthen Russian President Vladimir Putin’s position and pose threats to global national security.

Despite this victory in Senate with strong GOP backing, uncertainty hangs over the bill’s future in House where hardline Republicans aligned with former President Donald Trump are opposing it.

Biden INKS $8863 Billion Defense Act, SLAMS Congressional Oversight

— President Joe Biden has put his signature on the National Defense Authorization Act, green-lighting a hefty $886.3 billion in spending. This act aims to equip our military with the means to deter future conflicts and provide support for service members and their families.

Despite giving his approval, Biden raised eyebrows with concerns over certain provisions. He argues these clauses excessively limit executive power in national security matters by calling for more congressional oversight.

According to Biden, these provisions could force the disclosure of highly sensitive classified information to Congress. There’s a risk this could expose crucial intelligence sources or military operational plans.

The extensive bill, which covers over 3,000 pages, sets out a policy agenda for the Department of Defense and U.S military but doesn’t earmark funding for specific initiatives or operations. Additionally, Biden voiced his ongoing concern about clauses barring Guantanamo Bay detainees from setting foot on U.S soil.

STOLTENBERG’S Pledge: NATO Commits a Whopping $25 Billion in Ammunition to UKraine Amid Russian Tensions

— NATO Secretary-General Jens Stoltenberg and Ukrainian President Volodymyr Zelenskyy convened on Thursday, amid rising tensions with Russia. Their meeting came on the heels of Russia’s allegations that Ukraine’s Western allies aided in a recent missile strike on the Black Sea Fleet’s base in Crimea.

Zelenskyy shared that Stoltenberg has committed to helping Ukraine secure more air defense systems. These are vital for safeguarding the nation’s power plants and energy infrastructure, which took a heavy hit during Russia’s aggressive attacks last winter.

Stoltenberg unveiled NATO contracts totaling 2.4 billion euros ($2.5 billion) for ammunition supplies destined for Ukraine, including Howitzer shells and anti-tank guided missiles. He stressed, “The stronger Ukraine becomes, the closer we get to halting Russia’s aggression.”

On Wednesday, Russian Foreign Ministry spokeswoman Maria Zakharova alleged that resources from the U.S., U.K., and NATO facilitated the attack on their Black Sea Fleet headquarters. Yet these claims remain unbacked by concrete evidence.

Video

“UKRAINE’S $2 Billion Defense Deal: A Bold Move Against Russia”

— British Prime Minister Keir Starmer has announced a major $2 billion deal with Ukraine. This agreement lets Ukraine buy 5,000 air-defense missiles, boosting its defense capabilities amid ongoing tensions with Russia. The deal highlights a strong partnership between the UK and Ukraine, facilitated through export finance.

In the Asia-Pacific region, geopolitical tensions are rising due to China’s assertive actions and North Korea’s provocations. These developments strain U.S.-China relations further, with trade disputes and export controls on critical technologies continuing. Analysts warn of possible retaliatory measures from Beijing that could affect multinational corporations in the area.

In U.S. politics, former President Donald Trump remains in the spotlight. He recently thanked Chief Justice for keeping him out of jail in a viral moment that sparked widespread discussion. Trump’s controversial comments about a Washington crash continue to fuel debates across the political spectrum.

Global stock markets are experiencing fluctuations influenced by economic indicators and geopolitical events. Indian markets have seen recovery due to positive global cues and lower crude prices but caution is essential for investors amid market volatility. These developments highlight how interconnected global economies are and emphasize strategic financial planning’s importance.

More Videos

Invalid Query

The keyword entered was invalid, or we couldn't gather enough relevant information to construct a thread. Try checking the spelling or entering a broader search term. Often simple one-word terms are enough for our algorithms to build a detailed thread on the topic. Longer multi-word terms will refine the search but create a narrower information thread.