THREAD: anglo american bold 500m nickel

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

GOLD PRICES Surge: Brace for Economic Shockwaves from New US Tariffs

— Gold prices have surged as investors brace for the U.S. “Liberation Day” tariff announcement. This has led to cautious trading, with businesses gearing up for possible economic shifts.

The jump in gold signals a move towards safety amid uncertainty over trade relations and policies under the current administration. Many companies are rethinking strategies due to potential tariff impacts.

Analysts worry about major economic fallout, especially for export-reliant industries. The business community is closely watching international reactions and possible retaliatory measures that could escalate global trade tensions.

TRUMP’S Tarif Actions Spark Gold Rush Over $3,100

— Gold prices have soared past $3,100 per ounce for the first time. Concerns over President Donald Trump’s tariffs and geopolitical tensions are pushing investors to seek safety in gold. This surge shows market anxiety about potential economic impacts from U.S. policy changes.

President Trump plans to announce a new round of tariffs on Wednesday, dubbing it “liberation day.” These actions are expected to significantly influence currency markets. ING analysts suggest that the USD might benefit from these tariff announcements as global trade dynamics shift.

Meanwhile, futures markets are dipping as investors brace for upcoming tariff implementations and their broader economic effects. The uncertainty surrounding these policies is causing volatility across various financial sectors.

In related news, China’s major state-owned banks are raising substantial funds to support their economy amid global financial shifts. Beijing’s support highlights the interconnectedness of international markets during this period of heightened tension and change.

GOGOLD’S $75M WINDFALL: A Strategic Financial Move

— GoGold Resources Inc. just announced a major financial boost, securing C$75 million through a bought deal financing. The agreement involves a group of underwriters led by BMO Capital Markets. This move aims to strengthen GoGold’s financial position and support future projects.

The financing is exclusive to Canadian markets since the securities aren’t registered under U.S. law. GoGold stresses that these securities can’t be offered or sold in the U.S. without compliance, showing its commitment to regulatory standards while expanding its capital base.

The press release warns about “forward-looking information,” pointing out potential risks and uncertainties in their plans and expectations. Investors should consider these factors when thinking about joining this financing round. GoGold’s decision shows confidence in its growth strategy despite market challenges and opportunities.;

MAGNACHIP’S BOLD Shift: Power Move to Boost Profits

— Magnachip Semiconductor Corporation is shifting gears to focus solely on its Power business. This decision comes after a thorough review by the Board of Directors and management. The goal is clear: boost revenue growth and maximize shareholder value.

The company plans to explore options for its Display business, which will be marked as discontinued in Q1 2025 results. Possible paths include selling, merging, forming a joint venture, licensing, or winding down operations. Magnachip aims for steady profitability and earnings growth during this shift.

By Q4 2025, Magnachip targets quarterly Adjusted EBITDA break-even from ongoing operations. It plans for positive adjusted operating income by 2026 and positive adjusted free cash flow in 2027. The Power segment caters to broader markets with longer product cycles compared to the smartphone-centric Display segment.

MAGNACHIP’S BOLD Move: Shift to Power Business Promises Big Profits

— Magnachip Semiconductor Corporation is making a bold shift to focus solely on its Power business. This strategic move, decided by the Board and management, aims to boost revenue growth and increase shareholder value.

The company plans to phase out its Display segment, classifying it as discontinued in the next Q1 results. Options like selling or merging this segment are on the table. The goal is clear: ensure steady profits and keep shareholders happy.

Magnachip aims for quarterly break-even by Q4 2025 and expects positive operating income by 2026. By 2027, they foresee positive free cash flow. The Power business will target stable markets with long product cycles, unlike the unpredictable smartphone market of their Display segment.

METAL STOCKS Soar: Investors Cheer Global Demand Boom

— METAL stocks like Tata Steel, Hindalco, and Vedanta are seeing a rise of up to 4% in share prices. This jump is due to favorable global market conditions and increased demand for metals. Investors feel hopeful about the sector’s future.

Tata Steel shares have climbed about 4%, thanks to positive quarterly results and higher production forecasts. Hindalco gains from rising aluminum prices and a brighter outlook as global demand increases.

Vedanta’s shares are also climbing because of strong performance and smart strategies to boost production efficiency. These companies’ gains show broader economic conditions that favor raw material demand.

Market experts point to international trade dynamics, better supply chains, and more infrastructure spending worldwide for this bullish trend. These factors boost investor confidence in METAL stocks amid growing global need for raw materials.

SUPREMEX CFO Exit Sparks Strategic Shift

— Supremex Inc., a key player in North America’s envelope and packaging market, announced the exit of its Chief Financial Officer, François Bolduc. Known for its strong industry presence, this leadership change hints at a possible strategic shift as Supremex faces future challenges.

To ensure stability during this transition, Supremex has Stewart Emerson working closely with the finance team. This plan aims to keep operations steady while searching for Bolduc’s replacement. The company is dedicated to finding a new CFO soon.

The hunt for a new CFO will start shortly, showing Supremex’s proactive stance on leadership changes. Investors and stakeholders are watching closely as the company advances with this process. Stay tuned for updates on how this may affect Supremex’s market strategies and performance.

TRUMP and Zelenskiy’s BOLD Minerals Deal: A Game-Changer Without Security Guarantees

— President TRUMP announced that Ukrainian President Zelenskiy will visit Washington on Friday. The purpose of the visit is to sign a significant minerals deal. This follows a recent tense exchange between the two leaders.

The draft agreement focuses on critical minerals, crucial for various industries, but notably omits U.S. security guarantees for Ukraine. This omission may raise concerns about Ukraine’s strategic position in the region.

Despite previous tensions, both leaders seem eager to finalize this economic agreement. The deal highlights the importance of resource access over military assurances in current U.S.-Ukraine relations.

GOLD Prices PLUMMET Amid Trade WAR Jitters

— Gold prices took a big hit on Tuesday as traders cashed in profits with US Treasury bond yields falling. The XAU/USD pair saw a noticeable drop during the North American session. President Trump’s tariff threats against Mexico and Canada added to market uncertainty, affecting investor choices.

The decline in gold prices marks a change from the previous session’s record highs, driven by fears about Trump’s trade policies. Investors are reacting to possible instability in global markets, leading them to take profits.

This market shift highlights ongoing worries about economic stability and trade relations under the current administration. As traders adjust their positions, gold’s recent rally seems to be losing momentum amid these geopolitical tensions.

ANGLO AMERICAN’S Bold $500M Nickel Sale: A Strategic Shift

— Anglo American has sold its nickel business for $500 million. This move lets the mining giant focus on copper and iron operations. The decision follows a rejected takeover attempt by BHP, signaling a strategic shift in focus.

Insolvencies are rising in England and Wales due to economic pressures. Fladgate LLP reports more administration cases, showing a tough business climate in early 2025. Economic turbulence may lead to more insolvencies as businesses struggle to adapt.

A Northampton business owner is under investigation for allegedly issuing fake fire safety certificates for high-rise flats. The accusations include stealing credentials and signatures from another engineer, raising serious safety concerns.

Elliott Management has taken a short position against Nvidia, betting on at least $600 million in downside exposure. The firm labeled Nvidia as a “bubble,” reflecting skepticism over its market valuation amid AI sector growth concerns.

/Super%20Micro%20Computer%20Inc%20HQ%20photo-by%20Tada%20Images%20via%20Shutterstock.jpg)

SUPER MICRO Stock Skyrockets: Investors Cheer Bold 2026 Goals

— Super Micro’s stock jumped after the company set bold goals for 2026, calming investor worries about its future. Despite controversies and a Department of Justice probe into its accounting, Super Micro is working to stabilize. The company hired a new accountant and announced an independent review found no wrongdoing.

Nasdaq gave Super Micro more time to submit filings by February 25, which the company plans to meet. This extension follows a tough year with challenges noted in the Hindenburg report. Investors reacted positively to these updates, causing stock prices to soar after the business update on February 11.

BOLD Heist ROCKS London: Community Demands Action

— A jewelry store in London faced a shocking heist on February 11, 2025. Masked thieves broke in during the early morning, stealing high-value items. Witnesses reported loud noises and saw the suspects fleeing in a vehicle later found abandoned nearby.

Police have sealed off the area and are collecting evidence, including CCTV footage from local businesses. Detective Chief Inspector Sarah Thompson assured, “We are doing everything possible to capture those responsible for this brazen act.” Officers are also conducting house-to-house inquiries for more information.

Residents expressed shock and worry over safety after the incident. One local mentioned how frightening it is when such crimes happen close to home. Police urge anyone with information to come forward and remind people to report suspicious activity quickly.

As investigations continue, there is growing demand for better security measures in the area to prevent future incidents. The community remains shaken by this daring crime, highlighting concerns about local safety needs.

GOLD PRICES Skyrocket: Trump’s Bold Tariffs Spark Investor Panic

— Gold prices have soared to nearly $2,950 per ounce after President Trump announced new tariffs on steel and aluminum imports. Investors are rushing to gold, seeing it as a safe haven amid fears of a global trade war. This surge shows rising concerns about market instability and potential economic fallout.

The tariffs have caused big swings in both commodities and stock markets, with gold seeing the most dramatic rise. Analysts caution that these actions might lead to retaliation from other countries, making international trade relations even more complex.

Investors are keeping a close eye on U.S.-China trade talks since any changes could affect gold’s future path in the market. The situation is still developing, leaving many worried about the wider effects on global economic stability.

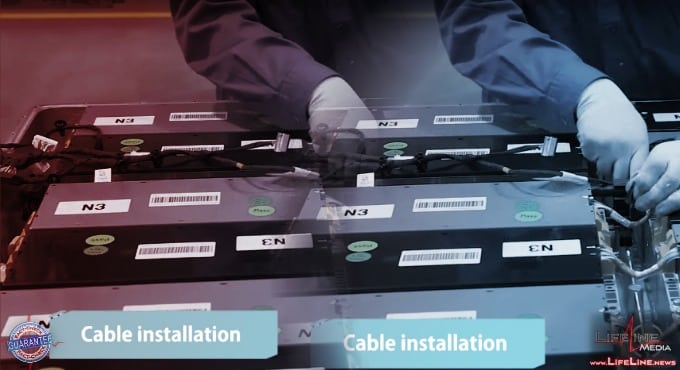

BATTERY Giant’s SHOCKING Exit: $26 Billion Georgia Plant Scrapped

— A battery company has scrapped its plan for a $2.6 billion manufacturing plant in Georgia, sparking concerns about the future of electric vehicle (EV) production. This decision raises questions about the local economy and job market, which were expected to thrive from this project.

Details are limited, but the move follows struggles within the battery production sector. The plant was supposed to be a major supplier for EVs as part of a global shift toward sustainability and green technology.

Industry experts wonder if this decision will affect EV demand in Georgia and create challenges for other manufacturers expanding in the U.S., possibly impacting investments and economic growth in regions relying on such projects.

As events progress, stakeholders will keep a close watch on the viability of large investment projects linked to renewable energy and EV industries across America.

TRUMP’S Trade WAR Ignites Gold Rush And Market Turmoil

— Gold prices have hit a record high as investors flock to safe assets amid President Donald Trump’s new tariffs. These measures target imports from Canada, China, and Mexico, sparking worries about inflation and economic growth. JP Morgan is optimistic about gold, urging investors to buy during this dip.

Wall Street braces for losses due to fears of an escalating trade war from Trump’s tariff actions. The 25% tariffs on Canada and Mexico and 10% on China may cause “short-term” pain for Americans, according to Trump. Global markets watch cautiously as these policies unfold.

Oil prices are climbing in response to the tariffs, while metal and agricultural commodities face pressure downward. The financial landscape is shifting with markets adjusting to a potential prolonged trade conflict led by the U.S., causing the dollar to gain strength amid global trade uncertainty.

APTIV STOCK Skyrockets After Bold Business Move

— Aptiv plans to spin off its electrical distribution systems (EDS) into a new company. This bold move lets Aptiv focus on advanced driver-aid technology. After the announcement, Aptiv’s shares soared by 5%.

Analysts point out that EDS has lower profit margins. The adjusted EBITDA margin for EDS is expected to be 9.5% in 2024, while Aptiv’s other operations boast an 18.8% margin.

Garrett Nelson from CFRA Research supports the spin-off, saying it aligns with Aptiv’s push toward high-margin growth areas. This strategic shift could enhance Aptiv’s future profitability and market position.

AMAZON’S BOLD Move: New South Africa Center Shakes UP Market

— Amazon has opened a new center in Cape Town, South Africa, to support its independent sellers. This is part of Amazon’s plan to grow its market share and compete with local leader Takealot, owned by Naspers. The center aims to help sellers attract more customers and expand Amazon’s product range, potentially boosting revenue.

APPLE’s CHINA TROUBLES: iPhone Shipments PLUMMET

Apple shares fell 3.2% after research firm Canalys reported a 17% drop in iPhone shipments in China for 2024. This decline pushed Apple down to third place in China’s market share rankings. Despite the stock’s volatility, this news is significant but doesn’t drastically change the company’s business outlook.

STOCK MARKET SLUMP: Earnings Reports RATTLE Investors

The stock market took a hit following Wednesday’s rally due to retail sales data and major bank earnings reports taking the spotlight. Analysts remain hopeful about gains for the S&P 500 by year-end despite current swings. Focus is also on upcoming hearings on tariff plans before President-elect Donald Trump that could affect future economic strategies moving forward.

WORLD’S Largest Gold Discovery: China’s $83 Billion Treasure Unearthed

— Geologists in China have uncovered what is being called the largest gold deposit in the world. The find, located in Pingjiang County, Hunan Province, is valued at $83 billion. This discovery was made about 12 miles beneath the surface and includes 40 gold ore veins with a total of 300.2 tons of gold resources.

The Hunan Academy of Geology suggests there could be over 1,000 tons of gold reserves at depths beyond 3,000 meters. This major find highlights China’s position as the world’s top gold producer, contributing around 10% to global output in 2023.

This discovery comes amid rising bullion prices and growing interest in gold investments worldwide. As markets react to this news, it could heavily influence global economic strategies and investment trends.

— Cheaper High-Speed Rail Alternative Proposed After HS2 Northern Leg Cancellation A new plan for a cost-effective high-speed rail option has been introduced, promising to be only 15 minutes longer than the original HS2 northern leg

— Cheaper High-Speed Rail Proposal Unveiled as HS2 Northern Leg Scrapped A new plan promises a cost-effective high-speed alternative to the abandoned northern section of HS2, claiming only a 15-minute increase in travel time compared to original designs

— S&P 500 Ends Lower on Friday, Yet AI Trading Sparks 145% Surge in First Half of 2024

CHINA’S Failed Nicaragua Canal: A Symbol of Lost Ambitions

— The Interoceanic Grand Canal, also known as the Nicaragua Canal, was a bold initiative intended to link the Atlantic and Pacific Oceans via Central America’s largest lake. Daniel Ortega’s government in Nicaragua promoted this $50 billion project as a competitor to the Panama Canal. It also risked boosting China’s influence in the region with a 50-year lease given to HKND Group, led by Chinese tycoon Wang Jing.

Despite breaking ground in December 2014 amid much celebration, no substantial progress ensued. Wang Jing saw his wealth plummet by 85% shortly thereafter. By 2021, he and his company were ousted from the Shanghai Stock Exchange due to unethical practices, signaling a sharp fall from their lofty ambitions.

Following these setbacks, Nicaragua’s National Assembly enacted legal reforms at Ortega’s behest. They annulled previous laws that had granted canal concessions and declared these changes essential for “strengthening” Nicaragua’s legal framework for improved national governance. Critics suggest these actions were mere attempts to recover dignity following an embarrassing failure

In sum, while initially seen as a strategic geopolitical move and economic boon for Nicaragua, the failed canal project has instead become emblematic of overreach and mismanagement under Ortega’s rule.

— Alphabet Stock Surges: 14% Increase Post Strong Earnings and Debut Dividend

— Stellantis’ Profit Slides as Detroit Three Strikes Take a Toll Jeep and Dodge manufacturer, Stellantis, experiences a decline in profits due to ongoing strikes by the Detroit Three automakers

US STEEL Takeover: BLOCKING Japanese Buyout Could Save American Jobs

— Nippon Steel, Japan’s leading steel company, is facing a storm of criticism over its planned $14 billion acquisition of U.S. Steel Corporation. The deal, unveiled on Monday, values U.S. Steel at $55 per share and has sparked immediate opposition, especially in the Rust Belt where U.S. Steel has been a cornerstone since 1901.

Despite U.S. Steel’s assurances that the merger would unite “two storied companies with rich histories,” lawmakers are demanding action. Senators J.D. Vance (R-OH), Josh Hawley (R-MO), and Marco Rubio (R-FL) have written to Treasury Secretary Janet Yellen urging the Committee on Foreign Investment in the United States (CFIUS) to halt the deal.

The senators contend that domestic steel production is vital for national security and needs careful scrutiny before permitting foreign investment. CFIUS, led by Yellen, holds the authority to stop such investments after a review process.

While experts predict CFIUS is more likely to block deals involving countries perceived as adversaries like Russia or China rather than allies like Japan, this situation highlights bipartisan worries about foreign control over crucial industries.

Video

BRITISH PM’S Bold Housing Plan: 15 Million Homes to FIX Crisis

— British Prime Minister Keir Starmer has announced a plan to tackle the UK’s housing crisis by building 1.5 million homes over the next five years. This initiative aims to address the severe shortage of housing and create jobs in the construction sector.

The plan includes government-led projects and incentives for private developers, focusing on sustainable urban planning and energy-efficient homes. This aligns with broader goals to reduce carbon emissions and combat climate change.

Critics question whether the government can secure adequate funding and navigate bureaucratic challenges to achieve this ambitious goal. Despite these concerns, the government cites past successes in large-scale infrastructure as evidence of its capability.

More Videos

Invalid Query

The keyword entered was invalid, or we couldn't gather enough relevant information to construct a thread. Try checking the spelling or entering a broader search term. Often simple one-word terms are enough for our algorithms to build a detailed thread on the topic. Longer multi-word terms will refine the search but create a narrower information thread.

Politics

The latest uncensored news and conservative opinions in US, UK, and global politics.

get the latestLaw

In-depth legal analysis of the latest trials and crime stories from around the world.

get the latest

Social Chatter

What the World is SayingOn April 18, 1775, Paul Revere set out on a midnight ride that would help ignite the American Revolution. Two hundred and fifty years later, we remember his courage—and the enduring spirit...

. . .Had a thoughtful conversation with @bbcnickrobinson about leadership, tough decisions, and the lessons you take from them. We also spoke about Britain’s challenges, faith, and why I’m proud...

. . .Choice between ETFs. Choice between ETFs To choose, for a very long term investment will you go with Amundi MSCI World UCITS ETF LU1681043599 alone or FRO011550193 BNPP STOXX 600C + FRO011871110 AM NSDQ 100 (50/50)?

. . .Mizuno Pro S & X - Our Pride... Your Play. Mizuno Pro S & X - Our Pride... Your Play "Frankly astounding" Introducing the ALL NEW Mizuno Pro S & X golf balls.

. . .Why Actelis Networks (ASNS) Is a Hidden Value Pick. Why Actelis Networks (ASNS) Is a Hidden Value Pick Actelis Networks, Inc. (NASDAQ: ASNS) is quietly positioning itself as a standout opportunity for savvy investors looking for undervalued small-cap stocks with growth potential. Here’s why this company deserves your attention right now: **1. Solid ...

. . .