THREAD: battery giant 26 billion georgia

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

SPAIN BLACKOUT Shock: Massive Power Outage Leaves Millions Fearful and Stranded

— A huge blackout hit Spain on April 29, 2025, throwing much of the country into confusion. Cities and towns across the Iberian Peninsula lost power, leaving families in the dark and daily routines shattered. The sudden outage brought public transportation to a halt. Hospitals scrambled to keep critical care running on backup generators. Many people rushed to grocery stores for supplies, worried about how long the lights would stay off. Officials are still searching for answers about what caused this disaster. Emergency crews have been sent out as many neighborhoods remain without electricity. European leaders are watching closely as concerns grow over energy security. Stay with LifeLine News for more breaking updates as this story develops.

US-CHINA IMPORT Tariffs Spark Fear and Chaos for Businesses

— A new 50% tariff on Chinese goods like smartphones and batteries will slam American businesses starting April 2025. This is the latest move in a trade fight that began with President Trump’s tough stance on China, which included a massive 145% tariff. Now, companies from small shops in Vermont to big airlines like Delta warn of higher prices and supply chain headaches. Goldman Sachs CEO David Solomon says business leaders would prefer lower tariffs, but many understand the need to protect U.S. interests. The European Union has blasted these tariffs as harmful taxes that could shake up the global economy. Small businesses are struggling too. Some local shops using American-made products may not feel much pain, but many others report shrinking profits and less hope for growth, according to the National Federation of Independent Business. Stock markets have dropped as worries grow over what comes next. Export-heavy countries like Germany are also feeling pressure as U.S. trade policies send shockwaves around the world. This story is still unfolding as businesses watch for more changes ahead.

BOEING’S Bold $105 Billion Sale Sparks Hope For American Manufacturing

— Boeing is selling its navigation and flight planning tech businesses to Thoma Bravo, a private equity firm, for $10.5 billion in cash. The move aims to cut Boeing’s huge debt and help the company refocus on building planes — its main business. Nearly 4,000 workers are part of this digital unit, but not all of them or their projects are included in the sale. Some technology will stay with Boeing even after the deal wraps up, which should happen by late 2025. Boeing’s CEO said this sale is key to getting back on track and keeping the company strong financially. He believes it will help protect Boeing’s credit rating and allow leaders to focus on what matters most. Many conservatives view this as a smart return to basics at a time when America needs strong manufacturing jobs — not more risky side projects or growing debt loads.

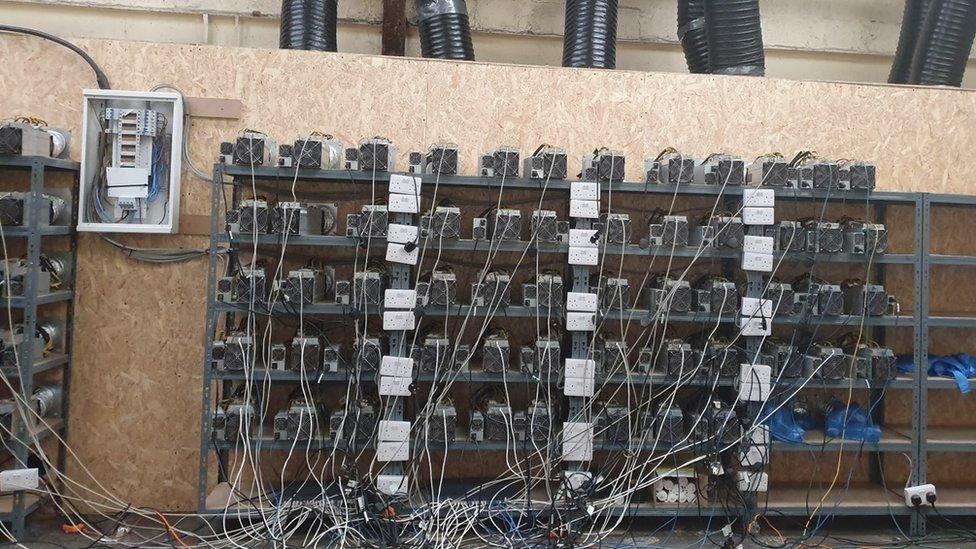

UK ENERGY THEFT Surge: Families Desperate as Bills Spike and Dangers Grow

— Energy theft is exploding across the UK as families battle record-high bills in 2025. Reports from Crimestoppers show more people are tampering with meters or making illegal hookups. The latest government price cap hike and the cost-of-living crisis are pushing many to take risky steps just to keep the lights on. Experts say this is not just about money — it’s a real danger. Messing with gas lines or meters can cause deadly fires and explosions, putting whole neighborhoods at risk. There have already been tragic deaths linked to these desperate acts. The financial toll is massive too. Stolen energy now costs an estimated £1.5 billion each year, while total energy debt in Britain has soared to a record £3.9 billion — more than double what it was before the crisis. Lawmakers say urgent action is needed, like better home insulation and lower rates for struggling families. Critics argue current government help isn’t enough, warning that without stronger action, both public safety and the UK’s entire energy system could be in trouble.

GOGOLD’S $75M WINDFALL: A Strategic Financial Move

— GoGold Resources Inc. just announced a major financial boost, securing C$75 million through a bought deal financing. The agreement involves a group of underwriters led by BMO Capital Markets. This move aims to strengthen GoGold’s financial position and support future projects.

The financing is exclusive to Canadian markets since the securities aren’t registered under U.S. law. GoGold stresses that these securities can’t be offered or sold in the U.S. without compliance, showing its commitment to regulatory standards while expanding its capital base.

The press release warns about “forward-looking information,” pointing out potential risks and uncertainties in their plans and expectations. Investors should consider these factors when thinking about joining this financing round. GoGold’s decision shows confidence in its growth strategy despite market challenges and opportunities.;

MAGNACHIP’S BOLD Shift: Power Move to Boost Profits

— Magnachip Semiconductor Corporation is shifting gears to focus solely on its Power business. This decision comes after a thorough review by the Board of Directors and management. The goal is clear: boost revenue growth and maximize shareholder value.

The company plans to explore options for its Display business, which will be marked as discontinued in Q1 2025 results. Possible paths include selling, merging, forming a joint venture, licensing, or winding down operations. Magnachip aims for steady profitability and earnings growth during this shift.

By Q4 2025, Magnachip targets quarterly Adjusted EBITDA break-even from ongoing operations. It plans for positive adjusted operating income by 2026 and positive adjusted free cash flow in 2027. The Power segment caters to broader markets with longer product cycles compared to the smartphone-centric Display segment.

MAGNACHIP’S BOLD Move: Shift to Power Business Promises Big Profits

— Magnachip Semiconductor Corporation is making a bold shift to focus solely on its Power business. This strategic move, decided by the Board and management, aims to boost revenue growth and increase shareholder value.

The company plans to phase out its Display segment, classifying it as discontinued in the next Q1 results. Options like selling or merging this segment are on the table. The goal is clear: ensure steady profits and keep shareholders happy.

Magnachip aims for quarterly break-even by Q4 2025 and expects positive operating income by 2026. By 2027, they foresee positive free cash flow. The Power business will target stable markets with long product cycles, unlike the unpredictable smartphone market of their Display segment.

APPLE’S $500 Billion Gamble: Can It Really Boost American Jobs?

— Apple has unveiled a groundbreaking $500 billion investment plan in the U.S. over the next four years. A new manufacturing facility in Houston, focused on AI servers, is part of this initiative. CEO Tim Cook highlighted this as a major push for American innovation and job creation.

The plan includes doubling Apple’s U.S. Advanced Manufacturing Fund to $10 billion, aiming to create 20,000 jobs. The Houston plant will cover 250,000 square feet and produce hardware for Apple Intelligence, their AI system. This comes amid trade tensions from tariffs on Chinese imports imposed by President Trump that affect tech sectors like chips.

Apple’s strategy appears aimed at countering trade challenges while competing with tech giants like Microsoft and Google in AI markets. Yet analysts question the feasibility of such an ambitious plan given Apple’s current capital of less than $160 billion and wonder if inflation-adjusted spending might actually decrease rather than increase real terms spending.

Questions persist about creating 20,000 jobs at an estimated cost of $25 million per job, casting doubt on Apple’s claims’ practicality. While Apple’s bold move seeks to navigate geopolitical pressures and market realities, its success remains uncertain amidst these challenges.

ANGLO AMERICAN’S Bold $500M Nickel Sale: A Strategic Shift

— Anglo American has sold its nickel business for $500 million. This move lets the mining giant focus on copper and iron operations. The decision follows a rejected takeover attempt by BHP, signaling a strategic shift in focus.

Insolvencies are rising in England and Wales due to economic pressures. Fladgate LLP reports more administration cases, showing a tough business climate in early 2025. Economic turbulence may lead to more insolvencies as businesses struggle to adapt.

A Northampton business owner is under investigation for allegedly issuing fake fire safety certificates for high-rise flats. The accusations include stealing credentials and signatures from another engineer, raising serious safety concerns.

Elliott Management has taken a short position against Nvidia, betting on at least $600 million in downside exposure. The firm labeled Nvidia as a “bubble,” reflecting skepticism over its market valuation amid AI sector growth concerns.

BATTERY GIANT’S $26 Billion Georgia Plant Cancelation Shocks Industry

— A massive battery manufacturing project in Georgia, worth $26 billion, has been unexpectedly canceled. This decision is causing concern across the industry as experts consider its impact on electric vehicle production and battery supply in the United States. The reasons for this abrupt cancelation are still under investigation, with regulatory challenges and market saturation being potential factors.

The plant was set to be a major player in the manufacturing sector, showcasing Georgia’s role in energy innovation. Its cancelation raises questions about future investments and projects within the state and beyond. Industry insiders are closely watching how this development will affect supply chains and production timelines for electric vehicles nationwide.

This news arrives amid ongoing discussions about energy sustainability initiatives across the U.S., marking a pivotal moment for stakeholders in both energy and automotive sectors. The project’s halt highlights the complexities of balancing regulatory demands with market needs, a challenge that continues to shape America’s industrial landscape.

BATTERY Giant’s SHOCKING Exit: $26 Billion Georgia Plant Scrapped

— A battery company has scrapped its plan for a $2.6 billion manufacturing plant in Georgia, sparking concerns about the future of electric vehicle (EV) production. This decision raises questions about the local economy and job market, which were expected to thrive from this project.

Details are limited, but the move follows struggles within the battery production sector. The plant was supposed to be a major supplier for EVs as part of a global shift toward sustainability and green technology.

Industry experts wonder if this decision will affect EV demand in Georgia and create challenges for other manufacturers expanding in the U.S., possibly impacting investments and economic growth in regions relying on such projects.

As events progress, stakeholders will keep a close watch on the viability of large investment projects linked to renewable energy and EV industries across America.

NIKOLA’S Financial Freefall: What It Means for the Electric Truck Industry

— Nikola, the electric-truck maker, faces financial restructuring as its market value drops from $30 billion to just $63 million. This sharp decline shows serious financial trouble within the company. Investors are keeping a close eye on how Nikola handles these stormy times.

KLARNA’S BOLD MOVE: Chasing a $15 BILLION US IPO

Fintech giant Klarna plans a US IPO in April, aiming for a valuation of up to $15 billion. If successful, it would be one of the biggest listings this year. This move highlights Klarna’s drive to grow its influence in the competitive fintech world.

PRINCIPAL FINANCIAL’S Q4 SUCCESS: A Beacon Amid Economic Uncertainty

Principal Financial reported strong fourth-quarter earnings with a 12% revenue increase year-over-year, reaching $4.75 billion. Earnings per share rose to $1.94 from last year’s $1.83, showing solid growth and key performance metrics for investors amid economic uncertainties.

TECH GIANTS Spark Stock Market Surge: What Investors Need to Know

— The STOCK MARKET is seeing a surge, with predictions of a 0.49% rise. This optimism comes from major tech companies, whose earnings reports are expected to beat estimates. Investors are eagerly awaiting these results, fueling excitement across the market.

However, concerns about rising interest rates could dampen this enthusiasm. While the outlook remains positive now, potential rate hikes might impact investor sentiment soon. Market participants stay cautious as they navigate these mixed signals.

Besides stock market news, debates continue over a new lunch plan proposed by a coalition that may affect small businesses’ futures. Stakeholders are split on the possible effects of these changes, highlighting ongoing challenges in balancing economic growth with regulations.

CHINA’S AI Threat: Tech Stocks in Danger of $1 Trillion Wipeout

— Chinese AI startup DeepSeek has shaken global tech stocks, sparking fears about America’s technological advantage. Investors worry about a potential $1 trillion loss in tech value due to rising foreign competition.

The drop in tech shares shows growing concern over the competitive landscape. Major indices have fallen, urging investors to be cautious as the situation develops.

This happens amid wider talks on global trade and economic competitiveness, especially in tech-heavy areas. Experts recommend reassessing portfolios, favoring stable investments over risky tech stocks.

Market analysts emphasize watching these changes closely as they could affect market stability and growth prospects in the technology sector moving forward.

APTIV STOCK Skyrockets After Bold Business Move

— Aptiv plans to spin off its electrical distribution systems (EDS) into a new company. This bold move lets Aptiv focus on advanced driver-aid technology. After the announcement, Aptiv’s shares soared by 5%.

Analysts point out that EDS has lower profit margins. The adjusted EBITDA margin for EDS is expected to be 9.5% in 2024, while Aptiv’s other operations boast an 18.8% margin.

Garrett Nelson from CFRA Research supports the spin-off, saying it aligns with Aptiv’s push toward high-margin growth areas. This strategic shift could enhance Aptiv’s future profitability and market position.

TRUMP’S $500 BILLION AI Move: A Bold Step for America’s Future

— President Donald TRUMP has announced a massive $500 billion investment in artificial intelligence infrastructure. This joint venture involves OpenAI, Oracle, and SoftBank. The initiative aims to build data centers, marking a significant technological advancement.

The project began during the Biden administration but has gained momentum under Trump’s leadership. This investment underscores the importance of AI for future economic growth and national security.

Trump’s announcement highlights his commitment to keeping America ahead in technology. The collaboration between these major companies is expected to drive innovation and create jobs across the country.

CALIFORNIA BATTERY Plant In Flames: Evacuations Spark Safety Fears

— A massive FIRE has erupted at one of the world’s largest battery plants in California, forcing evacuations. Authorities have ordered nearby areas to clear out due to safety concerns. This plant is vital for producing batteries that support California’s renewable energy goals.

The blaze has raised fears about the dangers of large-scale battery manufacturing, including chemical exposure and toxic fumes. Firefighting crews are working hard to control the fire and stop it from spreading further. Emergency services are keeping residents updated on safety measures and evacuation plans.

This incident highlights California’s challenges with new energy technologies amid environmental crises like extreme wildfires. The state’s infrastructure and emergency response will be under scrutiny as events progress. More updates will be needed to assess the fire’s containment and ensure resident safety in surrounding areas.

CHINA’S Record Trade Surplus Sparks Global Alarm

— In December 2024, CHINA reached a record trade surplus of $104.8 billion. This was due to a surge in exports before President-elect Donald Trump could impose tariffs. The New York Times reported that China’s export boom is causing friction with many trade partners, not just the United States. Several nations are now erecting tariff barriers against Chinese products to protect their markets.

China’s export success has been an economic boon, creating millions of jobs in sectors like manufacturing and engineering. The nation dominates industries such as solar panels and is becoming self-sufficient in areas like commercial jets. However, China still struggles with energy independence outside solar power.

The automobile industry showcases China’s manufacturing strength, evolving from a major importer to the world’s largest car exporter in two decades. Critics argue that China’s overcapacity and government subsidies distort global auto markets by flooding them with cheap vehicles amid declining local demand.

While record exports might seem beneficial for China, they could lead to financial strain if companies face bankruptcy due to low prices and excess inventory as tariff barriers persist globally. The auto industry may have peaked, facing strong resistance from politically influential foreign markets protecting their own electric vehicle sectors through tariffs and subsidies.

— Alabama Leads Nation in Prison Labor Contracts The state has a longstanding and lucrative history of outsourcing prisoner labor to private companies

WORLD’S Largest Gold Discovery: China’s $83 Billion Treasure Unearthed

— Geologists in China have uncovered what is being called the largest gold deposit in the world. The find, located in Pingjiang County, Hunan Province, is valued at $83 billion. This discovery was made about 12 miles beneath the surface and includes 40 gold ore veins with a total of 300.2 tons of gold resources.

The Hunan Academy of Geology suggests there could be over 1,000 tons of gold reserves at depths beyond 3,000 meters. This major find highlights China’s position as the world’s top gold producer, contributing around 10% to global output in 2023.

This discovery comes amid rising bullion prices and growing interest in gold investments worldwide. As markets react to this news, it could heavily influence global economic strategies and investment trends.

— Nvidia Set to Release Q3 Earnings Today The tech giant will unveil its third-quarter financial results after market close, drawing attention from investors and analysts alike

— Three Mile Island Restart: A Potential Nuclear Energy Revolution The planned restart of the Three Mile Island facility signals a pivotal moment for nuclear energy amid increasing interest from Big Tech companies

— Alphabet Reports Strong Earnings, Driven by Cloud Growth The tech giant exceeded expectations in both revenue and profit, thanks to a significant increase in cloud services

— Tesla Stock Soars 22% on Musk’s Bold 2025 Growth Forecast The electric vehicle giant experienced its best trading day in over a decade following CEO Elon Musk’s optimistic projections for future growth

Wall Street’s NEXT MOVE: Will Nvidia’s AI Power Drive BIG Gains?

Wall Street Hints at Gains as Markets Pivot to Fresh Economic Data Following Nvidia’s Earnings...

ELF BAR Exposed: The Shocking Truth Behind the World’s Top E-Cigarette and Its Billion-Dollar TAX Scam

— In just two years, Elf Bar, a flashy vaping gadget, has skyrocketed to global prominence as the leading disposable e-cigarette. Not only has it raked in billions in sales, but it has also become a favorite among underage American teens who vape. Last week saw the first public confiscation of Elf Bar products by U.S. authorities during an operation that seized 1.4 million illegal flavored e-cigarettes from China.

The confiscated goods were worth $18 million and included brands beyond Elf Bar. However, public records and court documents disclose that Chinese e-cigarette manufacturers have smuggled in products valued at hundreds of millions while adeptly circumventing customs duties and import fees. These firms frequently mislabel their shipments as “battery chargers’ or ”flashlights', thereby hampering efforts to control teen vaping in America.

Eric Lindblom, a former FDA official, lambasted regulatory approaches towards disposables as “very weak”, allowing this issue to spiral out of control. Meanwhile, fruit-and-candy-flavored disposables have flooded into America following China’s ban on vaping flavors last year under the pretense of safeguard

Video

TOXIC TRAIN Wreck: Biden’s Shocking Ignorance of East Palestine’s Cries for Help

— Eight months have passed since a Norfolk Southern train derailment unleashed 1.6 million pounds of hazardous chemicals in East Palestine. The residents, numbering around 4,700, feel forsaken by President Biden. They accuse the man they once knew as “working class Joe” of turning a deaf ear to their crisis.

Resident Jessica Conard, who cast her vote for Biden in 2020, feels slighted by his absence. Her disappointment peaked when Biden flew over their town in September to join striking union workers in Michigan — a crucial swing state.

Krissy Ferguson lives within one mile of the disaster site and suspects politics influenced Biden’s non-response. She shared with the New York Times that if they were situated in a Democrat-leaning area rather than Trump-dominated territory where he bagged over 70% votes in 2020, they would have seen Biden.

The sense of betrayal from the president they once backed has left East Palestine citizens disenchanted and wounded. As they struggle with this catastrophe’s aftermath, their desperate calls for help fall on deaf ears.

More Videos

Invalid Query

The keyword entered was invalid, or we couldn't gather enough relevant information to construct a thread. Try checking the spelling or entering a broader search term. Often simple one-word terms are enough for our algorithms to build a detailed thread on the topic. Longer multi-word terms will refine the search but create a narrower information thread.

Politics

The latest uncensored news and conservative opinions in US, UK, and global politics.

get the latestLaw

In-depth legal analysis of the latest trials and crime stories from around the world.

get the latest

Social Chatter

What the World is SayingELON: UNSUPERVISED FSD WILL RAPIDLY EXPAND TO THE WHOLE COUNTRY “In a few months, Tesla will release unsupervised full self-driving. The cars will be driving around by themselves with no...

. . .The Starlink mini is amazing. I’ve used mine at home, in a boat, in a small plane, out and about at a picnic table using my usual USB battery. @Starlink Direct to Cell (texting and lite data)...

. . .Historically, it was difficult to reinvent a company at the height of its market cap. When I was in Nokia, I asked why my Finnish colleagues why the company did not reinvest its resources to...

. . .In Q1 we deployed more than double the energy storage products compared to Q1 2024 4.05 GWh Q1 2024 → 10.4 GWh Q1 2025

. . .PC AUTO, a known Chinese auto publication, recently reviewed intelligent driving systems from eight major brands: Huawei, BYD, XPeng, Zeekr, LI, Xiaomi, NIO and Tesla. In 2 scenarios where...

. . .