THREAD: billionaire bold 1 million gift

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

BILLIONAIRE’S Bold £1 Million Gift Ignites Reform Party Hope

— British tech billionaire Bassim Haidar just gave a huge £1 million boost to Nigel Farage’s REFORM party. Haidar called Farage the only leader who can “bring this country back to glory.” He used to support the Conservatives, but says they turned their backs on business and started pushing left-wing tax ideas.

Haidar slammed both the Conservative and Labour parties for hurting businesses with higher taxes. He’s especially angry about plans to scrap non-dom status and raise inheritance taxes. Haidar warned that if these changes go ahead, more wealthy people could leave Britain for good.

This donation shows how frustrated big donors are with old parties like the Conservatives. Haidar hinted that other rich supporters are thinking about switching sides too, which could shake up British politics in a big way.

Many voters feel let down by the Conservatives on key issues such as migration and the economy, making Reform’s message stronger than ever right now.

:max_bytes(150000):strip_icc()/US10Y_2025-04-03_11-20-02-ed576f9bbbed4ee3924f06b3d31b0b93.png)

TRUMP’S Bold Trade Shift Ignites Stock Surge, Gold Soars, Bitcoin ETF Shatters Records

— U.S. stocks jumped for the third day after President Trump signaled a gentler approach on tariffs, especially with China and car makers. The White House is weighing exemptions for auto parts from China, lifting hopes among investors. Big names like Alphabet and Procter & Gamble will report earnings soon. Gold prices shot up over 1% after a rocky week. Uncertainty around the globe and changing interest rates helped push gold above $3,300 an ounce. Experts say it’s smart to hold gold right now as Trump eases up on both the Fed and China. The U.S. dollar lost steam when Trump backed away from firing Fed Chair Jerome Powell and hinted at softer trade moves. The Japanese Yen got stronger as talk of a fast US-China deal faded. In crypto news, BlackRock’s Bitcoin ETF smashed records — pulling in $643 million in one day and winning “Best New ETF.” Trump Media also announced new financial products focused on American-made digital assets and held an invite-only event for top holders of its meme coin.

BOEING’S Bold $105 Billion Sale Sparks Hope For American Manufacturing

— Boeing is selling its navigation and flight planning tech businesses to Thoma Bravo, a private equity firm, for $10.5 billion in cash. The move aims to cut Boeing’s huge debt and help the company refocus on building planes — its main business. Nearly 4,000 workers are part of this digital unit, but not all of them or their projects are included in the sale. Some technology will stay with Boeing even after the deal wraps up, which should happen by late 2025. Boeing’s CEO said this sale is key to getting back on track and keeping the company strong financially. He believes it will help protect Boeing’s credit rating and allow leaders to focus on what matters most. Many conservatives view this as a smart return to basics at a time when America needs strong manufacturing jobs — not more risky side projects or growing debt loads.

BEZOS’ STUNNING $63 Million Mansion Sale Shocks Washington State

— Jeff Bezos has shattered records by selling his Seattle-area mansion for $63 million. This is now the most expensive home sale in Washington state history. He bought the Hunts Point property in 2019 for $37.5 million, making a huge profit on the deal. The home features a rooftop deck, elevator, two-story guesthouse, and 300 feet of Lake Washington waterfront. Its design mixes luxury with natural beauty. Bezos is moving his main residence to Miami with his fiancée Lauren Sanchez. The couple now lives in a $237 million compound there. While he still owns two other homes near Seattle, it’s clear he’s making Florida his new home base. This record-breaking sale shows how strong the luxury real estate market is right now and marks another step in Bezos’s move from Seattle to Miami. The deal has caught attention across business and real estate circles nationwide.

GOGOLD’S $75M WINDFALL: A Strategic Financial Move

— GoGold Resources Inc. just announced a major financial boost, securing C$75 million through a bought deal financing. The agreement involves a group of underwriters led by BMO Capital Markets. This move aims to strengthen GoGold’s financial position and support future projects.

The financing is exclusive to Canadian markets since the securities aren’t registered under U.S. law. GoGold stresses that these securities can’t be offered or sold in the U.S. without compliance, showing its commitment to regulatory standards while expanding its capital base.

The press release warns about “forward-looking information,” pointing out potential risks and uncertainties in their plans and expectations. Investors should consider these factors when thinking about joining this financing round. GoGold’s decision shows confidence in its growth strategy despite market challenges and opportunities.;

TRUMP’S GOLD Card Plan: Economic Boost or Risky Gamble?

— During a chat with Laura Ingraham, former President Donald Trump tackled worries about his gold card plan. He assured that any unsavory individuals would be screened and removed if needed. Trump stressed that those found unfit would get refunds and be sent out of the country.

Trump pointed out the economic perks of the plan, noting that people who can pay the $5 million fee are likely to create jobs. He believes these immigrants will boost the economy by generating jobs and encouraging business growth.

Trump also mentioned that companies might buy these gold cards to hire top graduates from America’s best schools. This strategy aims to attract skilled professionals who can drive innovation and competitiveness in various fields.

RICH ELITES Panic: Fleeing Trump’S America For Safety Abroad

— The Daily Mail reports that 6,100 wealthy Americans, dubbed “Donald Dashers,” have left the U.S. for the U.K. and New Zealand, fearing Donald Trump’s potential return to power. This is a 26% increase from 2023 and the highest in two decades. However, this exodus is more about personal fantasy than reality, as only a privileged few can afford such moves.

While these elites head overseas, domestic migration tells a different story. According to the Census Bureau’s 2023 report, California saw over 268,000 residents move to other states like Texas and Florida. Texas gained over 133,000 people net, with nearly 94,000 Californians choosing it as their new home.

New York also experienced significant out-migration with nearly 179,000 residents leaving for states like Florida. The Sunshine State gained over 126,000 people net last year alone. These trends highlight how blue states are losing residents while red states continue to thrive economically and demographically amid fears of Trump’s influence on America’s future direction.;

WARREN BUFFETT’S Bold Moves in a Chaotic Economy

— Warren Buffett, the billionaire investor, is taking a careful approach in today’s economic climate. He has trimmed Berkshire Hathaway’s equity portfolio and boosted investments in Treasury bills. This strategy shows caution as financial markets face turmoil.

Berkshire Hathaway has also changed its focus on diversity and inclusion. The company removed these topics from its annual report, joining other American firms rethinking their stance on such issues. Instead, the report highlights human capital and practices for attracting and keeping employees across its 189 businesses.

Buffett’s annual letter to shareholders remains a key source of investment wisdom. Investors watch these letters closely for insights into his strategies and market views. His guidance continues to influence many in the financial world, stressing long-term value over short-term gains.

ANGLO AMERICAN’S Bold $500M Nickel Sale: A Strategic Shift

— Anglo American has sold its nickel business for $500 million. This move lets the mining giant focus on copper and iron operations. The decision follows a rejected takeover attempt by BHP, signaling a strategic shift in focus.

Insolvencies are rising in England and Wales due to economic pressures. Fladgate LLP reports more administration cases, showing a tough business climate in early 2025. Economic turbulence may lead to more insolvencies as businesses struggle to adapt.

A Northampton business owner is under investigation for allegedly issuing fake fire safety certificates for high-rise flats. The accusations include stealing credentials and signatures from another engineer, raising serious safety concerns.

Elliott Management has taken a short position against Nvidia, betting on at least $600 million in downside exposure. The firm labeled Nvidia as a “bubble,” reflecting skepticism over its market valuation amid AI sector growth concerns.

TRUMP-Linked Firm’s BOLD Crypto Move Shakes Wall Street

— World Liberty Financial (WLF), linked to Donald TRUMP, has announced a strategic reserve of digital assets. The firm is moving over $307 million to Coinbase Prime. Initially thought to be a sell-off, WLF clarified these are routine treasury operations.

The project aims to tokenize real-world assets, providing secure infrastructure for institutional investors. At the Ondo Summit, WLF highlighted blockchain’s potential to modernize outdated financial systems. This move has attracted major partners like Franklin Templeton and Google Cloud, showing strong interest in blockchain’s role in traditional finance.

Market analysts suggest WLF’s crypto involvement could sway investor sentiment and influence regulatory developments. If successful, it might prompt other institutions to explore similar strategies, potentially transforming the financial landscape.

Financial markets are watching closely amid concerns about Trump’s tariff policies and their impact on inflation and interest rates. The outcome of this initiative could have far-reaching effects on both Wall Street and global finance sectors.

TRUMP-Linked Firm’s BOLD Crypto Move Shakes Up Wall Street

— World Liberty Financial (WLF), associated with former President Donald TRUMP, is making a splash in the crypto world. The firm has moved over $307 million in digital assets to Coinbase Prime. While some speculate a sell-off, WLF says these are just routine financial operations.

WLF plans to tokenize real-world assets, providing a secure platform for big investors. At the Ondo Summit, executives emphasized blockchain’s potential to update traditional finance systems. Partnerships with Franklin Templeton and Google Cloud highlight this drive for innovation.

Market experts believe WLF’s crypto involvement could sway investor opinions and regulatory trends. If successful, it might lead other firms to adopt similar strategies, significantly reshaping the financial scene.

TRUMP’S Bold Gaza Plan Stirs Global Debate

— President Donald Trump suggested relocating over a million Palestinians from Gaza to nearby countries, causing a stir. He talked about this idea with Jordan’s king, proposing housing projects in Jordan and Egypt. This is a big change from the usual U.S. support for a two-state solution between Israel and Palestine.

Jordan’s state news agency confirmed Trump’s call but didn’t mention moving Palestinians. The proposal questions decades of foreign policy and raises concerns about its practicality and acceptance by regional partners.

Egypt and Jordan are likely to reject Trump’s idea, despite their strong ties with the U.S. Both countries have historically been against taking in many Palestinian refugees due to political and social issues within their borders.

Trump’s comments have sparked debates worldwide, showing tensions between old diplomatic strategies and new ideas under his leadership. The plan highlights ongoing challenges in Middle Eastern politics as stakeholders consider its impact on regional stability.

TRUMP’S $500 BILLION AI Move: A Bold Step for America’s Future

— President Donald TRUMP has announced a massive $500 billion investment in artificial intelligence infrastructure. This joint venture involves OpenAI, Oracle, and SoftBank. The initiative aims to build data centers, marking a significant technological advancement.

The project began during the Biden administration but has gained momentum under Trump’s leadership. This investment underscores the importance of AI for future economic growth and national security.

Trump’s announcement highlights his commitment to keeping America ahead in technology. The collaboration between these major companies is expected to drive innovation and create jobs across the country.

TRUMP’S Bold Clemency Stirs Fierce Debate

— Former Proud Boys leader Enrique Tarrio and Oath Keepers founder Stewart Rhodes are now free. President Trump issued a sweeping CLEMENCY order, erasing their sentences for seditious conspiracy tied to the January 6 Capitol incident.

This decision has sparked intense debate over political extremism and accountability in the U.S. Critics say such pardons could weaken legal responses to political violence. Supporters argue it corrects perceived injustices against these individuals in the judicial process.

Presidential pardons are under close watch amid ongoing talks about extremism in American politics. Trump’s move raises questions about balancing justice with executive power in politically charged cases.

AMERICAN EXPRESS Faces $230 Million Settlement: A Wake-Up Call for Financial Giants

— American Express has settled for $230 million over claims of misleading customers about fees and services. This hefty settlement reflects the increasing scrutiny on financial institutions and their business methods.

As part of the agreement, affected customers will receive refunds. American Express is also enhancing customer service training and tightening compliance measures to prevent future deceptive practices and regain customer trust.

This settlement highlights the stricter regulatory environment demanding more accountability from financial companies, showcasing the challenges in maintaining transparency under consumer protection laws.

This case serves as a reminder of how crucial ethical business practices are in a competitive market, stressing that consumer trust is key to long-term success in financial services.

JANUARY 6 LAWSUIT: Defendants’ Bold $50 Billion Move Against Government

— Over 100 people charged in the January 6 Capitol riot are suing the government. They’re filing a $50 billion class-action lawsuit, claiming unfair targeting and mistreatment by the FBI. The lawsuit accuses political bias behind their harsh treatment and sentencing.

As Donald Trump gears up for his potential return, talks about pardons for January 6 defendants are heating up. Trump may consider clemency for some involved in the riots. The decision is tricky due to serious charges like seditious conspiracy, even though some defendants acted non-violently.

Attorney General Merrick Garland marked four years since the Capitol attack with a statement on legal actions against over 1,500 individuals involved. He stressed the Justice Department’s commitment to law and civil rights while holding those responsible accountable for that day’s violence.

These events highlight ongoing legal and political fallout from January 6, showcasing law enforcement’s response and court proceedings tied to this significant moment in recent history.

— Global Fireworks Mark Milestones: 82 Billion People and Paris Olympics As the world celebrates with firework displays, it reflects on a year of significant events, including a population surge to 82 billion and the Paris Olympics viewed by 5 billion

TRUMP’S Bold Move: Withdrawing From WHO On Inauguration DAY

— The U.S. gives 16% of the World Health Organization’s budget, making it the top donor. Conservative voices have criticized this large financial commitment. Former President Trump has called the W.H.O. a tool of China’s global ambitions.

According to the Financial Times, Trump’s team plans to announce a withdrawal from the Geneva-based health body on January 20, inauguration day. This move would cut off the W.H.O.’s biggest source of funds in one decisive action.

Trump began a withdrawal process in 2020 during his presidency, accusing the agency of being under China’s control amid Covid-19’s spread. Joe Biden reversed this decision on his first day in office in 2021 by restarting relations with the organization.

Experts say Trump’s team aims to act quickly if he returns to office, emphasizing symbolism by reversing Biden’s actions immediately upon inauguration. Ashish Jha noted that many within Trump’s circle do not trust the W.H.O., seeking a symbolic departure as a clear statement of their stance on day one.

— Tesla Stock Soars 22% on Musk’s Bold 2025 Growth Forecast The electric vehicle giant experienced its best trading day in over a decade following CEO Elon Musk’s optimistic projections for future growth

HARRIS’S FUNDING Frenzy: Can Trump’s Campaign Catch UP?

— Vice President Kamala Harris has surged ahead of former President Donald Trump in campaign fundraising. On the day she announced her candidacy, Harris raised $25 million and reached $500 million within a month. This financial boost gives her a strong edge as the 2024 presidential race intensifies.

Trump’s campaign, however, had collected $309 million by the end of August. To close this gap, Republican super PACs are stepping up, spending over $80 million on TV ads nationwide in September alone. They’ve also set aside more than $100 million for advertising during the campaign’s final weeks.

Despite this fundraising difference, Republicans remain determined. They’re investing heavily in online, mail, and door-to-door campaigns to counter Harris’s financial lead. The race for the White House is becoming fiercely competitive as both sides strategically deploy their resources to win voters over.

BLOOMBERG’S $1 Billion Gift Transforms Johns Hopkins Medical School

— Starting this fall, Bloomberg Philanthropies will cover tuition for Johns Hopkins medical students from families earning under $300,000 annually. This initiative aims to reduce student debt and increase opportunities.

Students from families making less than $175,000 a year will also have their living expenses and fees covered. Mike Bloomberg stated that more generous financial aid has made Johns Hopkins more economically diverse and selective.

The $1 billion gift will not only make medical school tuition-free for those with limited means but also boost financial aid for other graduate programs at Johns Hopkins. This move is expected to attract top students who might otherwise be deterred by financial constraints.

— BREAKING: Donald Trump’s Sentencing Delayed in Hush Money Case, Providing Significant Relief for the Former President

— IRS to Close Lucrative Tax Loophole, Potentially Generating $50 Billion in Revenue The Internal Revenue Service announces the closure of a significant tax loophole, projecting a revenue increase exceeding $50 billion in the next ten years

— Argentina’s ‘Anarcho-Capitalist’ Milei Holds High-Profile Meetings to Boost Investment Argentinean economist Milei engages with tech giants Altman, Cook, and Pichai to drive investment initiatives

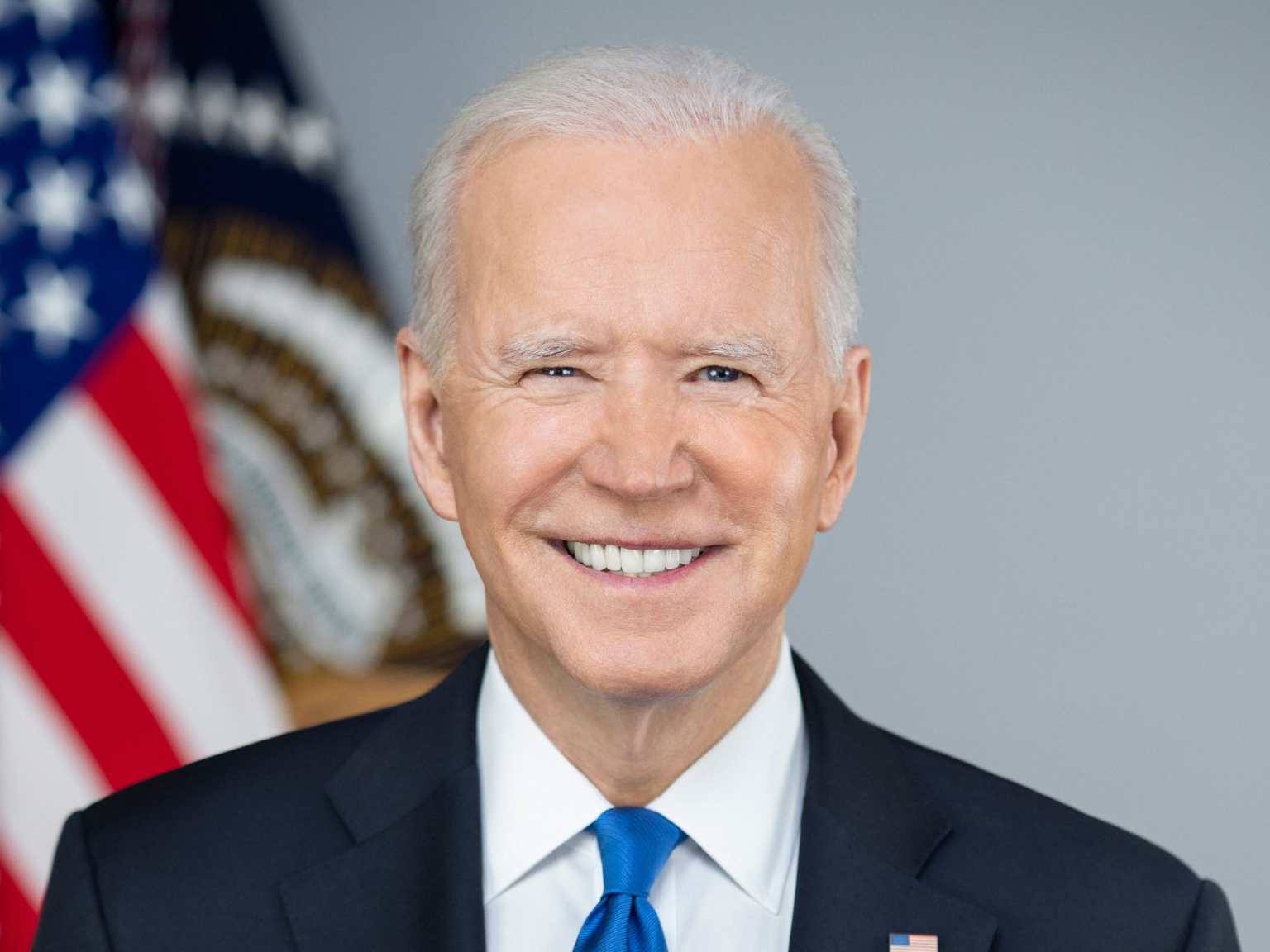

Biden’s BOLD Defiance of Supreme Court: The TRUTH Behind Student Loan Forgiveness Numbers

— President Joe Biden made a bold claim on Wednesday, boasting about his defiance of the Supreme Court’s ruling on student loans. During a speech in Milwaukee, he asserted that he had wiped out the debt for 136 million people. This statement came despite the Supreme Court rejecting his $400 billion loan forgiveness plan back in June.

However, this claim not only challenges the separation of powers but also holds no water factually. As per data from early December, only $132 billion in student loan debt has been cleared for a mere 3.6 million borrowers. This implies that Biden exaggerated the number of beneficiaries by an astounding figure – approximately 133 million.

Biden’s misrepresentation sparks concerns about his administration’s transparency and its respect for judicial decisions. His remarks further fuel ongoing discussions around student loan forgiveness and its ripple effects on economic aspects like homeownership and entrepreneurship.

“This incident underscores the need for accurate information from our leaders and respectful adherence to judicial rulings. It also highlights how critical it is to have open dialogues about policy impacts, particularly when they affect millions of Americans’ financial futures.”

Video

STARKEIR STARMER’S £100K Freebies Spark Outrage

— Prime Minister Sir Keir Starmer has received more freebies than any other MP since becoming Labour leader. He declared gifts and hospitality worth over £100,000, surpassing all other MPs. These gifts include tickets to sporting events and lavish dinners from various organizations.

This trend of MPs receiving substantial benefits raises ethical questions about the influence of such gifts on political decisions. Public trust in politicians is already low, and further scrutiny is anticipated from both the public and political adversaries. Starmer’s office claims all gifts were declared according to parliamentary rules, ensuring transparency.

The disclosure has sparked debate on stricter regulations for MPs accepting gifts and benefits. Critics argue that lavish gifts can lead to conflicts of interest and compromise impartiality. Supporters say these experiences help politicians engage with different sectors, benefiting their understanding and policy-making.

As the story unfolds, calls for reform in regulations governing MPs may arise. Sky News’ investigation highlights the blurred lines between politics and external influences, prompting a re-evaluation of ethical standards for public servants.

More Videos

Invalid Query

The keyword entered was invalid, or we couldn't gather enough relevant information to construct a thread. Try checking the spelling or entering a broader search term. Often simple one-word terms are enough for our algorithms to build a detailed thread on the topic. Longer multi-word terms will refine the search but create a narrower information thread.

Politics

The latest uncensored news and conservative opinions in US, UK, and global politics.

get the latestLaw

In-depth legal analysis of the latest trials and crime stories from around the world.

get the latest

Social Chatter

What the World is SayingPresident Trump: “I can’t speak more highly of any individual than Elon Musk… He’s an incredible, brilliant guy. A wonderful person.. He’s saved us almost $200 billion, and rising...

. . .It was very special to bring my children, each born in New York, to the very place where over 12 million began their American journey. I am one of the nearly 40% of all U.S. citizens who can...

. . .It was very special to bring my children, each born in New York, to the very place where over 12 million began their American journey. I am one of the nearly 40% of all U.S. citizens who can...

. . .It was very special to bring my children, each born in New York, to the very place where over 12 million began their American journey. I am one of the nearly 40% of all U.S. citizens who can...

. . .Later this year, Akshata and I will launch The Richmond Project - a new charity focused on improving numeracy. Confidence with numbers transforms lives. It unlocks opportunity, fuels social...

. . .