:max_bytes(150000):strip_icc()/US10Y_2025-04-03_11-20-02-ed576f9bbbed4ee3924f06b3d31b0b93.png)

THREAD: bloomberg 1

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

:max_bytes(150000):strip_icc()/US10Y_2025-04-03_11-20-02-ed576f9bbbed4ee3924f06b3d31b0b93.png)

TRUMP’S Bold Trade Shift Ignites Stock Surge, Gold Soars, Bitcoin ETF Shatters Records

— U.S. stocks jumped for the third day after President Trump signaled a gentler approach on tariffs, especially with China and car makers. The White House is weighing exemptions for auto parts from China, lifting hopes among investors. Big names like Alphabet and Procter & Gamble will report earnings soon. Gold prices shot up over 1% after a rocky week. Uncertainty around the globe and changing interest rates helped push gold above $3,300 an ounce. Experts say it’s smart to hold gold right now as Trump eases up on both the Fed and China. The U.S. dollar lost steam when Trump backed away from firing Fed Chair Jerome Powell and hinted at softer trade moves. The Japanese Yen got stronger as talk of a fast US-China deal faded. In crypto news, BlackRock’s Bitcoin ETF smashed records — pulling in $643 million in one day and winning “Best New ETF.” Trump Media also announced new financial products focused on American-made digital assets and held an invite-only event for top holders of its meme coin.

BOEING’S Bold $105 Billion Sale Sparks Hope For American Manufacturing

— Boeing is selling its navigation and flight planning tech businesses to Thoma Bravo, a private equity firm, for $10.5 billion in cash. The move aims to cut Boeing’s huge debt and help the company refocus on building planes — its main business. Nearly 4,000 workers are part of this digital unit, but not all of them or their projects are included in the sale. Some technology will stay with Boeing even after the deal wraps up, which should happen by late 2025. Boeing’s CEO said this sale is key to getting back on track and keeping the company strong financially. He believes it will help protect Boeing’s credit rating and allow leaders to focus on what matters most. Many conservatives view this as a smart return to basics at a time when America needs strong manufacturing jobs — not more risky side projects or growing debt loads.

TRUMP’S Bold Trade Shock Rocks Markets, Sparks Fear And Hope

— President Trump is set to announce tough new tariffs this week. His unpredictable style keeps Wall Street and America’s allies on edge. The latest 25% tariff on cars from Europe and Mexico caused the biggest stock market drop since 2020. Elon Musk, a vocal Trump supporter, is stepping up his political game in Wisconsin. At a Green Bay event, Musk plans to give million-dollar checks to two men fighting activist judges. This move puts him front and center in the state’s Supreme Court race. Inside the Pentagon, sources say there’s chaos as leaders scramble to keep up with Trump’s aggressive trade and immigration push. Despite distractions at home and abroad, Trump keeps pressing forward with his agenda. While Biden battles lawsuits in courtrooms across the country, Trump faces legal fights of his own. With both sides under fire, Americans are left wondering what comes next as markets swing wildly and politics heat up.

NO NEW World News Shocks: Media Silent Beyond US, UK on April 21

— On April 21, 2025, global news outlets had nothing new to report outside the United States and United Kingdom. Headlines stayed the same as previous days.

Most coverage still centers on the Israel-Palestine conflict. Aid groups warn about Gaza’s growing crisis because of ongoing blockades. In the UK, protests and legal fights over transgender rights continue to make news.

No fresh international events or emergencies have surfaced beyond these stories today.

Conservative readers may notice how media keeps focusing on just a few issues instead of reporting unexpected world events that matter to everyday people.

TRUMP’S “Liberation DAY” Shocks Markets: Wall Street Reels as Tariffs Spark Global Showdown

— President Trump’s “Liberation Day” tariffs have rocked the markets. The Dow dropped more than 2,000 points on some days. The S&P 500 and Nasdaq both fell into bear market territory. These tariffs, reaching up to 125% for some countries, are the highest seen in a hundred years. China, the EU, and Japan are feeling the pain most. China hit back with its own tariffs on American goods. Japan’s finance minister warned of global trouble ahead. Still, US officials say they’re hopeful about future trade talks. Big companies are taking hits too. CarMax shares sank after weak earnings reports. Nvidia tumbled more than 20% from its high point this year. UnitedHealth lowered its profit forecast because Medicare costs keep rising. Experts think this wild ride will last until trade fights settle down. Some industries are holding up better than others under pressure. The Federal Reserve might cut rates three times this year if things get worse — some warn a financial crisis could happen if tariff chaos continues much longer.

ZERO FINTECH’S Astonishing WIN: 2024 Profits Smash Wall Street Expectations

— Zero Fintech Group Limited, known as 0093.HK, just reported its highest profits ever for 2024. The company’s strong revenue and earnings came at a time when many feared the economy was slowing down.

Investors wasted no time reacting. After the news broke on April 16, Zero Fintech’s stock jumped sharply. Experts say this shows how well the company has managed risk in a tough industry.

This financial victory gives Zero Fintech a strong foundation for future growth in 2025 and beyond. Industry experts are now watching to see if this will shake up fintech markets around the world.

MARKET PANIC: Bitcoin and Stocks Plummet in US Tariff Chaos

— Bitcoin dropped below $80,000 on Sunday, falling over 3% in just two hours. This decline happened alongside major losses in U.S. stock markets. The S&P 500 and Nasdaq Composite both closed nearly 6% lower on April 4. Analyst Holger Zschaepitz noted the stock market lost $8.2 trillion, surpassing losses from the worst week of the 2008 financial crisis.

The market chaos comes from recent U.S. tariffs that have sparked widespread sell-offs across many sectors. Despite this turmoil, some investors see potential buying opportunities as stocks are now trading at historically low valuations of 15 times future earnings projections.

Jim Cramer has warned this could be just the start of a bigger downturn for the S&P 500, predicting a further meltdown of up to 20%. As of Sunday night, S&P futures were down about 4%. Global stocks have already lost $7.46 trillion since April 2nd and may exceed $10 trillion if recent sell-offs continue to unfold.;

FIDELITY and TRUMP’S Bold Move: Stablecoins to Revolutionize Finance

— Fidelity is pushing forward with its digital asset strategy by testing a new stablecoin. This aligns with the Trump administration’s plans to overhaul cryptocurrency oversight, marking a big change in the financial world. Fidelity’s move shows how important stablecoins are becoming in modern finance.

Donald Trump’s World Liberty Financial is launching a dollar-pegged stablecoin called USD1. It will be fully backed by U.S. Treasuries and other cash equivalents, ensuring stability and trust for investors. This launch highlights Trump’s ongoing influence in finance, especially digital currencies.

In Canada, Tesla faces halted rebate payments due to trade tensions with the U.S., impacting its operations as taxis or ride shares. Rebates will stay frozen until individual claims are checked, showing ongoing international trade challenges under current policies.

Moody’s has issued warnings about worsening U.S. public finances under Trump’s policies, which could make it harder to manage rising deficits and debt levels effectively.

TRUMP’S Targeted Tarif Plan Ignites Stock Surge

— Global stocks soared on Monday, fueled by gains in U.S. markets. Reports suggest President TRUMP’s tariff strategy is more targeted than expected, boosting investor confidence and risk appetite.

U.S. Treasury yields rose with the optimistic outlook on tariffs. Investors hope a targeted approach will ease potential economic disruptions. The market’s reaction shows strong support for Trump’s strategic trade policy shift.

Meanwhile, the IRS expects a significant drop in tax revenue — over 10% by April 15th — according to the Washington Post. This decline raises concerns about fiscal health and future government funding.

In currency markets, the dollar strengthened against both the euro and yen as U.S. business activity improved in March. Bitcoin analysts predict a potential surge to $110K before any major correction, reflecting ongoing interest in cryptocurrency markets.

HONG KONG Surge Ignites Asian Market Boom

— Hong Kong is leading a major surge in Asian markets, sparking excitement and strong trading. Big gains are seen in Japan, India, and Malaysia. Indonesia trails slightly behind.

This market shift lines up with possible geopolitical changes, including hints from former President Trump about a potential visit from President Xi to Washington DC. Such moves could impact international relations and economic plans.

China’s tech giants like Alibaba and Tencent are seeing big gains thanks to positive domestic consumption outlooks. This growth shows the strength of China’s tech sector amid global uncertainties.

NIO’s partnership with CATL signals more growth in the tech industry, boosting investor confidence across Asia. The collaboration highlights the region’s focus on innovation and technological progress.

WORLD NEWS Pause: A Calm Before the Storm?

— The current world news cycle shows no fresh BREAKING developments. Events remain steady, reflecting a pause in major headlines.

This stability offers a chance to focus on ongoing stories and their impacts. It’s a moment to dig deeper into existing issues and understand their implications.

Stay informed by watching for updates as they happen. Even in calm times, deeper analysis can provide valuable insights into global affairs.

WARREN BUFFETT’S Bold Moves in a Chaotic Economy

— Warren Buffett, the billionaire investor, is taking a careful approach in today’s economic climate. He has trimmed Berkshire Hathaway’s equity portfolio and boosted investments in Treasury bills. This strategy shows caution as financial markets face turmoil.

Berkshire Hathaway has also changed its focus on diversity and inclusion. The company removed these topics from its annual report, joining other American firms rethinking their stance on such issues. Instead, the report highlights human capital and practices for attracting and keeping employees across its 189 businesses.

Buffett’s annual letter to shareholders remains a key source of investment wisdom. Investors watch these letters closely for insights into his strategies and market views. His guidance continues to influence many in the financial world, stressing long-term value over short-term gains.

:max_bytes(150000):strip_icc()/GettyImages-2192142603-a439d21d07ef4ace9708e5f08f188b0b.jpg)

CHINA’S Tech Boom: How Deepseek AI is Shaking Global Markets

— China’s tech industry is booming, thanks to the rise of the DeepSeek AI model. Major companies like Alibaba, Baidu, and Xiaomi are seeing big benefits. This surge has pushed Hong Kong’s Hang Seng Tech Index up this year.

Alibaba, co-founded by Jack Ma, stands out in this market rally. The company’s growth shows the broader impact of tech advancements on China’s economy. Investors are watching these changes for possible global effects.

The rise in China’s tech stocks might affect U.S. investments and international trade ties. As U.S. markets close with small changes in the S&P 500, global investors keep an eye on shifts in Chinese tech trends.

This ongoing rally highlights China’s growing influence on worldwide economic dynamics, making it a key player to watch in global markets.

TRUMP-Linked Firm’s BOLD Crypto Move Shakes Wall Street

— World Liberty Financial (WLF), linked to Donald TRUMP, has announced a strategic reserve of digital assets. The firm is moving over $307 million to Coinbase Prime. Initially thought to be a sell-off, WLF clarified these are routine treasury operations.

The project aims to tokenize real-world assets, providing secure infrastructure for institutional investors. At the Ondo Summit, WLF highlighted blockchain’s potential to modernize outdated financial systems. This move has attracted major partners like Franklin Templeton and Google Cloud, showing strong interest in blockchain’s role in traditional finance.

Market analysts suggest WLF’s crypto involvement could sway investor sentiment and influence regulatory developments. If successful, it might prompt other institutions to explore similar strategies, potentially transforming the financial landscape.

Financial markets are watching closely amid concerns about Trump’s tariff policies and their impact on inflation and interest rates. The outcome of this initiative could have far-reaching effects on both Wall Street and global finance sectors.

TRUMP-Linked Firm’s BOLD Crypto Move Shakes Up Wall Street

— World Liberty Financial (WLF), associated with former President Donald TRUMP, is making a splash in the crypto world. The firm has moved over $307 million in digital assets to Coinbase Prime. While some speculate a sell-off, WLF says these are just routine financial operations.

WLF plans to tokenize real-world assets, providing a secure platform for big investors. At the Ondo Summit, executives emphasized blockchain’s potential to update traditional finance systems. Partnerships with Franklin Templeton and Google Cloud highlight this drive for innovation.

Market experts believe WLF’s crypto involvement could sway investor opinions and regulatory trends. If successful, it might lead other firms to adopt similar strategies, significantly reshaping the financial scene.

TECH GIANTS Spark Stock Market Surge: What Investors Need to Know

— The STOCK MARKET is seeing a surge, with predictions of a 0.49% rise. This optimism comes from major tech companies, whose earnings reports are expected to beat estimates. Investors are eagerly awaiting these results, fueling excitement across the market.

However, concerns about rising interest rates could dampen this enthusiasm. While the outlook remains positive now, potential rate hikes might impact investor sentiment soon. Market participants stay cautious as they navigate these mixed signals.

Besides stock market news, debates continue over a new lunch plan proposed by a coalition that may affect small businesses’ futures. Stakeholders are split on the possible effects of these changes, highlighting ongoing challenges in balancing economic growth with regulations.

TRUMP’S $500 BILLION AI Move: A Bold Step for America’s Future

— President Donald TRUMP has announced a massive $500 billion investment in artificial intelligence infrastructure. This joint venture involves OpenAI, Oracle, and SoftBank. The initiative aims to build data centers, marking a significant technological advancement.

The project began during the Biden administration but has gained momentum under Trump’s leadership. This investment underscores the importance of AI for future economic growth and national security.

Trump’s announcement highlights his commitment to keeping America ahead in technology. The collaboration between these major companies is expected to drive innovation and create jobs across the country.

STOCK MARKET Chaos: Inflation Fears Shake Investor Confidence

— The U.S. STOCK market took a big hit today, with major indexes dropping over 3% due to rising inflation fears. Investors worry about possible Federal Reserve policy changes after high inflation numbers came out earlier this week. This is one of the steepest drops in months, shaking confidence that had been boosted by strong job reports.

Bond yields are up, with the 10-year Treasury bond yield hitting about 4.1%, its highest since late 2023, signaling increased inflation expectations. Big tech stocks like Apple and Microsoft saw sell-offs over 5%, adding to the market slump. Analysts warn that ongoing inflation might push the Federal Reserve to rethink interest rate policies, possibly leading to more hikes instead of cuts.

The decline comes after a strong holiday shopping season that initially suggested steady economic growth but is now overshadowed by ongoing inflation problems. Retail and consumer sectors face rising costs and reduced spending, making investors cautious in these areas. Companies like Walmart and Target report higher holiday sales but shrinking profit margins due to inflation pressures, prompting them to rethink annual forecasts.

Banks like JPMorgan are bracing for possible loan defaults as consumers struggle with higher living costs by setting aside more reserves. Market analysts expect continued volatility as investors digest new inflation data and Fed policy implications.;

WALL STREET Surges: Oil Price Drop Sparks Investor Optimism

— Wall Street is climbing today, driven by a 6% DROP in oil prices. Investors are gearing up for a crucial week of earnings reports from major tech firms.

Tech and energy stocks are leading the way, with analysts hopeful about tech giants’ futures. However, there is still caution about the overall economic outlook.

The fall in oil prices comes from oversupply worries and easing geopolitical tensions, affecting inflation rates and consumer spending that Wall Street closely monitors.

While U.S. markets rise, Asian markets face recession fears linked to U.S. economic performance, showing global interconnectedness and financial volatility.

— Nasdaq Soars 1% as Wall Street Overcomes Russia-Ukraine Concerns The tech-heavy index rallied, buoyed by a significant surge in Nvidia shares despite ongoing geopolitical tensions

— S&P 500 RISES NEARLY 1% as Cooler Oil Prices Boost Market The Dow gained 100 points, reflecting positive investor sentiment amid declining oil prices

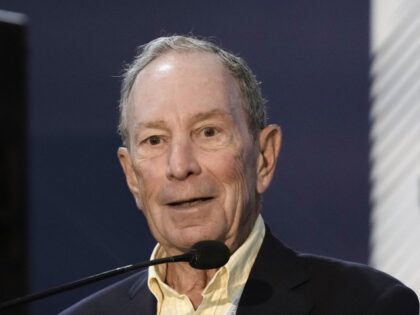

BLOOMBERG’S $1 Billion Gift Transforms Johns Hopkins Medical School

— Starting this fall, Bloomberg Philanthropies will cover tuition for Johns Hopkins medical students from families earning under $300,000 annually. This initiative aims to reduce student debt and increase opportunities.

Students from families making less than $175,000 a year will also have their living expenses and fees covered. Mike Bloomberg stated that more generous financial aid has made Johns Hopkins more economically diverse and selective.

The $1 billion gift will not only make medical school tuition-free for those with limited means but also boost financial aid for other graduate programs at Johns Hopkins. This move is expected to attract top students who might otherwise be deterred by financial constraints.

— Alphabet Stock Surges: 14% Increase Post Strong Earnings and Debut Dividend

MIXED Signals: How to SAIL Through the Stock Market’s Choppy Waters NOW

Stock Market Swirls in Uncertainty: Is Your Investment Safe? Find Out How to Steer Through! As the stock market dances on...

— **Global Shipping Giant Alters Economic Forecast Amidst Shifting Outlook** One of the leading ocean shipping companies adjusts its global economic predictions in response to changing conditions

— Tech Layoffs Surge in January as Wall Street Rally Boosts Alphabet, Meta, and Microsoft to Record Highs

Video

ELON MUSK Champions Free Speech On X

— Elon Musk, owner of X (formerly Twitter), has increasingly used the platform to amplify his political views and those of right-wing figures. Musk’s actions align with his 2022 statement that he bought Twitter to protect free speech. He believes a public platform for free speech is crucial for civilization’s future.

Musk often discusses existential threats like population collapse and artificial intelligence, framing threats to free speech as another crisis. He sees X as a “digital town square” where vital issues are debated. In the U.S., Musk has shared memes and sometimes misinformation about illegal immigration, election fraud, and transgender policies while endorsing Donald Trump’s presidential bid.

In May 2023, Musk co-hosted Florida Gov. Ron DeSantis’ presidential bid announcement on X, which faced technical issues but highlighted his vision for the platform. Despite the glitches, Musk invited other candidates to use X for their announcements.

Trump accepted and had an interview with Musk that also experienced technical difficulties but eventually took place after a 42-minute delay.

More Videos

Invalid Query

The keyword entered was invalid, or we couldn't gather enough relevant information to construct a thread. Try checking the spelling or entering a broader search term. Often simple one-word terms are enough for our algorithms to build a detailed thread on the topic. Longer multi-word terms will refine the search but create a narrower information thread.

Politics

The latest uncensored news and conservative opinions in US, UK, and global politics.

get the latestLaw

In-depth legal analysis of the latest trials and crime stories from around the world.

get the latest

![How Biden’s Corporate Tax Hike, 100+ Wall Street Pictures [HD]](https://lifeline.news/wp-content/uploads/bidens-tax-hike-terror-how-wall.jpg)

Social Chatter

What the World is Sayinghttps://youtu.be/rguHublkxCQ?si=9b_S0IXBQWwdWvVS The US stock market is in the biggest bubble in history. The entire economy is at risk. Geopolitical Economy Report 458K subscribers 618,152 views 3 Jan 2025 The US stock market is in "the mother of all bubbles", with the market capitalization of pu...

. . .News; Analysis & Opinion. MSCI World News. Find the latest financial news about the MSCI World. Citi expects rally in global stocks to extend into 2025, sees 10 ...

. . .S. Korean President Arrested; Biden Toughens China Tech Curbs | Bloomberg: The China Show 1/15/2025. S. Korean President Arrested; Biden Toughens China Tech Curbs | Bloomberg: The China Show 1/15/2025 Bloomberg: The China Show” is your definitive source for news and analysis on the world's second-biggest economy.

. . .On Bubble Watch By Howard Marks 1/2/2025. On Bubble Watch By Howard Marks 1/2/2025 [https://www.oaktreecapital.com/insights/memo/on-bubble-watch](https://www.oaktreecapital.com/insights/memo/on-bubble-watch) A good read by Howard Marks from Oaktree Capital Management. Exactly 25 years ago today, I published the first memo that brought...

. . .How to Publish a Press Release on Benzinga. How to Publish a Press Release on Benzinga

. . .