THREAD: boeing bold 105 billion sale

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

BOEING’S Bold $105 Billion Sale Sparks Hope For American Manufacturing

— Boeing is selling its navigation and flight planning tech businesses to Thoma Bravo, a private equity firm, for $10.5 billion in cash. The move aims to cut Boeing’s huge debt and help the company refocus on building planes — its main business. Nearly 4,000 workers are part of this digital unit, but not all of them or their projects are included in the sale. Some technology will stay with Boeing even after the deal wraps up, which should happen by late 2025. Boeing’s CEO said this sale is key to getting back on track and keeping the company strong financially. He believes it will help protect Boeing’s credit rating and allow leaders to focus on what matters most. Many conservatives view this as a smart return to basics at a time when America needs strong manufacturing jobs — not more risky side projects or growing debt loads.

BEZOS’ STUNNING $63 Million Mansion Sale Shocks Washington State

— Jeff Bezos has shattered records by selling his Seattle-area mansion for $63 million. This is now the most expensive home sale in Washington state history. He bought the Hunts Point property in 2019 for $37.5 million, making a huge profit on the deal. The home features a rooftop deck, elevator, two-story guesthouse, and 300 feet of Lake Washington waterfront. Its design mixes luxury with natural beauty. Bezos is moving his main residence to Miami with his fiancée Lauren Sanchez. The couple now lives in a $237 million compound there. While he still owns two other homes near Seattle, it’s clear he’s making Florida his new home base. This record-breaking sale shows how strong the luxury real estate market is right now and marks another step in Bezos’s move from Seattle to Miami. The deal has caught attention across business and real estate circles nationwide.

TRUMP’S Bold Stance on Auto Price Hikes and Global Diplomacy Revealed

— President Donald Trump recently declared he “couldn’t care less” if foreign automakers hike prices due to his auto tariffs. This bold move shows his commitment to putting American interests first, despite foreign economic pressures. Trump also confirmed he won’t fire anyone involved in the Signal group chat controversy.

Internationally, Iran has rejected direct nuclear talks with Trump but is open to indirect discussions. The President has warned of military action if Tehran doesn’t agree to a nuclear deal with Washington, highlighting his strong approach to national security and diplomacy.

Trump criticized Russian President Vladimir Putin and warned of secondary tariffs on nations buying oil from Russia amid Ukraine tensions. These potential tariffs are part of Trump’s broader strategy as he nears an April 2 deadline for major tariff actions against adversaries while staying open to negotiation deals.

Domestically, Republicans face challenges as Democrats aim for gains in Florida’s Sixth District despite Trump’s past success there. Meanwhile, Trump withdrew Congresswoman Elise Stefanik’s nomination for U.N. ambassador amidst a slim GOP House majority and upcoming special elections, underscoring internal party dynamics and strategic shifts before future political battles.

GOGOLD’S $75M WINDFALL: A Strategic Financial Move

— GoGold Resources Inc. just announced a major financial boost, securing C$75 million through a bought deal financing. The agreement involves a group of underwriters led by BMO Capital Markets. This move aims to strengthen GoGold’s financial position and support future projects.

The financing is exclusive to Canadian markets since the securities aren’t registered under U.S. law. GoGold stresses that these securities can’t be offered or sold in the U.S. without compliance, showing its commitment to regulatory standards while expanding its capital base.

The press release warns about “forward-looking information,” pointing out potential risks and uncertainties in their plans and expectations. Investors should consider these factors when thinking about joining this financing round. GoGold’s decision shows confidence in its growth strategy despite market challenges and opportunities.;

MAGNACHIP’S BOLD Shift: Power Move to Boost Profits

— Magnachip Semiconductor Corporation is shifting gears to focus solely on its Power business. This decision comes after a thorough review by the Board of Directors and management. The goal is clear: boost revenue growth and maximize shareholder value.

The company plans to explore options for its Display business, which will be marked as discontinued in Q1 2025 results. Possible paths include selling, merging, forming a joint venture, licensing, or winding down operations. Magnachip aims for steady profitability and earnings growth during this shift.

By Q4 2025, Magnachip targets quarterly Adjusted EBITDA break-even from ongoing operations. It plans for positive adjusted operating income by 2026 and positive adjusted free cash flow in 2027. The Power segment caters to broader markets with longer product cycles compared to the smartphone-centric Display segment.

MAGNACHIP’S BOLD Move: Shift to Power Business Promises Big Profits

— Magnachip Semiconductor Corporation is making a bold shift to focus solely on its Power business. This strategic move, decided by the Board and management, aims to boost revenue growth and increase shareholder value.

The company plans to phase out its Display segment, classifying it as discontinued in the next Q1 results. Options like selling or merging this segment are on the table. The goal is clear: ensure steady profits and keep shareholders happy.

Magnachip aims for quarterly break-even by Q4 2025 and expects positive operating income by 2026. By 2027, they foresee positive free cash flow. The Power business will target stable markets with long product cycles, unlike the unpredictable smartphone market of their Display segment.

APPLE’S $500 Billion Gamble: Can It Really Boost American Jobs?

— Apple has unveiled a groundbreaking $500 billion investment plan in the U.S. over the next four years. A new manufacturing facility in Houston, focused on AI servers, is part of this initiative. CEO Tim Cook highlighted this as a major push for American innovation and job creation.

The plan includes doubling Apple’s U.S. Advanced Manufacturing Fund to $10 billion, aiming to create 20,000 jobs. The Houston plant will cover 250,000 square feet and produce hardware for Apple Intelligence, their AI system. This comes amid trade tensions from tariffs on Chinese imports imposed by President Trump that affect tech sectors like chips.

Apple’s strategy appears aimed at countering trade challenges while competing with tech giants like Microsoft and Google in AI markets. Yet analysts question the feasibility of such an ambitious plan given Apple’s current capital of less than $160 billion and wonder if inflation-adjusted spending might actually decrease rather than increase real terms spending.

Questions persist about creating 20,000 jobs at an estimated cost of $25 million per job, casting doubt on Apple’s claims’ practicality. While Apple’s bold move seeks to navigate geopolitical pressures and market realities, its success remains uncertain amidst these challenges.

WARREN BUFFETT’S Bold Moves in a Chaotic Economy

— Warren Buffett, the billionaire investor, is taking a careful approach in today’s economic climate. He has trimmed Berkshire Hathaway’s equity portfolio and boosted investments in Treasury bills. This strategy shows caution as financial markets face turmoil.

Berkshire Hathaway has also changed its focus on diversity and inclusion. The company removed these topics from its annual report, joining other American firms rethinking their stance on such issues. Instead, the report highlights human capital and practices for attracting and keeping employees across its 189 businesses.

Buffett’s annual letter to shareholders remains a key source of investment wisdom. Investors watch these letters closely for insights into his strategies and market views. His guidance continues to influence many in the financial world, stressing long-term value over short-term gains.

ANGLO AMERICAN’S Bold $500M Nickel Sale: A Strategic Shift

— Anglo American has sold its nickel business for $500 million. This move lets the mining giant focus on copper and iron operations. The decision follows a rejected takeover attempt by BHP, signaling a strategic shift in focus.

Insolvencies are rising in England and Wales due to economic pressures. Fladgate LLP reports more administration cases, showing a tough business climate in early 2025. Economic turbulence may lead to more insolvencies as businesses struggle to adapt.

A Northampton business owner is under investigation for allegedly issuing fake fire safety certificates for high-rise flats. The accusations include stealing credentials and signatures from another engineer, raising serious safety concerns.

Elliott Management has taken a short position against Nvidia, betting on at least $600 million in downside exposure. The firm labeled Nvidia as a “bubble,” reflecting skepticism over its market valuation amid AI sector growth concerns.

HSBC’S BOLD Move: 40 Dealmakers CUT in Hong Kong

— HSBC has laid off 40 investment bankers in Hong Kong. This is part of a global restructuring plan to cut costs. The layoffs hit several divisions, including technology, media, telecommunications, and financial institutions. HSBC aims to streamline operations worldwide with this bold move.

GOLD SHINES: Prices RISE Despite STRONG Dollar

Gold prices are climbing even as the dollar gains strength. Investors flock to gold as a safe haven during economic uncertainty over tariffs and interest rates. This highlights gold’s lasting appeal in volatile markets.

MILEI FIGHTS BACK: Denies WRONGDOING in Crypto SCANDAL

Argentine President Javier Milei denies any wrongdoing in a cryptocurrency scandal threatening his political career. Facing lawsuits and impeachment calls, Milei defends himself amid growing scrutiny. The controversy adds pressure on his administration during tough economic times for Argentina.

Heartland Bank reports a $50 million loss from bad loans but insists its overall financial health is stable. Despite this setback, the bank plans to issue a half-year dividend as expected, reassuring investors of its resilience.

/Super%20Micro%20Computer%20Inc%20HQ%20photo-by%20Tada%20Images%20via%20Shutterstock.jpg)

SUPER MICRO Stock Skyrockets: Investors Cheer Bold 2026 Goals

— Super Micro’s stock jumped after the company set bold goals for 2026, calming investor worries about its future. Despite controversies and a Department of Justice probe into its accounting, Super Micro is working to stabilize. The company hired a new accountant and announced an independent review found no wrongdoing.

Nasdaq gave Super Micro more time to submit filings by February 25, which the company plans to meet. This extension follows a tough year with challenges noted in the Hindenburg report. Investors reacted positively to these updates, causing stock prices to soar after the business update on February 11.

BATTERY GIANT’S $26 Billion Georgia Plant Cancelation Shocks Industry

— A massive battery manufacturing project in Georgia, worth $26 billion, has been unexpectedly canceled. This decision is causing concern across the industry as experts consider its impact on electric vehicle production and battery supply in the United States. The reasons for this abrupt cancelation are still under investigation, with regulatory challenges and market saturation being potential factors.

The plant was set to be a major player in the manufacturing sector, showcasing Georgia’s role in energy innovation. Its cancelation raises questions about future investments and projects within the state and beyond. Industry insiders are closely watching how this development will affect supply chains and production timelines for electric vehicles nationwide.

This news arrives amid ongoing discussions about energy sustainability initiatives across the U.S., marking a pivotal moment for stakeholders in both energy and automotive sectors. The project’s halt highlights the complexities of balancing regulatory demands with market needs, a challenge that continues to shape America’s industrial landscape.

BATTERY Giant’s SHOCKING Exit: $26 Billion Georgia Plant Scrapped

— A battery company has scrapped its plan for a $2.6 billion manufacturing plant in Georgia, sparking concerns about the future of electric vehicle (EV) production. This decision raises questions about the local economy and job market, which were expected to thrive from this project.

Details are limited, but the move follows struggles within the battery production sector. The plant was supposed to be a major supplier for EVs as part of a global shift toward sustainability and green technology.

Industry experts wonder if this decision will affect EV demand in Georgia and create challenges for other manufacturers expanding in the U.S., possibly impacting investments and economic growth in regions relying on such projects.

As events progress, stakeholders will keep a close watch on the viability of large investment projects linked to renewable energy and EV industries across America.

CHINA’S AI Threat: Tech Stocks in Danger of $1 Trillion Wipeout

— Chinese AI startup DeepSeek has shaken global tech stocks, sparking fears about America’s technological advantage. Investors worry about a potential $1 trillion loss in tech value due to rising foreign competition.

The drop in tech shares shows growing concern over the competitive landscape. Major indices have fallen, urging investors to be cautious as the situation develops.

This happens amid wider talks on global trade and economic competitiveness, especially in tech-heavy areas. Experts recommend reassessing portfolios, favoring stable investments over risky tech stocks.

Market analysts emphasize watching these changes closely as they could affect market stability and growth prospects in the technology sector moving forward.

APTIV STOCK Skyrockets After Bold Business Move

— Aptiv plans to spin off its electrical distribution systems (EDS) into a new company. This bold move lets Aptiv focus on advanced driver-aid technology. After the announcement, Aptiv’s shares soared by 5%.

Analysts point out that EDS has lower profit margins. The adjusted EBITDA margin for EDS is expected to be 9.5% in 2024, while Aptiv’s other operations boast an 18.8% margin.

Garrett Nelson from CFRA Research supports the spin-off, saying it aligns with Aptiv’s push toward high-margin growth areas. This strategic shift could enhance Aptiv’s future profitability and market position.

TRUMP’S $500 BILLION AI Move: A Bold Step for America’s Future

— President Donald TRUMP has announced a massive $500 billion investment in artificial intelligence infrastructure. This joint venture involves OpenAI, Oracle, and SoftBank. The initiative aims to build data centers, marking a significant technological advancement.

The project began during the Biden administration but has gained momentum under Trump’s leadership. This investment underscores the importance of AI for future economic growth and national security.

Trump’s announcement highlights his commitment to keeping America ahead in technology. The collaboration between these major companies is expected to drive innovation and create jobs across the country.

— Alphabet Reports Strong Earnings, Driven by Cloud Growth The tech giant exceeded expectations in both revenue and profit, thanks to a significant increase in cloud services

— Tesla Stock Soars 22% on Musk’s Bold 2025 Growth Forecast The electric vehicle giant experienced its best trading day in over a decade following CEO Elon Musk’s optimistic projections for future growth

NEW FIGHTER JET Program Aims to Counter China and Russia Threats

— Japan, the U.K., and Italy are teaming up to create a new combat aircraft by 2035 under the Global Combat Air Program (GCAP). This project aims to strengthen defense against threats from China, Russia, and North Korea. The advanced stealth fighter will replace Japan’s F-2s and Eurofighter Typhoons.

Japanese Defense Minister Gen Nakatani announced the creation of the GCAP International Government Organization (GIGO) by year’s end. GIGO will manage aircraft development from its base in the U.K., led by a Japanese official. This announcement came after a meeting with his U.K. and Italian counterparts at the Group of Seven defense ministers meeting in Naples, Italy.

Private companies like Japan’s Mitsubishi Heavy Industries, Britain’s BAE Systems PLC, and Italy’s Leonardo are part of this effort. Nakatani confirmed that GIGO is on track to sign its first contract next year despite leadership changes in Japan and the U.K. This partnership highlights a commitment to boosting military capabilities amid global security concerns.

Tech Stocks SOAR: Why the S&P 500 and DOW are on Fire Right NOW

U.S. Stocks End Week on High Note with Best Performance of the Year...

— Apple Unveils $110 Billion Share Buyback Amid 10% iPhone Sales Decline Tech giant Apple reveals its biggest-ever share buyback plan following a 10% drop in iPhone sales

— Alphabet Stock Surges: 14% Increase Post Strong Earnings and Debut Dividend

MIXED Signals: How to SAIL Through the Stock Market’s Choppy Waters NOW

Stock Market Swirls in Uncertainty: Is Your Investment Safe? Find Out How to Steer Through! As the stock market dances on...

— **Global Shipping Giant Alters Economic Forecast Amidst Shifting Outlook** One of the leading ocean shipping companies adjusts its global economic predictions in response to changing conditions

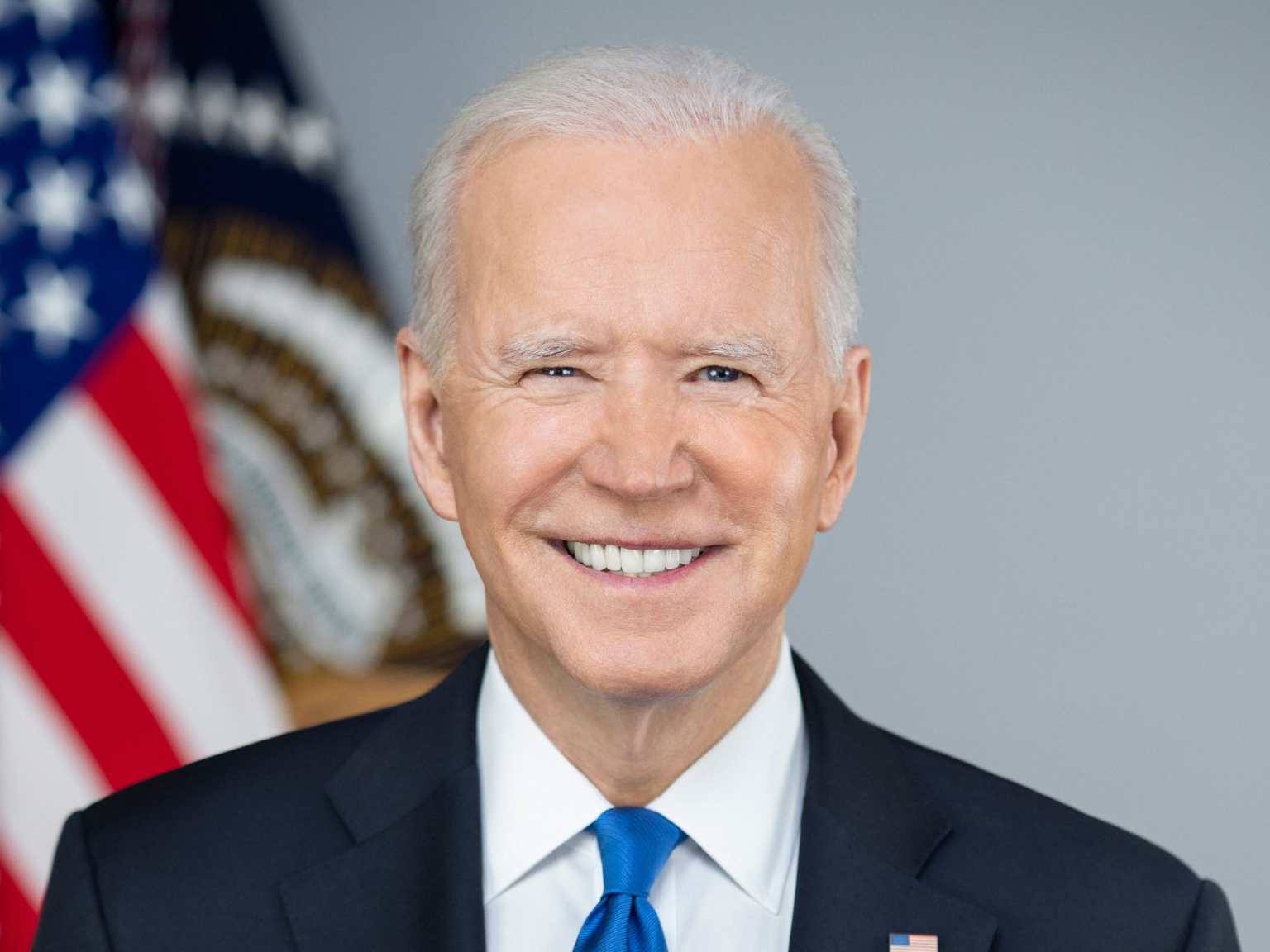

EMERGENCY Weapons Sale to Israel: BIDEN’S Bold Move Amidst Foreign Aid Stalemate

— Once again, the Biden administration has greenlit an emergency sale of weapons to Israel. The State Department made this announcement on Friday, stating that the move is designed to support Israel in its ongoing conflict with Hamas in Gaza.

Secretary of State Antony Blinken notified Congress about a second emergency determination that approves over $147.5 million in equipment sales. These sales encompass necessary components for 155 mm shells previously bought by Israel, including fuses, charges, and primers.

This decision was executed under an emergency provision of the Arms Export Control Act. This provision enables the State Department to sidestep Congress’ review role concerning foreign military sales. Interestingly enough, this move coincides with President Joe Biden’s request for nearly $106 billion in aid for countries like Israel and Ukraine being held up due to border security management debates.

“The United States remains dedicated to ensuring the security of Israel against threats it encounters,” declared the department.

Biden INKS $8863 Billion Defense Act, SLAMS Congressional Oversight

— President Joe Biden has put his signature on the National Defense Authorization Act, green-lighting a hefty $886.3 billion in spending. This act aims to equip our military with the means to deter future conflicts and provide support for service members and their families.

Despite giving his approval, Biden raised eyebrows with concerns over certain provisions. He argues these clauses excessively limit executive power in national security matters by calling for more congressional oversight.

According to Biden, these provisions could force the disclosure of highly sensitive classified information to Congress. There’s a risk this could expose crucial intelligence sources or military operational plans.

The extensive bill, which covers over 3,000 pages, sets out a policy agenda for the Department of Defense and U.S military but doesn’t earmark funding for specific initiatives or operations. Additionally, Biden voiced his ongoing concern about clauses barring Guantanamo Bay detainees from setting foot on U.S soil.

US STEEL Takeover: BLOCKING Japanese Buyout Could Save American Jobs

— Nippon Steel, Japan’s leading steel company, is facing a storm of criticism over its planned $14 billion acquisition of U.S. Steel Corporation. The deal, unveiled on Monday, values U.S. Steel at $55 per share and has sparked immediate opposition, especially in the Rust Belt where U.S. Steel has been a cornerstone since 1901.

Despite U.S. Steel’s assurances that the merger would unite “two storied companies with rich histories,” lawmakers are demanding action. Senators J.D. Vance (R-OH), Josh Hawley (R-MO), and Marco Rubio (R-FL) have written to Treasury Secretary Janet Yellen urging the Committee on Foreign Investment in the United States (CFIUS) to halt the deal.

The senators contend that domestic steel production is vital for national security and needs careful scrutiny before permitting foreign investment. CFIUS, led by Yellen, holds the authority to stop such investments after a review process.

While experts predict CFIUS is more likely to block deals involving countries perceived as adversaries like Russia or China rather than allies like Japan, this situation highlights bipartisan worries about foreign control over crucial industries.

Video

BRITISH PM’S Bold Housing Plan: 15 Million Homes to FIX Crisis

— British Prime Minister Keir Starmer has announced a plan to tackle the UK’s housing crisis by building 1.5 million homes over the next five years. This initiative aims to address the severe shortage of housing and create jobs in the construction sector.

The plan includes government-led projects and incentives for private developers, focusing on sustainable urban planning and energy-efficient homes. This aligns with broader goals to reduce carbon emissions and combat climate change.

Critics question whether the government can secure adequate funding and navigate bureaucratic challenges to achieve this ambitious goal. Despite these concerns, the government cites past successes in large-scale infrastructure as evidence of its capability.

More Videos

Invalid Query

The keyword entered was invalid, or we couldn't gather enough relevant information to construct a thread. Try checking the spelling or entering a broader search term. Often simple one-word terms are enough for our algorithms to build a detailed thread on the topic. Longer multi-word terms will refine the search but create a narrower information thread.

Politics

The latest uncensored news and conservative opinions in US, UK, and global politics.

get the latestLaw

In-depth legal analysis of the latest trials and crime stories from around the world.

get the latest

Social Chatter

What the World is SayingMSCI Index Shakeup 2025: United Airlines, Reddit IN – DINO, Celanese OUT? 🚀📉. MSCI Index Shakeup 2025: United Airlines, Reddit IN – DINO, Celanese OUT? 🚀📉 Background: A dynamic split screen – one side showing an airplane (United Airlines) and the Reddit logo, the other side showing ...

. . .MSCI Index Shakeup 2025: United Airlines, Reddit IN – DINO, Celanese OUT? 🚀📉. MSCI Index Shakeup 2025: United Airlines, Reddit IN – DINO, Celanese OUT? 🚀📉 Background: A dynamic split screen – one side showing an airplane (United Airlines) and the Reddit logo, the other side showing ...

. . .MSCI Index Shakeup 2025: United Airlines, Reddit IN – DINO, Celanese OUT? 🚀📉. MSCI Index Shakeup 2025: United Airlines, Reddit IN – DINO, Celanese OUT? 🚀📉 Background: A dynamic split screen – one side showing an airplane (United Airlines) and the Reddit logo, the other side showing ...

. . .MSCI Index Shakeup 2025: United Airlines, Reddit IN – DINO, Celanese OUT? 🚀📉. MSCI Index Shakeup 2025: United Airlines, Reddit IN – DINO, Celanese OUT? 🚀📉 Background: A dynamic split screen – one side showing an airplane (United Airlines) and the Reddit logo, the other side showing ...

. . .MSCI Index Shakeup 2025: United Airlines, Reddit IN – DINO, Celanese OUT? 🚀📉. MSCI Index Shakeup 2025: United Airlines, Reddit IN – DINO, Celanese OUT? 🚀📉 Background: A dynamic split screen – one side showing an airplane (United Airlines) and the Reddit logo, the other side showing ...

. . .