THREAD: brexit auto industry trump tax

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

TRUMP’S Bold Farmer AID Plan Ignites Hope And Fear In Trade WAR Storm

— The Trump administration is looking at giving direct help to American farmers as trade fights heat up. President Trump’s new tariffs, like the 25% tax on imported cars, have made some worry about payback from other countries. Still, Trump stands firm and tells Americans to buy homegrown cars instead of imports.

Stock markets took a hit after the tariff news. Global shares dropped, and JPMorgan now says there’s a 40% chance of recession. UBS cut its outlook for the S&P 500 but still thinks stocks could rise by year’s end.

Some critics are upset with the White House for going after law firms that file “frivolous” lawsuits against the government. This has sparked debate over whether everyday Americans can still take legal action when they feel wronged.

At the same time, businesses that depend on immigrant workers want changes in immigration laws as deportations go up. Chinese tech investments and efforts by some groups to calm global tensions show how closely politics and business are tied together today.

US-INDIA TRADE Shock: Trump TAX Bill Turmoil and LIV Golf Losses Rattle Markets

— A new US-India trade deal slashing tariffs could shake up global markets. This agreement is set to boost economic ties and change the game for key industries. While American businesses may find fresh opportunities, some will battle tougher competition from Indian imports.

At the same time, Republicans are split over President Trump’s tax cut bill. The fight has stalled progress in Congress and left voters fed up with Washington’s gridlock. One report says people feel “angry and hopeless.”

LIV Golf’s big money losses have cast doubt on Saudi Arabia’s sports gamble. Investors are now questioning if the league can survive after pouring in so much cash.

America is also facing chaos from a major prison break and strikes across several sectors, adding more stress to an already tense economy. Meanwhile, India’s stock market jumped thanks to new rules and growing industries — even as some areas still struggle to keep up.

FORD’S $15 Billion Loss Shock: Trump-Era Auto Tariffs Spark Industry Fears

— Ford Motor Company has hit pause on its earnings forecast after revealing a stunning $15 billion loss. The company blames tariffs from the Trump years and ongoing trade fights for the huge setback. Ford also warns that if these policies stay in place, the entire U.S. auto industry could face over $100 billion in extra costs.

To fight back, Ford tried rerouting vehicles through Canada, which saved about $1 billion. Still, there’s a lot of uncertainty ahead. This news comes as the Federal Reserve keeps interest rates steady and points to trade disputes as a big economic risk.

Industry experts say Ford’s move is a warning sign for all of American manufacturing. It raises tough questions about profits and stability for other car makers too.

No one knows yet how bad things will get, but Ford’s losses are shining a light on growing dangers for U.S. jobs and businesses if these tariffs stick around.

FORD’S Shocking Loss: Tariffs Deliver $15 Billion Blow to Auto Giant

— Ford Motor Company just took a huge hit—$15 billion lost, all thanks to tariffs. The company has now suspended its financial outlook for the year. Ford says these trade fights, many started under President Trump, are costing not just them but could slam the whole U.S. auto industry with over $100 billion in extra costs if things don’t change soon.

The Federal Reserve decided not to raise interest rates this time. They say it’s because of all the uncertainty from tariffs and global trade battles. This move caught Wall Street off guard and left some investors worried about what comes next.

There is one bright spot: The U.S. government has lifted tariffs on UK steel and aluminum and cut car tariffs down to 10%. This new deal was worked out between President Trump’s team and UK Prime Minister Keir Starmer.

These events show how much trade policy matters for American jobs and businesses. Car makers are feeling squeezed while leaders try to steer through a risky economic moment.

FORD’S $15 Billion Trade WAR Shock: How Trump’s Tough Tariffs Rattled the Auto Giant

— Ford Motor Company just hit the brakes on its earnings forecast. The company says tariffs from President Trump’s trade war could cost Ford a whopping $15 billion. Profits have already dropped 64% in the first quarter, and Ford blames these tariffs for most of the pain. Other carmakers may face over $100 billion in extra costs too.

To dodge some of these fees, Ford started sending cars from Mexico to Canada using special bond carriers. This helps avoid certain tariffs but doesn’t solve everything. By suspending its guidance, Ford is telling investors things are shaky and uncertain.

The Federal Reserve chose not to raise interest rates this time. Leaders pointed to risks from trade fights and older tariff rules as reasons for their caution. Big banks like Goldman Sachs also warned about possible trouble ahead for Wall Street.

There is some good news for global trade, though. A fresh deal between the U.S. and UK will remove steel and aluminum tariffs while cutting car taxes down to 10%. This agreement — first set up under President Trump — could help cool off some tensions even as other problems remain unsolved.

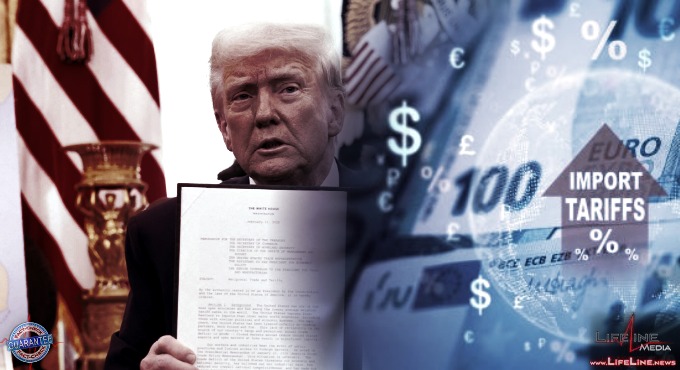

TRUMP’S Auto Import Tarifs Spark Fears And Rattle Markets

— Swiss bank UBS has cut its S&P 500 forecast for the end of 2025 from 6,600 to 6,400 points. This comes after President Trump announced new 25% tariffs on imported cars. Many worry these tariffs could start a bigger global trade fight. Still, UBS’s Mark Haefele says there is “meaningful upside” for U.S. stocks this year.

The new tariffs have shaken investors in the U.S., Asia-Pacific, and Europe. President Trump stands firm on his decision. He said he “couldn’t care less” if automakers raise prices and believes Americans will buy more cars made at home.

Markets worldwide are reacting fast to the news. The MSCI world stock index fell by 4.5% in March — the worst drop since September 2022. JPMorgan’s Bruce Kasman now says there is a 40% chance of a recession.

Investors face more risk as these bold trade moves take effect under Trump’s America-first plan. Wall Street is watching closely to see how this will impact jobs and growth in the months ahead.

TRUMP’S Auto-Tariff Order Brings Hope And Relief To Struggling CAR Industry

— President Trump signed a new order on April 29, 2025, to help American car makers. The rule stops the government from piling different tariffs — like those on steel and aluminum — on top of auto tariffs. This change comes after automakers asked for help with rising costs.

The order also gives companies a 15% credit if they use foreign parts but build cars in the U.S. Big names like General Motors have delayed earnings calls as they figure out how this will affect their profits. Even with these changes, car prices could still go up by as much as 15% this summer because of other tariffs.

Trump’s move aims to give car makers time to bring more jobs and factories back to America — a promise he made during his campaign. The stock market liked the news, with both the Dow and S&P 500 showing gains.

Most in the industry see this step as positive for now. However, strict electric vehicle rules in California are still causing trouble for automakers trying to follow both state and federal laws.

TRUMP’S Auto Imports TarifF Shock: “Liberation DAY” Ignites Hope For American Jobs

— President Trump just announced a 25% tariff on imported cars and parts, starting April 2, 2025. He calls it “Liberation Day” for American industry. The new tariffs will hit countries like Canada, Mexico, Japan, South Korea, and Germany.

The Trump team says these tariffs will boost U.S. manufacturing and protect American jobs. They believe it’s time to put America first and make foreign countries play by our rules — even if there’s some short-term pain.

Critics warn car prices could rise for families and that supply chains might get disrupted. Some experts say there could be temporary shutdowns in auto plants while companies adjust.

This move is part of Trump’s bigger plan to target steel, aluminum, and other imports from places like China and Venezuela. India may get special treatment as talks continue. Europe is already threatening to fight back over past metal tariffs.

TRUMP’S Bold Trade Shock Rocks Markets, Sparks Fear And Hope

— President Trump is set to announce tough new tariffs this week. His unpredictable style keeps Wall Street and America’s allies on edge. The latest 25% tariff on cars from Europe and Mexico caused the biggest stock market drop since 2020.

Elon Musk, a vocal Trump supporter, is stepping up his political game in Wisconsin. At a Green Bay event, Musk plans to give million-dollar checks to two men fighting activist judges. This move puts him front and center in the state’s Supreme Court race.

Inside the Pentagon, sources say there’s chaos as leaders scramble to keep up with Trump’s aggressive trade and immigration push. Despite distractions at home and abroad, Trump keeps pressing forward with his agenda.

While Biden battles lawsuits in courtrooms across the country, Trump faces legal fights of his own. With both sides under fire, Americans are left wondering what comes next as markets swing wildly and politics heat up.

TRUMP’S “Liberation DAY” Shocks Markets: Wall Street Reels as Tariffs Spark Global Showdown

— President Trump’s “Liberation Day” tariffs have rocked the markets. The Dow dropped more than 2,000 points on some days. The S&P 500 and Nasdaq both fell into bear market territory. These tariffs, reaching up to 125% for some countries, are the highest seen in a hundred years. China, the EU, and Japan are feeling the pain most. China hit back with its own tariffs on American goods. Japan’s finance minister warned of global trouble ahead. Still, US officials say they’re hopeful about future trade talks. Big companies are taking hits too. CarMax shares sank after weak earnings reports. Nvidia tumbled more than 20% from its high point this year. UnitedHealth lowered its profit forecast because Medicare costs keep rising. Experts think this wild ride will last until trade fights settle down. Some industries are holding up better than others under pressure. The Federal Reserve might cut rates three times this year if things get worse — some warn a financial crisis could happen if tariff chaos continues much longer.

TRUMP’S Trade WAR: A Global Financial Nightmare?

— The Bank of England warns of a looming global financial crisis due to Donald Trump’s trade war. The Financial Policy Committee (FPC) pointed out risks from new global tariffs introduced on April 9. These tariffs have increased uncertainty in world markets, possibly leading to debt spirals for governments.

The UK, with its open economy and large financial sector, is especially vulnerable to shocks from international trade conflicts. Rachel Reeves, the Chancellor, confirmed ongoing talks with the Bank’s Governor to watch market developments amid these tensions.

Trump’s threats of more tariffs on China could escalate the conflict and harm international cooperation. Such actions may worsen financial conditions worldwide, according to the FPC’s warning note.

Despite these worries, analysts believe that the well-capitalized UK banking system might offer some protection against economic turmoil. However, watching trade war developments remains crucial as they could greatly impact both local and global markets.

TRUMP’S 104% China Tarifs Stun Global Markets

— The UK and EU stock markets are feeling the pressure as President Trump’s tariffs, including a steep 104% on Chinese goods, take effect. EU trade commissioner Maroš Šefčovič announced that the EU will not retaliate against these U.S. tariffs, citing limited options for response. European Commission President Ursula von der Leyen suggested a “zero-for-zero” trade deal to the White House amid talks of an EU-US free trade zone by Trump adviser Elon Musk.

Concerns about the economic impact of these tariffs are growing in Europe. Patrick Martin, head of France’s Medef business lobby, warned that U.S. tariffs could harm France’s economic growth and possibly lead to a recession. Meanwhile, Wall Street has also taken a hit as hopes for tariff delays fade, with the S&P 500 dropping 1.6%.

Elon Musk has publicly criticized Trump adviser Peter Navarro over comments related to Tesla and the broader effects of U.S. tariffs on American businesses. In other business news unrelated to tariffs, a Chinese billionaire is looking to purchase multiple Hudson’s Bay locations in Canada due to an emotional connection with the brand and aims to prevent its financial collapse. Binding bids for these assets are expected by April 30th with lease offers due by May 1st.;

TRUMP’S Auto TAX Shock: Jaguar Land Rover Halts US Shipments

— Jaguar Land Rover is pausing shipments to the U.S. due to President Trump’s 25% import tax on vehicles. This British auto giant is adjusting its strategy to cope with new trade rules. The halt aims to help the company plan for long-term responses to these tariffs.

Experts say other British carmakers might follow Jaguar Land Rover’s lead. The higher tariffs add strain on an already struggling industry facing low domestic demand and a shift toward electric cars. “I expect similar stoppages from other producers,” said David Bailey, an automotive expert from the University of Birmingham.

The Society of Motor Manufacturers and Traders (SMMT) noted a 13.9% drop in U.K.-made cars last year, with over 77% exported mainly to the U.S. Factories making models like Nissan’s Qashqai and Juke are also feeling the heat from these issues.

SMMT’s chief executive, Mike Hawes, stressed that faster trade talks are crucial for supporting jobs and economic growth in both countries as they navigate these challenges together.

TRUMP’S Trade WAR Shocks: China And EU Face Major Impacts

— President Donald TRUMP announced sweeping tariffs affecting nearly all U.S. trading partners. China and the EU are hit hardest. The White House imposed a 10% tariff on all imports, with China facing an additional 34% on top of an existing 20%, totaling a hefty 54%. This move is just shy of Trump’s campaign promise of a 60% tariff on Chinese goods.

China reacted strongly, promising countermeasures against what it calls “protectionism.” The Chinese Commerce Ministry argues that trade wars have no winners and urges the U.S. to resolve differences through fair talks. Meanwhile, European nations face a blanket 20% tariff along with existing tariffs on steel, aluminum, and car exports.

Canada’s Prime Minister Carney has vowed to “fight” these tariffs as other world leaders assess their economic impact. The European Union has also promised retaliation against Trump’s aggressive trade policies. As tensions rise globally, nations brace for potential economic fallout from this escalating trade war initiated by the U.S..

TRUMP’S Bold Trade Move Shakes Global Markets

— Former President Donald Trump has signed orders for “reciprocal tariffs” aimed at countries with unfair trade practices. This plan is to protect American jobs by taxing goods from nations harming the U.S. economy. It’s a major shift in U.S. trade policy, affecting many imports.

Trump calls these tariffs vital to balance foreign advantages over American manufacturers, showing his focus on American workers and industries. This aligns with his re-election strategy, emphasizing economic nationalism as a key point. Supporters see it as reclaiming economic control, while critics warn of possible retaliatory tariffs and tense international relations.

Economists are split on the effects, worried about complicating U.S. trade further and raising consumer costs if other countries retaliate. The announcement has sparked mixed reactions across political lines, showing different views on its economic impact potential.

As Trump boosts his campaign efforts, this sweeping tariff policy will be watched closely by both domestic and international stakeholders for its effects on global trade dynamics and the future direction of the U.S economy’s path forward.

TRUMP’S Bold Stance on Auto Price Hikes and Global Diplomacy Revealed

— President Donald Trump recently declared he “couldn’t care less” if foreign automakers hike prices due to his auto tariffs. This bold move shows his commitment to putting American interests first, despite foreign economic pressures. Trump also confirmed he won’t fire anyone involved in the Signal group chat controversy.

Internationally, Iran has rejected direct nuclear talks with Trump but is open to indirect discussions. The President has warned of military action if Tehran doesn’t agree to a nuclear deal with Washington, highlighting his strong approach to national security and diplomacy.

Trump criticized Russian President Vladimir Putin and warned of secondary tariffs on nations buying oil from Russia amid Ukraine tensions. These potential tariffs are part of Trump’s broader strategy as he nears an April 2 deadline for major tariff actions against adversaries while staying open to negotiation deals.

Domestically, Republicans face challenges as Democrats aim for gains in Florida’s Sixth District despite Trump’s past success there. Meanwhile, Trump withdrew Congresswoman Elise Stefanik’s nomination for U.N. ambassador amidst a slim GOP House majority and upcoming special elections, underscoring internal party dynamics and strategic shifts before future political battles.

TRUMP’S Bold Move: UK Could Dodge US Trade Barriers

— Donald Trump praised UK Labour leader Keir Starmer for his effective lobbying during a recent meeting. Trump described the encounter as “tremendously productive.” This hints at a possible exemption for the UK from new US tariffs.

Trump expressed optimism, stating there is “a very good chance at arriving at a very good deal.” This suggests positive developments in US-UK trade relations. The meeting also touched on foreign policy issues, especially concerning Ukraine.

The talks could signal big shifts in transatlantic ties as both nations navigate complex political landscapes. Trump’s remarks highlight potential changes in US trade policy favoring the UK.

Such developments may have far-reaching effects on both countries’ political and economic environments, strengthening their relationship even further.

“TRUMP’S Steel Tariffs Ignite Fears Among UK Businesses”

— President Donald TRUMP plans a 25% tariff on steel imports, causing unease in the UK. The move, described as “without exceptions,” has led UK shadow business secretary Andrew Griffith to urge negotiations for an exemption. The Department for Business and Trade warns these tariffs could harm UK steelmakers by allowing cheaper imports to undercut them.

A survey shows 37% of UK entrepreneurs fear increased operational costs due to TRUMP’s proposed tariffs. With the US accounting for 22% of the UK’s total exports, the potential impact is significant. Entrepreneurs worry about staying competitive amid these new financial pressures.

In response, the UK government is taking steps to bolster its steel industry through a Plan for Steel Consultation initiative. This strategy includes up to £2.5 billion aimed at protecting jobs and fostering economic growth within the sector. These efforts highlight ongoing challenges in international trade relations between the US and UK under TRUMP’s tariff policies.

TRUMP’S Bold Trade Plan Sends Global Markets Into Turmoil

— President Donald TRUMP is set to announce new reciprocal tariffs on Thursday. These tariffs aim to match the tax rates other countries impose on U.S. imports. This move is part of Trump’s strategy to reshape international trade and counteract barriers that hurt American businesses.

Trump’s plan has sparked discussions among global trading partners, potentially impacting economic relations and market stability. The announcement follows a memo he signed, directing his team to calculate duties that align with those charged by other nations.

In addition to trade policy changes, the Trump administration has started workforce reductions across federal agencies, affecting recent hires in departments like Education and Energy. These actions reflect a broader agenda focused on reducing government size and boosting efficiency.

Meanwhile, Southern California faces severe weather threats as heavy rains prompt evacuations due to potential debris flows in wildfire-scarred areas. Residents are urged to stay alert as CalTrans crews work tirelessly to reduce flooding risks in affected regions.

— UK Ambassador Teams Up with Farage to Win Over Trump Lord Mandelson plans to collaborate with Nigel Farage in efforts to strengthen ties with the Trump administration

— EU Sets Three Conditions for UK Trade Deal as Starmer Pursues Post-Brexit Agreement Brussels is reportedly preparing to demand that the UK adhere to EU laws for the first time since Brexit in negotiations with Labour leader Sir Keir Starmer

— Canada Prepares Tariff Retaliation Amid Trade Tensions A Canadian government official announced that the country is considering potential tariff targets in response to ongoing trade disputes

— Business Leaders Optimistic for Trump Victory Despite Current Polls: C-Suite Advisor Warns of Denial Trend Among CEOs

— Thailand Emerges as Crucial China Hedge for Automakers Eyeing EV Market Expansion Automakers view Thailand, known as the ‘Detroit of Asia,’ as a strategic pivot to mitigate reliance on China in the growing electric vehicle sector

UK-CANADA Trade Talks GRIND to a Halt: The Beef and Cheese Battle That’s Costing Billions

— The UK government has unexpectedly put the brakes on post-Brexit trade talks with Canada. This sudden move follows a two-year stalemate over beef and cheese imports and exports, which began after Britain officially left the European Union.

Trade between these nations, valued at roughly 26 billion pounds ($33 billion) per year, has mostly persisted under the initial agreement made while Britain was still an EU member. However, Canadian negotiators are feeling the heat from their own beef industry and local cheesemakers. The former is pushing for access to the UK market for hormone-fed beef, while cheesemakers are raising alarms about tariff-free imports of British cheese.

The privilege of tariff-free British cheese exports came to a halt at the close of 2023 when a temporary agreement expired. This change led to a staggering 245% duty hike for British producers. Canada’s trade minister Mary Ng firmly stated that Canada “will never agree to a deal that isn’t beneficial for our workers, farmers and businesses.” Minette Batters, president of the National Farmers’ Union in England and Wales praised Britain’s resistance against hormone-fed beef imports.

Despite this hiccup in negotiations, the UK government remains open-minded about future discussions. However, any significant progress appears unlikely at present.

Video

GLOBAL ELECTIONS Shock: What’s at Stake for Iran, Britain, and France

— Over the next week, voters in countries like Iran, Britain, and France will head to the polls. These elections come at a critical time with global tensions high and public concerns over jobs, climate change, and inflation.

In Iran, Supreme Leader Ayatollah Ali Khamenei seeks a successor for President Ebrahim Raisi following his recent death. Candidates include hard-liners Saeed Jalili and Mohammad Bagher Qalibaf as well as reformist Masoud Pezeshkian.

These elections could significantly impact global politics amid ongoing wars in Europe, the Middle East, and Africa. The outcomes may reorient international relations during this period of mutual suspicion among major powers.

![How Biden’s Corporate Tax Hike, 100+ Wall Street Pictures [HD]](https://lifeline.news/wp-content/uploads/bidens-tax-hike-terror-how-wall.jpg)

Social Chatter

What the World is SayingFormer President Donald Trump is once again targeting global trade practices, this time zeroing in on tech giant Apple and its increasing reliance on India for iPhone production. 🔗: https://what...

. . .🇺🇸🇬🇧 "We signed a tremendous trade deal... With this deal, the UK joins the US in affirming that reciprocity and fairness is an essential and vital principle of international trade....

. . .THE TRUMP EFFECT: $8 TRILLION in U.S. Investments and Climbing! 🇺🇸💰

. . .Just 100 days in, President Trump’s economic policy is driving down inflation, gas, and grocery costs, while jobs boom, investments pour in, and America First proves it’s not just a slogan...

. . .Time for Britain to lead the world out of tariff chaos - and end the tragedy of American cheese

. . .