THREAD: business shocker chorus saks and

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

NO SHOCKING Financial News Rocks Markets: Investors Relieved on May 17, 2025

— Conservative investors hoping for big headlines today can breathe easy. There are no new financial shocks or surprises for May 17, 2025. The news cycle remains calm, with no sudden market drops or major policy changes making waves.

Instead, the main stories still center on ongoing issues like the Russia-Ukraine conflict and U.S. ties in the Middle East. Some reports mention local ceasefires, but nothing has rattled Wall Street or Main Street today. No big IPOs or earnings shakeups have hit the wires either.

Japan’s decision to treat crypto assets as financial products stands out as a recent highlight from late March — not today. Inflation is cooling a bit, but worries about tariffs and global trade fights continue to linger over the markets’ future direction.

In short, it’s a steady day for finance with no fresh disruptions or breakthroughs reported. Smart investors should keep watching world events that could change things in the days ahead — but for now, all is quiet on Wall Street.;

US-INDIA TRADE Shock: Trump TAX Bill Turmoil and LIV Golf Losses Rattle Markets

— A new US-India trade deal slashing tariffs could shake up global markets. This agreement is set to boost economic ties and change the game for key industries. While American businesses may find fresh opportunities, some will battle tougher competition from Indian imports.

At the same time, Republicans are split over President Trump’s tax cut bill. The fight has stalled progress in Congress and left voters fed up with Washington’s gridlock. One report says people feel “angry and hopeless.”

LIV Golf’s big money losses have cast doubt on Saudi Arabia’s sports gamble. Investors are now questioning if the league can survive after pouring in so much cash.

America is also facing chaos from a major prison break and strikes across several sectors, adding more stress to an already tense economy. Meanwhile, India’s stock market jumped thanks to new rules and growing industries — even as some areas still struggle to keep up.

BUSINESS SHOCKER: Chorus, Saks, And Starbucks Unleash Bold Moves On Global Markets

— Chorus is rolling out faster business fibre plans in New Zealand. The company now offers a 1Gbit/s plan with equal upload and download speeds. They also promise quicker service if things go wrong. Experts say if more businesses use the cloud, it could add billions to New Zealand’s economy.

Saks Fifth Avenue is trying something new by selling luxury goods on Amazon’s UK website. With brands like Dolce&Gabbana and Balmain, Saks hopes Amazon will help them reach more shoppers across Europe.

Starbucks may sell part of its China business. The coffee giant has started talking with private equity groups and tech firms as it looks for new ways to grow in China.

These bold moves show how big companies are changing fast to stay ahead in a tough global market. Conservatives know that innovation and competition keep economies strong — these updates are proof of that belief.

RETAIL MELTDOWN: Joann Fabrics Bankruptcy Leaves Loyal Shoppers Stunned

— Joann Fabrics has filed for bankruptcy and plans to shut down around 500 stores nationwide. The company is drowning in nearly $1 billion of debt and is now scrambling to survive. This move shows just how tough things are for brick-and-mortar retailers right now.

Many shoppers are shocked by Joann’s collapse. It highlights the shaky ground that many traditional stores stand on today. While some familiar chains struggle, a few big companies are still doing well.

Disney, for example, just reported a $2.36 billion profit this quarter — a 7% jump — thanks to packed theme parks and more people streaming at home. The gap between Joann’s troubles and Disney’s success reveals how much shopping habits have changed since COVID-19.

This uneven recovery means Main Street businesses could face even more trouble ahead as Americans keep changing where — and how — they spend their money.

RETAIL CHAOS Rocks Main Street: Joann Bankruptcy Stuns Shoppers, Disney Soars, Dollar General Surges

— Joann Fabrics just filed for Chapter 11 bankruptcy and plans to shut down 500 stores across the country. The company is drowning in $1 billion of debt as it hopes a sale will keep it afloat. This marks another blow to old-school retailers who can’t keep up with shifting shopping habits and rising costs.

Meanwhile, Disney posted a huge quarterly profit of $2.36 billion — a jump of 7% from last year. Packed theme parks and booming streaming services helped Disney beat Wall Street’s predictions even while the economy stays shaky.

Dollar General is bucking the trend by predicting more growth ahead. While Joann Fabrics closes its doors, this discount chain expects to thrive as shoppers hunt for bargains during tough times.

These changes reveal a split in America’s economy — traditional retailers are struggling while entertainment giants like Disney and budget chains like Dollar General find new ways to win over customers.;

JOANN FABRICS Shocker: Heartbreaking Store Closures Hit 2025

— Joann Fabrics will shut down about 500 of its 850 U.S. locations in 2025 after filing for bankruptcy again. The company is drowning in $1 billion of debt and has failed to recover as a private business.

Florida will lose around 35 Joann stores, making it one of the worst-hit states. To survive, Joann is trying to bring in new shoppers by selling gaming merchandise and old-school game consoles.

This isn’t just about Joann. Big retailers all over the country are closing doors. Advance Auto Parts plans to shut more than 700 locations by mid-2025. Experts warn that up to 15,000 U.S. stores could close next year — twice as many as this year.

These closures show how tough things are for specialty and department store chains right now. High costs, changing shopping habits, and fierce online competition are pushing many longtime businesses out of the market.

GOLDMAN SACHS Sounds Alarm: S&P 500 Faces Shock From Trump-ERA Trade Fight

— Goldman Sachs is warning that the recent jump in the S&P 500 may not last. The bank says new trade tensions under President Trump and signs of a weaker economy are big risks for investors.

Trump’s “Liberation Day” announcement has stirred up talk about more U.S.-China tariffs. Goldman Sachs questions if the market can keep rising if these trade fights heat up again.

TD Cowen now says there’s a 70% chance that Chinese stocks could be kicked off U.S. exchanges, thanks to ongoing pressure from Trump’s team. This adds even more worry for investors as trade rules keep changing fast.

These warnings show how quickly things can shift on Wall Street when leaders make bold moves and economic data sends mixed signals. Investors are watching closely to see if tariffs will cause real trouble — or if relief is on the way soon.

BUFFETT SHOCKS Wall Street: Berkshire CEO Steps Down, New Era Begins

— Warren Buffett, the 94-year-old investment icon, just announced he will step down as CEO of Berkshire Hathaway at the end of 2025. He broke the news at the company’s annual meeting, sending shockwaves through Wall Street and Main Street. For over sixty years, Buffett built Berkshire into a powerhouse that shaped American business.

Greg Abel will become the new CEO. Abel is currently vice chairman and has been seen as Buffett’s pick to lead next. Investors are watching to see if Abel can keep Berkshire steady and stick to its conservative values.

Berkshire shares saw heavy trading after Buffett’s announcement. Some investors feel hopeful about a smooth handoff, but others worry about losing Buffett’s steady leadership.

Buffett will stay on as board chairman for now. His exit marks a huge change in American business at a time when markets face new tariffs, government fights in Washington, and global uncertainty.

UPS LAYOFFS Spark Fear: American Jobs At Risk From Trade Shock

— UPS just announced it will lay off 20,000 workers and shut down 73 buildings. The company blames falling package numbers and new tariffs for the cuts. UPS hopes to save $35 billion as Amazon sends fewer shipments after recent trade changes.

Amazon is also under stress. Many sellers are piling up extra inventory to avoid shipping delays, but this is only a short-term fix. Even Amazon’s cloud service isn’t doing as well as some of its competitors.

Other big names like McDonald’s and General Motors have warned that sales could drop because of tariff worries. Chinese shopping app Temu is now trying to work with more American sellers to get around these rules.

In retail news, Kohl’s fired CEO Ashley Buchanan over business deals tied to his girlfriend. These changes show how trade policies can shake up everything from shipping companies to major retailers across America.

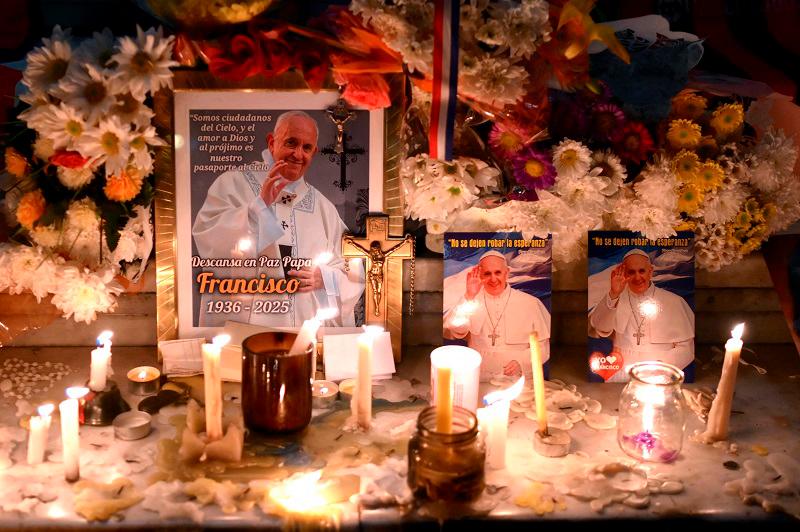

POPE FRANCIS Death Shock: World Stunned as Global News Stalls

— The world is standing still after the death of POPE FRANCIS. Business leaders worldwide have sent their condolences, but there are no major international events making headlines.

Most news outlets have shifted focus to U.S. stories, like the Arizona Department of Corrections investigation and Harvard’s lawsuit against the Trump administration. These are not global stories and offer little for those wanting international updates.

Outside of ongoing coverage about Pope Francis’s passing, there is almost no movement on the world stage. Anyone hoping for big news from abroad will have to wait until something new breaks.

RETAIL CHAOS: Forever 21 and Joann Shut Doors as Ollie’S Surges Forward

— Forever 21 is heading for its second bankruptcy and plans to shutter about 200 U.S. stores. Once a mall favorite, the chain has struggled to keep up with online shopping and new trends. Closures have already begun in states like Michigan, New York, and California. Joann Fabrics is closing all its locations after filing for Chapter 11 bankruptcy. Even their website has shut down because of high demand during clearance sales. Many shoppers are upset about store policies as hundreds of sites get ready to close. While others shrink, Ollie’s Bargain Outlet is on the rise. The discount chain will grab up to 100 Big Lots store leases as Big Lots faces its own financial troubles. Ollie’s expects to open around 75 new outlets in 2025 — much faster than usual. Retailers are feeling the heat from online competition and a shaky economy. Walgreens and Kohl’s are also closing hundreds of stores as more Americans turn away from old-school shopping habits.

NO NEW World News Shocks: Media Silent Beyond US, UK on April 21

— On April 21, 2025, global news outlets had nothing new to report outside the United States and United Kingdom. Headlines stayed the same as previous days.

Most coverage still centers on the Israel-Palestine conflict. Aid groups warn about Gaza’s growing crisis because of ongoing blockades. In the UK, protests and legal fights over transgender rights continue to make news.

No fresh international events or emergencies have surfaced beyond these stories today.

Conservative readers may notice how media keeps focusing on just a few issues instead of reporting unexpected world events that matter to everyday people.

WH SMITH’S High Street Exit: A Shocking Shift in Retail

— Modella has bought WH Smith’s online operations for £76 million. The company will now run under the TGJones name, while WH Smith keeps its travel shops. This move shows the tough times high street retailers face in a digital world.

WH Smith might sell its digital card business, Funky Pigeon, as part of restructuring. Nicholas Found from Retail Economics says old-school retailers struggle with fewer shoppers and rising costs. This sale highlights the economic pressures on traditional high street businesses.

Modella plans to keep current products and services in WH Smith stores, like Post Office and Toys R Us sections. They also want to add new items like craft goods to boost business. For now, it’s “business as usual” as Modella works on future plans for growth.

The acquisition shows WH Smith’s shift towards travel retail, which is more profitable despite industry challenges. With 480 high street stores and 5,000 employees affected by this change, focusing on travel-related retail could increase revenue in a tough market landscape.

NEW DUTY Shock: Retail Prices to Skyrocket, Consumers Worried

— Retailers are raising concerns about a looming price surge. A new 25% duty on exports from Mexico and Canada is set to increase costs. This change could lead to higher prices for shoppers almost immediately.

The duty affects a wide range of goods, impacting everyday items. Retailers warn this could disrupt supply chains and limit product availability. Shoppers should brace for potential price hikes at local stores.

Efforts to ease these effects are underway, but challenges remain tough. Businesses might need new strategies to handle rising costs. The economic impact of this policy change deserves close attention from policymakers and the public alike.

SURFWEAR SHOCK: Billabong and Quiksilver’s US Parent Company Hits Bankruptcy

— The U.S. parent company of popular surfwear brands Billabong and Quiksilver has filed for bankruptcy, leading to the closure of over 100 retail locations. Despite this setback, the Australian operations of these iconic brands remain unaffected. This marks a big shift in the surfwear industry, impacting both employees and shoppers.

Canadian businesses face new challenges as a key cross-border exemption is set to end due to U.S.-imposed tariffs on Canadian goods. The removal will likely raise operational costs for many companies relying on easier product movement between countries. Businesses brace for an economic impact similar to previous tariff threats under former President Trump’s administration.

Stifel Nicolaus has reaffirmed its “Buy” rating for IBM, setting a price target of $290 based on strong AI advancements and cash flow growth projections. IBM continues to lead in AI innovation through consulting services and software development, positioning itself among top trending stocks in this sector. Investors remain hopeful about IBM’s future amid growing interest in artificial intelligence technologies.

Bristol-Myers Squibb saw more than a 2% drop in premarket trading after announcing 2025 guidance that fell short of analyst expectations. The pharmaceutical giant’s disappointing forecast has raised concerns among investors about its future performance.;

UPS STOCKS Plummet: Amazon Partnership Slashed, Investors Shocked

— United Parcel Service Inc. (UPS) shares have dropped sharply after announcing a major cut in its business dealings with Amazon.com Inc. UPS plans to reduce its low-margin Amazon business by half, surprising analysts and impacting the company’s revenue projections. Daniel Imbro from Stephens Inc. noted the unexpected nature of this rapid shift in strategy.

The company has projected $89 billion in revenue for 2025, falling short of analysts’ expectations of $94.9 billion, following a reported $91.1 billion for 2024. UPS is focusing on higher-margin sectors like healthcare, aiming for $20 billion in revenue from this segment by 2026 as it raises prices and implements surcharges to offset losses from Amazon’s reduced contribution.

Amazon accounted for 11.8% of UPS’s revenue last year, making the decision to slash this partnership significant amid weak demand recovery for parcel services this year. This strategic pivot highlights UPS’s efforts to stabilize its financial outlook by prioritizing more profitable ventures over volume-driven partnerships with lower margins like Amazon’s delivery services.;

UPS SHARES Plummet: Bold Move to Slash Amazon Business Stuns Investors

— UPS shares dropped sharply after the company revealed plans to cut its business with Amazon in half. This move comes as UPS faces lower-than-expected revenue projections, signaling that a rise in parcel demand isn’t likely this year. To cope, UPS has been hiking prices and adding surcharges.

In a bid for bigger profits, UPS is focusing on growing its health-care segment, aiming for $20 billion in revenue by 2026. The company predicted $89 billion in revenue for 2025, which is below analysts’ expectations of $94.9 billion. In 2024, UPS reported revenues of $91.1 billion with Amazon making up 11.8% of that total.

The sudden cutback with Amazon caught many investors and analysts off guard. Daniel Imbro from Stephens Inc., noted the swift change as surprising news within industry circles. This strategic shift shows UPS’s dedication to prioritizing higher-margin ventures over volume-driven deals like the one with Amazon.

ITALY’S Financial Shock: Monte Paschi’s Bold Move

— Banca Monte dei Paschi di Siena SpA is making waves with its surprising plan to buy a larger competitor. Finance Minister Giancarlo Giorgetti shared his confidence in Paschi’s leadership, applauding their impressive results and strategic market vision. This acquisition could challenge bigger banks and keep Italy’s financial services under local control.

Monte Paschi’s rocky history began in 2007 when it bought Banca Antonveneta SpA for €9 billion, much more than its earlier value. The global financial crisis hit soon after, causing big losses for Paschi and years of restructuring efforts.

Despite past struggles, the Italian government remains the bank’s largest shareholder, backing its current plan to boost national financial independence.

AMERICAN EXPRESS Hit Hard: $230 Million Settlement Shocks Industry

— American Express has agreed to a $230 million settlement, surprising customers and industry insiders. This hefty financial blow highlights the growing scrutiny on major financial institutions. Analysts see this as a turning point, pushing companies to rethink their compliance strategies.

The settlement raises concerns about deeper issues within the financial industry. Customers are shocked and worried about how this might tarnish American Express’s reputation. Experts say this incident could lead to stricter oversight of financial firms in the future.

This development is crucial as it signals a potential shift in accountability for big financial players. The pressure is building for these giants to adapt to tighter regulations and increased consumer awareness. Financial companies may need to reevaluate their practices in response to this wake-up call.

— S&P 500 SOARS to NEW RECORD CLOSE The index surged as traders sought to capitalize on the momentum from recent Federal Reserve interest rate cuts

— Oasis Fans May Get Refunds as Watchdog Investigates Ticketmaster Disappointed fans of the Britpop band are seeking refunds after ticket prices for the Gallagher brothers’ reunion tour surged over 100% while they were in the purchasing process

— Stocks Stage Impressive Recovery, Recouping Weekly Losses: Market closes higher, bouncing back significantly from Monday’s sell-off

SUNAK SHOCKS Nation: Calls Surprise Election for July 4

— British Prime Minister Rishi Sunak has shocked many by calling a general election for July 4. Known for being thorough and evidence-led, this move contrasts sharply with his usual cautious approach.

Opinion polls suggest that Sunak’s Conservative Party is trailing behind the opposition Labour Party, which could spell trouble for his leadership. Sunak took office in October 2022, replacing Liz Truss after her economic policies caused market turmoil.

Sunak had warned against Truss’s unfunded tax cuts, predicting economic havoc that indeed followed. His rise to power was rapid, becoming Britain’s first leader of color and youngest prime minister in over two centuries at age 42.

Sunak previously served as Treasury chief during the coronavirus pandemic, where he introduced an unprecedented economic support package. Now at age 44, he faces a critical test with this upcoming election amid challenging political landscapes.

— Google Employees Raise Concerns Over Decline in Morale Following Strong Earnings Report Amid exceptional financial results, Google faces internal scrutiny as employees express morale issues to executives

— Alphabet Stock Surges: 14% Increase Post Strong Earnings and Debut Dividend

Video

GLOBAL ELECTIONS Shock: What’s at Stake for Iran, Britain, and France

— Over the next week, voters in countries like Iran, Britain, and France will head to the polls. These elections come at a critical time with global tensions high and public concerns over jobs, climate change, and inflation.

In Iran, Supreme Leader Ayatollah Ali Khamenei seeks a successor for President Ebrahim Raisi following his recent death. Candidates include hard-liners Saeed Jalili and Mohammad Bagher Qalibaf as well as reformist Masoud Pezeshkian.

These elections could significantly impact global politics amid ongoing wars in Europe, the Middle East, and Africa. The outcomes may reorient international relations during this period of mutual suspicion among major powers.

Social Chatter

What the World is SayingI'm still shocked that this is the reality of farming.

. . .I'm still shocked that this is the reality of farming.

. . .This comes as a surprise to most people

. . .Happy 1 year to the biggest surprise ever #1YearOfTSTTPD

. . .🚨 SIGNAL SCANDAL: Katherine Maher, the leftist NPR CEO, is currently the Chair of the Board of Signal! WHAT ARE THE ODDS?

. . .