THREAD: china failed

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

CHINA’S 34% Tariff Shock: How It Could Hurt American Wallets

— China has slapped a 34% tariff on U.S. goods, ramping up trade tensions. This follows recent U.S. tariffs on Chinese imports, sparking fears of a trade war.

Experts warn these tariffs might harm American businesses and consumers by raising prices and slowing economic growth. Washington is concerned about undoing post-pandemic recovery efforts.

The Trump administration is considering countermeasures and may seek international support to tackle China’s trade practices. This situation has ignited debates over the future of U.S.-China relations and global trade dynamics.

Financial markets reacted quickly, with stocks dropping due to fears that escalating conflicts could further destabilize the global economy. These developments could significantly affect both U.S.-China relations and international markets.

TRUMP’S Trade WAR Shocks: China And EU Face Major Impacts

— President Donald TRUMP announced sweeping tariffs affecting nearly all U.S. trading partners. China and the EU are hit hardest. The White House imposed a 10% tariff on all imports, with China facing an additional 34% on top of an existing 20%, totaling a hefty 54%. This move is just shy of Trump’s campaign promise of a 60% tariff on Chinese goods.

China reacted strongly, promising countermeasures against what it calls “protectionism.” The Chinese Commerce Ministry argues that trade wars have no winners and urges the U.S. to resolve differences through fair talks. Meanwhile, European nations face a blanket 20% tariff along with existing tariffs on steel, aluminum, and car exports.

Canada’s Prime Minister Carney has vowed to “fight” these tariffs as other world leaders assess their economic impact. The European Union has also promised retaliation against Trump’s aggressive trade policies. As tensions rise globally, nations brace for potential economic fallout from this escalating trade war initiated by the U.S..

CHINA’S Aggressive Moves Near Taiwan Spark Fears

— Taiwan has spotted 11 Chinese military aircraft and nine vessels close to its territory. This highlights the rising tensions between China and Taiwan.

China’s United Front Work Department has created a misinformation unit, boosting efforts in cognitive warfare against Taiwan. This shows China’s strategic focus on psychological operations in the area.

These military actions stress Taiwan’s need to stay alert as China increases its maneuvers. The situation demands global attention to maintain regional stability and peace.

CHINA’S Military Moves Near Taiwan Stir Global Concern

— Taiwan has spotted 11 Chinese military aircraft and 9 vessels close to its territory. This marks a major increase in China’s military activity around Taiwan.

China is also boosting its cognitive warfare against Taiwan by setting up a misinformation unit within its United Front Work Department. This move raises fears of rising tensions in the region.

In other news, AIM Vaccine’s improved diploid rabies vaccine has been approved for clinical trials. The new vaccine promises better results than current options, highlighting AIM’s innovative power on the global stage.

SOUTH CHINA SEA Showdown: Rising Fears and Global Stakes

— Armed forces from several nations are boosting their presence in the South China Sea, raising tensions over territorial claims. Chinese naval vessels have confronted American warships in disputed waters, leading to close encounters. The United States reaffirms its commitment to freedom of navigation, while China insists the area is under its sovereignty.

Regional allies like Japan and Australia are worried about the rising tension and call for diplomatic solutions. Chinese vessels have intercepted U.S. Navy ships during routine operations, prompting condemnation from the U.S. State Department. In response, China defends its actions as protecting sovereignty and warns against foreign provocations.

Both sides prepare for possible military drills in the region, raising fears of accidental conflict. Analysts warn that ongoing military posturing could trigger a major geopolitical crisis affecting trade routes and international relations across Asia-Pacific.

The situation demands careful handling to avoid unintended escalation and maintain regional stability as tensions continue to simmer in these contested waters.

CHINA WARNS of Escalation Over US Tariff Moves

— China has issued a stern warning in response to recent U.S. tariff challenges, signaling potential escalation if tensions continue. A Chinese official stated that the situation could worsen dramatically if provoked further by the United States. Beijing remains committed to supporting its economy while criticizing U.S. actions as aggressive and harmful to international trade relations.

TAIWAN RALLIES UKRAINE SUPPORT Against CHINA THREATS

Taiwan is reportedly teaming up with Ukrainian companies to develop contingency plans due to rising tensions with China. This strategic move aims at bolstering Taiwan’s defenses and ensuring economic stability against potential threats from mainland China.

CONGO VIOLENCE SURGES, Raising HUMANITARIAN ALARMS

The conflict in the Democratic Republic of the Congo has intensified significantly, raising alarms over worsening humanitarian conditions. Local reports highlight increased violence, prompting international scrutiny of the situation’s impact on civilians.

South Sudan faces political turmoil following the arrest of a key military leader, confirmed by a vice-presidential spokesperson. This development threatens the country’s fragile peace deal amidst ongoing internal conflicts and power struggles. These stories underscore current geopolitical challenges as of March 5, 2025, reflecting a dynamic landscape

US TRADE WAR Heats UP: China and Canada Strike Back

— China and Canada hit back at the U.S. with their own tariffs after America imposed new levies on them. This could worsen trade ties with these key partners. China set additional tariffs up to 15% on certain American goods.

Canada also announced it would impose tariffs as high as 25% in response to the U.S.'s recent actions against both countries. These moves follow America’s new tariffs targeting these nations, heightening global trade tensions.

This growing tariff battle shows the increasing economic friction between major economies under current U.S. policies. The situation is still changing, affecting international trade and domestic markets in all involved countries.

CHINA STRIKES Back: US Farmers Face Uncertain Future in Trade WAR

— China swiftly hit back at new U.S. tariffs by imposing higher import taxes on $21 billion of American agricultural goods. This move ramps up tensions between the world’s two largest economies, edging them closer to a trade war.

Despite the increased tariffs, China’s futures markets stayed steady, showing strength amid this economic clash. The Chinese government has stated it won’t be cowed by these new actions from the Trump administration.

This situation highlights the growing economic rivalry and its impact on global trade relations, especially in agriculture — a vital sector for both countries. As this dispute unfolds, American farmers might struggle to keep their export markets in China.

:max_bytes(150000):strip_icc()/GettyImages-2192142603-a439d21d07ef4ace9708e5f08f188b0b.jpg)

CHINA’S Tech Boom: How Deepseek AI is Shaking Global Markets

— China’s tech industry is booming, thanks to the rise of the DeepSeek AI model. Major companies like Alibaba, Baidu, and Xiaomi are seeing big benefits. This surge has pushed Hong Kong’s Hang Seng Tech Index up this year.

Alibaba, co-founded by Jack Ma, stands out in this market rally. The company’s growth shows the broader impact of tech advancements on China’s economy. Investors are watching these changes for possible global effects.

The rise in China’s tech stocks might affect U.S. investments and international trade ties. As U.S. markets close with small changes in the S&P 500, global investors keep an eye on shifts in Chinese tech trends.

This ongoing rally highlights China’s growing influence on worldwide economic dynamics, making it a key player to watch in global markets.

US RECLAIMS PANAMA Canal: A Bold Move Against China

— Panama’s President José Raúl Mulino announced plans to end a major development deal with China after meeting U.S. Secretary of State Marco Rubio. This decision comes after President Trump raised concerns about China’s influence over the Panama Canal, a key shipping route connecting the Pacific Ocean and the Caribbean Sea. Mulino stressed that Panama’s control over the canal remains firm but showed interest in boosting ties with the United States instead of renewing its 2017 agreement with China’s Belt and Road Initiative.

On his first international trip since confirmation, Secretary Marco Rubio promised to further America’s interests in Panama. He emphasized his dedication to advancing President Trump’s “America First” foreign policy during meetings with U.S. Embassy staff in Panama City. Rubio declared that the United States will not allow more Chinese control over this strategic waterway, echoing Trump’s resolve to protect American economic interests in global trade routes.

Trump has criticized China’s alleged grip on the canal, accusing Beijing of charging high fees on U.S. ships using this crucial passage built by America and handed to Panama under President Carter’s administration. By refocusing on U.S.-Panama relations, both Trump and Rubio aim to counter what they see as increasing Chinese influence in Latin America’s vital infrastructure projects like the canal itself.

CHINESE AI Revolution: DeepSeek’s Shockwave Hits US Tech Giants

— A new force in artificial intelligence, DeepSeek from China, is shaking up major U.S. tech firms. Their latest AI model, DeepSeek-R1, rivals top U.S. products like OpenAI’s GPT-4 and Google’s Gemini but at a fraction of the cost. This move challenges American dominance and has triggered a massive selloff in tech stocks.

Launched on January 20, 2025, DeepSeek-R1 boasts impressive performance with lower training costs than competitors. Nvidia faced a record market cap drop of over $500 billion — the largest single-day loss in U.S. stock market history — due to this launch. Experts are both amazed and skeptical about DeepSeek’s cost claims, sparking debate on future AI investment strategies.

DeepSeek’s CEO Liang Wenfeng has held closed-door meetings with Chinese leaders to discuss global tech competition implications from their advancements. The rapid rise of DeepSeek has sparked talks about traditional tech investment sustainability and potential industry shifts needed moving forward. Consumers are also interested, as the DeepSeek app topped download charts in both U.S. and China App Stores shortly after release.;

CHINA’S AI Threat: Tech Stocks in Danger of $1 Trillion Wipeout

— Chinese AI startup DeepSeek has shaken global tech stocks, sparking fears about America’s technological advantage. Investors worry about a potential $1 trillion loss in tech value due to rising foreign competition.

The drop in tech shares shows growing concern over the competitive landscape. Major indices have fallen, urging investors to be cautious as the situation develops.

This happens amid wider talks on global trade and economic competitiveness, especially in tech-heavy areas. Experts recommend reassessing portfolios, favoring stable investments over risky tech stocks.

Market analysts emphasize watching these changes closely as they could affect market stability and growth prospects in the technology sector moving forward.

CHINA’S Record Trade Surplus Sparks Global Alarm

— In December 2024, CHINA reached a record trade surplus of $104.8 billion. This was due to a surge in exports before President-elect Donald Trump could impose tariffs. The New York Times reported that China’s export boom is causing friction with many trade partners, not just the United States. Several nations are now erecting tariff barriers against Chinese products to protect their markets.

China’s export success has been an economic boon, creating millions of jobs in sectors like manufacturing and engineering. The nation dominates industries such as solar panels and is becoming self-sufficient in areas like commercial jets. However, China still struggles with energy independence outside solar power.

The automobile industry showcases China’s manufacturing strength, evolving from a major importer to the world’s largest car exporter in two decades. Critics argue that China’s overcapacity and government subsidies distort global auto markets by flooding them with cheap vehicles amid declining local demand.

While record exports might seem beneficial for China, they could lead to financial strain if companies face bankruptcy due to low prices and excess inventory as tariff barriers persist globally. The auto industry may have peaked, facing strong resistance from politically influential foreign markets protecting their own electric vehicle sectors through tariffs and subsidies.

DEVASTATING EARTHQUAKE Rocks China: Tragedy Strikes Remote Region

— A powerful earthquake hit Tibet, China, on January 7, 2025. The disaster resulted in at least 53 fatalities and extensive damage across towns and rural areas.

Emergency services are conducting rescue operations as local authorities mobilize resources to help affected communities. Residents have been warned about potential aftershocks and advised to avoid damaged structures.

This earthquake adds to China’s ongoing challenges with natural disasters, raising concerns about the region’s readiness for seismic events. Past criticisms of government response strategies linger in public discourse.

Authorities will continue providing updates as rescue efforts progress and damage assessments are made. International aid may soon be offered to support recovery efforts in the devastated region.

— China’s Xi Jinping Calls for Action to Prevent Future Mass Killings The Chinese president has emphasized the need for measures to ensure that recent mass killings do not recur in the nation

WORLD’S Largest Gold Discovery: China’s $83 Billion Treasure Unearthed

— Geologists in China have uncovered what is being called the largest gold deposit in the world. The find, located in Pingjiang County, Hunan Province, is valued at $83 billion. This discovery was made about 12 miles beneath the surface and includes 40 gold ore veins with a total of 300.2 tons of gold resources.

The Hunan Academy of Geology suggests there could be over 1,000 tons of gold reserves at depths beyond 3,000 meters. This major find highlights China’s position as the world’s top gold producer, contributing around 10% to global output in 2023.

This discovery comes amid rising bullion prices and growing interest in gold investments worldwide. As markets react to this news, it could heavily influence global economic strategies and investment trends.

— China Prepares for Key Week Amid US Elections and Stimulus Anticipation Markets are closely watching as China braces for significant developments related to the upcoming US elections and potential economic stimulus announcements

— China SLAMS US for Expanding Export Control List, Promises Retaliation The Chinese government has criticized the United States for adding more companies to its export control list and has vowed to take countermeasures

— **Southeast Asia Emerges as Prime Supply Chain Diversification Hub Amid US-China Tensions** Companies increasingly turn to Southeast Asia for diversifying supply chains amidst escalating tensions between the US and China

CHINA’S Moon Landing: A Bold Step in Space Race

— China’s space program reached a major milestone by landing a module on the moon’s far side. The lander touched down at 6:23 a.m. Beijing time in the South Pole-Aitken Basin, according to the China National Space Administration. This mission is China’s sixth in its moon exploration program, aiming to compete with the United States, Japan, and India.

The mission involves using a mechanical arm and drill to gather up to 2 kilograms of surface and underground material over two days. An ascender will then transfer these samples to another module orbiting the moon, which will return them to Earth by June 25. The samples are expected to land in China’s Inner Mongolia region.

Landing on the far side of the moon presents unique challenges due to lack of direct communication and difficult terrain. Neil Melville-Kenney from the European Space Agency noted that automation is particularly challenging at high latitudes because long shadows can confuse landers. Despite these difficulties, China continues its ambitious plans with an eye on putting a person on the moon by 2030, making it only the second country after America to achieve this feat.

— Thailand Emerges as Crucial China Hedge for Automakers Eyeing EV Market Expansion Automakers view Thailand, known as the ‘Detroit of Asia,’ as a strategic pivot to mitigate reliance on China in the growing electric vehicle sector

CHINA’S Failed Nicaragua Canal: A Symbol of Lost Ambitions

— The Interoceanic Grand Canal, also known as the Nicaragua Canal, was a bold initiative intended to link the Atlantic and Pacific Oceans via Central America’s largest lake. Daniel Ortega’s government in Nicaragua promoted this $50 billion project as a competitor to the Panama Canal. It also risked boosting China’s influence in the region with a 50-year lease given to HKND Group, led by Chinese tycoon Wang Jing.

Despite breaking ground in December 2014 amid much celebration, no substantial progress ensued. Wang Jing saw his wealth plummet by 85% shortly thereafter. By 2021, he and his company were ousted from the Shanghai Stock Exchange due to unethical practices, signaling a sharp fall from their lofty ambitions.

Following these setbacks, Nicaragua’s National Assembly enacted legal reforms at Ortega’s behest. They annulled previous laws that had granted canal concessions and declared these changes essential for “strengthening” Nicaragua’s legal framework for improved national governance. Critics suggest these actions were mere attempts to recover dignity following an embarrassing failure

In sum, while initially seen as a strategic geopolitical move and economic boon for Nicaragua, the failed canal project has instead become emblematic of overreach and mismanagement under Ortega’s rule.

TIME to STOP Iran’s Terror Funding: The Unholy Alliance Exposed

— The current geopolitical landscape has raised serious concerns, according to a recent statement by Lawler. He drew attention to an emerging alliance between China, Russia, and Iran that is becoming increasingly visible. Notably, he identified China as the largest consumer of Iranian petroleum. These sales are providing financial support for dangerous terrorist groups.

Lawler stressed the need for immediate action against Iran in response to over 150 attacks on U.S. military bases and personnel since October 7. Tragically, these assaults have resulted in three servicemembers losing their lives. He called on the administration for a decisive response against Iran.

A bipartisan bill designed to curb illegal funds supporting terrorism was approved in the House after October 7 but has hit a roadblock in the Senate. Lawler urged both Senate and administration officials to advance this bill as part of a comprehensive strategy against these threats.

Lawler believes that an effective response should not only be military or diplomatic but also economic: cutting off funding at its roots. This multi-pronged approach is essential for effectively fighting terrorism.

Bipartisan Committee CALLS for END of China’s Trade Status: A Potential Jolt to US Economy

— A bipartisan committee, led by Rep. Mike Gallagher (R-WI) and Rep. Raja Krishnamoorthi (D-IL), has been studying the economic effects of China on the US for a year. The investigation centered on job market changes, manufacturing shifts, and national security concerns since China joined the World Trade Organization (WTO) in 2001.

The committee released a report this Tuesday recommending President Joe Biden’s administration and Congress to implement nearly 150 policies to counteract China’s economic influence. One significant suggestion is to cancel China’s permanent normal trade relations status (PNTR) with the U.S., a status endorsed by former President George W. Bush in 2001.

The report argues that granting PNTR to China did not bring anticipated benefits for the US or trigger expected reforms in China. It asserts that this has led to a loss of vital U.S. economic leverage and inflicted damage on U.S industry, workers, and manufacturers due to unfair trade practices.

The committee proposes shifting China into a new tariff category that reinstates U.S economic leverage while reducing dependence on Chinese

ITALY’S Bold Exit from China’s Belt and Road Initiative: A Triumph for Western Independence

— Italy recently declared its departure from China’s Belt and Road Initiative (BRI), signifying a major shift in Western attitudes towards Beijing’s economic clout. After four years of involvement, Italian Foreign Minister Antonio Tajani noted that nations not participating in the initiative have seen superior results.

The official withdrawal notice was issued by Prime Minister Giorgia Meloni’s administration this week, well before the initial agreement expires next year. This decision sets the stage for an upcoming summit hosted by China with European Union leaders who have lately adopted a more wary stance towards Beijing.

In response to mounting skepticism, Chinese Foreign Minister Wang Yi advocated for mutually beneficial relationships between Europe and China to boost global development. However, such views are increasingly met with suspicion in Europe as Western societies strive to steer clear of economic connections that might give Beijing an upper hand during political upheavals.

Stefano Stefanini, former Italian Ambassador, underscored an official G7 policy termed “de-risking”, spotlighting U.S.'s opposition against Italy’s participation in BRI. Despite U.S warnings labeling it as a “predatory” lending scheme aimed at controlling strategic infrastructure, Italy joined the initiative back in 2019.

Video

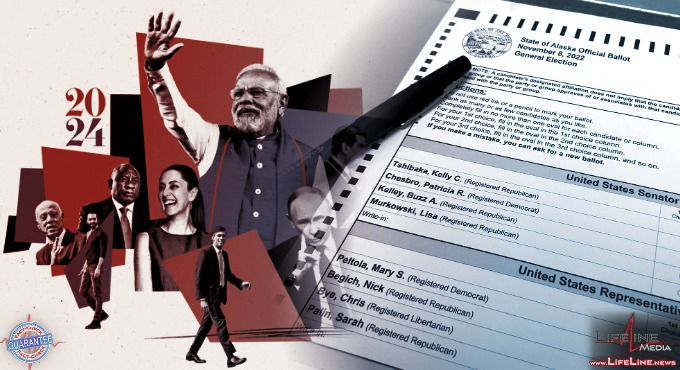

GLOBAL ELECTIONS Shock: What’s at Stake for Iran, Britain, and France

— Over the next week, voters in countries like Iran, Britain, and France will head to the polls. These elections come at a critical time with global tensions high and public concerns over jobs, climate change, and inflation.

In Iran, Supreme Leader Ayatollah Ali Khamenei seeks a successor for President Ebrahim Raisi following his recent death. Candidates include hard-liners Saeed Jalili and Mohammad Bagher Qalibaf as well as reformist Masoud Pezeshkian.

These elections could significantly impact global politics amid ongoing wars in Europe, the Middle East, and Africa. The outcomes may reorient international relations during this period of mutual suspicion among major powers.

More Videos

Invalid Query

The keyword entered was invalid, or we couldn't gather enough relevant information to construct a thread. Try checking the spelling or entering a broader search term. Often simple one-word terms are enough for our algorithms to build a detailed thread on the topic. Longer multi-word terms will refine the search but create a narrower information thread.

Politics

The latest uncensored news and conservative opinions in US, UK, and global politics.

get the latestLaw

In-depth legal analysis of the latest trials and crime stories from around the world.

get the latest

Social Chatter

What the World is SayingChina’s shocking DeepSeek AI pops US Big Tech monopoly bubble Chinese AI company DeepSeek shocked the West with a groundbreaking open-source artificial intelligence model that beats huge Silicon Valley Big Tech monopolies. Is the US stock market bubble popping? By Ben Norton China is making enormous...

. . .[World] - China’s EV champion Geely bets on tech edge to expand in Asia, Europe | South China Morning Post. [World] - China’s EV champion Geely bets on tech edge to expand in Asia, Europe | South China Morning Post

. . .[World] - China’s EV champion Geely bets on tech edge to expand in Asia, Europe. [World] - China’s EV champion Geely bets on tech edge to expand in Asia, Europe

. . .30.01.2024. 30.01.2024 **China reportedly started mapping out a big-budget rescue mission to bring $300 billion back onto its shores.** * China's stock market fell 7% this January alone. * Government is now raiding state companies' offshore accounts, gaining $300 billion to be funnelled straight into the econ...

. . .China in MSCI Index - Chinese Stock Market. China in MSCI Index - Chinese Stock Market In economic news Last week, Morgan Stanley Capital International (MSCI), a widely-tracked global index provider, said it would ...

. . .