THREAD: cineworlds gamble and the markets...

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

UK ENERGY GAMBLE: Billions Risked to Break Foreign OIL Chains

— The UK government just rolled out a massive energy plan, promising to spend over £15 billion on homegrown wind, solar, and nuclear power. Prime Minister Keir Starmer says the goal is simple — cut ties with foreign oil and make sure Britain’s lights stay on no matter what.

Officials argue this bold move is needed after recent global chaos exposed how much the country relies on others for energy. They claim it will also bring thousands of new jobs, especially in rural areas where many projects are set to break ground.

But not everyone is cheering. Critics say the price tag is sky-high and worry about delays that could leave families waiting years for real results. Some are also raising red flags about what these giant new sites might do to local land and wildlife.

Still, government leaders insist this risky push is vital for national security and true independence from foreign oil. As more details come out, many are watching closely to see if this gamble pays off — or backfires.

LIV GOLF’S Shocking Losses Spark Doubt Over Saudi Sports Gamble

— LIV Golf, the Saudi-funded golf league, is in big trouble. Its UK branch saw losses jump from $244 million to $394 million in 2023. This huge spike has many wondering if the league can survive.

The soaring losses show deep problems behind the scenes. Critics say LIV Golf’s shaky finances could scare off top players and sponsors.

Saudi Arabia’s push into global sports has faced tough questions before. Now, LIV Golf’s risky business plan is under even more pressure.

Fans and investors are watching as doubts grow about whether Middle Eastern money alone can keep this struggling league afloat.

WH SMITH’S High Street Exit: A Shocking Shift in Retail

— Modella has bought WH Smith’s online operations for £76 million. The company will now run under the TGJones name, while WH Smith keeps its travel shops. This move shows the tough times high street retailers face in a digital world.

WH Smith might sell its digital card business, Funky Pigeon, as part of restructuring. Nicholas Found from Retail Economics says old-school retailers struggle with fewer shoppers and rising costs. This sale highlights the economic pressures on traditional high street businesses.

Modella plans to keep current products and services in WH Smith stores, like Post Office and Toys R Us sections. They also want to add new items like craft goods to boost business. For now, it’s “business as usual” as Modella works on future plans for growth.

The acquisition shows WH Smith’s shift towards travel retail, which is more profitable despite industry challenges. With 480 high street stores and 5,000 employees affected by this change, focusing on travel-related retail could increase revenue in a tough market landscape.

WARREN BUFFETT’S Bold Moves in a Chaotic Economy

— Warren Buffett, the billionaire investor, is taking a careful approach in today’s economic climate. He has trimmed Berkshire Hathaway’s equity portfolio and boosted investments in Treasury bills. This strategy shows caution as financial markets face turmoil.

Berkshire Hathaway has also changed its focus on diversity and inclusion. The company removed these topics from its annual report, joining other American firms rethinking their stance on such issues. Instead, the report highlights human capital and practices for attracting and keeping employees across its 189 businesses.

Buffett’s annual letter to shareholders remains a key source of investment wisdom. Investors watch these letters closely for insights into his strategies and market views. His guidance continues to influence many in the financial world, stressing long-term value over short-term gains.

— Nvidia Set to Release Q3 Earnings Today The tech giant will unveil its third-quarter financial results after market close, drawing attention from investors and analysts alike

— Nasdaq Soars 1% as Wall Street Overcomes Russia-Ukraine Concerns The tech-heavy index rallied, buoyed by a significant surge in Nvidia shares despite ongoing geopolitical tensions

— Stocks Stage Impressive Recovery, Recouping Weekly Losses: Market closes higher, bouncing back significantly from Monday’s sell-off

— S&P 500 Ends Lower on Friday, Yet AI Trading Sparks 145% Surge in First Half of 2024

CONSERVATIVE Officials in HOT Water Over Election Betting Scandal

— Nick Mason is the fourth Conservative official to be investigated by the U.K.’s Gambling Commission for allegedly betting on election timing before the date was announced. Dozens of bets with potential winnings worth thousands of pounds are under scrutiny.

Two other Conservative candidates, Laura Saunders and Craig Williams, are also being investigated. Tony Lee, Saunders’ husband and Conservative director of campaigning, has taken a leave of absence amid similar allegations.

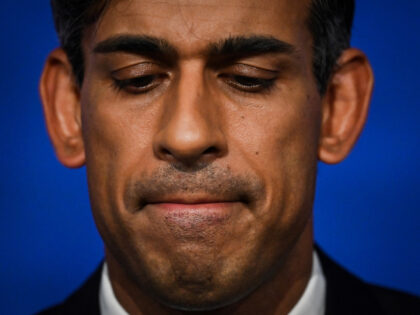

The scandal comes just two weeks before the national election, dealing a blow to Prime Minister Rishi Sunak’s party. Sunak expressed anger over the allegations and stated that lawbreakers should be expelled from the party.

Saunders has pledged full cooperation with investigators. Williams served as Sunak’s parliamentary private secretary in addition to being a candidate.

— Dow Jones Slides Over 100 Points Amid Economic Concerns in June Trading The Dow Jones Industrial Average dips over 100 points in the first trading session of June, with investor sentiment impacted by ongoing economic uncertainties

From BETTING FRENZY to Prison: Andy May’s £13M Gamble and His Fight Against Addiction

— Andy May, once a finance manager from Norfolk, squandered his family’s house deposit in a gambling frenzy. After seven years of abstinence from betting, the allure of a “free bet” during the 2014 World Cup lured him back into the destructive habit.

May’s addiction spiraled out of control as he misused his company credit card to gamble away £1.3 million. This reckless act led him straight to prison. Now released after two years, he has teamed up with GambleAware to share his cautionary tale and raise awareness about gambling addiction.

During his four-and-a-half-year betting spree, May wagered on everything conceivable. He even resorted to paying off personal credit card debts using company funds. His illicit activities eventually caught up with him in 2019 when he was found guilty of stealing over £1.3 million from his employer.

Despite losing his job and deceiving his family about it, May confesses that he might be tempted by gambling again but fights daily against this urge. He underscores that no amount of potential winnings could enhance his life while everything is

Social Chatter

What the World is Saying