THREAD: frank bisignano social security shocks

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

GOLDMAN SACHS Sounds Alarm: S&P 500 Faces Shock From Trump-ERA Trade Fight

— Goldman Sachs is warning that the recent jump in the S&P 500 may not last. The bank says new trade tensions under President Trump and signs of a weaker economy are big risks for investors.

Trump’s “Liberation Day” announcement has stirred up talk about more U.S.-China tariffs. Goldman Sachs questions if the market can keep rising if these trade fights heat up again.

TD Cowen now says there’s a 70% chance that Chinese stocks could be kicked off U.S. exchanges, thanks to ongoing pressure from Trump’s team. This adds even more worry for investors as trade rules keep changing fast.

These warnings show how quickly things can shift on Wall Street when leaders make bold moves and economic data sends mixed signals. Investors are watching closely to see if tariffs will cause real trouble — or if relief is on the way soon.

TRUMP’S Third Term Bombshell: Social Security Upheaval and Supreme Court Fury Rock America

— Frank Bisignano, a longtime Wall Street leader, was confirmed by the Senate to run the Social Security Administration in a close 53-47 vote. Conservatives see hope for long-overdue changes, while liberals are already protesting. The vote shows just how divided Washington is about Social Security’s future.

Overseas, trouble is brewing between India and Pakistan. Pakistan tested a ballistic missile and deadly violence broke out in Kashmir. India answered with military drills and threats to cut off water supplies. World leaders warn that nuclear conflict could be closer than we think.

President Trump’s new tariffs have restarted the fight over his “America First” trade plan. Ford Motor Company pulled its earnings forecast because of tariff worries, sparking debate about whether these moves will save American jobs or make life more expensive for families.

Trump also hinted he might seek a third term as president, saying “there are methods” but it’s “far too early.” The Supreme Court allowed Trump’s transgender military ban to stay in place, while his team announced $1,000 incentives for illegal immigrants who agree to leave on their own — both decisions causing heated arguments across the country as crime and unrest continue at public events and college campuses.

BISIGNANO VICTORY: Senate Ignites Hope for Social Security Reform Amid Liberal Fury

— Frank Bisignano, a seasoned Wall Street leader, has been confirmed by the Senate to head the Social Security Administration. The vote was close — 53 in favor and 47 against.

Liberal lawmakers and activists are furious over his appointment. They worry he will push for big changes to Social Security. Conservatives, however, see this as a much-needed step toward fixing the program.

Bisignano’s new role could mean real change in how Social Security is run. Many on the right hope he will bring discipline and accountability to a system that desperately needs it.

BISIGNANO SHOCKS Washington: Senate Greenlights Social Security Shakeup Despite Liberal Fury

— Frank Bisignano, a seasoned Wall Street leader, has been confirmed by the Senate to head the Social Security Administration. The vote was tight — 53 in favor, 47 against — showing just how divided Washington is over this pick.

Bisignano takes charge as big changes hit the agency. In recent months, there have been layoffs, office closures, and program cuts — all part of President Trump’s push for a leaner government with help from adviser Elon Musk.

Democrats are using Social Security as a rallying cry against Trump. Joe Biden even claimed that Trump “has taken a hatchet” to benefits for seniors and families who rely on these programs.

Despite all the noise from Democrats and activists, Bisignano will serve as commissioner until January 2031. At his confirmation hearing, he made it clear he has no plans to privatize Social Security — putting some worries to rest but leaving others fired up about what comes next.

BUFFETT SHOCKS Wall Street: Berkshire CEO Steps Down, New Era Begins

— Warren Buffett, the 94-year-old investment icon, just announced he will step down as CEO of Berkshire Hathaway at the end of 2025. He broke the news at the company’s annual meeting, sending shockwaves through Wall Street and Main Street. For over sixty years, Buffett built Berkshire into a powerhouse that shaped American business.

Greg Abel will become the new CEO. Abel is currently vice chairman and has been seen as Buffett’s pick to lead next. Investors are watching to see if Abel can keep Berkshire steady and stick to its conservative values.

Berkshire shares saw heavy trading after Buffett’s announcement. Some investors feel hopeful about a smooth handoff, but others worry about losing Buffett’s steady leadership.

Buffett will stay on as board chairman for now. His exit marks a huge change in American business at a time when markets face new tariffs, government fights in Washington, and global uncertainty.

US MARKETS SHAKEN: GDP Slump and Trump’S Tough Trade Moves Rattle Investors

— Wall Street had a rocky day. The Dow Jones rose by 141 points, but the S&P 500 and Nasdaq barely moved. New data showed the US economy shrank for the first time in three years, and job growth was weaker than hoped. Many investors are watching President Trump’s trade tariffs as inflation reports come out and tech stocks struggle.

Visa stood strong with big profits and a $30 billion stock buyback plan. CEO Ryan McInerney said Visa’s business model is helping them stay steady in these tough times. But airlines and auto parts companies are still feeling the pain from tariffs.

Outside the US, Pakistan’s stock market crashed over fears of military conflict with India, which also hurt Indian markets. In Europe, the central bank raised interest rates even though banks are still shaky after problems at Credit Suisse.

Tech firms like Super Micro Computer reported less demand for AI equipment, while BlackRock invested more in blockchain technology. Experts say investors should be careful with risky stocks right now and look at safer options as global uncertainty grows.

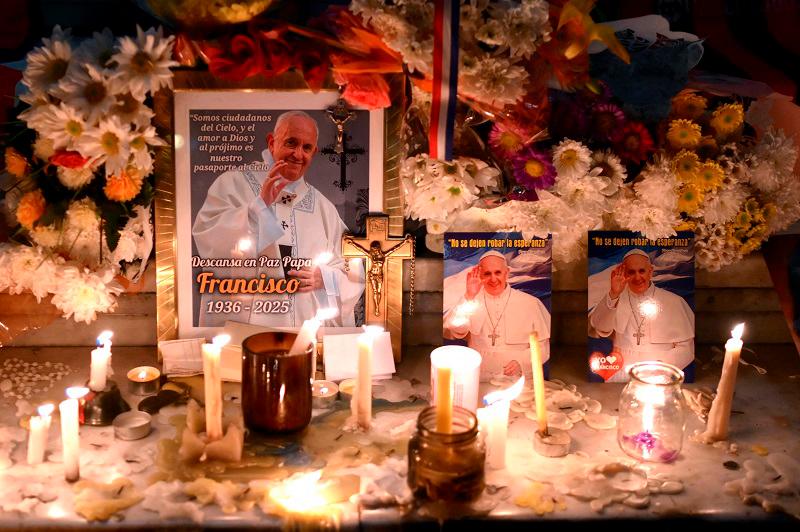

POPE FRANCIS Death Shock: World Stunned as Global News Stalls

— The world is standing still after the death of POPE FRANCIS. Business leaders worldwide have sent their condolences, but there are no major international events making headlines.

Most news outlets have shifted focus to U.S. stories, like the Arizona Department of Corrections investigation and Harvard’s lawsuit against the Trump administration. These are not global stories and offer little for those wanting international updates.

Outside of ongoing coverage about Pope Francis’s passing, there is almost no movement on the world stage. Anyone hoping for big news from abroad will have to wait until something new breaks.

ZERO FINTECH’S Astonishing WIN: 2024 Profits Smash Wall Street Expectations

— Zero Fintech Group Limited, known as 0093.HK, just reported its highest profits ever for 2024. The company’s strong revenue and earnings came at a time when many feared the economy was slowing down.

Investors wasted no time reacting. After the news broke on April 16, Zero Fintech’s stock jumped sharply. Experts say this shows how well the company has managed risk in a tough industry.

This financial victory gives Zero Fintech a strong foundation for future growth in 2025 and beyond. Industry experts are now watching to see if this will shake up fintech markets around the world.

HHS LAYOFFS Shock Nation: 10,000 Jobs at Risk

— The U.S. Department of Health and Human Services (HHS) is undergoing a major shake-up, leading to layoff notices for up to 10,000 workers. Senator Bill Cassidy wants Health Secretary Robert F. Kennedy Jr. to explain the changes next week. HHS hasn’t shared many details about the mass firings that started Tuesday but did release some information on Thursday.

Meanwhile, Democratic attorneys general and governors from 23 states and Washington, DC, are suing HHS and Secretary Kennedy over a $12 billion cut in public health funding. They claim this reduction is illegal and harmful during ongoing health crises like the opioid epidemic and mental health care issues. New York Attorney General Letitia James warned these cuts could undo progress in vital healthcare areas.

These events put more pressure on HHS’s actions under Secretary Kennedy’s leadership, affecting public health systems nationwide. The upcoming Senate hearing will likely reveal more about these controversial decisions impacting thousands of jobs and billions in funding across states.;

FIDELITY and TRUMP’S Bold Move: Stablecoins to Revolutionize Finance

— Fidelity is pushing forward with its digital asset strategy by testing a new stablecoin. This aligns with the Trump administration’s plans to overhaul cryptocurrency oversight, marking a big change in the financial world. Fidelity’s move shows how important stablecoins are becoming in modern finance.

Donald Trump’s World Liberty Financial is launching a dollar-pegged stablecoin called USD1. It will be fully backed by U.S. Treasuries and other cash equivalents, ensuring stability and trust for investors. This launch highlights Trump’s ongoing influence in finance, especially digital currencies.

In Canada, Tesla faces halted rebate payments due to trade tensions with the U.S., impacting its operations as taxis or ride shares. Rebates will stay frozen until individual claims are checked, showing ongoing international trade challenges under current policies.

Moody’s has issued warnings about worsening U.S. public finances under Trump’s policies, which could make it harder to manage rising deficits and debt levels effectively.

Rural Seniors STRUGGLE as SOCIAL Security Rules Shift

— Veronica Taylor, a 73-year-old from rural West Virginia, faces challenges with new Social Security rules. She lacks internet skills and transportation, making it hard to access her benefits.

The Trump administration wants to streamline processes and cut fraud by requiring online or in-person identity checks for Social Security recipients. This change could be tough for people like Taylor.

Mary Weaver, visiting the McDowell County Senior Center, shares worries about these changes starting on March 31. Seniors in remote areas might struggle without proper support systems.

FEDERAL JUDGE Stands Firm: Social Security Agency’s Future in Jeopardy

— A federal judge has pushed back against Leland Dudek, the acting head of the Social Security Administration (SSA), over his threat to close the agency. Dudek argued that a ruling blocking Elon Musk’s cost-cutting team from accessing sensitive taxpayer data could apply broadly to all employees. He suggested this might require blocking nearly all SSA employees from computer systems access.

Dudek first made his closure threat during an interview with Bloomberg News on Thursday night, sparking concerns about potential disruptions in social security services. In a Friday interview with The Washington Post, he criticized the judge’s decision as overly broad and warned of its implications for agency operations.

This legal standoff highlights ongoing tensions between government agencies and private sector influences under Musk’s leadership. The situation raises questions about how far private interests can go in influencing public institutions without compromising essential services for citizens.

TRUMP’S Bold SSA Shakeup: What It Means for Americans

— The Social Security Administration (SSA) is reshaping its Office of Analytics, Review, and Oversight (OARO) into existing divisions. This move aims to streamline management and boost data sharing. The SSA wants to improve fraud detection and tackle waste more effectively.

Additionally, the SSA will end agreements with the Retirement and Disability Research Consortium (RDRC), saving about $15 million in 2025. These changes align with President Trump’s Department of Government Efficiency (DOGE), which focuses on modernizing federal technology. However, there’s no direct confirmation that DOGE influenced these specific changes at the SSA.

Acting Social Security Commissioner Lee Dudek says these adjustments are crucial for maintaining program integrity. Democratic senators Ron Wyden and Chuck Schumer raised concerns about the removal of former Acting Commissioner Michelle King, claiming she was ousted for resisting data access pressures.

Future plans regarding further cuts by DOGE at the SSA remain unclear, sparking ongoing discussions among stakeholders. This reflects broader efforts under Trump’s administration to enhance efficiency in social services through governmental reforms.

SUPREMEX CFO Exit Sparks Strategic Shift

— Supremex Inc., a key player in North America’s envelope and packaging market, announced the exit of its Chief Financial Officer, François Bolduc. Known for its strong industry presence, this leadership change hints at a possible strategic shift as Supremex faces future challenges.

To ensure stability during this transition, Supremex has Stewart Emerson working closely with the finance team. This plan aims to keep operations steady while searching for Bolduc’s replacement. The company is dedicated to finding a new CFO soon.

The hunt for a new CFO will start shortly, showing Supremex’s proactive stance on leadership changes. Investors and stakeholders are watching closely as the company advances with this process. Stay tuned for updates on how this may affect Supremex’s market strategies and performance.

TRUMP-Linked Firm’s BOLD Crypto Move Shakes Wall Street

— World Liberty Financial (WLF), linked to Donald TRUMP, has announced a strategic reserve of digital assets. The firm is moving over $307 million to Coinbase Prime. Initially thought to be a sell-off, WLF clarified these are routine treasury operations.

The project aims to tokenize real-world assets, providing secure infrastructure for institutional investors. At the Ondo Summit, WLF highlighted blockchain’s potential to modernize outdated financial systems. This move has attracted major partners like Franklin Templeton and Google Cloud, showing strong interest in blockchain’s role in traditional finance.

Market analysts suggest WLF’s crypto involvement could sway investor sentiment and influence regulatory developments. If successful, it might prompt other institutions to explore similar strategies, potentially transforming the financial landscape.

Financial markets are watching closely amid concerns about Trump’s tariff policies and their impact on inflation and interest rates. The outcome of this initiative could have far-reaching effects on both Wall Street and global finance sectors.

TRUMP-Linked Firm’s BOLD Crypto Move Shakes Up Wall Street

— World Liberty Financial (WLF), associated with former President Donald TRUMP, is making a splash in the crypto world. The firm has moved over $307 million in digital assets to Coinbase Prime. While some speculate a sell-off, WLF says these are just routine financial operations.

WLF plans to tokenize real-world assets, providing a secure platform for big investors. At the Ondo Summit, executives emphasized blockchain’s potential to update traditional finance systems. Partnerships with Franklin Templeton and Google Cloud highlight this drive for innovation.

Market experts believe WLF’s crypto involvement could sway investor opinions and regulatory trends. If successful, it might lead other firms to adopt similar strategies, significantly reshaping the financial scene.

$40K EGG HEIST Exposes Shocking Security Flaws

— A daring $40,000 egg heist has left the business world in shock. The CEO of the affected company spoke to the media, explaining how thieves stole a large batch of premium eggs. These eggs were likely targeted for their high market value, showing weaknesses in supply chains.

The CEO stressed the urgent need for better security to prevent such thefts. He voiced worries about rising crime rates affecting businesses, especially in agriculture. This event highlights larger safety issues within the industry.

The business community reacted with sympathy and outrage, demanding stronger protections for local businesses against crime. Support efforts are underway to help the impacted company during this tough period.

This theft is a stark reminder of risks even established businesses face today, urging a reevaluation of security practices across all sectors.

ITALY’S Financial Shock: Monte Paschi’s Bold Move

— Banca Monte dei Paschi di Siena SpA is making waves with its surprising plan to buy a larger competitor. Finance Minister Giancarlo Giorgetti shared his confidence in Paschi’s leadership, applauding their impressive results and strategic market vision. This acquisition could challenge bigger banks and keep Italy’s financial services under local control.

Monte Paschi’s rocky history began in 2007 when it bought Banca Antonveneta SpA for €9 billion, much more than its earlier value. The global financial crisis hit soon after, causing big losses for Paschi and years of restructuring efforts.

Despite past struggles, the Italian government remains the bank’s largest shareholder, backing its current plan to boost national financial independence.

AMERICAN EXPRESS Hit Hard: $230 Million Settlement Shocks Industry

— American Express has agreed to a $230 million settlement, surprising customers and industry insiders. This hefty financial blow highlights the growing scrutiny on major financial institutions. Analysts see this as a turning point, pushing companies to rethink their compliance strategies.

The settlement raises concerns about deeper issues within the financial industry. Customers are shocked and worried about how this might tarnish American Express’s reputation. Experts say this incident could lead to stricter oversight of financial firms in the future.

This development is crucial as it signals a potential shift in accountability for big financial players. The pressure is building for these giants to adapt to tighter regulations and increased consumer awareness. Financial companies may need to reevaluate their practices in response to this wake-up call.

STOCK MARKET Chaos: Inflation Fears Shake Investor Confidence

— The U.S. STOCK market took a big hit today, with major indexes dropping over 3% due to rising inflation fears. Investors worry about possible Federal Reserve policy changes after high inflation numbers came out earlier this week. This is one of the steepest drops in months, shaking confidence that had been boosted by strong job reports.

Bond yields are up, with the 10-year Treasury bond yield hitting about 4.1%, its highest since late 2023, signaling increased inflation expectations. Big tech stocks like Apple and Microsoft saw sell-offs over 5%, adding to the market slump. Analysts warn that ongoing inflation might push the Federal Reserve to rethink interest rate policies, possibly leading to more hikes instead of cuts.

The decline comes after a strong holiday shopping season that initially suggested steady economic growth but is now overshadowed by ongoing inflation problems. Retail and consumer sectors face rising costs and reduced spending, making investors cautious in these areas. Companies like Walmart and Target report higher holiday sales but shrinking profit margins due to inflation pressures, prompting them to rethink annual forecasts.

Banks like JPMorgan are bracing for possible loan defaults as consumers struggle with higher living costs by setting aside more reserves. Market analysts expect continued volatility as investors digest new inflation data and Fed policy implications.;

— UnitedHealthcare Shooting Suspect Struggles with Health Issues Friends disclose that Luigi Mangione went missing and severed ties with loved ones after recent back surgery

— BREAKING: Donald Trump’s Sentencing Delayed in Hush Money Case, Providing Significant Relief for the Former President

— Trump Warns of Social Security Threat and Predicts Chaos if Defeated in Ohio Campaign Rally Former President Donald Trump asserts he will safeguard Social Security, predicts potential turmoil if he loses the upcoming election, and supports Senate candidate Bernie Moreno in Ohio

— Trump Faces Potential Loss of Properties Over New York Civil Fraud Penalty Threat Former President Donald Trump risks losing valuable properties due to looming New York civil fraud penalty non-payment

— BREAKING: Tax Legislation Breakthrough: House Struggles No More

Video

GLOBAL ELECTIONS Shock: What’s at Stake for Iran, Britain, and France

— Over the next week, voters in countries like Iran, Britain, and France will head to the polls. These elections come at a critical time with global tensions high and public concerns over jobs, climate change, and inflation.

In Iran, Supreme Leader Ayatollah Ali Khamenei seeks a successor for President Ebrahim Raisi following his recent death. Candidates include hard-liners Saeed Jalili and Mohammad Bagher Qalibaf as well as reformist Masoud Pezeshkian.

These elections could significantly impact global politics amid ongoing wars in Europe, the Middle East, and Africa. The outcomes may reorient international relations during this period of mutual suspicion among major powers.

![How Biden’s Corporate Tax Hike, 100+ Wall Street Pictures [HD]](https://lifeline.news/wp-content/uploads/bidens-tax-hike-terror-how-wall.jpg)

Social Chatter

What the World is SayingThis alone makes the Department of Government efficiency worth it. D.O.G.E. has removed 7 MILLION scammers from the Social Security system so far. If each fraudulent person was making just...

. . .RFK Jr. is facing major backlash after claiming people with autism “will never pay taxes, hold a job, [or] go on a date.” Many have taken to social media to condemn the remarks as harmful...

. . .RFK Jr. is facing major backlash after claiming people with autism “will never pay taxes, hold a job, [or] go on a date.” Many have taken to social media to condemn the remarks as harmful...

. . .Florida has a condo crisis that is impacting many of our residents, especially seniors living on a fixed income. While recent legislation was well-intended, it has resulted in unaffordable...

. . .Florida has a condo crisis that is impacting many of our residents, especially seniors living on a fixed income. While recent legislation was well-intended, it has resulted in unaffordable...

. . .