THREAD: imf sounds alarm deepening uncertainty...

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

TRUMP’S Bold Trade Shock Rocks Markets, Sparks Fear And Hope

— President Trump is set to announce tough new tariffs this week. His unpredictable style keeps Wall Street and America’s allies on edge. The latest 25% tariff on cars from Europe and Mexico caused the biggest stock market drop since 2020. Elon Musk, a vocal Trump supporter, is stepping up his political game in Wisconsin. At a Green Bay event, Musk plans to give million-dollar checks to two men fighting activist judges. This move puts him front and center in the state’s Supreme Court race. Inside the Pentagon, sources say there’s chaos as leaders scramble to keep up with Trump’s aggressive trade and immigration push. Despite distractions at home and abroad, Trump keeps pressing forward with his agenda. While Biden battles lawsuits in courtrooms across the country, Trump faces legal fights of his own. With both sides under fire, Americans are left wondering what comes next as markets swing wildly and politics heat up.

TRUMP’S “Liberation DAY” Shocks Markets: Wall Street Reels as Tariffs Spark Global Showdown

— President Trump’s “Liberation Day” tariffs have rocked the markets. The Dow dropped more than 2,000 points on some days. The S&P 500 and Nasdaq both fell into bear market territory. These tariffs, reaching up to 125% for some countries, are the highest seen in a hundred years. China, the EU, and Japan are feeling the pain most. China hit back with its own tariffs on American goods. Japan’s finance minister warned of global trouble ahead. Still, US officials say they’re hopeful about future trade talks. Big companies are taking hits too. CarMax shares sank after weak earnings reports. Nvidia tumbled more than 20% from its high point this year. UnitedHealth lowered its profit forecast because Medicare costs keep rising. Experts think this wild ride will last until trade fights settle down. Some industries are holding up better than others under pressure. The Federal Reserve might cut rates three times this year if things get worse — some warn a financial crisis could happen if tariff chaos continues much longer.

TOURISM INDUSTRY Braces for ‘Trump Slump’ Fears

— The U.S. TOURISM industry, worth $2.36 trillion, is under pressure from economic and political uncertainties. Concerns over tariffs and currency fluctuations are making foreign visitors uneasy. This turbulence could affect the world’s strongest travel market.

American Ring Travel, a California-based tour operator, reports a slowdown in bookings from Germany. This drop followed Elon Musk’s endorsement of a far-right party in Germany’s election, showing broader worries impacting international travel to the U.S.

Industry insiders humorously compare their uncertainty to Batman and King Kong’s fictional adventures. Their feelings mirror those of Times Square’s superhero-themed businesses facing similar struggles last week. Optimism remains cautious as stakeholders navigate these unpredictable times.

TRUMP’S Trade WAR: A Global Financial Nightmare?

— The Bank of England warns of a looming global financial crisis due to Donald Trump’s trade war. The Financial Policy Committee (FPC) pointed out risks from new global tariffs introduced on April 9. These tariffs have increased uncertainty in world markets, possibly leading to debt spirals for governments.

The UK, with its open economy and large financial sector, is especially vulnerable to shocks from international trade conflicts. Rachel Reeves, the Chancellor, confirmed ongoing talks with the Bank’s Governor to watch market developments amid these tensions.

Trump’s threats of more tariffs on China could escalate the conflict and harm international cooperation. Such actions may worsen financial conditions worldwide, according to the FPC’s warning note.

Despite these worries, analysts believe that the well-capitalized UK banking system might offer some protection against economic turmoil. However, watching trade war developments remains crucial as they could greatly impact both local and global markets.

UK Economy SHOCK: 2025 Growth Forecast SLASHED to 1%

— The UK government is scrambling to address a major financial shortfall as the growth forecast for 2025 has been slashed to just 1%. This sharp reduction raises concerns about the country’s economic health, affected by both domestic and international challenges. The Chancellor of the Exchequer will provide more details in a press conference today.

This development highlights ongoing economic issues like inflation and external pressures that have forced a reassessment of growth projections. Experts worry about the impact on public services and potential tax hikes.

Increased scrutiny of government spending priorities and economic policies is expected following this announcement. The government’s response will be crucial in navigating these turbulent economic waters.

TRUMP’S Trade Policy Shocks: US Stocks Plunge in Market Chaos

— The EURO has surged to a six-month high as investors react to the latest U.S. tariff announcements. Meanwhile, the Australian dollar has taken a hit, reflecting global market volatility. These currency shifts highlight ongoing economic uncertainties fueled by international trade tensions.

U.S. stock futures have plummeted after China’s retaliatory tariffs on American goods, marking another phase in the global trade conflict. The Dow Jones dropped 1,679 points, causing widespread concern among investors and financial strategists who urge calm and strategic planning during these turbulent times.

Bitcoin ETFs saw nearly $100 million in net outflows as markets reacted sharply to tariff news from the Trump administration. This exodus underscores investor anxiety and uncertainty about future economic conditions amid escalating trade disputes with China.

Goldman Sachs has revised its oil price forecasts downward due to fears of a potential recession and increased supply from OPEC+. Gold prices have steadied after an initial selloff triggered by aggressive U.S. tariff policies, indicating cautious optimism among investors seeking safe-haven assets in uncertain times.

GOLD PRICES Surge: Brace for Economic Shockwaves from New US Tariffs

— Gold prices have surged as investors brace for the U.S. “Liberation Day” tariff announcement. This has led to cautious trading, with businesses gearing up for possible economic shifts.

The jump in gold signals a move towards safety amid uncertainty over trade relations and policies under the current administration. Many companies are rethinking strategies due to potential tariff impacts.

Analysts worry about major economic fallout, especially for export-reliant industries. The business community is closely watching international reactions and possible retaliatory measures that could escalate global trade tensions.

FCA WARNING: UK Motor Finance Ruling Could Devastate Economy

— The Financial Conduct Authority (FCA) has raised alarms over a court ruling that could saddle car lenders with a £44 billion compensation bill. The FCA warned the Supreme Court that this decision might deter business investments in the UK. The ruling’s impact could extend beyond car loans to other financial products sold on commission, such as insurance.

Close Brothers, a financial services firm, backed the FCA’s stance during Supreme Court discussions. They argued that car dealers should not bear significant responsibility for consumers’ financial interests, similar to shop workers’ duties. Darren Smith of Courmacs Legal criticized this position, questioning their commitment to consumer protection.

The controversy began when the Court of Appeal ruled against “secret” commissions paid to car salesmen for motor finance loans. This decision sparked fears of compensation payouts reaching £38 billion for affected drivers. The FCA urged the Supreme Court to overturn this ruling, arguing it disrupts balance between consumer interests and financial institutions.

STOCK MARKET Chaos: US Faces Economic Fears as Tariffs Loom

— U.S. stocks took a nosedive today as President Donald Trump’s “Liberation Day” approaches, bringing potential tariffs on Canadian steel and aluminum imports. Analysts warn these tariffs could trigger a market downturn and increase recession risks. Wolfe Research has already revised U.S. growth estimates for 2025 down to 1.6%.

Retail giant Kohl’s experienced its worst trading day since 1992, with stocks tumbling by 26% after issuing disappointing guidance for the year. Investor anxiety is also heightened by an upcoming House vote on a stopgap funding bill, adding to market volatility.

The Dow Jones Industrial Average has fallen 8.3% from its peak, raising concerns about the tech sector’s performance compared to the S&P 500. Investors are bracing for further shifts as policy decisions unfold in the coming days amid fears of reduced earnings across sectors due to new tariffs and declining consumer confidence.

“GOLD Prices SOAR: A Safe-Haven in Chaotic Times”

— Gold prices skyrocketed to a record $3,000 an ounce on Friday. Investors are anxious over President Trump’s tariffs and global tensions. Viktoria Kuszak from Sucden Financial highlighted Russia’s rejection of a US ceasefire proposal in Ukraine as a key factor adding to the instability.

Gold’s rise proves its lasting role as a safe-haven asset during uncertain times. It first topped $1,000 after the financial crisis and hit $2,000 during COVID-19. Now, it reaches new heights amid trade wars and global unrest.

The gold surge mirrors broader financial market shifts influenced by geopolitical factors. Meanwhile, the crypto market is on edge awaiting a crucial ruling in the Ripple-SEC case that could change digital asset regulations worldwide. This decision may set new standards for future finance tech developments.

TRUMP’S Bold Move: How NEW Tariffs Rattle the Stock Market

— U.S. stocks fell sharply as President Donald Trump’s tariffs on Canada and Mexico took effect, sparking economic fears. Investors worry about the potential impact amid existing uncertainties. Analysts warn of a possible recession, urging caution in market activities.

The S&P 500 and Nasdaq composite saw major drops, hitting technology stocks hard. Companies across sectors are revising forecasts due to these new trade policies. Experts suggest these tariffs could worsen inflation and reduce consumer spending soon.

These tariffs are part of Trump’s broader trade agenda to boost U.S. manufacturing but risk retaliatory actions that may harm American businesses and consumers. The market remains bearish as analysts closely watch for policy fallout effects.

GOLD PRICES Soar: How Trade Uncertainty is Shaking Markets

— Gold prices have hit a record high of $2,985 as trade tensions shake up markets. Mixed signals from the Trump administration are fueling fears of a trade-induced recession. Investors are flocking to gold and the Japanese Yen, pushing the metal closer to the $3,000 mark.

The S&P 500 index has seen its first 10% drop from its peak since 2023. Market volatility is increasing, with many stocks showing big daily declines. This correction shows growing uncertainty in financial markets amid ongoing economic challenges.

Despite risks, variable-rate mortgages are attracting borrowers looking for lower initial rates. The current economic climate is influencing mortgage trends and borrower behavior significantly. Homebuyers must weigh potential savings against future rate increases in their financial decisions.

The IRS warns that over one billion dollars in unclaimed tax refunds for 2021 will expire soon if not claimed by April 15, 2025. After this deadline, these funds will revert to the U.S Treasury permanently. Taxpayers should act quickly to claim their refunds before it’s too late.

TRUMP’S Trade WAR: Global Markets in Chaos

— President Donald TRUMP’s recent tariffs have sparked swift retaliation from Mexico, Canada, and China. These actions have thrown financial markets into chaos, raising fears of inflation and uncertainty for businesses.

Imports from Canada and Mexico now face a 25% tariff, with Canadian energy products specifically taxed at 10%. This move has heightened global trade tensions significantly.

China responded quickly to the U.S. tariffs, escalating an already heated international dispute. A Chinese spokesperson warned that these measures could harm the U.S. economy by disrupting beneficial trade relations.

Analysts worry about potential backlash against U.S. exports as these trade disputes unfold. The situation is seen as a risky maneuver that might reshape global trade dynamics and impact both consumers and businesses in the long run.

LIV Golf’s FINANCIAL Turmoil: Is the Dream Fading?

— LIV Golf is facing big financial problems, with losses “piling up at a staggering rate.” Analysts have looked into recent financial reports to reach this conclusion.

The UK branch of LIV Golf, which manages operations outside the U.S., saw its losses jump from $244 million to $394 million in 2023. This huge increase has sparked talk about possible merger discussions with the PGA Tour.

Regular cash boosts from the Saudi Public Investment Fund (PIF) are seen as vital for LIV Golf’s survival amid these growing losses. The situation raises questions about LIV Golf’s future and potential shifts in professional golf dynamics.

Bank of England’s RATE CUT Sends Shockwaves Through Markets

— The Bank of England has cut interest rates by 25 basis points, causing the Pound Sterling to drop sharply against the US Dollar. This move shows worries about economic growth and inflation. Experts expect more rate cuts in 2025, signaling a careful approach to monetary policy.

Market analysts warn this could affect savings rates and borrowing costs, urging people and businesses to rethink financial plans. The immediate effect saw GBP/USD fall by 0.93%, hitting a session low of 1.2359.

This has increased market volatility, raising concerns about future economic stability in the UK. As uncertainty grows, many wonder how these changes will impact their finances and investments moving forward.

TRUMP’S Trade WAR Ignites Gold Rush And Market Turmoil

— Gold prices have hit a record high as investors flock to safe assets amid President Donald Trump’s new tariffs. These measures target imports from Canada, China, and Mexico, sparking worries about inflation and economic growth. JP Morgan is optimistic about gold, urging investors to buy during this dip.

Wall Street braces for losses due to fears of an escalating trade war from Trump’s tariff actions. The 25% tariffs on Canada and Mexico and 10% on China may cause “short-term” pain for Americans, according to Trump. Global markets watch cautiously as these policies unfold.

Oil prices are climbing in response to the tariffs, while metal and agricultural commodities face pressure downward. The financial landscape is shifting with markets adjusting to a potential prolonged trade conflict led by the U.S., causing the dollar to gain strength amid global trade uncertainty.

CHINA’S AI Threat: Tech Stocks in Danger of $1 Trillion Wipeout

— Chinese AI startup DeepSeek has shaken global tech stocks, sparking fears about America’s technological advantage. Investors worry about a potential $1 trillion loss in tech value due to rising foreign competition.

The drop in tech shares shows growing concern over the competitive landscape. Major indices have fallen, urging investors to be cautious as the situation develops.

This happens amid wider talks on global trade and economic competitiveness, especially in tech-heavy areas. Experts recommend reassessing portfolios, favoring stable investments over risky tech stocks.

Market analysts emphasize watching these changes closely as they could affect market stability and growth prospects in the technology sector moving forward.

STOCK MARKET Chaos: Inflation Fears Shake Investor Confidence

— The U.S. STOCK market took a big hit today, with major indexes dropping over 3% due to rising inflation fears. Investors worry about possible Federal Reserve policy changes after high inflation numbers came out earlier this week. This is one of the steepest drops in months, shaking confidence that had been boosted by strong job reports.

Bond yields are up, with the 10-year Treasury bond yield hitting about 4.1%, its highest since late 2023, signaling increased inflation expectations. Big tech stocks like Apple and Microsoft saw sell-offs over 5%, adding to the market slump. Analysts warn that ongoing inflation might push the Federal Reserve to rethink interest rate policies, possibly leading to more hikes instead of cuts.

The decline comes after a strong holiday shopping season that initially suggested steady economic growth but is now overshadowed by ongoing inflation problems. Retail and consumer sectors face rising costs and reduced spending, making investors cautious in these areas. Companies like Walmart and Target report higher holiday sales but shrinking profit margins due to inflation pressures, prompting them to rethink annual forecasts.

Banks like JPMorgan are bracing for possible loan defaults as consumers struggle with higher living costs by setting aside more reserves. Market analysts expect continued volatility as investors digest new inflation data and Fed policy implications.;

— US dockworkers threaten STRIKE over automation concerns Unions representing thousands of dockworkers warn that increased automation could displace jobs, raising fears of cargo shipment disruptions and potential inflation impacts

ECONOMISTS SOUND Alarm: 2025 Financial Crisis Looms

— Economists are raising alarms about a potential financial crisis in 2025. David Kelly from JPMorgan warns that high stock market valuations pose a significant risk despite strong economic indicators like low layoffs and cooling inflation. Investors should be cautious as these inflated values could lead to a sudden market downturn.

Current economic signs show paychecks growing faster than prices, and stable gas prices offer optimism for Americans. However, the high asset valuations remain a critical concern for analysts. They suggest preparing for increased market volatility throughout 2025, with a crisis potentially emerging early in the year.

These warnings have led to cautious trading, especially in tech stocks that previously drove gains. Traders are balancing concern with optimism, causing fluctuating stock prices in early sessions.

This situation may prompt investors to reassess their portfolios and strategies as they navigate potential shifts due to changing market conditions. The economic concerns highlighted could significantly influence investor behavior and market dynamics moving forward.

— Adani’s US Fraud Charges May Impact India’s Economy Gautam Adani faces fraud allegations in the US, raising concerns about potential broader implications for India’s financial landscape

— Nasdaq Soars 1% as Wall Street Overcomes Russia-Ukraine Concerns The tech-heavy index rallied, buoyed by a significant surge in Nvidia shares despite ongoing geopolitical tensions

— Dow Drops 300 Points as Rate Concerns Weigh on Post-Election Rally The Dow Jones Industrial Average fell 300 points on Friday, stifling momentum from the recent election amid ongoing worries about rising interest rates

— Fed Officials Split on Potential Half-Point Rate Cut in September Minutes reveal a division among Federal Reserve officials regarding a possible half-point interest rate reduction this month

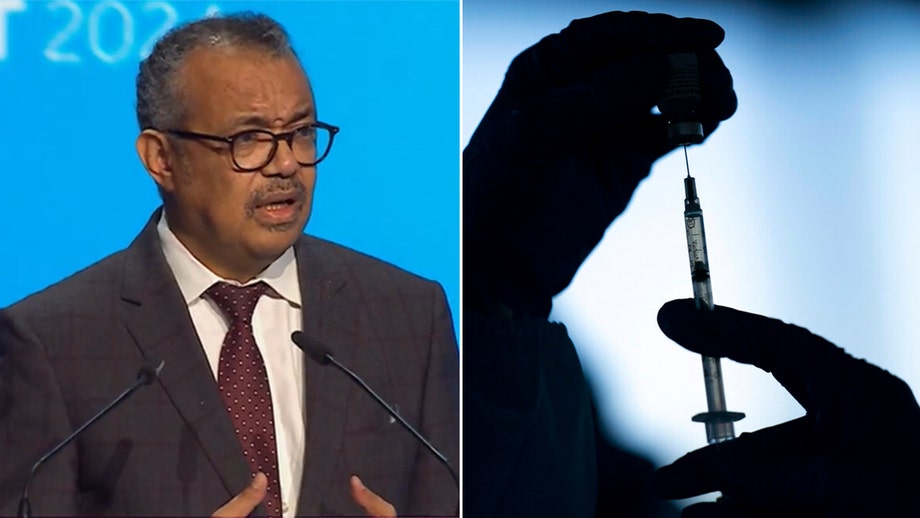

WHO Chief SOUNDS Alarm on ‘Disease X’: The Inevitable Threat We’re Not Ready For

— World Health Organization (WHO) Director-General, Tedros Ghebreyesus, has issued a stark warning about the looming threat of “Disease X”. Speaking at the World Government Summit in Dubai, he stressed that another pandemic is not just likely — it’s inevitable.

Tedros, who accurately predicted a similar outbreak in 2018 before COVID-19 hit, criticized the world’s lack of readiness. He dismissed any doubts that his call for a global treaty by May was simply an effort to expand WHO’s influence.

Tedros labels the proposed treaty as “mission critical for humanity”. Despite some advancements in disease surveillance and vaccine production capabilities, he maintains that we are still ill-prepared for another pandemic.

Reflecting on COVID-19’s severe impact, Tedros underscored the urgency of addressing this issue. The world is still wrestling with social, economic and political aftershocks from the ongoing pandemic.

Video

GLOBAL ELECTIONS Shock: What’s at Stake for Iran, Britain, and France

— Over the next week, voters in countries like Iran, Britain, and France will head to the polls. These elections come at a critical time with global tensions high and public concerns over jobs, climate change, and inflation.

In Iran, Supreme Leader Ayatollah Ali Khamenei seeks a successor for President Ebrahim Raisi following his recent death. Candidates include hard-liners Saeed Jalili and Mohammad Bagher Qalibaf as well as reformist Masoud Pezeshkian.

These elections could significantly impact global politics amid ongoing wars in Europe, the Middle East, and Africa. The outcomes may reorient international relations during this period of mutual suspicion among major powers.

More Videos

Invalid Query

The keyword entered was invalid, or we couldn't gather enough relevant information to construct a thread. Try checking the spelling or entering a broader search term. Often simple one-word terms are enough for our algorithms to build a detailed thread on the topic. Longer multi-word terms will refine the search but create a narrower information thread.

Politics

The latest uncensored news and conservative opinions in US, UK, and global politics.

get the latestLaw

In-depth legal analysis of the latest trials and crime stories from around the world.

get the latest

![How Biden’s Corporate Tax Hike, 100+ Wall Street Pictures [HD]](https://lifeline.news/wp-content/uploads/bidens-tax-hike-terror-how-wall.jpg)

Social Chatter

What the World is SayingThe interest on the federal debt has escalated dramatically in recent years and will continue to gobble up more and more revenue…

. . .The interest on the federal debt has escalated dramatically in recent years and will continue to gobble up more and more revenue…

. . .Navigating the New Normal: Understanding the Impact of Rising Interest Rates on Consumers and Businesses. Navigating the New Normal: Understanding the Impact of Rising Interest Rates on Consumers and Businesses https://bgodinspired.com/wp-content/uploads/2025/02/1738675234.png In a world where everything feels fleeting, the rise of interest rates comes like an unexpected storm, shaking the ground benea...

. . .Brace Yourselves: The Global Economic Shift Looming Worse Than the Great Depression. Brace Yourselves: The Global Economic Shift Looming Worse Than the Great Depression We are on the brink of an unprecedented shift in global power dynamics and economic structures, one that could rival and even surpass the hardships of the Great Depression. Before his death, an economist predicted fi...

. . .US market sharp correction SPY 3% down!. US market sharp correction SPY 3% down! Anyone that has been buying US listed equities over the last month should be facing huge volatility in their portfolio. This sort of correction was last seen in early August when Japan equities rocked the world due to their interest rate policies. Wall St...

. . .