THREAD: innovative business ideas

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

BOEING’S Bold $105 Billion Sale Sparks Hope For American Manufacturing

— Boeing is selling its navigation and flight planning tech businesses to Thoma Bravo, a private equity firm, for $10.5 billion in cash. The move aims to cut Boeing’s huge debt and help the company refocus on building planes — its main business. Nearly 4,000 workers are part of this digital unit, but not all of them or their projects are included in the sale. Some technology will stay with Boeing even after the deal wraps up, which should happen by late 2025. Boeing’s CEO said this sale is key to getting back on track and keeping the company strong financially. He believes it will help protect Boeing’s credit rating and allow leaders to focus on what matters most. Many conservatives view this as a smart return to basics at a time when America needs strong manufacturing jobs — not more risky side projects or growing debt loads.

WH SMITH’S High Street Exit: A Shocking Shift in Retail

— Modella has bought WH Smith’s online operations for £76 million. The company will now run under the TGJones name, while WH Smith keeps its travel shops. This move shows the tough times high street retailers face in a digital world.

WH Smith might sell its digital card business, Funky Pigeon, as part of restructuring. Nicholas Found from Retail Economics says old-school retailers struggle with fewer shoppers and rising costs. This sale highlights the economic pressures on traditional high street businesses.

Modella plans to keep current products and services in WH Smith stores, like Post Office and Toys R Us sections. They also want to add new items like craft goods to boost business. For now, it’s “business as usual” as Modella works on future plans for growth.

The acquisition shows WH Smith’s shift towards travel retail, which is more profitable despite industry challenges. With 480 high street stores and 5,000 employees affected by this change, focusing on travel-related retail could increase revenue in a tough market landscape.

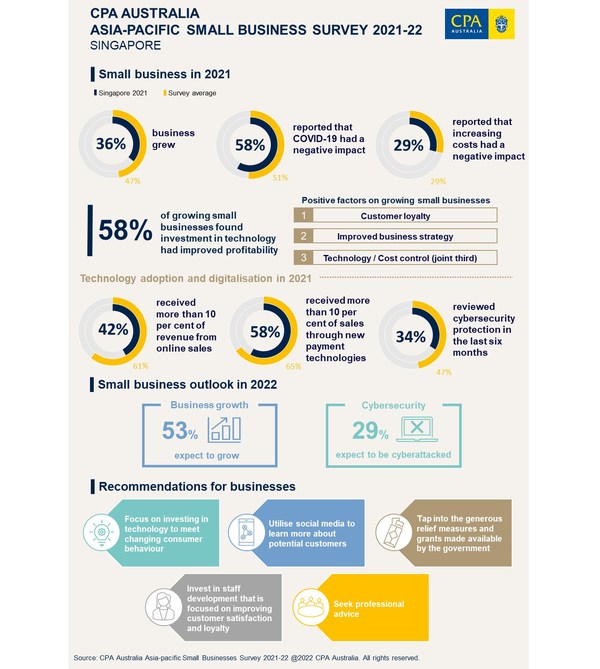

SINGAPORE’S Business Boom: Small Firms’ Confidence Soars to New Heights

— Confidence among small businesses in Singapore has hit its highest point since 2019, says a survey by CPA Australia. The Asia-Pacific Small Business Survey shows that 62% of these businesses expect growth this year, marking the most optimism since 2018. This positive trend is expected to continue into 2025.

Greg Unsworth from CPA Australia notes that this confidence reflects not just business prospects but also a brighter economic environment. The survey highlights a big jump in technology use, with more firms embracing online and digital payments.

In 2024, an impressive 63% of small businesses reported earning over 10% of their revenue from online sales, up from just 36% in 2019. This shift shows a strong move towards digital transformation among Singapore’s small enterprises.

“Hudson’s Bay COLLAPSE: 9,000 Jobs in JEOPARDY”

— Hudson’s Bay Company, Canada’s oldest business, plans to liquidate by June. Unable to secure financing, the company will shut down all operations. This decision puts over 9,000 jobs across Canada at risk.

The company’s financial troubles were clear in a March court filing. Hudson’s Bay delayed payments to landlords and vendors due to ongoing money problems. They initially hoped to stay open despite these issues.

Richard Baker bought Hudson’s Bay in 2008 for $1.1 billion, but it has steadily declined since then. The liquidation involves selling inventory and real estate while gradually laying off employees until mid-June.

MAGNACHIP’S BOLD Move: Shift to Power Business Promises Big Profits

— Magnachip Semiconductor Corporation is making a bold shift to focus solely on its Power business. This strategic move, decided by the Board and management, aims to boost revenue growth and increase shareholder value.

The company plans to phase out its Display segment, classifying it as discontinued in the next Q1 results. Options like selling or merging this segment are on the table. The goal is clear: ensure steady profits and keep shareholders happy.

Magnachip aims for quarterly break-even by Q4 2025 and expects positive operating income by 2026. By 2027, they foresee positive free cash flow. The Power business will target stable markets with long product cycles, unlike the unpredictable smartphone market of their Display segment.

“UAE’S BOLD Move: A Thriving Startup Paradise”

— The United Arab Emirates is becoming a global leader in startup growth. The nation attracts innovators with flexible government policies and advanced laws. Entrepreneurs find a welcoming environment thanks to the UAE’s top-notch infrastructure.

The government’s dedication to fostering innovation shows in its strategic plans for new businesses. These efforts create an ecosystem where startups can thrive and boost the economy. This strategy not only strengthens local industries but also draws international talent and investment.

By focusing on entrepreneurship, the UAE stands out as a beacon for business-minded people worldwide. The country’s emphasis on innovation keeps it competitive in the global market, offering opportunities for growth and development.

As more entrepreneurs head to the region, the UAE’s reputation as a startup hub grows stronger by the day, solidifying its place as a thriving paradise for new businesses seeking success on an international scale.

.png)

NVIDIA EARNINGS Shock: What It Means for Inflation and Your Wallet

— The optimism that marked the start of the year for U.S. businesses has faded. Now, economic uncertainty, stalled business activity, and rising prices dominate the scene. Investors are especially focused on Nvidia’s earnings this week to understand the state of the AI market.

Nvidia’s report is vital as tech stocks have struggled in early 2025. The company’s performance could reveal broader market trends and investor feelings about AI technologies. Other companies reporting include Anheuser-Busch InBev, Advance Auto Parts, and Salesforce among others.

Chris Williamson from S&P Global Market Intelligence notes a shift to a gloomier economic outlook. This change highlights concerns about inflation affecting business activities across sectors. As February 2025 continues, these reports will be key in understanding economic directions and investment strategies moving forward.

INNOVATIVE BUSINESS Ideas Face Economic Hurdles In Today’S Market

— The current market offers many opportunities for new business ideas. AI-powered financial coaching apps are gaining popularity, especially among women entrepreneurs. There’s also a growing demand for senior care services due to an aging population. Eco-friendly products, second-hand fashion, and zero-waste packaging are on the rise as consumers focus on sustainability.

Labour’s proposed tax hikes on businesses could threaten low-paid jobs in the UK. Employers face financial pressure from rising business rates and national insurance costs. These changes may cost businesses about £5 billion, potentially impacting low-income workers significantly.

In the U.S., stock markets saw a sharp decline with the Dow dropping nearly 750 points amid tariff concerns. Reports suggest U.S. business activity is nearing a stall with growth at a 17-month low. Businesses express widespread worries over federal policies affecting their operations and future optimism.

UNMISSABLE Business OPPORTUNITIES: How to Thrive in Today’s Market

— The current market offers many business opportunities that align with consumer needs and personal passions. AI-powered financial coaching apps are becoming popular, especially among women entrepreneurs seeking personalized advice. Senior care services are also in demand due to the aging population needing more in-home support.

Eco-friendly products like second-hand fashion and zero-waste packaging are trending as consumers focus on sustainability. Success in these areas depends on marketing strategies that emphasize transparency and ethical practices.

Meanwhile, Dorset is seeing fewer new business startups due to economic pressures and job security worries. Ian Girling of the Dorset Chamber of Commerce calls for government action to help new businesses survive better.

In contrast, Syntheia Corp., which specializes in AI-driven call handling solutions, reports a surge in subscriptions, doubling to 2,000 within a week. This growth highlights the increasing reliance on conversational AI technologies to transform customer service experiences.

INSOLVENCIES SURGE: Businesses Face Economic Pressures in England and Wales

— Insolvencies in England and Wales have jumped from December 2024 to January 2025. Law firm Fladgate LLP reports a significant rise in administrations. The economic climate is tough for businesses, especially in retail, which already struggles with slim profit margins. The upcoming Spring Budget might introduce tax hikes that could further pressure businesses and consumer spending.

ANGLO AMERICAN’s $500 Million NICKEL Sale Marks Strategic SHIFT

Anglo American has sold its nickel business for $500 million as part of a strategic shift to focus on copper and iron. This sale follows the disposal of its steelmaking coal business, bringing total asset sales to about $5.3 billion. CEO Duncan Wanblad highlighted that these moves are meant to streamline the company’s portfolio and boost value.

COLORADO BILL DEMANDS Climate Transparency from Businesses

Colorado will require businesses to disclose their greenhouse gas emissions starting in 2028, aligning with similar efforts by other states. This legislation responds to past criticisms about inconsistent sustainability reporting practices across industries. The goal is more transparency and accountability regarding environmental impacts from companies within the state.

The IRS plans major layoffs during tax season due to budget cuts initiated by the Trump administration, which may affect its

TRUMP’S Bold Move: Ending Canadian Trade Loophole Shakes Up Business

— Canadian businesses are facing new challenges as the U.S. ends the “de minimis” rule for duty-free imports. This change, driven by former President Donald Trump’s executive order, will now impose tariffs on goods that were previously exempt due to their low value.

Sheena Russell, founder of Made with Local in Dartmouth, N.S., is worried about rising costs affecting her snack food business. With the executive order taking effect next month, companies are bracing for higher expenses and more administrative hurdles.

This development comes when businesses are already dealing with various economic pressures. The end of this loophole is expected to cause a demand shock as Canadian companies adjust to the new trade landscape.

COALITION’S Lunch Plan Stirs Fiery Debate Over Small Business Future

— The COALITION’s proposal to offer tax deductions for business lunches has sparked a heated debate. Treasurer Jim Chalmers criticized the plan, noting that 25,000 new firms are created monthly. He suggests this shows strong small-business growth despite economic hurdles. The Coalition argues their plan supports hospitality and highlights 27,000 insolvencies since Labor took office.

Westpac is boosting its business banking by investing $10 million in Lawpath to provide legal services to customers. This move aims to increase Westpac’s market share by offering a year-long subscription for legal documents and registration services. It reflects Westpac’s strategy of providing non-banking perks to attract small business clients.

The federal government claims Peter Dutton’s tax deduction plan for business lunches could cost taxpayers $1.6 billion annually if fully used by eligible businesses. This measure targets small businesses with turnovers up to $10 million and would be exempt from Fringe Benefits Tax for two years. Critics argue it shifts costs onto workers while aiming to cut red tape under a potential Dutton-Coalition Government.

“INDIA’S Jan Vishwas Bill: A Bold Boost for Business”

— The Indian government has rolled out the “Jan Vishwas Bill” to transform how businesses operate. This law aims to simplify rules and cut down on red tape. It hopes to make India more welcoming for investors, drawing in foreign money and helping local companies grow.

By tackling bureaucratic obstacles, the Bill is expected to drive economic growth. Supporters say it will make business dealings clearer and more efficient. This could make India a top choice for global companies wanting to expand their reach.

The Jan Vishwas Bill shows India’s active stance during global economic changes. It highlights the importance of a competitive business scene in the country. This move is a key step in India’s push to boost its economy through new laws.

BOLD MOVE: India’s Jan Vishwas Bill to Revolutionize Business

— The Indian government is set to introduce the Jan Vishwas Bill 2.0, targeting easier business operations by removing over 100 outdated legal provisions. Union Finance Minister Nirmala Sitharaman announced this during the Union Budget 2025-26 presentation. Key changes include amending the Trade Marks Act of 1999, replacing jail time for minor violations with fines based on business turnover.

These reforms aim to boost business and investment climates by reducing regulatory risks and encouraging entrepreneurship. The Observer Research Foundation noted that over half of India’s 1,536 business laws involve imprisonment clauses, creating legal hurdles for businesses.

Additional budget proposals include forming a High-Level Committee for Regulatory Reforms and introducing an Investment Friendliness Index of States. These measures seek to streamline regulations and attract both domestic and foreign investments, particularly benefiting MSMEs and startups.

The Economic Survey highlights deregulation’s role in boosting economic growth by enhancing capital formation and job opportunities in India. This aligns with global trends as countries look to simplify regulatory frameworks amidst changing trade dynamics influenced by international policies like potential Trump tariffs on China.

UPS SHARES Plummet: Bold Move to Slash Amazon Business Stuns Investors

— UPS shares dropped sharply after the company revealed plans to cut its business with Amazon in half. This move comes as UPS faces lower-than-expected revenue projections, signaling that a rise in parcel demand isn’t likely this year. To cope, UPS has been hiking prices and adding surcharges.

In a bid for bigger profits, UPS is focusing on growing its health-care segment, aiming for $20 billion in revenue by 2026. The company predicted $89 billion in revenue for 2025, which is below analysts’ expectations of $94.9 billion. In 2024, UPS reported revenues of $91.1 billion with Amazon making up 11.8% of that total.

The sudden cutback with Amazon caught many investors and analysts off guard. Daniel Imbro from Stephens Inc., noted the swift change as surprising news within industry circles. This strategic shift shows UPS’s dedication to prioritizing higher-margin ventures over volume-driven deals like the one with Amazon.

APTIV STOCK Skyrockets After Bold Business Move

— Aptiv plans to spin off its electrical distribution systems (EDS) into a new company. This bold move lets Aptiv focus on advanced driver-aid technology. After the announcement, Aptiv’s shares soared by 5%.

Analysts point out that EDS has lower profit margins. The adjusted EBITDA margin for EDS is expected to be 9.5% in 2024, while Aptiv’s other operations boast an 18.8% margin.

Garrett Nelson from CFRA Research supports the spin-off, saying it aligns with Aptiv’s push toward high-margin growth areas. This strategic shift could enhance Aptiv’s future profitability and market position.

TRUMP’S $500 BILLION AI Move: A Bold Step for America’s Future

— President Donald TRUMP has announced a massive $500 billion investment in artificial intelligence infrastructure. This joint venture involves OpenAI, Oracle, and SoftBank. The initiative aims to build data centers, marking a significant technological advancement.

The project began during the Biden administration but has gained momentum under Trump’s leadership. This investment underscores the importance of AI for future economic growth and national security.

Trump’s announcement highlights his commitment to keeping America ahead in technology. The collaboration between these major companies is expected to drive innovation and create jobs across the country.

AMAZON’S BOLD Move: New South Africa Center Shakes UP Market

— Amazon has opened a new center in Cape Town, South Africa, to support its independent sellers. This is part of Amazon’s plan to grow its market share and compete with local leader Takealot, owned by Naspers. The center aims to help sellers attract more customers and expand Amazon’s product range, potentially boosting revenue.

APPLE’s CHINA TROUBLES: iPhone Shipments PLUMMET

Apple shares fell 3.2% after research firm Canalys reported a 17% drop in iPhone shipments in China for 2024. This decline pushed Apple down to third place in China’s market share rankings. Despite the stock’s volatility, this news is significant but doesn’t drastically change the company’s business outlook.

STOCK MARKET SLUMP: Earnings Reports RATTLE Investors

The stock market took a hit following Wednesday’s rally due to retail sales data and major bank earnings reports taking the spotlight. Analysts remain hopeful about gains for the S&P 500 by year-end despite current swings. Focus is also on upcoming hearings on tariff plans before President-elect Donald Trump that could affect future economic strategies moving forward.

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/25083616/Press_Image_FINAL_16x9_4.jpg)

MICROSOFT’S Bold AI Move: Copilot Chat Unleashed

— Microsoft has launched Copilot Chat, a new service designed to increase AI use among businesses. This pay-as-you-go chat tool uses OpenAI’s GPT-4 to create AI agents for tasks like market research and strategy document creation. It supports multiple languages, including English and Mandarin, making it accessible to many users.

BUSINESSES WORRY OVER TRUMP POLICIES AS HE RETURNS TO POWER

A Federal Reserve survey shows U.S. businesses are worried about possible price hikes under President-elect Donald Trump’s policies. Even with moderate economic growth and more jobs at the end of 2024, concerns remain about Trump’s return to the White House next week. The survey includes feedback from business contacts across the Fed’s 12 regional banks as of January 6th.

BUFFETT CAUTIONS AGAINST COPYING HIS INVESTMENT MOVES BLINDLY

Warren Buffett warns against blindly following his investment strategies without understanding them fully. He points out that Berkshire Hathaway often buys entire businesses, not just stocks, requiring deep analysis and long-term planning. Buffett notes that unique advantages like Berkshire’s insurance “free float” significantly influence their investment choices.

CALIFORNIA FIRES Wreak Havoc: Small Businesses in Ruins

— The recent wildfires in Los Angeles, especially the Palisades and Eaton fires, have devastated small businesses. Iconic spots like a decades-old diner and a new yoga studio are now just ashes. This destruction hits both the local economy and community spirit hard.

Many small-business owners across Los Angeles face an uncertain future. Entrepreneurs who recently started working with other local businesses worry about their partnerships’ fate. The losses go beyond money, as these businesses often serve as community hubs.

The economic impact could spread through the local economy, affecting jobs and community unity. Business owners also face emotional stress as they deal with losing their life’s work. This situation highlights California’s ongoing environmental challenges and its effect on business stability.

— European SpaceX Rival Secures $160 Million for Reusable Space Capsule The funding will support the development of a new capsule designed to transport astronauts and cargo into space

— Three Mile Island Restart: A Potential Nuclear Energy Revolution The planned restart of the Three Mile Island facility signals a pivotal moment for nuclear energy amid increasing interest from Big Tech companies

— Hollywood’s Franchise Frenzy: Over 50% of 2025 Films from Major Studios are Existing IP A new report reveals that more than half of the movies planned by top studios for 2025 will be based on established intellectual properties

— UK Leads European Office Investment Resurgence The UK has emerged as a frontrunner in revitalizing office investments across Europe, signaling a strong recovery in the commercial property market

— UniCredit’s Andrea Orcel Eyes Commerzbank Acquisition The CEO of UniCredit is strategically targeting Commerzbank as part of a bold expansion plan

Video

BRITISH PM’S Bold Housing Plan: 15 Million Homes to FIX Crisis

— British Prime Minister Keir Starmer has announced a plan to tackle the UK’s housing crisis by building 1.5 million homes over the next five years. This initiative aims to address the severe shortage of housing and create jobs in the construction sector.

The plan includes government-led projects and incentives for private developers, focusing on sustainable urban planning and energy-efficient homes. This aligns with broader goals to reduce carbon emissions and combat climate change.

Critics question whether the government can secure adequate funding and navigate bureaucratic challenges to achieve this ambitious goal. Despite these concerns, the government cites past successes in large-scale infrastructure as evidence of its capability.

More Videos

Invalid Query

The keyword entered was invalid, or we couldn't gather enough relevant information to construct a thread. Try checking the spelling or entering a broader search term. Often simple one-word terms are enough for our algorithms to build a detailed thread on the topic. Longer multi-word terms will refine the search but create a narrower information thread.

Politics

The latest uncensored news and conservative opinions in US, UK, and global politics.

get the latestLaw

In-depth legal analysis of the latest trials and crime stories from around the world.

get the latest

Social Chatter

What the World is SayingHistorically, it was difficult to reinvent a company at the height of its market cap. When I was in Nokia, I asked why my Finnish colleagues why the company did not reinvest its resources to...

. . .This could help brands expand their networks of creators to partner with

. . .This could help brands expand their networks of creators to partner with

. . .🚨ELON: GROK 3 CAN DEVELOPS CREATIVE SOLUTIONS FOR BUILDING ORIGINAL VIDEO GAMES "If you ask an AI to create a game like Tetris, there are many examples of Tetris on the on the Internet....

. . .Launching Your Dreams: A Step-by-Step Guide to Starting Your Own Business. Launching Your Dreams: A Step-by-Step Guide to Starting Your Own Business https://bgodinspired.com/wp-content/uploads/2025/02/1738675417.png **Launching Your Dreams: A Step-by-Step Guide to Starting Your Own Business** In the quiet recesses of your mind, there lies a vision—a dream that burns like...

. . .