THREAD: teslas model y zooms ahead

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

TESLA’S Bold Nevada Gamble: Will This Powerhouse Plant Change America’s Future?

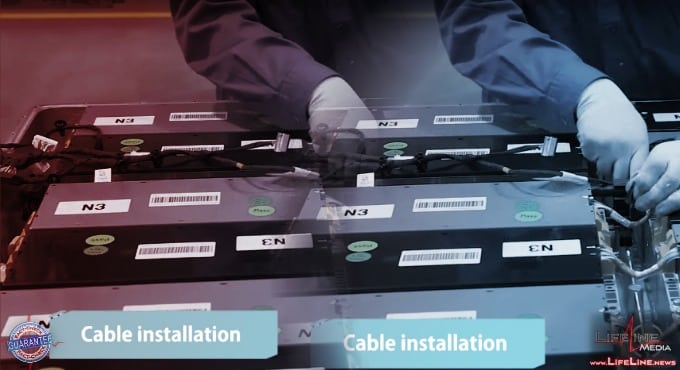

— Tesla just revealed plans for a giant battery plant in Nevada, called “Gigafactory Nevada.” The goal is to double its battery output and lower the price of electric vehicles across the country. Tesla says the factory will make over 100 gigawatt-hours of batteries each year, starting as soon as September 2025. CEO Elon Musk promises new automation and advanced battery tech.

Nevada officials are cheering on the $3 billion project, calling it a big win for local jobs and the economy. Experts think this move could help Tesla dodge supply chain headaches and make electric cars more available to American families.

But there’s another side to this story. Democrats keep pushing green energy rules that often use taxpayer money as incentives. Conservatives warn about too much government in private business but admit it’s better for America to lead than let China control key technology.

When Gigafactory Nevada opens, it could shake up both U.S. carmakers and global clean energy markets. Only time will tell if Tesla’s risky bet pays off for workers, drivers, and taxpayers across America.

TRUMP’S Fury Sends Tesla Stock Into Chaos

— Tesla shares crashed 14% after President Trump blasted Elon Musk for slamming a new tax bill. The public clash between Trump and Musk shook investors and sparked a massive selloff.

Musk has loudly criticized the legislation, which led to Trump’s blunt response: “I’m disappointed.” His words were aimed straight at Musk, making headlines across the country.

Experts say this high-profile feud adds more worry to an already shaky market. Many are now watching to see if this leadership battle will keep hurting Tesla’s value and shake investor trust even further.

TESLA STOCK Panic: Musk’s Shocking Admission Triggers Investor Fear

— Tesla shares took a hard hit on May 22 after CEO Elon Musk openly admitted the company is struggling with short-term production goals. Musk’s rare honesty came as he told investors he worries Tesla may not meet targets in today’s tough market. The electric car industry is facing more rivals and shaky economic times.

This blunt statement from Musk caught many off guard. He usually paints a bright picture of Tesla’s future. Investors didn’t wait to react — the stock price tumbled, and trading became more frantic.

Experts now wonder if this hints at bigger problems for Tesla down the road. “Investors are starting to doubt if Tesla can stay ahead,” one analyst said.

The news has sparked heated talk among shareholders and industry watchers about where Tesla goes next. For now, faith in the company seems rattled, leaving many to question what comes next for the electric car giant.

TESLA STOCK Panic: Musk’s Shocking Admission Sparks Investor Fear

— Tesla stock took a hard hit after CEO Elon Musk openly admitted the company is facing serious problems. His rare honesty sent investors scrambling, causing shares to drop fast.

Musk did not spell out the exact issues, leaving everyone guessing. This uncertainty has rattled shareholders. Many are now waiting for more news and watching how these troubles could affect Tesla’s next earnings report.

A photo from the event shows Musk on stage, holding his phone and speaking directly to the crowd. The personal tone of his message made it even more dramatic.

The announcement came out on May 22, 2025. Now, debate is heating up about where Tesla goes from here — and if Musk can turn things around.

TESLA STOCK Shock: Musk’s Candid Admission Sparks Investor Fears

— Elon Musk spoke at the Qatar Economic Forum and openly admitted Tesla sales are down in Europe. He claimed the company has “already turned around” worldwide, but his comments came as Tesla’s stock price kept bouncing up and down.

Musk told investors not to panic over short-term drops in TESLA shares. He said, “The market is the ultimate scoreboard,” trying to calm fears by focusing on long-term results instead of daily changes. Still, many investors are worried.

Conservatives have long warned against trusting big promises from corporate leaders or getting swept up in market hype. Musk’s latest admission could make some shareholders even more cautious.

This situation shows that Tesla still faces real challenges overseas and growing doubts here at home. Investors will be watching closely to see if Musk can deliver on his promises this time.

TESLA STOCK Shock: Musk’s Bold Promise Sparks Investor Fears

— Elon Musk faced tough questions at the Qatar Economic Forum. He admitted Tesla’s sales are weak in Europe but claimed the company has “already turned around” worldwide. Musk told investors not to worry about short-term drops in TESLA stock, calling the market “the ultimate scoreboard” for business health.

Musk pushed back against critics who say he’s stretched too thin across his many companies and government projects, especially with his Department of Government Efficiency (DOGE) plan. He also admitted Tesla’s software team Cariad is struggling and will have layoffs soon.

Still, Musk pointed to new partnerships with companies like Geely-backed Ecarx to boost smart car technology in Europe and America. He says these deals will help Tesla stay ahead as competition grows stronger around the globe.

Investors remain nervous about Tesla’s future and Musk’s leadership style. The company is betting on innovation and global teamwork to fix its weak spots and calm worried shareholders.

TESLA PAY Shock and Trump Saudi Deal Rattle Wall Street Fears

— Tesla’s board is taking a hard look at CEO Elon Musk’s pay as lawsuits pile up. Even with the legal drama, Tesla stock jumped almost 3%. The company is working on new pay plans to calm worried investors.

At the same time, former President Trump’s $142 billion arms deal with Saudi Arabia has sparked heated debate. This giant agreement is shaking up global markets and making investors nervous.

Wall Street is also feeling the heat from a Ford recall, anger over possible parole for the Menendez brothers, and tech sector panic after Saudi investments in artificial intelligence. These events show how unstable both business leadership and world politics are right now.

None of these big stories were seen in earlier financial reports, making them major breaking news for May 15, 2025. Investors are watching closely as decisions by top leaders and global deals keep markets on edge.

TESLA CYBERTRUCK Firestorm: Shocking Arson Charges Rock Missouri

— Federal agents have charged 19-year-old Owen McIntire from Parkville, Missouri, after a fire destroyed two Tesla Cybertrucks at a Kansas City dealership on March 17. The Department of Justice says McIntire is accused of using an unregistered destructive device and setting fire to property involved in interstate business. Police arrived to find smoke pouring from the lot. They discovered an unused Molotov cocktail near the burning trucks. The blaze damaged both Cybertrucks — each worth over $100,000 — and ruined two charging stations. The FBI’s Boston office announced McIntire’s arrest Friday and shared photos of the suspect and explosive devices. Journalist Andy Ngô reported that McIntire “appears to be trans” and was allegedly dressed in women’s clothing during the attack. This shocking act raises new questions about safety at car dealerships and how federal law enforcement handles these dangerous crimes. Many are watching closely as this case develops.

SHERYL CROW’S Bold Tesla Move: Why She Ditched Elon Musk

— Sheryl Crow recently posted a video on Instagram, showing her Tesla being towed away. She decided to part with the car due to Elon Musk’s actions. Crow said, "There comes a time when you have to decide who you are willing to align with.

The singer criticized Musk for his stance against NPR and announced she would donate to the organization. She accused Musk of threatening NPR, which he claims is biased against conservatives. Crow hopes her donation will help “the truth” reach those seeking it.

Musk has pushed for cutting NPR’s federal funding because of its perceived bias and censorship of conservative voices. During the 2020 election, NPR dismissed the Hunter Biden laptop story as not credible news, sparking criticism from many who saw it as shielding certain political figures from scrutiny.

NIKOLA’S Financial Freefall: What It Means for the Electric Truck Industry

— Nikola, the electric-truck maker, faces financial restructuring as its market value drops from $30 billion to just $63 million. This sharp decline shows serious financial trouble within the company. Investors are keeping a close eye on how Nikola handles these stormy times.

KLARNA’S BOLD MOVE: Chasing a $15 BILLION US IPO

Fintech giant Klarna plans a US IPO in April, aiming for a valuation of up to $15 billion. If successful, it would be one of the biggest listings this year. This move highlights Klarna’s drive to grow its influence in the competitive fintech world.

PRINCIPAL FINANCIAL’S Q4 SUCCESS: A Beacon Amid Economic Uncertainty

Principal Financial reported strong fourth-quarter earnings with a 12% revenue increase year-over-year, reaching $4.75 billion. Earnings per share rose to $1.94 from last year’s $1.83, showing solid growth and key performance metrics for investors amid economic uncertainties.

APTIV STOCK Skyrockets After Bold Business Move

— Aptiv plans to spin off its electrical distribution systems (EDS) into a new company. This bold move lets Aptiv focus on advanced driver-aid technology. After the announcement, Aptiv’s shares soared by 5%.

Analysts point out that EDS has lower profit margins. The adjusted EBITDA margin for EDS is expected to be 9.5% in 2024, while Aptiv’s other operations boast an 18.8% margin.

Garrett Nelson from CFRA Research supports the spin-off, saying it aligns with Aptiv’s push toward high-margin growth areas. This strategic shift could enhance Aptiv’s future profitability and market position.

— Tesla Stock Soars 22% on Musk’s Bold 2025 Growth Forecast The electric vehicle giant experienced its best trading day in over a decade following CEO Elon Musk’s optimistic projections for future growth

— Tesla Shares Soar 10% Following Profit Surge The electric vehicle manufacturer reported better-than-expected profits, bolstered by revenue from environmental credits

— Nvidia Surpasses Apple to Become Second-Most Valuable US Company Tech giant Nvidia overtakes Apple in market capitalization, claiming the position of the second-most valuable public company in the United States

— Thailand Emerges as Crucial China Hedge for Automakers Eyeing EV Market Expansion Automakers view Thailand, known as the ‘Detroit of Asia,’ as a strategic pivot to mitigate reliance on China in the growing electric vehicle sector

— Stellantis’ Profit Slides as Detroit Three Strikes Take a Toll Jeep and Dodge manufacturer, Stellantis, experiences a decline in profits due to ongoing strikes by the Detroit Three automakers

Video

ELON MUSK Champions Free Speech On X

— Elon Musk, owner of X (formerly Twitter), has increasingly used the platform to amplify his political views and those of right-wing figures. Musk’s actions align with his 2022 statement that he bought Twitter to protect free speech. He believes a public platform for free speech is crucial for civilization’s future.

Musk often discusses existential threats like population collapse and artificial intelligence, framing threats to free speech as another crisis. He sees X as a “digital town square” where vital issues are debated. In the U.S., Musk has shared memes and sometimes misinformation about illegal immigration, election fraud, and transgender policies while endorsing Donald Trump’s presidential bid.

In May 2023, Musk co-hosted Florida Gov. Ron DeSantis’ presidential bid announcement on X, which faced technical issues but highlighted his vision for the platform. Despite the glitches, Musk invited other candidates to use X for their announcements.

Trump accepted and had an interview with Musk that also experienced technical difficulties but eventually took place after a 42-minute delay.

Social Chatter

What the World is Saying