THREAD: uk businesses trouble financial distress

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

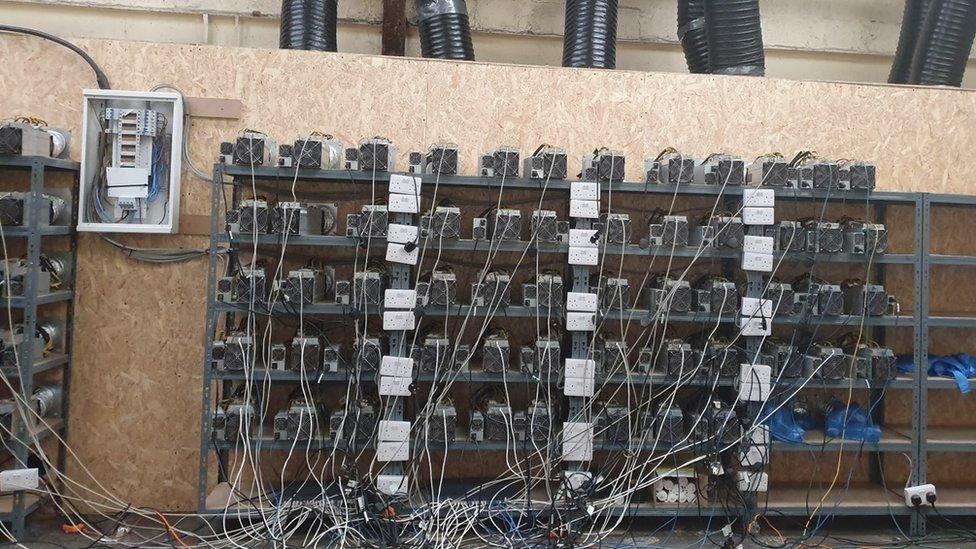

UK ENERGY THEFT Surge: Families Desperate as Bills Spike and Dangers Grow

— Energy theft is exploding across the UK as families battle record-high bills in 2025. Reports from Crimestoppers show more people are tampering with meters or making illegal hookups. The latest government price cap hike and the cost-of-living crisis are pushing many to take risky steps just to keep the lights on. Experts say this is not just about money — it’s a real danger. Messing with gas lines or meters can cause deadly fires and explosions, putting whole neighborhoods at risk. There have already been tragic deaths linked to these desperate acts. The financial toll is massive too. Stolen energy now costs an estimated £1.5 billion each year, while total energy debt in Britain has soared to a record £3.9 billion — more than double what it was before the crisis. Lawmakers say urgent action is needed, like better home insulation and lower rates for struggling families. Critics argue current government help isn’t enough, warning that without stronger action, both public safety and the UK’s entire energy system could be in trouble.

TRUMP’S Trade WAR: A Global Financial Nightmare?

— The Bank of England warns of a looming global financial crisis due to Donald Trump’s trade war. The Financial Policy Committee (FPC) pointed out risks from new global tariffs introduced on April 9. These tariffs have increased uncertainty in world markets, possibly leading to debt spirals for governments.

The UK, with its open economy and large financial sector, is especially vulnerable to shocks from international trade conflicts. Rachel Reeves, the Chancellor, confirmed ongoing talks with the Bank’s Governor to watch market developments amid these tensions.

Trump’s threats of more tariffs on China could escalate the conflict and harm international cooperation. Such actions may worsen financial conditions worldwide, according to the FPC’s warning note.

Despite these worries, analysts believe that the well-capitalized UK banking system might offer some protection against economic turmoil. However, watching trade war developments remains crucial as they could greatly impact both local and global markets.

US TRADE Policies Cause GLOBAL Economic Jitters

— Recent U.S. tariffs have left Canadian small businesses facing economic challenges, leading to job cuts and price hikes. The Canadian Federation of Independent Business reports nine percent of owners have issued layoff notices due to these tariffs. Businesses are raising prices by an average of 3.7 percent this month as they struggle with rising costs and decreased consumer spending.

In Alberta, business leaders feel cautiously optimistic after avoiding new U.S.-imposed tariffs that threatened the energy sector. Adam Legge from the Business Council of Alberta feels relieved but remains wary about future trade developments under current policies.

President Trump’s tariff strategy aims to equalize import taxes with those imposed by other nations, sparking debate over its economic impact on sectors like agriculture and manufacturing. Meanwhile, Japan’s Prime Minister Shigeru Ishiba expressed disappointment over Japan’s exclusion from tariff exemptions and plans support for affected industries domestically.

These developments highlight growing concerns about global economic instability driven by U.S. trade policies, particularly affecting small businesses worldwide as they navigate uncertain financial landscapes.

UK Economy SHOCK: 2025 Growth Forecast SLASHED to 1%

— The UK government is scrambling to address a major financial shortfall as the growth forecast for 2025 has been slashed to just 1%. This sharp reduction raises concerns about the country’s economic health, affected by both domestic and international challenges. The Chancellor of the Exchequer will provide more details in a press conference today.

This development highlights ongoing economic issues like inflation and external pressures that have forced a reassessment of growth projections. Experts worry about the impact on public services and potential tax hikes.

Increased scrutiny of government spending priorities and economic policies is expected following this announcement. The government’s response will be crucial in navigating these turbulent economic waters.

FCA WARNING: UK Motor Finance Ruling Could Devastate Economy

— The Financial Conduct Authority (FCA) has raised alarms over a court ruling that could saddle car lenders with a £44 billion compensation bill. The FCA warned the Supreme Court that this decision might deter business investments in the UK. The ruling’s impact could extend beyond car loans to other financial products sold on commission, such as insurance.

Close Brothers, a financial services firm, backed the FCA’s stance during Supreme Court discussions. They argued that car dealers should not bear significant responsibility for consumers’ financial interests, similar to shop workers’ duties. Darren Smith of Courmacs Legal criticized this position, questioning their commitment to consumer protection.

The controversy began when the Court of Appeal ruled against “secret” commissions paid to car salesmen for motor finance loans. This decision sparked fears of compensation payouts reaching £38 billion for affected drivers. The FCA urged the Supreme Court to overturn this ruling, arguing it disrupts balance between consumer interests and financial institutions.

WH SMITH’S High Street Exit: A Shocking Shift in Retail

— Modella has bought WH Smith’s online operations for £76 million. The company will now run under the TGJones name, while WH Smith keeps its travel shops. This move shows the tough times high street retailers face in a digital world.

WH Smith might sell its digital card business, Funky Pigeon, as part of restructuring. Nicholas Found from Retail Economics says old-school retailers struggle with fewer shoppers and rising costs. This sale highlights the economic pressures on traditional high street businesses.

Modella plans to keep current products and services in WH Smith stores, like Post Office and Toys R Us sections. They also want to add new items like craft goods to boost business. For now, it’s “business as usual” as Modella works on future plans for growth.

The acquisition shows WH Smith’s shift towards travel retail, which is more profitable despite industry challenges. With 480 high street stores and 5,000 employees affected by this change, focusing on travel-related retail could increase revenue in a tough market landscape.

UK Businesses WARNED: New LEASE Rules Could Bring Hefty Fines

— Over 720,000 UK businesses could face fines due to new lease accounting rules starting January 2026. A survey by IRIS Software Group found that 24% of businesses are unaware of the FRS 102 changes.

More than half of the companies surveyed think the new standards will raise costs, with industrial sectors feeling it most. Mark Chambers from IRIS Accountancy advises planning ahead to reduce risks.

Business equipment makes up 42% of leased assets, followed by IT and real estate. Companies need to act now to avoid penalties and ensure they comply with these upcoming regulations.

“Hudson’s Bay COLLAPSE: 9,000 Jobs in JEOPARDY”

— Hudson’s Bay Company, Canada’s oldest business, plans to liquidate by June. Unable to secure financing, the company will shut down all operations. This decision puts over 9,000 jobs across Canada at risk.

The company’s financial troubles were clear in a March court filing. Hudson’s Bay delayed payments to landlords and vendors due to ongoing money problems. They initially hoped to stay open despite these issues.

Richard Baker bought Hudson’s Bay in 2008 for $1.1 billion, but it has steadily declined since then. The liquidation involves selling inventory and real estate while gradually laying off employees until mid-June.

UK’S MULTIPLE WOES: Arrests, Economic Struggles, and Diplomatic Drama

— A cargo ship captain in the North Sea has been arrested by UK authorities for suspected manslaughter after a collision. This incident highlights rising safety concerns in maritime operations. The crash had serious consequences, leading to calls for stricter regulations to prevent future tragedies.

The UK economy unexpectedly shrank in January, surprising analysts and challenging the Treasury chief. This downturn complicates financial strategies and could affect future policies. The unexpected shrinkage puts pressure on government officials to stabilize the economy quickly.

Environmental issues are also pressing as the UK government vows to clean up Lake Windermere after sewage pollution reports. The popular tourist spot’s beauty is at risk, prompting immediate action to restore its condition. Preserving the environment remains a priority amid these challenges.

Diplomatic tensions with Russia have escalated as two British diplomats were expelled over espionage claims from Moscow’s embassy. This move underscores strained relations between the nations and raises questions about future diplomatic engagements, adding complexity to UK’s international standing.

UK NEWS ACCESS Problem Stirs Public Concern

— The inability to access the latest UK news stories has raised concerns among readers and media outlets. This issue highlights the challenges faced in obtaining timely and accurate information.

Media organizations rely heavily on up-to-date news to inform their audiences effectively. The disruption affects not only journalists but also the public who depend on these updates for their daily understanding of world events.

Resolving this access problem is crucial for maintaining transparency and trust in media reporting. As technology evolves, ensuring reliable news delivery remains a priority for both providers and consumers alike.

LIV Golf’s MONEY Woes: Is a PGA Merger the Only Hope?

— LIV Golf is facing serious financial trouble. Losses in its UK branch have jumped from $244 million to $394 million in 2023. This big spike has people wondering if a merger with the PGA Tour might be on the horizon.

The Saudi Public Investment Fund (PIF) is still a key lifeline for LIV Golf during these tough times. Without this support, the league could struggle to become profitable and sustainable.

These money problems raise questions about LIV Golf’s future in pro golf. Will it need major changes or a merger to keep going? The coming months are crucial for its survival and growth in the sport.

INSOLVENCIES SURGE: Businesses Face Economic Pressures in England and Wales

— Insolvencies in England and Wales have jumped from December 2024 to January 2025. Law firm Fladgate LLP reports a significant rise in administrations. The economic climate is tough for businesses, especially in retail, which already struggles with slim profit margins. The upcoming Spring Budget might introduce tax hikes that could further pressure businesses and consumer spending.

ANGLO AMERICAN’s $500 Million NICKEL Sale Marks Strategic SHIFT

Anglo American has sold its nickel business for $500 million as part of a strategic shift to focus on copper and iron. This sale follows the disposal of its steelmaking coal business, bringing total asset sales to about $5.3 billion. CEO Duncan Wanblad highlighted that these moves are meant to streamline the company’s portfolio and boost value.

COLORADO BILL DEMANDS Climate Transparency from Businesses

Colorado will require businesses to disclose their greenhouse gas emissions starting in 2028, aligning with similar efforts by other states. This legislation responds to past criticisms about inconsistent sustainability reporting practices across industries. The goal is more transparency and accountability regarding environmental impacts from companies within the state.

The IRS plans major layoffs during tax season due to budget cuts initiated by the Trump administration, which may affect its

“TRUMP’S Steel Tariffs Ignite Fears Among UK Businesses”

— President Donald TRUMP plans a 25% tariff on steel imports, causing unease in the UK. The move, described as “without exceptions,” has led UK shadow business secretary Andrew Griffith to urge negotiations for an exemption. The Department for Business and Trade warns these tariffs could harm UK steelmakers by allowing cheaper imports to undercut them.

A survey shows 37% of UK entrepreneurs fear increased operational costs due to TRUMP’s proposed tariffs. With the US accounting for 22% of the UK’s total exports, the potential impact is significant. Entrepreneurs worry about staying competitive amid these new financial pressures.

In response, the UK government is taking steps to bolster its steel industry through a Plan for Steel Consultation initiative. This strategy includes up to £2.5 billion aimed at protecting jobs and fostering economic growth within the sector. These efforts highlight ongoing challenges in international trade relations between the US and UK under TRUMP’s tariff policies.

LIV Golf’s SHOCKING Financial Woes: What’s Next for the Saudi-Backed League?

— LIV Golf is facing serious financial trouble, with losses skyrocketing. Reports show that the UK branch’s losses jumped from $244 million to $394 million in 2023. This has fueled rumors of possible merger talks with the PGA Tour.

The Saudi Public Investment Fund (PIF) is still providing crucial financial support to LIV Golf during these tough times. Without this backing, LIV Golf might struggle to survive as it deals with issues of profitability and sustainability.

These challenges raise questions about LIV Golf’s future in professional golf. Can it continue without major changes, or will a merger become necessary? The coming months could be pivotal for its survival and growth in the sport.

SANTANDER’S UK Business Safe: Rumors Debunked

— Banco Santander has confirmed its UK division is not for sale, despite recent rumors. A company spokesperson highlighted the importance of the UK business to Santander’s global strategy. This statement follows reports suggesting potential talks with NatWest and Barclays about selling the unit.

The Financial Times reported that discussions took place between Santander and NatWest, leading to speculation about a possible sale. However, these talks did not result in any formal proposals. Earlier interest from Barclays also didn’t turn into an offer as Santander reassessed its British operations.

Santander’s reassurance comes amid increased scrutiny of its UK activities and aims to calm stakeholders’ concerns. The bank emphasizes the strategic value of its British presence within its diverse financial portfolio.

This development underscores Santander’s commitment to maintaining a strong foothold in the competitive UK market, assuring investors and customers alike of their continued dedication to this key region.

LIV Golf’s FINANCIAL Turmoil: Is the Dream Fading?

— LIV Golf is facing big financial problems, with losses “piling up at a staggering rate.” Analysts have looked into recent financial reports to reach this conclusion.

The UK branch of LIV Golf, which manages operations outside the U.S., saw its losses jump from $244 million to $394 million in 2023. This huge increase has sparked talk about possible merger discussions with the PGA Tour.

Regular cash boosts from the Saudi Public Investment Fund (PIF) are seen as vital for LIV Golf’s survival amid these growing losses. The situation raises questions about LIV Golf’s future and potential shifts in professional golf dynamics.

NIKOLA’S Financial Freefall: What It Means for the Electric Truck Industry

— Nikola, the electric-truck maker, faces financial restructuring as its market value drops from $30 billion to just $63 million. This sharp decline shows serious financial trouble within the company. Investors are keeping a close eye on how Nikola handles these stormy times.

KLARNA’S BOLD MOVE: Chasing a $15 BILLION US IPO

Fintech giant Klarna plans a US IPO in April, aiming for a valuation of up to $15 billion. If successful, it would be one of the biggest listings this year. This move highlights Klarna’s drive to grow its influence in the competitive fintech world.

PRINCIPAL FINANCIAL’S Q4 SUCCESS: A Beacon Amid Economic Uncertainty

Principal Financial reported strong fourth-quarter earnings with a 12% revenue increase year-over-year, reaching $4.75 billion. Earnings per share rose to $1.94 from last year’s $1.83, showing solid growth and key performance metrics for investors amid economic uncertainties.

UK BUSINESSES in TROUBLE: Financial Distress Hits Record Levels

— A recent report reveals a sharp rise in UK businesses facing severe financial distress. The hospitality, leisure, and retail sectors are hit hardest, with construction also struggling. From September to December last year, the number of distressed businesses jumped by 50%, reaching 46,583.

Ric Traynor of Begbies Traynor highlighted the challenges these businesses face as they navigate early 2025 hurdles. Many find it nearly impossible to overcome current economic obstacles. This situation stresses the urgent need for strategic solutions and support for these industries.

HONEYWELL’s BOLD MOVE: Strategic SPLIT on the Horizon

Honeywell CEO Vimal Kapur is leading a reinvention plan amid shifting market valuations for industrial giants. The company plans to spin off its advanced material business into a new public entity by late 2025 or early 2026. Honeywell might split into two independent entities focusing on automation and aerospace, though no formal announcement has been made yet.

Since late October, Honeywell’s shares have risen by 8%, showing investor optimism about these potential changes. This strategic shift aims to better position Honeywell in a competitive market while maximizing shareholder value through focused operations in distinct sectors.

— News Access Issues: Journalist Unable to Retrieve Business s A reporter has encountered difficulties accessing the news timeline file, limiting their ability to search for specific business-related queries or breaking news updates

— UK Leads European Office Investment Resurgence The UK has emerged as a frontrunner in revitalizing office investments across Europe, signaling a strong recovery in the commercial property market

— New York Attorney General Seeks $370 Million and Business Ban for Trump and Co-Defendants

— Japan Slides into Technical Recession, Puts Pressure on BOJ to Balance Yen Support and Fragile Growth The Japanese economy enters a technical recession, prompting the Bank of Japan to navigate the delicate task of bolstering the yen while fostering fragile growth

— Stellantis’ Profit Slides as Detroit Three Strikes Take a Toll Jeep and Dodge manufacturer, Stellantis, experiences a decline in profits due to ongoing strikes by the Detroit Three automakers

-((($wid/$zoom)/2)-(($this.metadata.pointOfInterest.w/2)*100%))},{($this.metadata.pointOfInterest.y*100%)-((($hei/$zoom)/2)-(($this.metadata.pointOfInterest.h/2)*100%))},{$wid/$zoom},{$hei/$zoom}&w=$wid&h=$hei&sm=c&fmt=auto)

BODY SHOP Faces Uncertain Future: Insolvency Administrators Step In Amid Financial Crisis

— The Body Shop, a renowned British beauty and cosmetics retailer, has enlisted the help of insolvency administrators. This move follows years of financial struggles that have plagued the company. Established in 1976 as a single store, The Body Shop has grown into one of Britain’s most iconic high street retailers. Now, its future hangs in the balance.

FRP, the appointed administrators for The Body Shop, have revealed that past owners’ financial mismanagement has contributed to an extended period of hardship for the company. These issues are exacerbated by a challenging trading environment within the broader retail sector.

Just weeks before this announcement, European private equity firm Aurelius took over The Body Shop. Known for their expertise in revitalizing struggling companies, Aurelius now faces a significant challenge with this latest acquisition.

Anita Roddick and her husband established The Body Shop in 1976 with ethical consumerism at its core. Roddick earned herself the title “Queen of Green” by prioritizing corporate social responsibility and environmentalism long before they became fashionable business practices. Today however, her legacy is threatened by ongoing financial difficulties.

UK-CANADA Trade Talks GRIND to a Halt: The Beef and Cheese Battle That’s Costing Billions

— The UK government has unexpectedly put the brakes on post-Brexit trade talks with Canada. This sudden move follows a two-year stalemate over beef and cheese imports and exports, which began after Britain officially left the European Union.

Trade between these nations, valued at roughly 26 billion pounds ($33 billion) per year, has mostly persisted under the initial agreement made while Britain was still an EU member. However, Canadian negotiators are feeling the heat from their own beef industry and local cheesemakers. The former is pushing for access to the UK market for hormone-fed beef, while cheesemakers are raising alarms about tariff-free imports of British cheese.

The privilege of tariff-free British cheese exports came to a halt at the close of 2023 when a temporary agreement expired. This change led to a staggering 245% duty hike for British producers. Canada’s trade minister Mary Ng firmly stated that Canada “will never agree to a deal that isn’t beneficial for our workers, farmers and businesses.” Minette Batters, president of the National Farmers’ Union in England and Wales praised Britain’s resistance against hormone-fed beef imports.

Despite this hiccup in negotiations, the UK government remains open-minded about future discussions. However, any significant progress appears unlikely at present.

Video

UK HALTS Israel Arms Exports Amid GROWING Conflict

— The United Kingdom has suspended 30 out of its 350 arms export licenses to Israel. This decision, announced on September 2, 2024, comes amid rising concerns over the conflict between Israel and Hamas in Gaza. UK Foreign Secretary David Lammy stated that the suspension aims to ensure compliance with international humanitarian law.

The Labour government initiated this review in July, shortly after taking office. Lammy clarified that this is not a full embargo but a precautionary measure to reassess existing licenses. The UK remains committed to supporting Israel as an important ally while upholding humanitarian standards.

Reactions have been mixed. Human rights organizations welcomed the move as a step towards preventing potential violations of humanitarian laws by British arms. However, Israeli officials and their supporters are concerned about its impact on bilateral relations and security cooperation.

This decision adds to the growing international scrutiny over military aid and arms sales to conflict zones like Gaza. As the review continues, both nations will need to balance their strategic partnership with human rights considerations.

More Videos

Invalid Query

The keyword entered was invalid, or we couldn't gather enough relevant information to construct a thread. Try checking the spelling or entering a broader search term. Often simple one-word terms are enough for our algorithms to build a detailed thread on the topic. Longer multi-word terms will refine the search but create a narrower information thread.

Politics

The latest uncensored news and conservative opinions in US, UK, and global politics.

get the latestLaw

In-depth legal analysis of the latest trials and crime stories from around the world.

get the latest

Social Chatter

What the World is SayingHistorically, it was difficult to reinvent a company at the height of its market cap. When I was in Nokia, I asked why my Finnish colleagues why the company did not reinvest its resources to...

. . .Navigating the New Normal: Understanding the Impact of Rising Interest Rates on Consumers and Businesses. Navigating the New Normal: Understanding the Impact of Rising Interest Rates on Consumers and Businesses https://bgodinspired.com/wp-content/uploads/2025/02/1738675234.png In a world where everything feels fleeting, the rise of interest rates comes like an unexpected storm, shaking the ground benea...

. . .Lack of skilled manpower among concerns of S'pore firms moving to Johor-SG Special Economic Zone. Lack of skilled manpower among concerns of S'pore firms moving to Johor-SG Special Economic Zone Singapore companies that are already moving their facilities to the Johor-Singapore Special Economic Zone say they could face ...

. . .Lack of skilled manpower among concerns of S'pore firms moving to Johor-SG Special Economic Zone. Lack of skilled manpower among concerns of S'pore firms moving to Johor-SG Special Economic Zone Singapore companies that are already moving their facilities to the Johor-Singapore Special Economic Zone say they could face ...

. . .Lack of skilled manpower among concerns of S'pore firms moving to Johor-SG Special Economic Zone. Lack of skilled manpower among concerns of S'pore firms moving to Johor-SG Special Economic Zone Singapore companies that are already moving their facilities to the Johor-Singapore Special Economic Zone say they could face ...

. . .