THREAD: uk credit card borrowing skyrockets

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

TRUMP’S Trade WAR: A Global Financial Nightmare?

— The Bank of England warns of a looming global financial crisis due to Donald Trump’s trade war. The Financial Policy Committee (FPC) pointed out risks from new global tariffs introduced on April 9. These tariffs have increased uncertainty in world markets, possibly leading to debt spirals for governments.

The UK, with its open economy and large financial sector, is especially vulnerable to shocks from international trade conflicts. Rachel Reeves, the Chancellor, confirmed ongoing talks with the Bank’s Governor to watch market developments amid these tensions.

Trump’s threats of more tariffs on China could escalate the conflict and harm international cooperation. Such actions may worsen financial conditions worldwide, according to the FPC’s warning note.

Despite these worries, analysts believe that the well-capitalized UK banking system might offer some protection against economic turmoil. However, watching trade war developments remains crucial as they could greatly impact both local and global markets.

UK Economy SHOCK: 2025 Growth Forecast SLASHED to 1%

— The UK government is scrambling to address a major financial shortfall as the growth forecast for 2025 has been slashed to just 1%. This sharp reduction raises concerns about the country’s economic health, affected by both domestic and international challenges. The Chancellor of the Exchequer will provide more details in a press conference today.

This development highlights ongoing economic issues like inflation and external pressures that have forced a reassessment of growth projections. Experts worry about the impact on public services and potential tax hikes.

Increased scrutiny of government spending priorities and economic policies is expected following this announcement. The government’s response will be crucial in navigating these turbulent economic waters.

FCA WARNING: UK Motor Finance Ruling Could Devastate Economy

— The Financial Conduct Authority (FCA) has raised alarms over a court ruling that could saddle car lenders with a £44 billion compensation bill. The FCA warned the Supreme Court that this decision might deter business investments in the UK. The ruling’s impact could extend beyond car loans to other financial products sold on commission, such as insurance.

Close Brothers, a financial services firm, backed the FCA’s stance during Supreme Court discussions. They argued that car dealers should not bear significant responsibility for consumers’ financial interests, similar to shop workers’ duties. Darren Smith of Courmacs Legal criticized this position, questioning their commitment to consumer protection.

The controversy began when the Court of Appeal ruled against “secret” commissions paid to car salesmen for motor finance loans. This decision sparked fears of compensation payouts reaching £38 billion for affected drivers. The FCA urged the Supreme Court to overturn this ruling, arguing it disrupts balance between consumer interests and financial institutions.

BRITAIN’S NEW Tourist FEE Shocks Travelers: What You Need to Know

— The British government has raised the tourist fee for travelers entering the United Kingdom. Starting April 9, the Electronic Travel Authorization (ETA) system will charge nearly $18, up from about $13. This new system digitizes travel requests and adds a cost for visitors.

In 2023, the U.K. welcomed 38 million visits, an increase of 6.7 million from the previous year. Despite this tourism boost, travelers now face higher costs due to this fee hike. The ETA requires tourists to get “permission” before traveling to Britain, adding more red tape for visitors.

This decision has sparked debate as it comes amid rising visitor numbers and could affect future travel plans for many considering a trip to the U.K. As one of Europe’s top destinations, Britain’s move might influence other countries thinking about similar changes in their tourism policies.

UK INFLATION SURGE: What It Means for Your Wallet

— The United Kingdom is facing a jump in inflation, hitting a 10-month high. This spike raises concerns for the Bank of England as it works to maintain economic stability. The increase could impact future monetary policies and interest rates.

BRITISH MUSICIANS SILENCE AI with BOLD Protest

British musicians are making a statement against artificial intelligence by releasing a silent album. They oppose AI using their work without permission. This protest highlights growing tensions between artists and tech companies over intellectual property rights.

UK HALTS RWANDA AID Amid CONGO Violence Concerns

The UK has stopped some financial aid to Rwanda due to violence in eastern Congo. This decision reflects worries about regional stability and human rights issues, showing the UK’s cautious approach to foreign aid during geopolitical tensions.

Iran has accused a detained British couple of spying, increasing diplomatic tension between the two nations. This claim could complicate already strained relations and affect future diplomatic talks as both countries handle this sensitive issue carefully.

LIV Golf’s MONEY Woes: Is a PGA Merger the Only Hope?

— LIV Golf is facing serious financial trouble. Losses in its UK branch have jumped from $244 million to $394 million in 2023. This big spike has people wondering if a merger with the PGA Tour might be on the horizon.

The Saudi Public Investment Fund (PIF) is still a key lifeline for LIV Golf during these tough times. Without this support, the league could struggle to become profitable and sustainable.

These money problems raise questions about LIV Golf’s future in pro golf. Will it need major changes or a merger to keep going? The coming months are crucial for its survival and growth in the sport.

INSOLVENCIES SURGE: Businesses Face Economic Pressures in England and Wales

— Insolvencies in England and Wales have jumped from December 2024 to January 2025. Law firm Fladgate LLP reports a significant rise in administrations. The economic climate is tough for businesses, especially in retail, which already struggles with slim profit margins. The upcoming Spring Budget might introduce tax hikes that could further pressure businesses and consumer spending.

ANGLO AMERICAN’s $500 Million NICKEL Sale Marks Strategic SHIFT

Anglo American has sold its nickel business for $500 million as part of a strategic shift to focus on copper and iron. This sale follows the disposal of its steelmaking coal business, bringing total asset sales to about $5.3 billion. CEO Duncan Wanblad highlighted that these moves are meant to streamline the company’s portfolio and boost value.

COLORADO BILL DEMANDS Climate Transparency from Businesses

Colorado will require businesses to disclose their greenhouse gas emissions starting in 2028, aligning with similar efforts by other states. This legislation responds to past criticisms about inconsistent sustainability reporting practices across industries. The goal is more transparency and accountability regarding environmental impacts from companies within the state.

The IRS plans major layoffs during tax season due to budget cuts initiated by the Trump administration, which may affect its

LIV Golf’s SHOCKING Financial Woes: What’s Next for the Saudi-Backed League?

— LIV Golf is facing serious financial trouble, with losses skyrocketing. Reports show that the UK branch’s losses jumped from $244 million to $394 million in 2023. This has fueled rumors of possible merger talks with the PGA Tour.

The Saudi Public Investment Fund (PIF) is still providing crucial financial support to LIV Golf during these tough times. Without this backing, LIV Golf might struggle to survive as it deals with issues of profitability and sustainability.

These challenges raise questions about LIV Golf’s future in professional golf. Can it continue without major changes, or will a merger become necessary? The coming months could be pivotal for its survival and growth in the sport.

)

UK CHAOS: Knife ATTACK, Economic Shock, and Storm Havoc

— UK police have arrested a suspect after a knife attack in South London injured five people. The investigation continues, but no details about the suspect or motive have been released. This incident raises ongoing concerns about public safety and crime in urban areas.

The Bank of England has cut interest rates to 4.50% while slashing its growth forecast amid economic uncertainty. This move aims to boost economic activity but raises questions about long-term financial stability as the UK faces challenging conditions.

A major storm has wreaked havoc across Ireland and Scotland, with hurricane-force winds downing power lines and grounding flights. Authorities are on high alert as regions face widespread chaos from severe weather conditions. The UK’s tallest tree was destroyed in the storm, sparking discussions on environmental conservation efforts.

TV chef Gino D’Acampo denies allegations of inappropriate behavior and plans legal action to defend his reputation amid media scrutiny. Meanwhile, the UN reports over 13,000 children killed in Gaza due to conflict-related violence — highlighting a dire humanitarian crisis needing global attention. In other news, the Church of England seeks public input for naming its next Archbishop to increase engagement in church leadership matters.

Bank of England’s RATE CUT Sends Shockwaves Through Markets

— The Bank of England has cut interest rates by 25 basis points, causing the Pound Sterling to drop sharply against the US Dollar. This move shows worries about economic growth and inflation. Experts expect more rate cuts in 2025, signaling a careful approach to monetary policy.

Market analysts warn this could affect savings rates and borrowing costs, urging people and businesses to rethink financial plans. The immediate effect saw GBP/USD fall by 0.93%, hitting a session low of 1.2359.

This has increased market volatility, raising concerns about future economic stability in the UK. As uncertainty grows, many wonder how these changes will impact their finances and investments moving forward.

UK’S MIGRATION SURGE: Alarming Population Boom by 2032

— The UK’s population could hit 72.5 million by 2032, mostly due to migration, says the Office for National Statistics (ONS). The current count is about 69 million, but exact numbers are tricky because of undocumented residents. Between 2022 and 2023, births and deaths will balance at 6.8 million each, making migration the sole growth driver.

ONS predicts ten million immigrants will arrive long-term while five million will leave, leading to a net gain of five million through migration alone. Population growth from 2022 to 2032 is expected at 7.3%, up from the last decade’s rate of 6.1%. A “high migration” scenario suggests half a million net arrivals annually past 2028 could push the population close to 79 million by 2042.

Migration Watch Chairman Alp Mehmet criticized ONS’s view that net migration will drop without policy changes. He warned of economic impacts and noted a decline in the indigenous white British population percentage from over 95% in 1991 to just above three-quarters today. Many citizens feel immigration levels are too high and express concern over this issue.

Nigel Farage called immigration Britain’s most urgent problem, blaming both major parties for poor management. He emphasized that neither has effectively addressed public worries about rising immigration numbers and

UK BUSINESSES in TROUBLE: Financial Distress Hits Record Levels

— A recent report reveals a sharp rise in UK businesses facing severe financial distress. The hospitality, leisure, and retail sectors are hit hardest, with construction also struggling. From September to December last year, the number of distressed businesses jumped by 50%, reaching 46,583.

Ric Traynor of Begbies Traynor highlighted the challenges these businesses face as they navigate early 2025 hurdles. Many find it nearly impossible to overcome current economic obstacles. This situation stresses the urgent need for strategic solutions and support for these industries.

HONEYWELL’s BOLD MOVE: Strategic SPLIT on the Horizon

Honeywell CEO Vimal Kapur is leading a reinvention plan amid shifting market valuations for industrial giants. The company plans to spin off its advanced material business into a new public entity by late 2025 or early 2026. Honeywell might split into two independent entities focusing on automation and aerospace, though no formal announcement has been made yet.

Since late October, Honeywell’s shares have risen by 8%, showing investor optimism about these potential changes. This strategic shift aims to better position Honeywell in a competitive market while maximizing shareholder value through focused operations in distinct sectors.

AMERICAN EXPRESS Hit Hard: $230 Million Settlement Shocks Industry

— American Express has agreed to a $230 million settlement, surprising customers and industry insiders. This hefty financial blow highlights the growing scrutiny on major financial institutions. Analysts see this as a turning point, pushing companies to rethink their compliance strategies.

The settlement raises concerns about deeper issues within the financial industry. Customers are shocked and worried about how this might tarnish American Express’s reputation. Experts say this incident could lead to stricter oversight of financial firms in the future.

This development is crucial as it signals a potential shift in accountability for big financial players. The pressure is building for these giants to adapt to tighter regulations and increased consumer awareness. Financial companies may need to reevaluate their practices in response to this wake-up call.

— S&P 500 SOARS to NEW RECORD CLOSE The index surged as traders sought to capitalize on the momentum from recent Federal Reserve interest rate cuts

— UniCredit’s Andrea Orcel Eyes Commerzbank Acquisition The CEO of UniCredit is strategically targeting Commerzbank as part of a bold expansion plan

MASS MIGRATION Cripples UK Housing: Urgent Call for Policy Overhaul

— The Bank of England’s chief economist, Huw Pill, has identified a severe shortage in housing supply and skyrocketing demand as the primary reasons for rising rent prices. In 2022, a record-breaking net migration of 745,000 significantly fueled this demand. Pill criticizes the restrictive planning policies that have hindered adequate housing development.

Contrasting with the government’s positive spin on economic figures, Pill’s insights reveal underlying challenges. Treasury chief Jeremy Hunt highlighted a 0.6 percent GDP growth as evidence of post-pandemic recovery. Yet, this growth occurs against a backdrop of high taxes and limited spending cuts under what Hunt describes as a neo-liberal globalist agenda.

The escalating housing crisis necessitates immediate action as the existing supply fails to accommodate the influx from mass migration. This dire situation demands a thorough reassessment of immigration and housing regulations to effectively tackle these pressing issues.

— ***Consumer Sentiment Plummets Amid Soaring Inflation Concerns*** Consumer sentiment takes a nosedive as worries over inflation reach new heights

— Alphabet Stock Surges: 14% Increase Post Strong Earnings and Debut Dividend

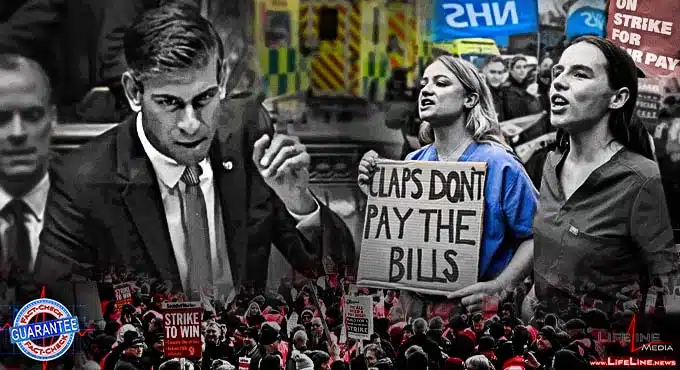

UK to RAMP UP Defense Spending: A Bold Call for NATO Unity

— During a military visit in Poland, British Prime Minister Rishi Sunak announced a significant increase in the UK’s defense budget. By 2030, spending is set to rise from just over 2% of GDP to 2.5%. Sunak described this boost as essential in what he termed “the most dangerous global climate since the Cold War,” calling it a "generational investment.

The next day, UK leaders pressed other NATO members to also raise their defense budgets. This push aligns with former U.S. President Donald Trump’s long-standing demand that NATO countries up their contributions for collective security. UK Defense Minister Grant Shapps voiced strong support for this initiative at an upcoming NATO summit in Washington DC.

Some critics question whether many nations will achieve these elevated spending targets without an actual attack on the alliance. Nonetheless, NATO has recognized that Trump’s firm stance on member contributions has significantly bolstered the alliance’s strength and capabilities.

At a Warsaw press conference with NATO Secretary General Jens Stoltenberg, Sunak discussed his commitment to supporting Ukraine and enhancing military cooperation within the alliance. This strategy represents a major policy shift aimed at strengthening Western defenses against escalating global threats.

— Luxury Items Splurged by £54m Benefit Scammers Revealed in Lavish Spending Report Details reveal extravagant purchases and trips made by Bulgarian gang in UK’s biggest benefit fraud case

REFORM UK RISES: Public Discontent Over Immigration Policies Fuels Momentum

— Reform UK is gaining momentum, largely fueled by its firm stance against “unchecked immigration,” as stated by the party’s deputy chair. This surge in support comes in light of recent data from Ipsos Mori and British Future, a pro-immigration think tank. The figures highlight public dissatisfaction with the government’s management of borders, indicating a potential shift in the UK’s political landscape.

Despite Labour currently leading in the polls, Nigel Farage’s Reform UK party is outpacing the Conservatives when it comes to trust and policy matters. This could serve as an alarm bell for Tory politicians who have been at Britain’s political helm for two centuries. Ben Habib, Deputy Leader of Reform UK, attributes this shift to what he perceives as the Conservative Party neglecting their own voter base.

According to Ipsos Mori research, 69% of Britons express dissatisfaction with immigration policies while only 9% are content. Of those dissatisfied individuals, over half (52%) believe migration should be reduced while just 17% think it should increase. Specific grievances include inadequate measures to prevent channel crossings (54%) and high immigration numbers (51%). Less concern was shown towards creating negative environments for migrants (28%) or poor treatment of asylum seekers (25%).

Habib asserts that this widespread discontent signifies a historic realignment in politics

GREEN AGENDA Hits Hard: Ofgem Warns of Financial Burden on Low-Income Consumers

— The Office of Gas and Electricity Markets (Ofgem) sounded an alarm on Monday. It cautioned that the shift towards a “Net Zero” carbon emissions economy could unfairly impact low-income consumers. These individuals might lack the financial resources to acquire government-approved technology or modify their lifestyle habits.

In the past year alone, debts from energy consumers have skyrocketed by 50%, amassing a total of £3 billion. Ofgem voiced grave concerns about struggling households’ limited resilience to future price shocks. The regulator also highlighted that the burden of recovering bad debts could pose serious threats to the retail energy sector.

Economic difficulties have already pushed British consumers into rationing their energy consumption. This has led to “harms associated with living in a cold, damp home,” potentially triggering an increase in mental health issues rates.

Tim Jarvis, Ofgem’s director general, underscored the necessity for a long-term strategy to manage escalating debt levels and shield struggling consumers from future price shocks. He mentioned that measures such as altering standing charges for prepayment meter customers and tightening requirements on suppliers had been implemented.

From BETTING FRENZY to Prison: Andy May’s £13M Gamble and His Fight Against Addiction

— Andy May, once a finance manager from Norfolk, squandered his family’s house deposit in a gambling frenzy. After seven years of abstinence from betting, the allure of a “free bet” during the 2014 World Cup lured him back into the destructive habit.

May’s addiction spiraled out of control as he misused his company credit card to gamble away £1.3 million. This reckless act led him straight to prison. Now released after two years, he has teamed up with GambleAware to share his cautionary tale and raise awareness about gambling addiction.

During his four-and-a-half-year betting spree, May wagered on everything conceivable. He even resorted to paying off personal credit card debts using company funds. His illicit activities eventually caught up with him in 2019 when he was found guilty of stealing over £1.3 million from his employer.

Despite losing his job and deceiving his family about it, May confesses that he might be tempted by gambling again but fights daily against this urge. He underscores that no amount of potential winnings could enhance his life while everything is

UK INFLATION TUMBLES to 39%: Central Bank May Slash Rates Sooner Than Predicted

— The Office for National Statistics (ONS) recently announced a surprising drop in UK inflation to 3.9% in November, a decrease from the previous month’s 4.6%. This dip, larger than what financial markets had forecasted, marks the lowest inflation level since September 2021.

This decline is primarily attributed to falling fuel and food prices according to the ONS. However, despite this optimistic news, the Bank of England’s primary interest rate remains at a staggering high of 5.25%, not seen for over a decade and a half.

Governor Andrew Bailey hinted that this stringent interest rate policy might continue for some time. Yet Samuel Tombs, chief U.K economist at Pantheon Macroeconomics suggests an alternative view — that this sharp fall in inflation could trigger an earlier-than-expected cut in interest rates; perhaps as early as the first half of next year.

While elevated interest rates initially helped curb inflation sparked by supply chain disruptions and Russia’s invasion of Ukraine, they have also put pressure on consumer spending and slowed economic growth. As such there are growing worries that maintaining high rates could inflict unnecessary damage on the economy.

UK Inflation DEFIES Predictions, STAYS at 67%: What’s Next for the Economy?

— The UK’s inflation rate held steady at 6.7% in September, flying in the face of economists’ predictions for a slight decrease. The Office for National Statistics highlighted that while food and drink prices dipped, they were counterbalanced by an uptick in fuel costs.

This persistent inflation rate is more than triple the Bank of England’s target of 2%. Despite this, it is not expected that the bank will hike interest rates during its November policy meeting. Instead, it seems set to keep its main borrowing rate at a peak not seen in 15 years — a hefty 5.25%.

James Smith from the Resolution Foundation think tank offered his perspective on this economic puzzle: “For now, progress on reducing inflation has hit a roadblock.” He anticipates a significant drop to below 5% next month as energy prices are projected to fall for most consumers.

In response to price surges triggered by pandemic-induced supply chain disruptions and Russia’s invasion of Ukraine — both factors contributing heavily to increased food and energy costs — the Bank of England has been steadily cranking up interest rates from near zero levels.

Video

STARKEIR STARMER’S £100K Freebies Spark Outrage

— Prime Minister Sir Keir Starmer has received more freebies than any other MP since becoming Labour leader. He declared gifts and hospitality worth over £100,000, surpassing all other MPs. These gifts include tickets to sporting events and lavish dinners from various organizations.

This trend of MPs receiving substantial benefits raises ethical questions about the influence of such gifts on political decisions. Public trust in politicians is already low, and further scrutiny is anticipated from both the public and political adversaries. Starmer’s office claims all gifts were declared according to parliamentary rules, ensuring transparency.

The disclosure has sparked debate on stricter regulations for MPs accepting gifts and benefits. Critics argue that lavish gifts can lead to conflicts of interest and compromise impartiality. Supporters say these experiences help politicians engage with different sectors, benefiting their understanding and policy-making.

As the story unfolds, calls for reform in regulations governing MPs may arise. Sky News’ investigation highlights the blurred lines between politics and external influences, prompting a re-evaluation of ethical standards for public servants.

More Videos

Invalid Query

The keyword entered was invalid, or we couldn't gather enough relevant information to construct a thread. Try checking the spelling or entering a broader search term. Often simple one-word terms are enough for our algorithms to build a detailed thread on the topic. Longer multi-word terms will refine the search but create a narrower information thread.

Politics

The latest uncensored news and conservative opinions in US, UK, and global politics.

get the latestLaw

In-depth legal analysis of the latest trials and crime stories from around the world.

get the latest

Social Chatter

What the World is SayingNavigating the New Normal: Understanding the Impact of Rising Interest Rates on Consumers and Businesses. Navigating the New Normal: Understanding the Impact of Rising Interest Rates on Consumers and Businesses https://bgodinspired.com/wp-content/uploads/2025/02/1738675234.png In a world where everything feels fleeting, the rise of interest rates comes like an unexpected storm, shaking the ground benea...

. . .Reinvesting spare change and cashback. Reinvesting spare change and cashback Hello everybody, this is my take on reinvesting my spare change and cashback from card payments. I plan to "set it and forget it" for the next 10 years. I have even set the date on which I will "unlock" this small "investment", which I personally prefer to cal...

. . .I’m still not seeing any dilution in our house…while they pay credit card interest rates to hang out with us. I’m still not seeing any dilution in our house…while they pay credit card interest rates to hang out with us

. . .Frax Finance Proposes Using BlackRock’s $530M BUIDL Token to Back Relaunched Stablecoin. Frax Finance Proposes Using BlackRock’s $530M BUIDL Token to Back Relaunched Stablecoin Frax Finance is considering a proposal by Securitize Markets to use BlackRock's BUIDL token, valued at over $530 million, as collateral for its upcoming **Frax USD (frxUSD)** stablecoin. BUIDL, backed by U.S. Tre...

. . .US market sharp correction SPY 3% down!. US market sharp correction SPY 3% down! Anyone that has been buying US listed equities over the last month should be facing huge volatility in their portfolio. This sort of correction was last seen in early August when Japan equities rocked the world due to their interest rate policies. Wall St...

. . .