THREAD: uk treasury

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

UK TAXPAYERS SHOCKED: Iranian Suspect In Israel Embassy Plot Housed For Free

— British police arrested five Iranians this month, suspecting them of planning a terror attack on the Israeli embassy in London. One of the men, age 40, had lived for over six months in a taxpayer-funded home in Rochdale run by Serco.

Reports say he crossed into the UK illegally from France by boat and then claimed asylum. Neighbors said migrants living there paid nothing for rent or bills — everything was covered by taxpayers.

Terrorism expert Anthony Glees called the Calais boat route a “clear and present danger” to national security. He said warships — not lifeboats — should meet migrants at the border to protect Britain.

Serco has tried using more private homes for asylum seekers instead of expensive hotels. But this plan has raised worries about safety and put more strain on local housing markets already under pressure.

TRUMP’S Trade WAR: A Global Financial Nightmare?

— The Bank of England warns of a looming global financial crisis due to Donald Trump’s trade war. The Financial Policy Committee (FPC) pointed out risks from new global tariffs introduced on April 9. These tariffs have increased uncertainty in world markets, possibly leading to debt spirals for governments.

The UK, with its open economy and large financial sector, is especially vulnerable to shocks from international trade conflicts. Rachel Reeves, the Chancellor, confirmed ongoing talks with the Bank’s Governor to watch market developments amid these tensions.

Trump’s threats of more tariffs on China could escalate the conflict and harm international cooperation. Such actions may worsen financial conditions worldwide, according to the FPC’s warning note.

Despite these worries, analysts believe that the well-capitalized UK banking system might offer some protection against economic turmoil. However, watching trade war developments remains crucial as they could greatly impact both local and global markets.

UK Economy SHOCK: 2025 Growth Forecast SLASHED to 1%

— The UK government is scrambling to address a major financial shortfall as the growth forecast for 2025 has been slashed to just 1%. This sharp reduction raises concerns about the country’s economic health, affected by both domestic and international challenges. The Chancellor of the Exchequer will provide more details in a press conference today.

This development highlights ongoing economic issues like inflation and external pressures that have forced a reassessment of growth projections. Experts worry about the impact on public services and potential tax hikes.

Increased scrutiny of government spending priorities and economic policies is expected following this announcement. The government’s response will be crucial in navigating these turbulent economic waters.

UK Government’s BOLD Move to OVERRIDE Controversial Sentencing

— The UK government plans to pass an emergency law to override newly released sentencing guidelines. This decision follows criticism from Conservative shadow justice secretary Robert Jenrick, who accused the Sentencing Council of yielding to outside pressures. The guidelines aimed at addressing sentencing disparities among ethnic groups but have sparked significant controversy.

New legislation will be introduced to tackle heated debates over the sentencing of ethnic minority offenders. The law seeks to address delays in justice for victims, especially those reporting serious crimes like rape, who face long waits for trials. This initiative highlights the government’s commitment to ensuring timely justice and addressing public concerns over fairness in the legal system.

Delaware’s STRATEGIC Law Change: Keeping Businesses HOME

Delaware has enacted changes to its corporate conduct regulations following high-profile departures like Elon Musk’s exit from the state. This legislation aims to prevent further corporate exoduses and underscores Delaware’s commitment to maintaining a business-friendly environment. By adapting its laws, Delaware seeks to retain businesses and bolster its economic standing amid competitive pressures from other states.

IRON AGE Treasure Trove: Unveiling Britain’s Ancient Secrets

— A stunning collection of Iron Age artifacts has been unearthed in the United Kingdom. Durham University hailed the find as “one of the largest and most important” in the nation. The Melonsby Hoard was discovered by metal detectorist Peter Heads in 2021 and excavated by archaeologists a year later.

The hoard consists of over 800 objects dating back around 2,000 years, during Roman rule in Britain. Among these are 28 iron tires likely used for wagons or chariots. Other notable items include a cauldron, a wine mixing bowl, horse harnesses, bridle bits, and ceremonial spears.

This discovery offers valuable insights into life during the Iron Age in Britain. Such finds are rare and provide a glimpse into ancient practices and technologies. The artifacts will undergo further study to better understand their historical significance.

UK INFLATION SURGE: What It Means for Your Wallet

— The United Kingdom is facing a jump in inflation, hitting a 10-month high. This spike raises concerns for the Bank of England as it works to maintain economic stability. The increase could impact future monetary policies and interest rates.

BRITISH MUSICIANS SILENCE AI with BOLD Protest

British musicians are making a statement against artificial intelligence by releasing a silent album. They oppose AI using their work without permission. This protest highlights growing tensions between artists and tech companies over intellectual property rights.

UK HALTS RWANDA AID Amid CONGO Violence Concerns

The UK has stopped some financial aid to Rwanda due to violence in eastern Congo. This decision reflects worries about regional stability and human rights issues, showing the UK’s cautious approach to foreign aid during geopolitical tensions.

Iran has accused a detained British couple of spying, increasing diplomatic tension between the two nations. This claim could complicate already strained relations and affect future diplomatic talks as both countries handle this sensitive issue carefully.

BRITAIN’S Ancient Coinage Tradition: A Fascinating Ritual

— In London, an ancient tradition ensures the integrity of British coinage. Judges in red robes gather for the Trial of the PYX, a ceremony dating back to the 12th century. This event inspects and weighs coins from The Royal Mint to prevent counterfeiting.

Eleni Bide from the Goldsmiths’ Company explained that standardized coins deter forgery by ensuring reliability and quality. Nearly 6,500 coins were tested, including future pocket change and collectible editions like Harry Potter and Star Wars themes.

The mint also honored figures such as Paul McCartney and George Orwell with special coin releases this year. A unique sixpence made from recycled silver X-ray films was among them.

The ceremony’s name comes from “pyxis,” meaning small box in Greek, reflecting how coins are presented for testing in Pyx boxes. Jurors randomly select these coins to ensure they meet strict standards.

TRUMP-Linked Firm’s BOLD Crypto Move Shakes Wall Street

— World Liberty Financial (WLF), linked to Donald TRUMP, has announced a strategic reserve of digital assets. The firm is moving over $307 million to Coinbase Prime. Initially thought to be a sell-off, WLF clarified these are routine treasury operations.

The project aims to tokenize real-world assets, providing secure infrastructure for institutional investors. At the Ondo Summit, WLF highlighted blockchain’s potential to modernize outdated financial systems. This move has attracted major partners like Franklin Templeton and Google Cloud, showing strong interest in blockchain’s role in traditional finance.

Market analysts suggest WLF’s crypto involvement could sway investor sentiment and influence regulatory developments. If successful, it might prompt other institutions to explore similar strategies, potentially transforming the financial landscape.

Financial markets are watching closely amid concerns about Trump’s tariff policies and their impact on inflation and interest rates. The outcome of this initiative could have far-reaching effects on both Wall Street and global finance sectors.

Bank of England’s RATE CUT Sends Shockwaves Through Markets

— The Bank of England has cut interest rates by 25 basis points, causing the Pound Sterling to drop sharply against the US Dollar. This move shows worries about economic growth and inflation. Experts expect more rate cuts in 2025, signaling a careful approach to monetary policy.

Market analysts warn this could affect savings rates and borrowing costs, urging people and businesses to rethink financial plans. The immediate effect saw GBP/USD fall by 0.93%, hitting a session low of 1.2359.

This has increased market volatility, raising concerns about future economic stability in the UK. As uncertainty grows, many wonder how these changes will impact their finances and investments moving forward.

— Fed Officials Split on Potential Half-Point Rate Cut in September Minutes reveal a division among Federal Reserve officials regarding a possible half-point interest rate reduction this month

— Fed Officials Split on September Rate Cut Decision Minutes reveal a division among Federal Reserve officials regarding a potential half-point interest rate cut in September

— Fed’s Major Interest Rate Decision Looms The Federal Reserve is set to announce its most significant interest rate decision in years on Wednesday, with markets eagerly anticipating the implications

— Saudi Arabia Shifts Strategy: Spending Signals Move Away from Being Financial Reservoir Saudi Arabia’s recent spending patterns indicate a significant departure from its traditional role as a financial reservoir

LABOUR PARTY’S Economic Plan Under Fire: Will It Really Work?

— Britain’s new Treasury chief, Rachel Reeves, vows to run the economy with “iron discipline.” She hinted at above-inflation pay raises for public sector workers to end ongoing strikes.

The Labour Party, elected two weeks ago, faces pressure to increase salaries and welfare without raising taxes or public borrowing. Reeves criticized the previous Conservative government for high taxes and debt.

Labour won a landslide victory on promises of economic growth, housebuilding, green energy projects, and improved public services. The electorate seeks relief from high living costs and past economic mismanagement.

Inflation has dropped to 2%, but strikes by hospital doctors strain the National Health Service. Other public-sector workers like nurses and teachers have also demanded higher pay through walkouts over the past year.

CONSERVATIVE Officials in HOT Water Over Election Betting Scandal

— Nick Mason is the fourth Conservative official to be investigated by the U.K.’s Gambling Commission for allegedly betting on election timing before the date was announced. Dozens of bets with potential winnings worth thousands of pounds are under scrutiny.

Two other Conservative candidates, Laura Saunders and Craig Williams, are also being investigated. Tony Lee, Saunders’ husband and Conservative director of campaigning, has taken a leave of absence amid similar allegations.

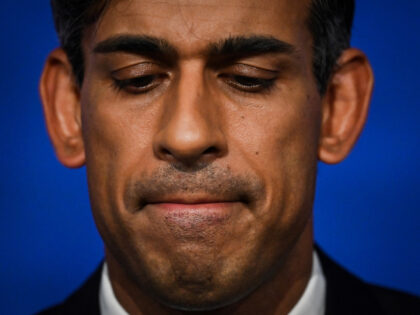

The scandal comes just two weeks before the national election, dealing a blow to Prime Minister Rishi Sunak’s party. Sunak expressed anger over the allegations and stated that lawbreakers should be expelled from the party.

Saunders has pledged full cooperation with investigators. Williams served as Sunak’s parliamentary private secretary in addition to being a candidate.

— IRS to Close Lucrative Tax Loophole, Potentially Generating $50 Billion in Revenue The Internal Revenue Service announces the closure of a significant tax loophole, projecting a revenue increase exceeding $50 billion in the next ten years

UK Government BLASTS ICC Over Netanyahu Arrest Warrants

— The British government has criticized the International Criminal Court (ICC) for seeking arrest warrants against Israeli Prime Minister Benjamin Netanyahu and Hamas leaders. UK Prime Minister Rishi Sunak called the move “deeply unhelpful” during a summit in Vienna, emphasizing that there is no moral equivalence between Israel’s self-defense and Hamas’s terrorism. Sunak’s stance aligns with U.S. President Biden, who labeled the ICC’s action as "outrageous.

Cabinet minister Michael Gove echoed these sentiments, accusing the ICC of double standards by targeting Netanyahu while ignoring Syria’s Bashar al-Assad. Gove argued that this narrative aims to delegitimize Israel by holding it to higher standards than other nations. The British government maintains that the ICC lacks jurisdiction over Israel since it is not a party to the Rome Statute.

However, Labour’s David Lammy supports the ICC’s decision, citing a legal obligation for signatories of the Rome Statute to comply with its orders. Lammy accused Conservatives of undermining international law by criticizing the court. This legalistic approach contrasts sharply with current government lawyers who argue that Palestine is not recognized as a state by many countries, including the UK, thus invalidating any jurisdiction over Israel by the ICC.

UK to RAMP UP Defense Spending: A Bold Call for NATO Unity

— During a military visit in Poland, British Prime Minister Rishi Sunak announced a significant increase in the UK’s defense budget. By 2030, spending is set to rise from just over 2% of GDP to 2.5%. Sunak described this boost as essential in what he termed “the most dangerous global climate since the Cold War,” calling it a "generational investment.

The next day, UK leaders pressed other NATO members to also raise their defense budgets. This push aligns with former U.S. President Donald Trump’s long-standing demand that NATO countries up their contributions for collective security. UK Defense Minister Grant Shapps voiced strong support for this initiative at an upcoming NATO summit in Washington DC.

Some critics question whether many nations will achieve these elevated spending targets without an actual attack on the alliance. Nonetheless, NATO has recognized that Trump’s firm stance on member contributions has significantly bolstered the alliance’s strength and capabilities.

At a Warsaw press conference with NATO Secretary General Jens Stoltenberg, Sunak discussed his commitment to supporting Ukraine and enhancing military cooperation within the alliance. This strategy represents a major policy shift aimed at strengthening Western defenses against escalating global threats.

BRITISH TRADER’S Appeal Crushed: Libor Conviction Stands Strong

— Tom Hayes, a former financial trader for Citigroup and UBS, has been unsuccessful in his attempt to overturn his conviction. This 44-year-old Brit was convicted in 2015 for manipulating the London Inter-Bank Offered Rate (LIBOR) from 2006 to 2010. His case marked the first-ever conviction of this kind.

Hayes served half of an 11-year sentence and was released in 2021. Despite asserting his innocence throughout, he faced another conviction by a U.S court in 2016.

Carlo Palombo, another trader implicated in similar manipulations with Euribor, also sought appeal through the U.K.'s Court of Appeal via the Criminal Cases Review Commission. However, after a three-day hearing earlier this month, both appeals were dismissed without success.

The Serious Fraud Office remained resolute against these appeals stating: “No one is above the law and the court has recognized that these convictions stand firm.” This decision comes on the heels of a contrasting verdict from a U.S court last year which reversed similar convictions of two former Deutsche Bank traders.

UK Museums RETURN Ghana’s STOLEN Treasures: A New Chapter in Colonial History?

— Two renowned British museums, the British Museum and Victoria & Albert Museum, are set to return gold and silver artifacts to Ghana. These treasures were taken during colonial times. The return is part of a long-term loan agreement, cleverly sidestepping U.K. laws that prevent the repatriation of cultural assets.

The loan comprises 17 items, including 13 pieces of Asante royal regalia that the V&A purchased at an auction in 1874. These precious items were taken by British soldiers from Kumasi’s royal palace during the Anglo-Asante wars in the late 19th century.

This act holds significant meaning for both Ghana and Britain. For Ghana, these artifacts embody their rich cultural heritage while for Britain it signifies a recognition of its colonial history.

Despite this move, U.K officials insist that these objects were obtained legally and have been well-preserved by institutions like the British Museum for global appreciation and research purposes.

Sunak’s RWANDA Gamble: A Crucial Test Amid Conservative Uproar

— UK Prime Minister Rishi Sunak faces a rebellion within his own party. He’s pushing for approval of a controversial plan to deport certain asylum-seekers to Rwanda. The plan has already been blocked by the UK Supreme Court, and 60 members of his party have attempted to toughen the legislation. This led to the resignation of two deputy chairmen and a junior ministerial aide from his party.

The “Safety of Rwanda Bill” could face defeat if another rebellion occurs within Sunak’s party. This would pose a significant threat to Sunak’s government, which is just over a year old. The Prime Minister has placed this contentious immigration policy at the center of his election campaign strategy, even though he trails significantly behind Labour in opinion polls.

Sunak believes that deporting unauthorized asylum-seekers will discourage dangerous crossings over the English Channel and disrupt people-smuggling operations. However, he faces an uphill battle in convincing both fellow Conservatives and voters that this plan is effective.

Navigating tensions between liberal and law-and-order factions within his own party adds another layer of complexity for Sunak as he tries to push through this divisive policy.

UK INFLATION TUMBLES to 39%: Central Bank May Slash Rates Sooner Than Predicted

— The Office for National Statistics (ONS) recently announced a surprising drop in UK inflation to 3.9% in November, a decrease from the previous month’s 4.6%. This dip, larger than what financial markets had forecasted, marks the lowest inflation level since September 2021.

This decline is primarily attributed to falling fuel and food prices according to the ONS. However, despite this optimistic news, the Bank of England’s primary interest rate remains at a staggering high of 5.25%, not seen for over a decade and a half.

Governor Andrew Bailey hinted that this stringent interest rate policy might continue for some time. Yet Samuel Tombs, chief U.K economist at Pantheon Macroeconomics suggests an alternative view — that this sharp fall in inflation could trigger an earlier-than-expected cut in interest rates; perhaps as early as the first half of next year.

While elevated interest rates initially helped curb inflation sparked by supply chain disruptions and Russia’s invasion of Ukraine, they have also put pressure on consumer spending and slowed economic growth. As such there are growing worries that maintaining high rates could inflict unnecessary damage on the economy.

UK Gives Greece the COLD SHOULDER Over Ancient Sculptures Dispute

— Britain and Greece have been at odds for years over where some of the finest ancient Greek sculptures should reside. These masterpieces have been showcased in London for more than two centuries. The disagreement reached a new peak when UK Prime Minister Rishi Sunak unexpectedly called off a meeting with his Greek counterpart, Kyriakos Mitsotakis.

This abrupt cancellation came after Mitsotakis used British television to reiterate his demand for the return of these 2,500-year-old works of art. The sculptures in question were crafted between 447-432 B.C., serving as decorations for the renowned Parthenon, a temple dedicated to Athena, Athens’ protective deity.

Although these pieces endured through wars, earthquakes, invasions and religious shifts in the temple over thousands of years, many were lost when Venetians besieged and destroyed the Parthenon in 1687.

The dispute over this cultural heritage is one of the most challenging unresolved issues globally. As diplomatic efforts falter and tensions rise between Britain and Greece, it’s unclear what measures will be taken next in this ongoing struggle over historical artifacts.

UK Government’s RWANDA Deportation Plan DERAILS: A Major U-Turn in Policy Revealed

— The UK government has confessed that it can’t assure any Rwanda deportation flights will depart before the forthcoming general election. This revelation from Chancellor Jeremy Hunt marks a significant shift from Prime Minister Rishi Sunak’s earlier statements. The Supreme Court recently deemed the Rwanda plan unlawful, prompting Sunak to hustle to regain control of the situation.

In an interview with Sky News, Hunt expressed optimism for flights next year but conceded, “We can’t guarantee that.” The United Kingdom is set for a general election next year at the latest by early January 2025. Current polling suggests that the ruling Conservatives are likely to be defeated.

An ex-government minister responsible for this policy cautioned that it won’t work as the government lacks boldness to implement necessary steps for deportations. Sunak had previously pledged in an emergency address to eliminate any further obstacles to enforce this policy and ensure planes depart as scheduled in Spring next year.

This reversal pushes back the revised date for deportation flights further into the future than initially expected. Despite this drawback, James Cleverly, new Home Secretary (interior minister), maintains they are “absolutely determined” to see them

Rishi Sunak’s TURBULENT First Year: Is History About to REPEAT Itself for the Conservatives?

— Rishi Sunak, UK Prime Minister, has marked his first year in office amidst a storm of international conflicts and domestic challenges. His Conservative Party is haunted by the ghost of 1996, when they were dethroned by the Labour Party after ruling for more than a decade.

Recent opinion polls reveal that the Conservatives are lagging 15 to 20 points behind Labour. This gap has remained steady throughout Sunak’s term. An Ipsos poll showed that a whopping 65% of respondents felt the Conservatives did not deserve another term, while merely 19% believed they did.

The ongoing Israel-Hamas conflict and Russia’s war in Ukraine have added layers of complexity to Sunak’s situation. Despite acknowledging his challenging year and vowing to continue serving hardworking families nationwide, there are widespread fears these hurdles may trigger another Conservative downfall.

Video

STARKEIR STARMER’S £100K Freebies Spark Outrage

— Prime Minister Sir Keir Starmer has received more freebies than any other MP since becoming Labour leader. He declared gifts and hospitality worth over £100,000, surpassing all other MPs. These gifts include tickets to sporting events and lavish dinners from various organizations.

This trend of MPs receiving substantial benefits raises ethical questions about the influence of such gifts on political decisions. Public trust in politicians is already low, and further scrutiny is anticipated from both the public and political adversaries. Starmer’s office claims all gifts were declared according to parliamentary rules, ensuring transparency.

The disclosure has sparked debate on stricter regulations for MPs accepting gifts and benefits. Critics argue that lavish gifts can lead to conflicts of interest and compromise impartiality. Supporters say these experiences help politicians engage with different sectors, benefiting their understanding and policy-making.

As the story unfolds, calls for reform in regulations governing MPs may arise. Sky News’ investigation highlights the blurred lines between politics and external influences, prompting a re-evaluation of ethical standards for public servants.

![How Biden’s Corporate Tax Hike, 100+ Wall Street Pictures [HD]](https://lifeline.news/wp-content/uploads/bidens-tax-hike-terror-how-wall.jpg)

Social Chatter

What the World is SayingContract update! Over the last two days, agencies terminated 401 wasteful contracts with a ceiling value of $2.1B and savings of $613M, including a $276k Treasury contract for a “Kenya program...

. . .My office processes millions of dollars in business incorporation fees every year, and we should be able to accept payment for those services in cryptocurrency. That’s why I joined @OhioTreasurer...

. . .Foreigners are selling US Treasuries. The trade war must end. And Soon. The Yen, Euro and Canadian Dollar growing in value interest rates for our debt is going higher. This is not the goal....

. . .The interest on the federal debt has escalated dramatically in recent years and will continue to gobble up more and more revenue…

. . .The interest on the federal debt has escalated dramatically in recent years and will continue to gobble up more and more revenue…

. . .