THREAD: wall street set for small...

LifeLine™ Media threads use our sophisticated algorithms to construct a thread around any topic you want, providing you with a detailed timeline, analysis, and related articles.

News Timeline

TRUMP’S “Liberation DAY” Shocks Markets: Wall Street Reels as Tariffs Spark Global Showdown

— President Trump’s “Liberation Day” tariffs have rocked the markets. The Dow dropped more than 2,000 points on some days. The S&P 500 and Nasdaq both fell into bear market territory. These tariffs, reaching up to 125% for some countries, are the highest seen in a hundred years. China, the EU, and Japan are feeling the pain most. China hit back with its own tariffs on American goods. Japan’s finance minister warned of global trouble ahead. Still, US officials say they’re hopeful about future trade talks. Big companies are taking hits too. CarMax shares sank after weak earnings reports. Nvidia tumbled more than 20% from its high point this year. UnitedHealth lowered its profit forecast because Medicare costs keep rising. Experts think this wild ride will last until trade fights settle down. Some industries are holding up better than others under pressure. The Federal Reserve might cut rates three times this year if things get worse — some warn a financial crisis could happen if tariff chaos continues much longer.

ZERO FINTECH’S Astonishing WIN: 2024 Profits Smash Wall Street Expectations

— Zero Fintech Group Limited, known as 0093.HK, just reported its highest profits ever for 2024. The company’s strong revenue and earnings came at a time when many feared the economy was slowing down.

Investors wasted no time reacting. After the news broke on April 16, Zero Fintech’s stock jumped sharply. Experts say this shows how well the company has managed risk in a tough industry.

This financial victory gives Zero Fintech a strong foundation for future growth in 2025 and beyond. Industry experts are now watching to see if this will shake up fintech markets around the world.

MARKET PANIC: Bitcoin and Stocks Plummet in US Tariff Chaos

— Bitcoin dropped below $80,000 on Sunday, falling over 3% in just two hours. This decline happened alongside major losses in U.S. stock markets. The S&P 500 and Nasdaq Composite both closed nearly 6% lower on April 4. Analyst Holger Zschaepitz noted the stock market lost $8.2 trillion, surpassing losses from the worst week of the 2008 financial crisis.

The market chaos comes from recent U.S. tariffs that have sparked widespread sell-offs across many sectors. Despite this turmoil, some investors see potential buying opportunities as stocks are now trading at historically low valuations of 15 times future earnings projections.

Jim Cramer has warned this could be just the start of a bigger downturn for the S&P 500, predicting a further meltdown of up to 20%. As of Sunday night, S&P futures were down about 4%. Global stocks have already lost $7.46 trillion since April 2nd and may exceed $10 trillion if recent sell-offs continue to unfold.;

TRUMP’S Trade Policy Shocks: US Stocks Plunge in Market Chaos

— The EURO has surged to a six-month high as investors react to the latest U.S. tariff announcements. Meanwhile, the Australian dollar has taken a hit, reflecting global market volatility. These currency shifts highlight ongoing economic uncertainties fueled by international trade tensions.

U.S. stock futures have plummeted after China’s retaliatory tariffs on American goods, marking another phase in the global trade conflict. The Dow Jones dropped 1,679 points, causing widespread concern among investors and financial strategists who urge calm and strategic planning during these turbulent times.

Bitcoin ETFs saw nearly $100 million in net outflows as markets reacted sharply to tariff news from the Trump administration. This exodus underscores investor anxiety and uncertainty about future economic conditions amid escalating trade disputes with China.

Goldman Sachs has revised its oil price forecasts downward due to fears of a potential recession and increased supply from OPEC+. Gold prices have steadied after an initial selloff triggered by aggressive U.S. tariff policies, indicating cautious optimism among investors seeking safe-haven assets in uncertain times.

GOLD PRICES Surge: Brace for Economic Shockwaves from New US Tariffs

— Gold prices have surged as investors brace for the U.S. “Liberation Day” tariff announcement. This has led to cautious trading, with businesses gearing up for possible economic shifts.

The jump in gold signals a move towards safety amid uncertainty over trade relations and policies under the current administration. Many companies are rethinking strategies due to potential tariff impacts.

Analysts worry about major economic fallout, especially for export-reliant industries. The business community is closely watching international reactions and possible retaliatory measures that could escalate global trade tensions.

STOCK MARKET Chaos: US Faces Economic Fears as Tariffs Loom

— U.S. stocks took a nosedive today as President Donald Trump’s “Liberation Day” approaches, bringing potential tariffs on Canadian steel and aluminum imports. Analysts warn these tariffs could trigger a market downturn and increase recession risks. Wolfe Research has already revised U.S. growth estimates for 2025 down to 1.6%.

Retail giant Kohl’s experienced its worst trading day since 1992, with stocks tumbling by 26% after issuing disappointing guidance for the year. Investor anxiety is also heightened by an upcoming House vote on a stopgap funding bill, adding to market volatility.

The Dow Jones Industrial Average has fallen 8.3% from its peak, raising concerns about the tech sector’s performance compared to the S&P 500. Investors are bracing for further shifts as policy decisions unfold in the coming days amid fears of reduced earnings across sectors due to new tariffs and declining consumer confidence.

TRUMP’S Targeted Tarif Plan Ignites Stock Surge

— Global stocks soared on Monday, fueled by gains in U.S. markets. Reports suggest President TRUMP’s tariff strategy is more targeted than expected, boosting investor confidence and risk appetite.

U.S. Treasury yields rose with the optimistic outlook on tariffs. Investors hope a targeted approach will ease potential economic disruptions. The market’s reaction shows strong support for Trump’s strategic trade policy shift.

Meanwhile, the IRS expects a significant drop in tax revenue — over 10% by April 15th — according to the Washington Post. This decline raises concerns about fiscal health and future government funding.

In currency markets, the dollar strengthened against both the euro and yen as U.S. business activity improved in March. Bitcoin analysts predict a potential surge to $110K before any major correction, reflecting ongoing interest in cryptocurrency markets.

SINGAPORE’S Business Boom: Small Firms’ Confidence Soars to New Heights

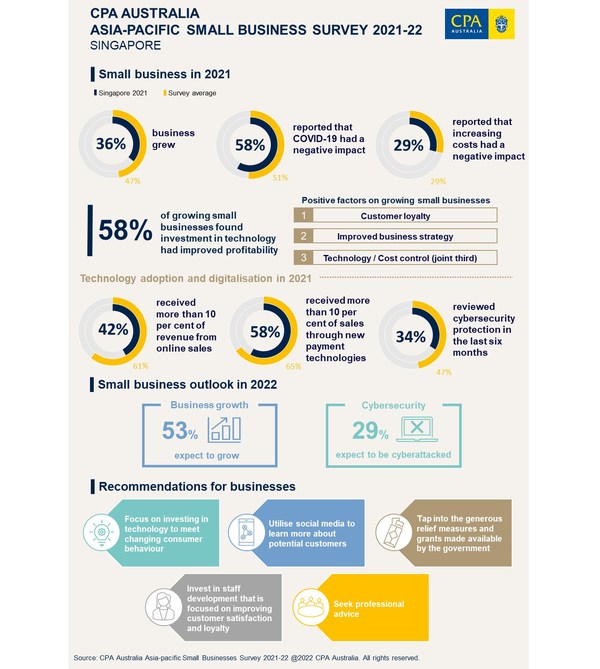

— Confidence among small businesses in Singapore has hit its highest point since 2019, says a survey by CPA Australia. The Asia-Pacific Small Business Survey shows that 62% of these businesses expect growth this year, marking the most optimism since 2018. This positive trend is expected to continue into 2025.

Greg Unsworth from CPA Australia notes that this confidence reflects not just business prospects but also a brighter economic environment. The survey highlights a big jump in technology use, with more firms embracing online and digital payments.

In 2024, an impressive 63% of small businesses reported earning over 10% of their revenue from online sales, up from just 36% in 2019. This shift shows a strong move towards digital transformation among Singapore’s small enterprises.

:max_bytes(150000):strip_icc()/GettyImages-2204542885-111eebb0d66b4ccdb80baeba920b68a8.jpg)

SENSEX SOARS: 3,000-Point Rally Ignites Investor Hope

— The SENSEX has soared over 3,000 points in just five sessions, marking its best week in four years. This impressive rally is fueled by cooling bond yields and a stronger rupee. Increased foreign investor interest also plays a key role in this upward trend.

Analysts urge investors to stay engaged and see market dips as chances for long-term growth. They warn of short-term volatility that might affect immediate gains. Vinod Nair from Geojit Financial Services highlights that improving domestic indicators are encouraging investors to seize bargains despite global uncertainties.

This surge shows significant market activity and investor sentiment in the Indian stock market. The unusual upward trend suggests optimism among investors amid strong earnings expectations. Staying informed and cautious remains crucial for navigating these financial waters effectively.

HONG KONG Surge Ignites Asian Market Boom

— Hong Kong is leading a major surge in Asian markets, sparking excitement and strong trading. Big gains are seen in Japan, India, and Malaysia. Indonesia trails slightly behind.

This market shift lines up with possible geopolitical changes, including hints from former President Trump about a potential visit from President Xi to Washington DC. Such moves could impact international relations and economic plans.

China’s tech giants like Alibaba and Tencent are seeing big gains thanks to positive domestic consumption outlooks. This growth shows the strength of China’s tech sector amid global uncertainties.

NIO’s partnership with CATL signals more growth in the tech industry, boosting investor confidence across Asia. The collaboration highlights the region’s focus on innovation and technological progress.

SENSEX SURGE: Investors Cheer as Market Confidence Grows

— The SENSEX index opened at 74,474.98 on March 9, 2025, marking a positive start to the trading day. This opening was slightly above its previous close of 74,332.58, signaling growing investor trust in the market’s stability.

As trading progressed, the index gained over 350 points, hitting a high of 74,713.17. This upward trend shows optimism among investors and suggests a strong economic outlook for India.

Growth in the SENSEX is often seen as an indicator of economic health and can positively influence global markets. Investors will be closely watching to see if this momentum continues in the coming days.

METAL STOCKS Soar: Investors Cheer Global Demand Boom

— METAL stocks like Tata Steel, Hindalco, and Vedanta are seeing a rise of up to 4% in share prices. This jump is due to favorable global market conditions and increased demand for metals. Investors feel hopeful about the sector’s future.

Tata Steel shares have climbed about 4%, thanks to positive quarterly results and higher production forecasts. Hindalco gains from rising aluminum prices and a brighter outlook as global demand increases.

Vedanta’s shares are also climbing because of strong performance and smart strategies to boost production efficiency. These companies’ gains show broader economic conditions that favor raw material demand.

Market experts point to international trade dynamics, better supply chains, and more infrastructure spending worldwide for this bullish trend. These factors boost investor confidence in METAL stocks amid growing global need for raw materials.

/Super%20Micro%20Computer%20Inc%20HQ%20photo-by%20Tada%20Images%20via%20Shutterstock.jpg)

SUPER MICRO Stock Skyrockets: Investors Cheer Bold 2026 Goals

— Super Micro’s stock jumped after the company set bold goals for 2026, calming investor worries about its future. Despite controversies and a Department of Justice probe into its accounting, Super Micro is working to stabilize. The company hired a new accountant and announced an independent review found no wrongdoing.

Nasdaq gave Super Micro more time to submit filings by February 25, which the company plans to meet. This extension follows a tough year with challenges noted in the Hindenburg report. Investors reacted positively to these updates, causing stock prices to soar after the business update on February 11.

TRUMP-Linked Firm’s BOLD Crypto Move Shakes Wall Street

— World Liberty Financial (WLF), linked to Donald TRUMP, has announced a strategic reserve of digital assets. The firm is moving over $307 million to Coinbase Prime. Initially thought to be a sell-off, WLF clarified these are routine treasury operations.

The project aims to tokenize real-world assets, providing secure infrastructure for institutional investors. At the Ondo Summit, WLF highlighted blockchain’s potential to modernize outdated financial systems. This move has attracted major partners like Franklin Templeton and Google Cloud, showing strong interest in blockchain’s role in traditional finance.

Market analysts suggest WLF’s crypto involvement could sway investor sentiment and influence regulatory developments. If successful, it might prompt other institutions to explore similar strategies, potentially transforming the financial landscape.

Financial markets are watching closely amid concerns about Trump’s tariff policies and their impact on inflation and interest rates. The outcome of this initiative could have far-reaching effects on both Wall Street and global finance sectors.

TRUMP-Linked Firm’s BOLD Crypto Move Shakes Up Wall Street

— World Liberty Financial (WLF), associated with former President Donald TRUMP, is making a splash in the crypto world. The firm has moved over $307 million in digital assets to Coinbase Prime. While some speculate a sell-off, WLF says these are just routine financial operations.

WLF plans to tokenize real-world assets, providing a secure platform for big investors. At the Ondo Summit, executives emphasized blockchain’s potential to update traditional finance systems. Partnerships with Franklin Templeton and Google Cloud highlight this drive for innovation.

Market experts believe WLF’s crypto involvement could sway investor opinions and regulatory trends. If successful, it might lead other firms to adopt similar strategies, significantly reshaping the financial scene.

TECH GIANTS Spark Stock Market Surge: What Investors Need to Know

— The STOCK MARKET is seeing a surge, with predictions of a 0.49% rise. This optimism comes from major tech companies, whose earnings reports are expected to beat estimates. Investors are eagerly awaiting these results, fueling excitement across the market.

However, concerns about rising interest rates could dampen this enthusiasm. While the outlook remains positive now, potential rate hikes might impact investor sentiment soon. Market participants stay cautious as they navigate these mixed signals.

Besides stock market news, debates continue over a new lunch plan proposed by a coalition that may affect small businesses’ futures. Stakeholders are split on the possible effects of these changes, highlighting ongoing challenges in balancing economic growth with regulations.

MARKETS UNDER Pressure: How Budget and Trade Uncertainty Impact You

— The BSE Sensex and Nifty have often closed lower on budget days over the past decade. Recent sessions continue this trend. However, a JM Financial report shows that Nifty usually rebounds within a week after the budget, posting positive results 75% of the time. The Nifty Mid-Cap Index also shows strength, closing higher 67% of the time with an average return of 1.5%.

In commodities, silver prices have fallen below $31.50 per ounce despite a bullish market outlook. Gold remains strong above $2,800 as fears over tariffs and inflation drive demand for safe-haven assets. Analysts predict growth toward $3,000 if current conditions persist.

The US Dollar Index is gaining strength due to expected tariffs on Mexico and Canada this weekend. These tariffs could affect grocery prices in America as President Trump plans a 25% levy on goods from these countries. Meanwhile, crude oil prices are dropping as analysts wait for confirmation before making further predictions about market trends.

In banking news, several branches of Lloyds Bank, Halifax, and Bank of Scotland will close in February 2025 due to broader economic adjustments. The Financial Conduct Authority is now empowered to address the impacts of these closures on communities and customers alike.

GOLD PRICES Soar: What You Need to Know About Plunging US Yields

— Gold prices climbed for the second day, fueled by falling U.S. yields and hints of easing core inflation. Investors are keeping a close eye on upcoming U.S. retail sales data, unemployment claims, and Federal Reserve announcements for more market insight.

The stock market saw a big lift after a surprisingly good consumer inflation report. The Dow surged 700 points while the Nasdaq jumped 2.5%. This shows optimism even though there are worries about high rates affecting stock performance.

Financial powerhouses Goldman Sachs and JPMorgan started the earnings season strong with impressive trading revenues, boosting the S&P 500’s financial sector to its best day in two months. Citigroup announced a $20 billion share buyback program as it tackles rising regulatory costs and compliance issues.

The U.S. dollar was volatile as traders analyzed inflation data showing core inflation dipped slightly from 3.3% to 3.2%. Market players await more direction from the Federal Reserve on interest rate policies amid these economic changes.

STOCK MARKET Chaos: Inflation Fears Shake Investor Confidence

— The U.S. STOCK market took a big hit today, with major indexes dropping over 3% due to rising inflation fears. Investors worry about possible Federal Reserve policy changes after high inflation numbers came out earlier this week. This is one of the steepest drops in months, shaking confidence that had been boosted by strong job reports.

Bond yields are up, with the 10-year Treasury bond yield hitting about 4.1%, its highest since late 2023, signaling increased inflation expectations. Big tech stocks like Apple and Microsoft saw sell-offs over 5%, adding to the market slump. Analysts warn that ongoing inflation might push the Federal Reserve to rethink interest rate policies, possibly leading to more hikes instead of cuts.

The decline comes after a strong holiday shopping season that initially suggested steady economic growth but is now overshadowed by ongoing inflation problems. Retail and consumer sectors face rising costs and reduced spending, making investors cautious in these areas. Companies like Walmart and Target report higher holiday sales but shrinking profit margins due to inflation pressures, prompting them to rethink annual forecasts.

Banks like JPMorgan are bracing for possible loan defaults as consumers struggle with higher living costs by setting aside more reserves. Market analysts expect continued volatility as investors digest new inflation data and Fed policy implications.;

WALL STREET Surges: Oil Price Drop Sparks Investor Optimism

— Wall Street is climbing today, driven by a 6% DROP in oil prices. Investors are gearing up for a crucial week of earnings reports from major tech firms.

Tech and energy stocks are leading the way, with analysts hopeful about tech giants’ futures. However, there is still caution about the overall economic outlook.

The fall in oil prices comes from oversupply worries and easing geopolitical tensions, affecting inflation rates and consumer spending that Wall Street closely monitors.

While U.S. markets rise, Asian markets face recession fears linked to U.S. economic performance, showing global interconnectedness and financial volatility.

— Nasdaq Soars 1% as Wall Street Overcomes Russia-Ukraine Concerns The tech-heavy index rallied, buoyed by a significant surge in Nvidia shares despite ongoing geopolitical tensions

— Dow Drops 300 Points as Rate Concerns Weigh on Post-Election Rally The Dow Jones Industrial Average fell 300 points on Friday, stifling momentum from the recent election amid ongoing worries about rising interest rates

— S&P 500 RISES NEARLY 1% as Cooler Oil Prices Boost Market The Dow gained 100 points, reflecting positive investor sentiment amid declining oil prices

— S&P 500 SOARS to NEW RECORD CLOSE The index surged as traders sought to capitalize on the momentum from recent Federal Reserve interest rate cuts

— Stocks Stage Impressive Recovery, Recouping Weekly Losses: Market closes higher, bouncing back significantly from Monday’s sell-off

Video

GLOBAL ELECTIONS Shock: What’s at Stake for Iran, Britain, and France

— Over the next week, voters in countries like Iran, Britain, and France will head to the polls. These elections come at a critical time with global tensions high and public concerns over jobs, climate change, and inflation.

In Iran, Supreme Leader Ayatollah Ali Khamenei seeks a successor for President Ebrahim Raisi following his recent death. Candidates include hard-liners Saeed Jalili and Mohammad Bagher Qalibaf as well as reformist Masoud Pezeshkian.

These elections could significantly impact global politics amid ongoing wars in Europe, the Middle East, and Africa. The outcomes may reorient international relations during this period of mutual suspicion among major powers.

Invalid Query

The keyword entered was invalid, or we couldn't gather enough relevant information to construct a thread. Try checking the spelling or entering a broader search term. Often simple one-word terms are enough for our algorithms to build a detailed thread on the topic. Longer multi-word terms will refine the search but create a narrower information thread.

Politics

The latest uncensored news and conservative opinions in US, UK, and global politics.

get the latestLaw

In-depth legal analysis of the latest trials and crime stories from around the world.

get the latest

Social Chatter

What the World is Sayinghttps://youtu.be/rguHublkxCQ?si=9b_S0IXBQWwdWvVS The US stock market is in the biggest bubble in history. The entire economy is at risk. Geopolitical Economy Report 458K subscribers 618,152 views 3 Jan 2025 The US stock market is in "the mother of all bubbles", with the market capitalization of pu...

. . .(1/29) - Wednesday's Pre-Market News & Stock Movers. (1/29) - Wednesday's Pre-Market News & Stock Movers #Good morning traders and investors of the r/StockMarketChat sub! Welcome to the new trading day and a fresh start! Here are your pre-market stock movers & news on this Wednesday, January the 29th, 2025- ***** # [Stock futures are little changed ...

. . .(1/29) - Wednesday's Pre-Market News & Stock Movers. (1/29) - Wednesday's Pre-Market News & Stock Movers #Good morning traders and investors of the r/StocksMarket sub! Welcome to the new trading day and a fresh start! Here are your pre-market stock movers & news on this Wednesday, January the 29th, 2025- ***** # [Stock futures are little changed as ...

. . .(1/29) - Wednesday's Pre-Market News & Stock Movers. (1/29) - Wednesday's Pre-Market News & Stock Movers #Good morning traders and investors of the r/StockMarketMovers sub! Welcome to the new trading day and a fresh start! Here are your pre-market stock movers & news on this Wednesday, January the 29th, 2025- ***** # [Stock futures are little change...

. . .(1/29) - Wednesday's Pre-Market News & Stock Movers. (1/29) - Wednesday's Pre-Market News & Stock Movers #Good morning traders and investors of the r/StockMarketChat sub! Welcome to the new trading day and a fresh start! Here are your pre-market stock movers & news on this Wednesday, January the 29th, 2025- ***** # [Stock futures are little changed ...

. . .