7 Easy SOLUTIONS for the Next Financial Catastrophe!

Is inflation or even hyperinflation coming? Our 2021 inflation forecast is very worrying as the stimulus inflation story plays out, but there are steps you can take today to protect your wealth. Inflation is coming to America and the United Kingdom, as well as many other nations. Here’s why inflation happens and how we can protect our hard-earned money.

When the pandemic hit last year, stock markets around the world plummeted at record speeds. The world was preparing for a global shutdown and knew the economy would tank.

Within months though, the markets recovered with the US market finishing the year at all-time highs. The United Kingdom FTSE 100 index made a substantial recovery but was one of the worse performers of the year. The German DAX also fully recovered.

It got better:

When the news of the vaccine being approved came out, markets went into a global rally at the end of the year. Oil prices started to recover despite hitting unprecedented negative numbers in the past year. The oil price now stands at around $60 per barrel, a substantial recovery.

Here’s why:

Most economists and Wall Street traders will say the recovery was led by monetary and fiscal policies that helped the economy. Without central banks stepping in with quantitative easing (money printing) and keeping interest rates at rock-bottom levels, it’s very likely the markets would not have recovered.

As governments shut down their country’s economy and asked businesses to close their doors, they had to provide huge amounts of financial assistance to businesses and individuals who were out of work.

President Biden has just announced an incredible $1.9 Trillion rescue package. With this sort of money being pumped into the economy, no wonder markets rallied. It all sounds great, but what are the consequences of all this stimulus? Are there any consequences?

YES, and they’re dreadful:

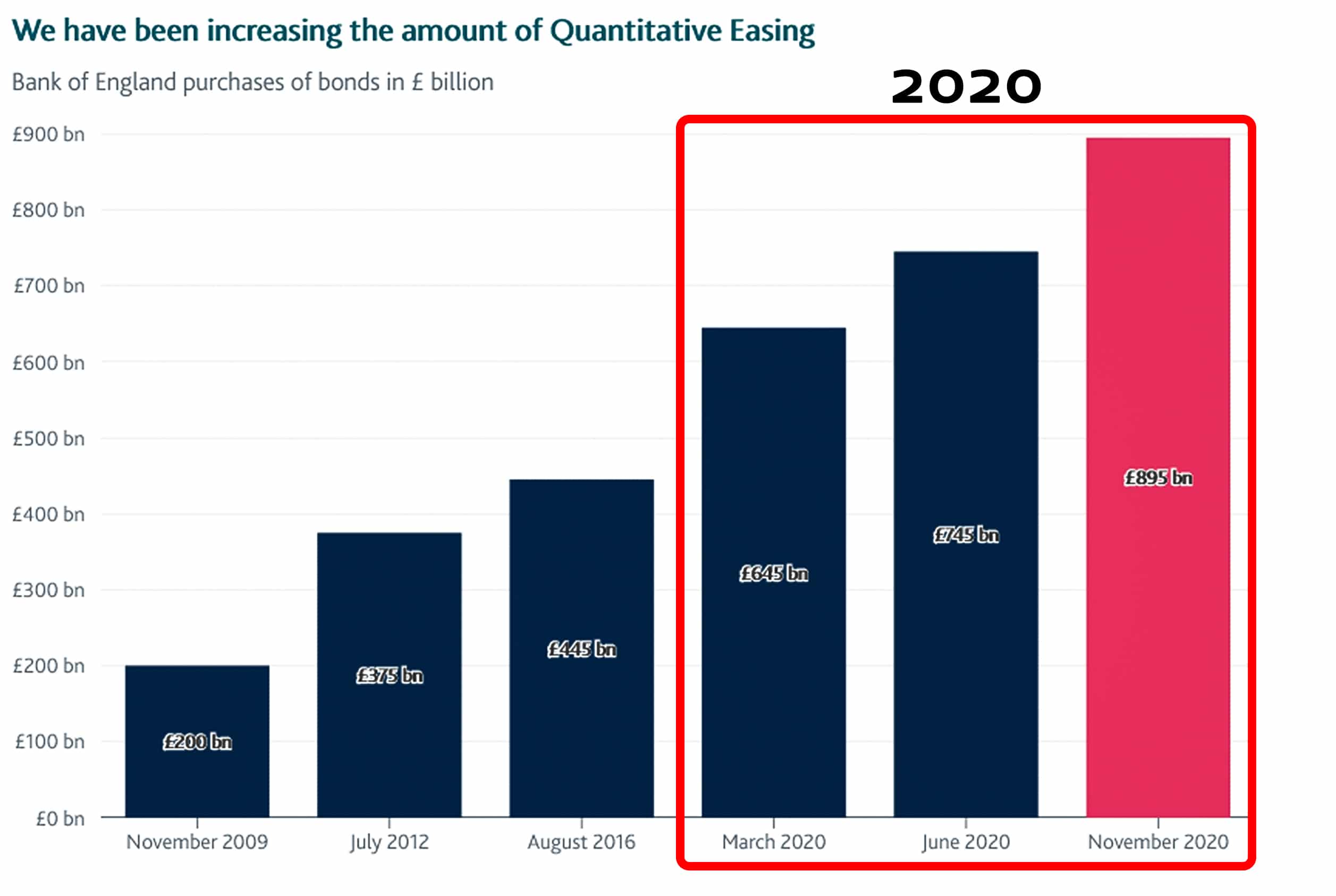

Since the financial crisis in 2008 central banks began regular quantitative easing programs, pumping new money into the economy by buying government and corporate bonds. In 2020, they took this to a new level.

Most would argue they had no choice, but we could be heading into a second world-altering disaster due to inflation. Believe me, when I say, this would be terrible and I’m very afraid.

Stimulus and inflation are connected but it is not that simple. Most people think that more dollars printed equals a weaker dollar because the supply of dollars has increased, simple supply and demand.

That’s correct in basic terms, but why haven’t we had inflation already in 2021? Inflation is the rising of prices and it’s measured in many ways. A common measure is the Consumer Price Index (CPI) which tracks the price of a basket of goods that consumers buy.

The current CPI forecast 2021 is not showing any huge price increases, but why? In order for prices to rise, there has to be increased demand for those goods and services (supply and demand). For inflation to come about there has to be huge amounts of spending by consumers.

This hasn’t happened yet because we are still in the midst of the COVID-19 pandemic and economies are only just starting to open. All this stimulus money is spring-loaded, ready to be spent. When the economy fully opens and consumers are armed with all this extra stimulus money, I predict there will be a surge in spending. Everyone has been stuck at home with little to do. When the risk of the Coronavirus substantially decreases, people will celebrate. They will celebrate with their stimulus money!

Oil prices will most likely skyrocket, as everyone will want to start traveling again. The oil market is already predicting inflation in the future because right now demand for oil is not that high. We’ve already seen signs of food inflation and when restaurants reopen there will undoubtedly be a surge in spending.

Here are the shocking numbers:

RELATED AND FEATURED ARTICLE: 5 UNKNOWN Altcoins That Are The FUTURE For Cryptocurrency

RELATED ARTICLE: Stock Market MELTDOWN: 5 Reasons to Get Out NOW

Let’s see exactly how much stimulus money has entered the economy in the United States and the United Kingdom. On March 15, 2020, the Federal Reserve announced approximately $700 billion in new quantitative easing via asset purchases and by mid-summer 2020 this resulted in a $2 trillion increase of the Federal Reserve’s balance sheet.

In March 2020, the Bank of England announced £645 billion in quantitative easing, £745 billion in June 2020 and £895 billion in November 2020. Put that into perspective against the last quantitative easing program done by the Bank of England which was £445 billion in total for the year 2016.

Printing (quantitative easing) this much money significantly devalues the dollar ($) and the pound (£) and once it gets through the system, we could get inflation. Inflation is damaging for one reason; your hard-earned money becomes less valuable and you’ll need more of it to buy the same thing. When this applies to things like food and housing, we have a significant crisis. Inflation and unemployment are the two worst things that most economists fear.

We’re truly in unknown territory as this sort of financial engineering done in 2020 has never happened before. The worst and most devastating outcome would be hyperinflation. While inflation is a measure of rising prices for goods and services, hyperinflation is rapidly rising inflation. Normally this is defined as more than 50% per month.

Here’s how you can protect your hard-earned money:

1) The dollar and the pound could be doomed, so it’s not a good idea to hold your life savings in those currencies. You could put your money into other currencies that are at less risk of being devalued, but you’re at the mercy of the government and the central bank issuing that currency.

2) If inflation is the rising prices of stuff and the devaluing of currency, then the simple option is to hold more stuff! Heavy metals are a great place to start, with gold being a favorite inflation hedge and one of the oldest stores of value. Silver is also especially useful as a store of value as silver has high industrial demand, the same can be said for copper, palladium and platinum. The demand for these metals will only get greater as countries such as China and India are becoming more industrialized.

3) Oil is denominated in US dollars usually, so as the dollar weakens oil prices should rise. However, the oil price is determined by many variables of supply and demand and with President Biden in the White House oil jobs are not looking so safe. The green energy revolution poses a huge threat to oil demand.

4) Stocks are another option, however not a particularly safe one as the stock market often declines in times of expected inflation. Sticking to shares in blue-chip companies, miners and retail are most likely the safest way to go.

5) Bitcoin and cryptocurrencies have soared recently, due in part to people being worried about government-backed currencies being devalued. Governments have no control over Bitcoin and the price is purely determined by supply and demand. However, Bitcoin is volatile and as we found out during our research it is controlled by a few big investors (the whales). If you can stomach huge swings in price, then Bitcoin may be great for you!

6) Investing in housing and land is also a good way to hedge against inflation, however, these markets are again controlled by other supply and demand variables and not an option unless you have huge amounts of spare cash. You could invest in a REIT ETF, which trades just like a company on the stock market. Buying a few shares of a REIT fund allows you to gain exposure to the housing market with extraordinarily little capital.

7) A more imaginative way of hedging against inflation, would be to short (bet on it going down in price) the dollar or the pound. Most retail brokers allow you to make such a trade. You could bet against the dollar index or trade with currency pairs.

What will the government and central banks do if inflation or hyperinflation comes about in 2021?

Central banks will tend to focus on increasing interest rates, this encourages people to save money and not spend, thus curbing inflation. However, high interest rates can shrink an economy as businesses and people can’t borrow so much due to the high interest rate they have to pay back. During a recession, this is precisely why the central banks lower interest rates, to stimulate the economy. it’s a fine balance and a very difficult job for central banks to achieve.

Higher interest rates are also bad for the stock market, once the yields on bonds (interest rates) start rising, investors will sell their stocks and move to bonds for a safer and substantial return.

Here’s the bottom line:

On a global basis, we’ll have to wait and see. There’s not much governments and central banks can do right now and inflation may be inevitable. On an individual basis though, don’t hold currencies like the US dollar and the British pound. Look to invest extra money into heavy metals, commodities, and cryptocurrencies.

Is inflation coming? Yes. Is hyperinflation coming? Maybe, I sincerely hope not. Inflation and hyperinflation can and will happen again and you don’t want to be the person carrying a wheelbarrow of hundred-dollar bills to buy a loaf of bread!

Click here for more financial news stories.

We need YOUR help! We bring you the uncensored news for FREE, but we can only do this thanks to the support of loyal readers just like YOU! If you believe in free speech and enjoy real news, please consider supporting our mission by becoming a patron or by making a one-off donation here. 20% of ALL funds are donated to veterans!

This article is only possible thanks to our sponsors and patrons!

By Richard Ahern – LifeLine Media

Contact: Richard@lifeline.news

References

1) Joe Biden signs $1.9tn stimulus bill into law: https://www.ft.com/content/ecc0cc34-3ca7-40f7-9b02-3b4cfeaf7099

2) Supply and Demand: https://corporatefinanceinstitute.com/resources/knowledge/economics/supply-demand/

3) Definition of Inflation: https://www.economicshelp.org/macroeconomics/inflation/definition/

4) Consumer Price Index: https://www.bls.gov/cpi/

5) Quantitative easing: https://en.wikipedia.org/wiki/Quantitative_easing

6) What is quantitative easing?:https://www.bankofengland.co.uk/monetary-policy/quantitative-easing

7) Hyperinflation: https://www.investopedia.com/terms/h/hyperinflation.asp

8) Distressing DATA Predicts a Devastating BITCOIN CRASH in 2021 Could be Coming!: https://www.youtube.com/watch?v=-kbRDHdc0SU&list=PLDIReHzmnV8xT3qQJqvCPW5esagQxLaZT&index=7

9) How to invest in real estate with ETFs: https://www.justetf.com/uk/news/etf/how-to-invest-in-real-estate-with-etfs.html

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.