Stock Market MELTDOWN: 5 Reasons to Get Out NOW

FACT-CHECK GUARANTEE (References): [Official statistics: 7 sources] [Government websites: 3 sources] [Academic website: 1 source] [Straight from the source: 2 sources]

13 September 2021 | By Richard Ahern – Warning lights are flashing indicating that it may be time to get out of the stock market now!

Many experts worry that a stock market crash could be inevitable because of a cocktail of economic bad news.

Since the March 2020 stock market crash, when the pandemic started, the US stock market has been making gain after gain with the S&P 500 reaching all-time highs over $4,500 and the NASDAQ 100 soaring over $15,600, but all good things must come to an end.

That end could be now…

There are five worrying reasons why it may be time to sell stocks and turn to other assets before your hard-earned profits are wiped out.

Let’s dive in…

1) We have a frothy stock market

We’ve been in a raging bull market and markets are priced to perfection; every bit of possible good news has been baked into prices leading to what investors call frothiness in the market.

That froth needs to eventually be skimmed off, prices can’t keep going up, we will run out of good news.

The chief market strategist at institutional trading firm Miller Tabak, claimed that a correction was “obvious” as it appears markets have a lot of froth.

The market has priced in strong expectations for GDP growth this year, but next year’s GDP will undoubtedly be lower.

From a valuation perspective, the market cap to GDP ratio, commonly known as the ‘Buffett indicator’, is at an all-time high of over 200%. In other words, the US stock market is expensive when compared to the US GDP, and in the past, this usually indicates a stock market crash is coming.

Let’s get technical…

From a technical standpoint, the 14-month relative strength index (RSI) for the S&P 500 is firmly in the ‘overbought’ range, indicating the market is due for a correction. Another indication that the market is ‘overbought’ is that the monthly chart is touching the upper Bollinger band, a technical measure that uses standard deviations to compare prices.

The volume of shares traded on the S&P 500 also seems to have declined while the index has rallied in the last few months, indicating that the bull market is losing steam.

Here’s the deal:

When the markets are in a position where they have priced in every good news scenario, even a bit of neutral news can cause a stock market decline.

It’s a simple inevitability, when prices go up, they have to eventually come down in part, this is how markets work in cycles.

High prices in themselves are a concern.

2) The Federal Reserve is pulling back

The Federal Reserve will start pulling back its stimulus efforts by tapering its bond-buying program.

The Fed bond-buying program gives the market a huge pool of excess liquidity which is great for stocks.

It can’t go on forever…

The Fed will undoubtedly be worried about inflation, inflation is already ramping up and with the Federal Reserve bond-buying program pumping more funds into the market, when supply chains are already stretched, could be catastrophic.

John C. Williams, the president of the Federal Reserve Bank of New York, hinted that the Fed could start removing support for the economy by the end of the year, even if the job market doesn’t improve.

Worryingly, in August, the US economy created the lowest number of jobs in seven months due to the resurgence of the COVID-19 delta variant hitting the leisure of hospitality sector.

There’s more…

To add to employment concerns, Biden saying that companies with 100 or more employees must ensure their workers are vaccinated (or tested weekly) could cause people to leave their jobs. Biden mandating vaccines for federal workers, federal contractors, and health workers could also lead to a mass walk-out by some employees.

The Fed’s liquidity pool is already priced into markets, if liquidity starts drying up along with the job market lagging, we’ll have a correction at best or a situation of panic-selling at worse.

The Fed must taper its bond-buying program, which is inevitable.

3) The economic recovery is slowing

There are concerns that the economic recovery may be slowing; less stimulus and worries about the COVID-19 delta variant are all making investors nervous.

The high market prices have been in part due to the reopening of the economy, but once we’ve fully reopened, we can’t expect continued fast growth.

Since the last stock market crash in 2020, the markets have been ‘propped up’ by the Federal Reserve and the government, they had to be because of the pandemic.

When those ‘props’ of the Fed and the government are pulled away, who knows how the markets will react without that safety net.

Worries about the spread of the delta variant are also concerning, if it continues to spread, we may be in a situation where we have to close down parts of the economy again.

With a reopening priced in, a return to lockdown would be disastrous for investors and would lead to widespread panic.

It gets worse…

As of late many retail investors have entered the market, with apps such as Robin Hood providing easy access to the stock market. The problem is that these retail investors are not professionals and generally have little knowledge about the economy and the stock market.

Many experts believed that the 2000 stock market crash was in part due to inexperienced day traders entering the market for a quick buck.

The problem is these retail investors panic quickly because they are inexperienced, which can lead to extremely deep market crashes.

4) Interest rates could be rising

If the economy overheats from too much spending, which will cause inflation, the Fed may step up interest rates to curb spending and encourage saving.

Biden has been on a government spending spree, plowing huge amounts of stimulus into the economy. When that stimulus gets into the hands of the American people, in the form of stimulus cheques, they spend it.

Increased spending creates more demand, which can stress supply chains and drive up prices, i.e., inflation. Rampant inflation is terrible for the American people, because it erodes the value of cash, just look at how the increasing gas prices have hurt the working class.

Inflation has to be curtailed by the central bank. They will first taper their bond-buying program, which they are already doing; if that’s not enough they will aim to increase interest rates.

Interest rates affect the stock market.

If rates go higher, it creates more demand for bonds because the return is more attractive, but this also means that bonds compete with stocks. Attractive yields will push some investors to sell their stocks and invest in government bonds instead.

Part of the reason the stock market has gone up as of late is that investors get such a small return on investment from bonds, bonds are currently a poor investment, indeed, the US 30-year treasury yield is currently hovering around 1.95%.

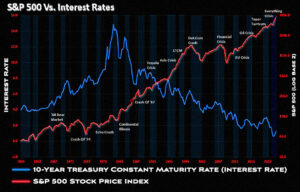

Interest rates have been low for some time, ever since the 2008 economic crisis, which has fueled the bull market in stocks.

If rates go up, there will be a huge transfer of funds going from the stock market and into the bond market leading to a stock market collapse.

5) Geopolitical concerns

The upcoming stock market crash could be triggered by the volatile geopolitical situation. With the Taliban in charge of Afghanistan and the increased risk of terror attacks, there is a wall of worry that will make investors nervy.

The Afghanistan situation is unprecedented, and the future looks very uncertain, uncertainty is bad for the markets.

The Afghanistan situation also presents economic concerns for the US. The Taliban are now in control of $1-3 trillion worth of rare earth metals in Afghanistan and China will likely be working with the Taliban to extract them.

If China gets its hands on metals such as gold, silver, copper, and zinc, that will give them a huge economic advantage over US companies in industries such as semiconductors, electronics, and aerospace.

Afghanistan is also abundant in lithium, a silvery metal that is essential for the production of renewable energy batteries used in electric cars. This will give Chinese electric car companies a decisive advantage over US companies, all bad news for the stock market.

More bad news…

There are also concerns about the situation with China and Taiwan, which is causing uncertainty within the semiconductor industry.

The Taiwan Semiconductor Manufacturing Company (TSMC) dominates the semiconductor industry, accounting for over 50% of the semiconductor foundries revenue share worldwide. US companies such as Apple, Nvidia, and Qualcomm outsource their chip production to TSMC foundries.

If a conflict arises between China and Taiwan, that could severely disrupt the semiconductor supply chain which would ultimately hurt companies like Apple and Nvidia which are stock market favorites.

Indeed, Apple is the largest component of the S&P 500, carrying over 6% of the index with a market capitalization of around $2.5 trillion!

However, geopolitical events don’t always have much effect on the stock market, but sometimes volatile events, like we’ve been having recently, can cause investors to panic and sell due to uncertainty.

The bottom line:

Stocks are priced to perfection and there is a cocktail of worries about the future, this means risk is at an all-time high along with prices.

Investors should be careful and diversifying to cash or preferably other assets that hedge against inflation may be prudent to reduce risk.

We need YOUR help! We bring you the uncensored news for FREE, but we can only do this thanks to the support of loyal readers just like YOU! If you believe in free speech and enjoy real news, please consider supporting our mission by becoming a patron or by making a one-off donation here. 20% of ALL funds are donated to veterans!

This article is only possible thanks to our sponsors and patrons!

Politics

The latest uncensored news and conservative opinions in US, UK, and global politics.

Law

In-depth legal analysis of the latest trials and crime stories from around the world.